A full range of emotions

Inflation and earnings have been the story the last 9 months and the last week. This is set to continue going forward to. How might it play out?

What a week! As I say in the title, we had a full range of emotions last week. Many of you that know me may be thinking that I am referring to the dreadful lows of the Chicago Bears loss on Thursday night, to the highs of the University of Illinois victory on Saturday. Nope, I am speaking of the range of emotions market players felt last week. Heck, we had a full range of emotions on Thursday alone. It was one of the 5 biggest percent turnarounds in S&P history and, if I am correct, the second largest gain of the Dow in points terms in history. Then came Friday, which was set up to be great but fizzled by the end of the day.

The initial reaction to the CPI number made complete sense. There was panic that the Fed has no control over this number. By all accounts, most think it should be falling. However, it is staying persistently high. After the early morning sell-off, the market ripped higher led by short-covering. As we have said since June, this market is incredibly bearish by sentiment and positioning. Interestingly, on Thursday, as there was clearly short-covering post CPI as there really isn’t any more negative economic news that we can get at this point, and because earnings were set to really kick off, the covering was entirely in broader market hedges. If we looked sector by sector at the stocks with high short interest vs. those without, traders were not covering shorts in the names they hate. Traders were covering shorts in e-minis and SPY and other macro hedges in place. After all, earnings are beginning so this is the last time you cover the names you hate since a catalyst is imminent. All of this amounted to a market that really didn’t go anywhere last week in spite of the sturm und drang.

This harkens back to a chart that I had shown much earlier this year, which Mr. Risk of the podcast two weeks ago had suggested to me. That is of the Post World War II analog of today’s market to then. That period was characterized by coming off the incredibly high fiscal and monetary stimulus necessary for the war. Today is characterized by coming off the high fiscal and monetary stimulus of Covid. You can see back in 1946 and 1947, the economy had to work off very high CPI but as it did, the market went sideways. Once inflation got in check, stocks were able to finally rally. However, for several years, stocks went sideways within a 20% range while the excesses were worked off. Is this a period where the market again trades in a wide and choppy range as excesses were worked off?

As I showed last week, again the two issues we need to worry about the next several weeks are inflation and earnings. Inflation staying high keeps the Fed in play which means multiples (in white) will continue to move lower. The last 30-year median multiple for forward earnings is 15x. We are basically at that median now. Could we go lower? Yes, if terminal Fed Funds moves above 5% we will. However, a lot of the multiples pain has already happened. The next leg of the market comes from earnings. The market P = P/E * E.

