A time for reflection

After an incredibly busy week, I find it is important to go through and try to understand what we learned so I don't get caught up in the noise

Before I begin this week’s Stay Vigilant, I want to tell you about a podcast I did this week. You may remember Sagar Singh Setia of the Marquee Finance by Sagar Substack blog. I had Sagar on as a podcast guest last year. This year, he returned the favor as I was his inaugural podcast guest. Quite the honor. If you want to listen, you can go here: Episode 1: Rich Excell! - by Sagar Singh Setia (substack.com)

If you want the TLDR, here it is from Sagar himself:

“We Are Heading For A Reset In World’s Largest Bond Market”

”These were the words of market veteran and Professor Rich Excell CFA, CMT, when I asked him about the fate of the Japanese bond market when the Bank Of Japan (BoJ) owns 100% of all the outstanding JGBs (Japanese Government Bonds) in less than 33 weeks if it continues with its “bold” policy of YCC (Yield curve control).

We also had a very interesting discussion about the US economy, markets, China and the demographic problem that plagues our world.

Rich is of the view that the S&P500 will likely bottom at 3200-3400, as his base scenario involves a multiple of 16-17X and an EPS of $200.

According to him, owning stocks at the 3400 level will be a great bargain for long-term investors.”

We covered the globe, and we covered several asset classes so have a listen.

As I wrote last week, it was a big week for catalysts - economic data, earnings and the FOMC. It was an opportunity for fundamental bears to decide if they saw the news they needed to see to stay uninvested/short/underweight. It was equally a big week for technical bulls to see if there was enough information to see more flows come into risk markets and support their positions.

Let me summarize by briefly going through my three-part approach.

FUNDAMENTALS

I have written many times about how the ISM is my favorite indicator of economic growth. It is coincident with the market, it has a long time series, and it has good correlation with yearly changes in the SPX and bond yields, as well as in earnings revisions data. It has been flashing a yellow warning sign now for months. Last week, the ISM data came out and it is still giving us a pretty bleak picture of the path forward. Not only did the headline number drop to 47.4 or worse than expected, but the ratio of new orders to inventories embedded within the data also broke out to the downside suggesting further weakness ahead. This puts the 45 level of the ISM in sight and this level is where we typically see recessions.

This would seem to suggest more negative earnings surprises in the weeks and months to come (more on earnings in the Catalyst section).

Which would also suggest that the cost of capital for companies is also going higher. Here I compare ISM to the Moody’s Corporate Baa yield (inverted). The cost of credit, in absolute and relative (to Treasury) terms has been one of the legs of the bull stool if you ask me:

However, financial conditions (which include stock prices and credit spreads but many other variables) have been easing which suggests that ISM could bottom soon. I think Jay Powell is the only person that doesn’t see that financial conditions have eased meaningfully.

Whether I look at the Chicago Fed National Financial Conditions or the Goldman Sachs Financial Conditions (both inverted), one can see that perhaps there is a soft-landing in the future:

However, when profits finally peak, we are typically not too far from a recession itself:

