A little bit of everything

I touch base on Central Bank Digital Currencies, the Dollar as a reserve asset, and ETH over NDX. A little bit of something for everyone

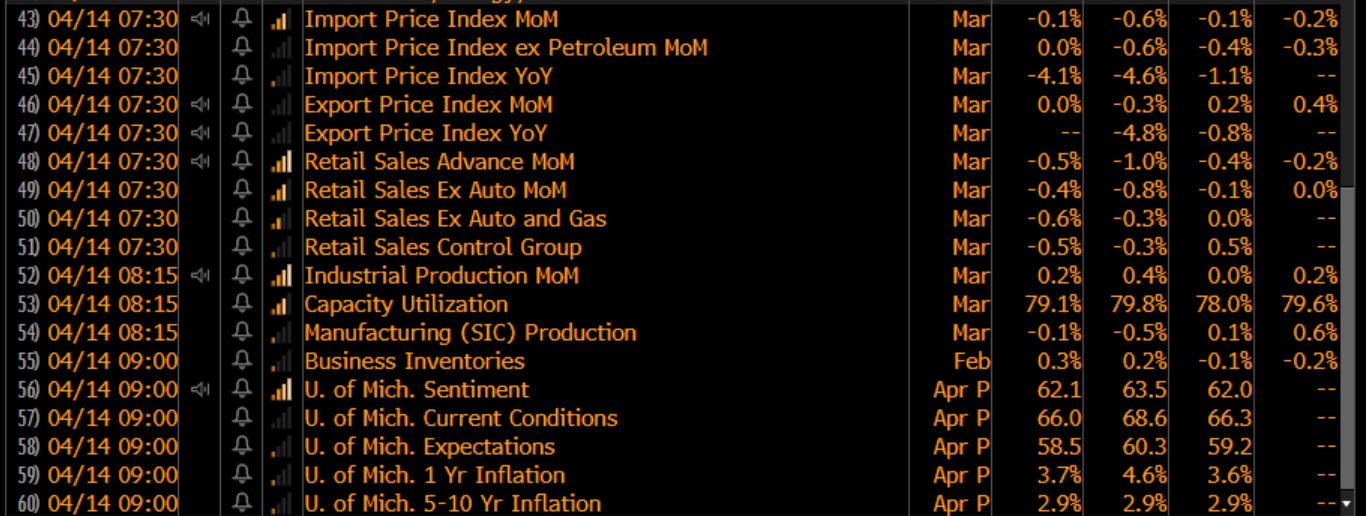

Not a lot new has happened in the last week. Yes, we got a fair bit of economic data. Yes, we started the earnings season with the banks. However, not much came out that changed anyone’s view on either. For instance, we can see from the economic data that the CPI, PPI, Import Price Index all was a little softer. The details of the CPI, with the core, ex-housing services still firm. Interestingly, with this softer data, the University of Michigan 1 year inflation expectations moved a fair bit higher to 4.6% from 3.7%. I have said it before but it bears repeating - inflation is not a number, it is a mindset. Jay Powell gets this. Ben Bernanke got this on the other end of the spectrum with deflation. When the consumer expectation of a price level sets in, it changes behavior. We are already starting to see that with employees trying to unionize in companies that previously did not have a union. We are seeing the unions win higher contract wins. This is the inflationary mindset creeping in. We see this in expectations.

Perhaps this expectations argument is why some member’s of the FOMC still want to hike. For instance, look at what Waller said this week:

We also saw this from Bostic:

These provide a counter-balance to the comments from newbie Goolsbee at the Chicago Fed:

So there is a debate at the FOMC much like there is in the market. We have seen a rate hike start to get put back into May.

Anyway, as I said there is not a lot new but I covered all of this and then some in a podcast this week with Ben McMillan, a long-time Vigilante, who is CIO of IDX. We talked about what happened in Q1 and what we should watch for in Q2.

You can listen to that here: IDX webcast Enjoy

There are two last things I want to cover quickly because this topic has come up a few times. I touched on the Central Bank Digital Currency before a few weeks ago. I understand the argument in favor of, for instance, having all of the transaction accounts located at the Fed using a CBDC. If the US government is on the hook for all of these accounts which are the uninsured accounts typically held by small businesses at banks and were the ones the US Government bailed out at SVB, then they might as well have these at the Fed and the banks then don’t earn any fees for risk they don’t take. However, think of the pushback we are already giving the idea of the IRS getting a look into transactions as small as $600. Imagine if the government had transparency on every single transaction occurring? In addition to this, think about the cyber security risk. If you don’t think this is as much a power grab as a convenience developed, consider this idea, that Ben made me aware of, which ZeroHedge wrote about:

You can read it all here

Again, I think we at least need to be aware of these developments and push back against them. Be careful when during a crisis, the government grabs more authority. It quietly grabbed about 2/3 of the US mortgage market over time via Fannie and Freddie. We will see how important this is when it comes time to get a mortgage this summer. Let’s see what happens with this CBDC. Just beware.

The other thing I want to speak about is the dollar as a reserve currency. While I agree the US is doing everything it can to upset as many people as possible globally. This has been going on more than the last 20 years but certainly seems to be getting worse and not better. However, right now, there is simply no alternative. This has nothing to do with all commodities being priced in dollars. That is a convenience. This has nothing to do with the US as global policeman, though it helps. it has everything to do with the depth and liquidity of the US capital markets.

For all companies and central banks holding reserves, they want to invest in something. In Europe, there is no depth to the sovereign market outside of countries like Germany. There is no real EU bond market, it is a collection of individual bond markets. The corporate credit market is tiny in relation to the US, which is why so many more companies raise capital here. China is not an option in spite of it pricing some commodities in Yuan. You need to ask permission of the Chinese government to put your money into AND get it out of the country. You think other countries like that like of flexibility? Even if you did get permission, what do you buy there?

Is Bitcoin a choice? Not at all. Again, because of the lack of depth of choices and lack of depth of liquidity. Is gold a choice? Central banks already own plenty of gold. I could perhaps lead to more countries swapping out of some gold into some Bitcoin. However, not swapping out of dollars into either.

When the Euro was coming on, there were calls for it to replace the Dollar. We can see what has happened over the last 20 years. A collection of many things has seen the Dollar drop from 70% to 60%. Over the next 20 years could it drop to 50%? Possibly. Maybe even likely. However, I do not see any single currency replacing it.

The dollar is just used for so many things:

I will end the dollar discussion with this piece from former colleague Jim O’Neill, the creator of the BRICs phrase, who looks at the BRICs risk to the dollar:

My last thought is something I touched on with Ben - the idea that I like Bitcoin more than tech stocks. In fact, I liek Ether more than NDX. It is at an interesting relative place:

Both are driven by US financial conditions:

I think the NDX is at risk of high expectations ahead of earnings the next 2 weeks:

While XET is being driven by a couple POSITIVE catalysts. The first is the Shappella upgrade which, among other things, unlocks a great deal of valued in staked ETH. You can read more from Bankless here

The other development is Dynamic NFTs. Don’t think of this as changing pictures of Apes. Think of this as smart contracts changing the very nature of the original content of any type that was created, unlocking value for content creators, and creating more value for the users of the NFT in terms of equity. Crypto is disruptive tech, not disruptive currency. ETH is leading the way in this disruption. Read the Metaversal discussion on Dynamic NFTs here

I gave you a lot to read and didn’t synthesize as much this week. However, I wanted to point out a few things I think are the most important, good and bad.

I will check in next week with a recap of the earnings we have seen and what this tells us going forward. Until then …

Stay Vigilant