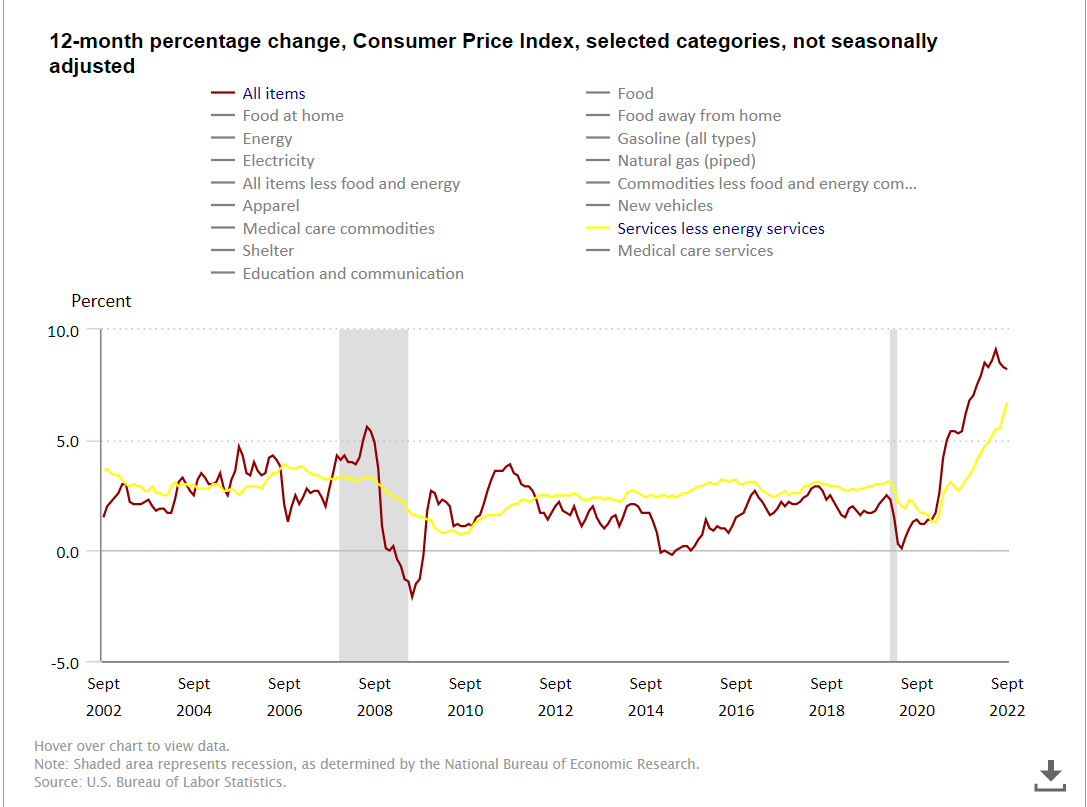

Let’s focus a lot on the inflation side for the moment in a series of charts. You can see that on a year over year basis, the headline number stayed persistent at 8.2% and the core is still rising at 6.6%. This suggests to me that the large increases in food and energy are making their way through the core, and this could continue.

Looking at Bureau of Labor Statistics data, we can see that the basket of goods for consumers is still very high but is starting to roll over. I know there is a lot of cynicism on what constitutes the basket of goods. The thing is goods inflation has not been the problem the last few months. Prices there are still high but are starting to roll. Also, thankfully, our electricity prices in light blue below are still incredibly cheap relative to our peers in Europe.

The issue with inflation now is on the services side. One can argue that Americans bought everything they needed to buy in late 2020 and all of 2021 as we were locked down and couldn’t leave or as we moved into new accommodations for a new work from home world. However, what we see now is that services inflation in yellow below are still high and rising. This is a negative issue for those who hope to see inflation roll over soon.

Jim Bianco posted on social media that he saw Larry Summers on Wall Street Week. Larry said what he watches are median inflation and the trimmed mean inflation. Below are measures of that data from the Cleveland and Dallas Fed. You can see this data is still moving higher as well. This is bad for inflation, bad for Fed Funds, bad for bonds and bad for P/Es.

The Cleveland Fed also uses a Nowcasting model, designed to be much faster moving and using much more high frequency data, for both current and next period CPI. You can see that both measures are moving lower now, past the peak, but are moving lower only very slightly. This is sure to frustrate the Fed and market participants.

I had posted on social media that I have my only very rough and simple forecast. It is based on the work my students do in class. I use the variables that show up most commonly in their models. While each shows in many models each semester, no group has used all of them in the same model. So, I put them in a simple geometric index in Bloomberg. These variables are M2 money supply, Financial Conditions Index, Commodity Prices, PPI and inflation expectations. There is a logic to using each of these. You can see two things from this model. It was persistently high leading into Covid. It also led CPI coming out of Covid. However, for all of 2022, it has been coming in lower than the actual number. So, there is some bias to the forecast. I wouldn’t use it for a quantitative trading model, though I think it does give a useful guide to trends.

The two biggest drivers of CPI outperformance the last two months have been housing and medical services. Here, we can see both are still high and rising. As Barry Knapp pointed out last week, medical services are tied to both fiscal spending and Baby Boomer retirements. Neither of these is slowing. We should expect this measure to remain stubbornly high. He references the paper at Jackson Hole called: Inflation is always and everywhere a FISCAL phenomenon. I can see the point.

However, many push back hard against the CPI measures of housing. Everyone can see the weakness in the housing data. They can see mortgages having spiked to 7%, NAHB numbers coming sharply lower, new homes sales collapsing. Piper Sandler uses existing home sales led by 14 months to forecast CPI shelter. it also suggests shelter should be falling.

However, as we can see from the St. Louis Fed database, the owners’ equivalent rent in the CPI is showing no signs of moving lower any time soon.

One reason for this is that owners’ equivalent rent looks at both house prices as well as rental prices. I know some in the market look at Zillow rental prices and suggest those should come lower too. However, the Bureau of Labor Statistics also looks at rental prices for primary residences. This does NOT suggest a top any time soon. Anecdotally, as affordability is still historically bad for those who want to buy, the decision to rent will still be first and foremost for most people.

We can look at the Census Bureau data on rents in white, the Case-Schiller national home price data in blue and the CPI owners’ equivalent rent in orange, we can see the trend for each of these the last decade and that none seem to be showing any signs of weakness in spite of the negative NAHB data we see. Perhaps, and likely, this is the strength of the job market and household formations coming through. For an awesome analysis of the housing market that really looks at everything, I would suggest the OddLots podcast that has Jim Egan from Morgan Stanley. He looks at everything and essentially says that: 1. affordability is brutal 2. that means people won’t buy houses 3. formations are historic 4. no one wants to sell because they are locked into a low-rate mortgage 5. the most likely scenario is not that prices collapse; it is that activity collapses. Prices stay the same but there are no buys and sells. This seems consistent with this data.