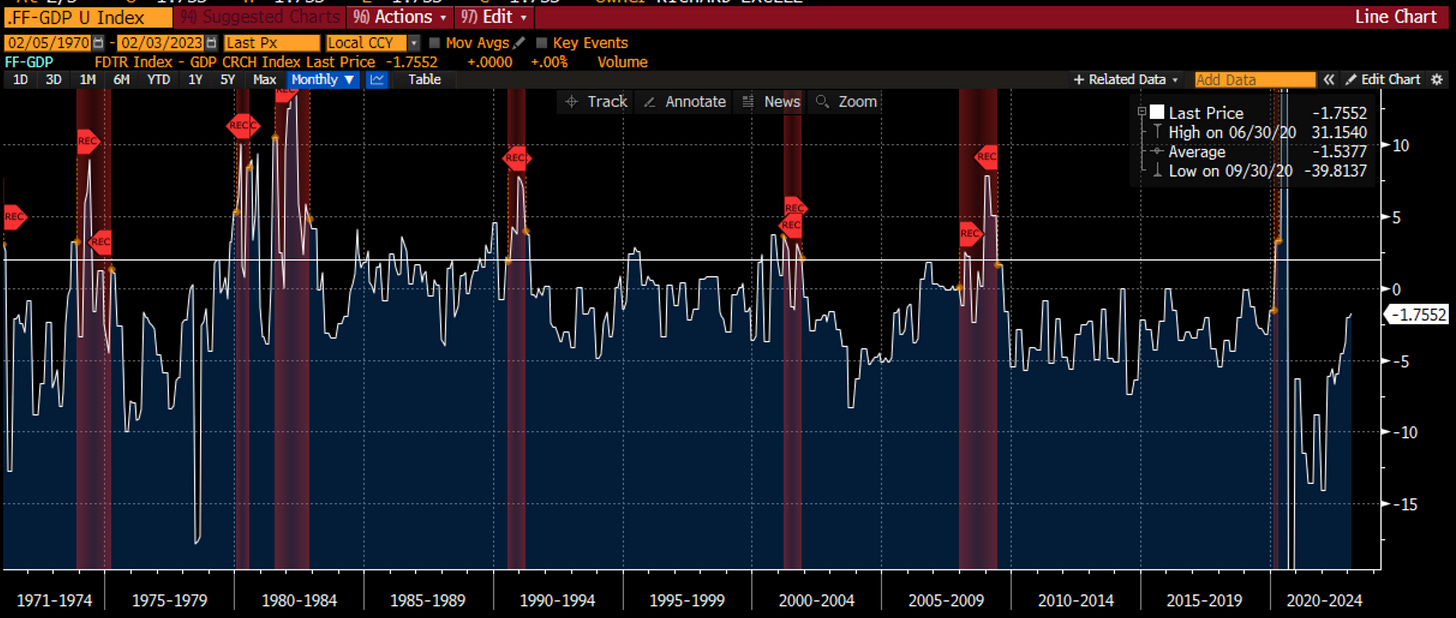

Does the FOMC stop hiking because of fears of a recession in the future? “That is not my base case” would seem to be the answer Jay Powell would give based on how he answered questions about a recession in the press conference this week. In fact, the FOMC has not stopped until Fed Funds has gotten over nominal GDP growth:

Fed Funds moving above nominal GDP by 2% appears to be a trigger when a recession starts. At the press conference, it appears the FOMC is on track for two more rate hikes (March and May) regardless of what the bond market is telling you as Jay referenced “hikes” plural multiple times. This gets us to the 5-5.25% range for Fed Funds by May. Where will nominal GDP be at that time? If we get 1% real GDP and 4% inflation, that could be the perfect place to stop and not cause a recession. However, is the Fed really able to thread the needle like this, particularly if it has litle interesting in cutting rates?

BEHAVIORAL

It would seem to appear that a recession is a highly likely event in the coming months. Perhaps the problem at this point is in spite of this bad news, everyone sees it coming. The odds of recession at the NY Fed are steadily moving higher and the last Bloomberg survey of a recession in the next 12 months put it at 100%. I am not 100% sure of anything in life, so this is a surprising reading.

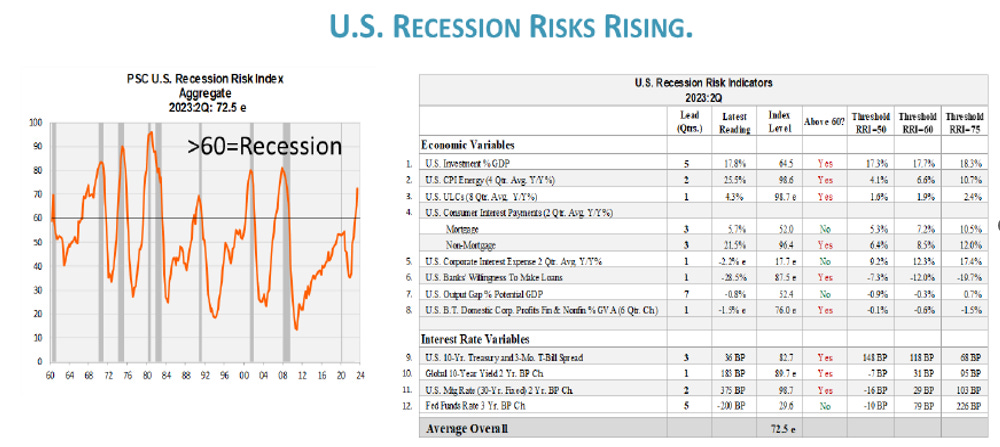

The esteemed Nancy Lazar at Piper, who is very well-followed and always near the top of the pack on the II rankings, has a recession risk index which is flashing a red warning signal:

On the back of this, the is a very large short interest base in the S&P 500 futures market, anticipating the coming recession. This provides the dry powder to buy when the news is not bad enough:

In fact, within the equity market, volatility, short-interest and leverage have been among the best performing factors this year:

I had a post this week about leverage and zombie companies. These were my thoughts on that:

Chart of the Day - Zombies. For whatever reason, the Twitter algo shows me ads for a gaming app. The game is about a Zombie apocalypse & the player has to fight the zombies with different weapons to get to the next level. Not sure why the algo thinks I care but I get it all the time.