Going through this data, looking at the potential for services inflation, led by housing and medical services, staying persistently high, which is corroborated by the median and trimmed mean measures of inflation, an investor gets the sense that there is no imminent Fed pivot. Looking at what is priced into the Fed Funds futures curve, we can see that on Monday, the market was pricing in an 86% chance of 75 bps in November and a further 55 bps in December. After the data this week, there is 100% chance of 75 bps and a 20% chance of a further 25 bps after that in November and now pricing in another 0.5 hikes in December and almost a full extra hike in February. The notion of a Fed pivot should be shelved for the time being. Those who read the Twin Peaks blog last week will know that this is an important overhang of the market.

With the Fed solidly in play, we cannot and should not expect multiples to expand any time soon. This is a big headwind. However, stocks also move on earnings. In fact, over the long haul, it is earnings that are the ultimate driver of equities. It is just that in the near-term investors can anticipate these changes via changes in the multiple.

The big banks reported earnings on Friday which is the unofficial kick-off to earnings season. You can see we had a few other names in various sectors that have also reported. It is far too early to begin extrapolating anything. You will have seen the negative news from the likes of Fedex, which traders extrapolate to the entire economy. However, we also got positive surprises from the likes of Pepsi, Constellation Brands, American Airlines and United Healthcare. Make sure you are looking at the full picture and avoiding the cognitive dissonance of simply looking for data that corroborates your view.

In the early going, not surprisingly, earnings growth in aggregate has been negative, down 3.5%. Sales growth has been positive across the board. Of course, sales are nominal which means higher inflation is helping revenues. Earnings take this inflation into account via margins, and as companies cannot all pass along the full price increases, earnings will not move up as much, or at all, even though nominal earnings will.

Importantly, because markets move at the margin, we must also consider how these negative earnings are coming in relative to what the market expects. You can see that the earnings surprise has been a positive 3.7% vs. the negative 3.5% actual growth. This is because the expectation coming into this quarter was that earnings would fall by more than 7%. Conversely you can also see that in spite of the strong sales growth, it was largely expected. The surprise is coming from the ability of the companies to pass on a little more price than analysts expected.

This was most notable from the JP Morgan earnings on Friday. I wrote about this on my LinkedIn that day:

“Chart of the Day - earnings. We finally get to focus on something other than the economic data & Fed pivot today as the earnings season moves into 2nd gear with the big banks reporting. We have had other earnings and with less than 10% of names having reported, the story so far is mixed to better. Earnings growth is -2.8% but -7% was expected so it is a 4% positive surprise.

This morning we got the earnings from JPM. Not surprising to me the earnings were better than expected. Recall, in my post a few weeks ago about there being too much cash in the banking system, I showed JPM deposit rates were still at 0%. This means its margins were increasing when the mkt was worried about bank margins compressing. The mkt looks at 3 mo vs 5yr (in blue) mkt rates to proxy margins. Margins are in white below & this data lags by a quarter. The relative performance of banks to the mkt in orange. Margins tell a big part of the story.

According to Bloomberg: " JPMorgan Chase & Co. reported its highest quarterly net interest income ever and raised its guidance for the year as the biggest US bank reaps rewards from the Federal Reserve’s interest-rate hikes. The firm generated $17.6 billion in third-quarter NII, the money it earns on loans minus what it pays out for deposits. Expenses also came in lower than analysts expected, driving a profit beat."

Yesterday, S&P Cap IQ had a story on regional banks saying : "Net interest margins have been expanding with the Federal Reserve raising the federal funds rate, analysts noted. The net interest margin for the median midcap bank stood at 3.24% in the second quarter and is projected to rise to 3.35% for the third quarter, Christopher Marinac, director of research at Janney Montgomery Scott, said in an interview. "Accelerating Fed actions provide a disproportionate advantage to banks with the best deposit franchises, as they can keep deposit costs and balances more stable, extending asset sensitivity benefits into 2023 and beyond," Wells Fargo analysts wrote in an Oct. 6 note."

So as we get bank earnings today & into next week setting the tone for earnings season, the tone should be a little better. It is pretty downbeat now with brad declines in earnings expected. Yesterday shows up what can happen to a mkt that is too bearish, even if we get bad news. What if we get better than expected news? What should we expect from the banks in the next week?”