The thing is, I do care about zombies, just not these kind of zombies. I have written about the zombies I have cared about before. The one where their EBIT is < Interest expense. The companies that can't afford to operate but still do.

We can learn a lot about what the mkt cares about by watching the performance of this collective lot. It helps us understand what the flow of capital is motivated by.

In 2020, the zombies were up 28% led by names like AMC & GME. We can say that this was just a Reddit thing but it wasn't. It was about free money that had given the zombies life support. The odds of bankruptcy were being reduced in models so the collective lot ripped higher.

This positive price action continued thru June of 2021. The group was up another 15% thru mid year. However, this was about the time when the free money was beginning to wane. This was the time when we saw a peak in negative yielding bonds globally too.

The second half of 2021 was not good to the zombies. The group ended the year with -15% returns. It was the start of long duration assets really starting to feel pain.

This continued thru 2022, a bad year for risk assets, but particularly a bad year for long duration assets in any asset class. Zombies are long duration. So is high growth tech and crypto. Zombies lost 48% in 2022 as the cost of capital rose.

How have the zombies done this year? So far this year zombies are up 30% thru 5 weeks. They are led by names like CVNA which is up 200% over that period. APPH which is vertical farming (as opposed to vertical car selling) is up 361%.

This list of names I track is not small. I look at the Russell 3000 which includes large & small cap. It is 12% of that index. If I look at the Russell 2k it is over 15% of that index & has been the entire period.

Zombies are back to winning but why? Is it because of the pervasiveness of free money that keeps them afloat? No, it is because leverage, short interest & volatility are the factors driving the mkt now. Especially short interest as heavily shorted stocks writ large are outperforming by 20%.

We have seen junk rallies that lead a new bull mkt. Many say that is the case now. However those periods (90s, 00s, 10s) were all led by junk after the cost of capital had reduced considerably. That is not the case right now. The cost of capital has risen & will still rise some more.

That tells me this is about short covering. It can & is very painful. Any HF short CVNA or APPH are getting carried out. This spills over & leads to shorts being reduced everywhere. Not an easy mkt but not something that persists.

How much does short-interest matter? High short interest stocks have out performed by 20% this year. 2023 is the year of shorts getting squeezed because all of the bad news is priced in:

One last picture comes from ZeroHedge via Sagar. It suggests the short squeeze in the back half of the week was the biggest in 8 years. Given the massive amount of 0 days to expiry call options that traded this week, one would think that shorts were getting carried out this week.

CATALYSTS

So what changes any of this? Catalysts typically get us to change our minds. Earnings, economic data, geopolitics. Any of these can be a positive or negative driver. Sometimes, getting through a catalyst with things not as bad as feared can also be seen as a positive catalyst.

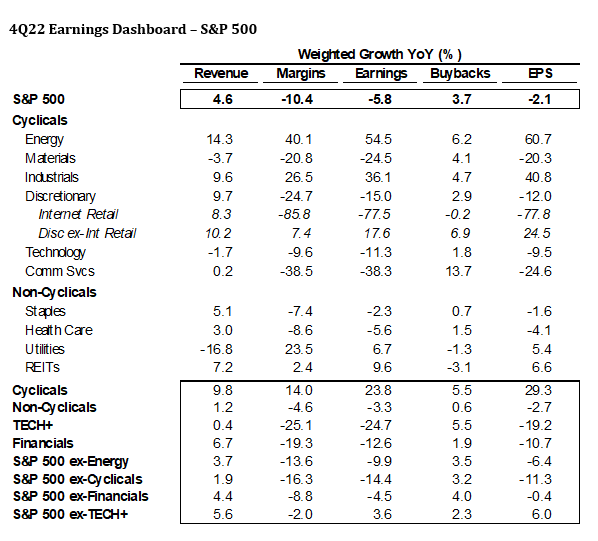

Earnings may be that story. With half of the market reporting, earnings growth is negative while sales growth is staying positive. This means margins are getting squeezed which is why we see cost cutting (read layoffs) in many high-profile firms.