These graphics come from Credit Suisse and show visually the negative expectation this quarter and compares to the expectation and reality of last quarter. Recall in Q2, the market rallied considerably during and after earnings, not because in absolute terms earnings were that good. It was because they were not as bad as feared.

If you then look on the right, you can see the expectations by sector. The only sector with positive expectations is the energy sector which makes sense. This sector is most able to pass on price. You can see those least able to, tech and consumer discretionary, have the lowest expectations.

Another set of charts courtesy of Credit Suisse shows this breakdown between revenues, margins, earnings, buybacks and EPS. It also shows how this can flow up to the top. It will be important to see if there are surprises, positive or negative, where they come from. Are companies missing on the revenue line, all of which are expected to be positive? This suggests some demand elasticity. Or are companies doing a little better or worse relative to margins? This is important because it comes down to management execution.

The biggest tech names will be the ones most watch because these are the names that are the biggest weight in most investors’ portfolios, even if those investors are indexing. The only positive expectations, and those are small, are in Apple and Microsoft. Amazon, Nvidia and Meta all have very negative expectations. There was a very negative story going around about Amazon this week, how it was shuddering some business lines. This is largely expected right now.

This whole notion of which companies can and cannot pass on price is important. You see, many value companies are much better at passing along price. How can this be you say. The reason many companies fall into the value zone is because there is something challenged about the business model. One big thing is that these companies often have high fixed costs. Well, inflation raises all prices. If your costs are fixed, this means more of the price increase drops to your bottom line. Conversely, with growth, much of the cost structure is variable, often it is human capital like in the big Tech names. Thus, as prices rise, margins get squeezed as your variable costs also go higher. Tech names are responding by laying people off. You are not hearing of layoffs in the old economy sectors, but in the new economy sectors.

If we look at this value vs. growth, on a sector and market neutral basis, that is the white line below. The blue line is CPI and the orange line is 10-year yields. As prices and yields go higher, value moves higher relative to growth because of this cost structure of the business. So above, we look at that on a sector basis (where energy and financials might benefit) and here we look at it within a sector purely on a style basis. This is something to consider especially if inflation stays sticky.

Will these surprises continue? That is not expected. I have shown this chart below which is the % of positive surprises compared to the ISM number. As the economy slows, fewer companies are expected to surprise positively. There is logic here. You will note that over the last 10 years, surprises are always positive, ranging from 65% of companies to 85% of companies. The 70% positive surprise expectation is on the low end but is still large in absolute terms. Could this be a return of the Q2 earnings and market price action?

We also care about the actual earnings, though. This one is noisier but as the number of positive surprises falls, so does the actual earnings. Will it fall from 55 last quarter to 35? Probably not. But even if it falls to 50, and we annualize that number to 200 for next year, and put a 15x multiple on it, that still spells trouble for a market at 3500 right now. Where the actual earnings settle will dictate that range we might be trading in.

We have had a full range of emotions in the market lately. We might be in a full and large range for the market going forward as we work off the excesses of fiscal and monetary stimulus. The next two weeks price action will be dictated primarily by the earnings news. Watch this news to see why companies do poorly or well relative to expectations. Is it due to revenues or margins? What would we expect of margins in that sector? What style does that company fit into (value or growth) and what should we expect. While there are headwinds to the market that will persist the rest of the year, the near-term moves will be the result of how these earnings stories are playing out.

Stay Vigilant

Excellent! Rj

Thoughts: Cleveland Median and Trim CPI are tainted by the fact that Rent is a massive chuck of that number, which means that these are highly correlated with rent. But we know that rent will come down on a forward basis. If the Fed determines they must wait for rent to come down, they are clearly going down the policy mistake road, because they know this will come down. This part of the inflation fabric should be ignored. One other thing which I share with Barry Knapp's view is that there are cracks emerging at the Fed, particularly listening to Brainard who is raising the issue of financial stability and others argue that the global tightening cycle impact is more than the sum of the parts. And another key point is that ahead of Midterms, every Democrat is focused on saying inflation is the problem, the Fed is here to fix it, it's not our problem. They have to say that because that is how polls reflect inflation is the biggest issue. Post-election, look for a 180 degree turn with focus on recession risks and unemployment. It is probably a canary that Brainard--Democrat leaning--is flaggging the initial stages of voices that are beginning to push back on the rate hiking consensus. Looking for the Fed pivot, the illusive one, looks not a bad thought post-Midterms. Could the market begin to price that in before? Obviously, 75bps looks dead certain at November, but the question will be what will that press conference be like? One suspects a more balanced look, which could be hugely positive for the bond market, and unleash the traditional Santa rally before year end. I am not convinced we have to wait for that. After all markets are supposed to be forward looking, right?