While the level of surprises relative to expectations are the lowest in years, it is still positive.

Jonathan Golub at CS has a great breakdown of the drivers of earnings across sectors. Cyclical sectors are the standout performer and TECH is the major source of weakness. Probability not surprising the big layoffs have largely been in tech.

Golub also shows us that positive news is being rewarded while negative news is being punished:

About those layoffs, the job market is the critical story right now as people point to it as a source of strength and a rationale for a soft-landing. Yes, there have been many high profile layoffs as we saw in the Challenger data this week. However, we saw jobless claims head to new lows this week suggesting a lot of those peopel are getting picked up pretty quickly. I have seen stories in the press about the NSA hiring these people, about the City of Chicago recruiting the tech layoff crowd even the HB-1 visa holders, and that start-ups are still in a big need for them.

In fact we continue to see 11mm job openings, primarily in healthcare, leisure and hospitality and retail. However, this is probably indicative that even in a slowdown, companies are going to be reticent to fire. This is also one reason the non-farm payroll surprised to the upside. That said, I think the adjustments from a year ago played an even bigger part. I still hold the premise of the job-full recession that I see happening:

Finally, let us remember, though, that employment is the most lagging of indicators. Mike Kantrowicz has talked about HOPE and I have shown you his premise. There is intuition and logic that money flows through the economy via housing → new orders → profits → employment. The first three are already falling. Unemployment always looks low just before a recession. If companies are reticent to fire, even as the economy slows (job-full recession), this just means margins and profits are squeezed even more and stocks should fall or at least have a strong headwind going forward.

We are at the tail end of a business cycle. This is ALWAYS the most difficult time to invest. With the record amounts of monetary and fiscal stimulus that need to be unwound, it is bound to be even more difficult than normal. There are some time-tested truths about the economy that we need to be aware of.

Pulling together, I do still strongly feel there is a cap on how high the market can go given the headwinds from the economy. This reminds me of the 35% rally in 2000 after the drawdown, which met another wave of selling. It reminds me of the “Bear Stearns bounce” in 2008 before the waterfall decline continued. Given this is most likely the most foreseen recession in the history of recessions, and that the market is incredibly short, there is still a good chance we have some upward momentum to the market. I don’t think that is the start of a new bull market. I think that is an opportunity to raise cash levels even more, to add some bearish option strategies, and to prepare for a tough market ahead.

In spite of the short-covering holding things in, it seems that investors have quickly moved from fear to greed:

That tells me, it is time to …

Stay Vigilant

Interestingly, most of the job openings are in services sector and the cyclical sectors of the economy continue to post modest to flat growth in openings. IMO we will probably have a shallow recession where services sector might hold well akin to the 70s/80s. UR may stay below 4.5% and we might rebound sharply. The movement in wage growth (AHE) remains the key to control inflation. Earnings can be tricky if we get a shallow recession. IMO the biggest hit to earnings will be from profit margins as they can revert to the mean after a sharp bump up post covid.

Ex--You and I are focused on many of the same charts. I am renting the bear for a few weeks now. NFP needs grain of salt. First the 4 sigma surprise is astonishing (ex Pandemic). But the seasonal factor is massive in Jan, because of seasonal jobs. So it appears that jobs that normally get lost in this seasonal did not occur as much as might have been indicated by seasonal. So I am sceptical about it. One point that seems worthy making on the bullside, is that the Global New Orders / Inventory has turned up, which leads PMI by 2 mos or so. Although you quite rightly point out the US has not. The other crazy thing, among many crazy things that makes drawing conclusions difficult is the difference in monthly change in ISM services minus ISM manuf, was one of the largest on record. Btw--I am also looking at IG vs ISM, and another one is cyc/def vs ISM, both positive and disconnected. Despite all this, I am very sceptical of markets ability to perform. If I were to go full crystal ball, I would suggest that we have risk off into the Ides of March, noted for its historic time of inflection points. It reminds me that in a couple of weeks i will need to roll out that chart. I know Kantro is defending his position because Fed pivots always lead to a bounce, but sometimes they don't hold, such as in 2000. Like the Zen master says, "we will see, what we see". Well at least this week we have break from immense data and central bank events risks. Last week was honestly a lot to deal with.