A year in review

At the end of every year, I think it is important to go back through your thought process each month in an attempt to improve. I'll let you in to my personal review

Before I dig in and go through my process, I want to say thank you for reading Stay Vigilant. I write these blogs for all of you as I want to demystify finance for everyone. I have a very eclectic mix of subscribers, as there are some who are active in financial markets and are institutional players, and I have others who have no idea what finance and markets are about. Thus, I try to thread the needle when I write to make it accessible to all. I recognize this may frustrate some. I hear from some people who say ‘I have no idea what you are talking about. It is over my head.’ I hear from others that say ‘It is too basic. I want something more meaningful to help with decisions.’

That said, I must be doing something that works. Subscribers grew by 50% this year. This in spite of the fact that I, by my own admission, have been too downbeat on stocks this year. However, the Stay Vigilant footprint continues to grow and is read in 49 states (Wyoming … really?) and 110 countries (I am light in Africa, any thoughts?) Because of this, I say thank you sincerely.

As always, please send me your comments on how I can improve in your opinion. For now, I am going to tell you how I think I can improve in my opinion.

January

I started the year by saying I was open to the idea of a soft-landing, but thought it might me more likely that we went sideways. If you recall, the NDX was up quite sharply in January, which meant if you weren’t invested early in the month, it made chasing the market hard from the get-go

My point in the early going was three-fold: 1. the technicals were very strong and you should keep an eye on them 2. the bond market was too dovish 3. best to keep your powder dry and earn the 3.5-4% you could in short-term Treasuries.

From this standpoint, I think I was right on all three fronts. However, what I think I really missed was how to weight each of these factors. Clearly the technicals - sentiment, positioning, charts, money flows - were BY FAR the most important consideration. Sure, the market was too dovish expecting Fed cuts by May or June. However, even when the market priced these out, it didn’t matter that much. The cash call made some sense if your benchmark was the Russell 2000 or the equal weight S&P for most of the year (until December). However, it didn’t help if you compared yourself to the S&P 500.

On the positive front, including technical analysis in my process to go with fundamentals and catalysts kept me from being short the market for the bulk of the year. However, I never really went all-in on stocks in one of the best bull markets we have seen.

February

My message in February was one where I felt the market had peaked. Shorts had been squeezed and my process suggested we would be in 3200-4200 range this year so we were at the top of the range. The fundamentals were still pointing lower and the cost of capital was going higher. The technicals that had driven the market were beginning to look negative. I suggested dry powder and earning on your cash was a good place to be, with more aggressive players maybe fading the market. This looks pretty good as the market peaked at 4200 early in the month and closed on the lows. One last thing - I mentioned the possibility of higher fiscal spending this year which came through. However, my focus was on the impact to inflation and not as much to growth. I missed the boat on that as it was the fiscal spending that really helped carry us this year while the inflation did not materialize as I feared.

March

My focus and everyone else’s focus was on the banking crisis. What happened? What did it mean? How should we react? When I say everyone, I mean the FOMC as well. My take was that this would lead to banks tightening credit, which would be bad for the economy. I said you should stay in cash. I felt financial conditions and credit would both tighten. This could lead to a pause from the Fed but it also increased the odds of a recession. While I had been a bit more mixed on the overall market up to now, pointing out that Fundamentals and Technicals were cancelling (other than the short-term trading top last month), March pushed me over the edge and got me to lean a bit more negative the rest of the year.

The fact is, while the bank credit tightening did get a little worse, it didn’t deteriorate as I thought it might. In addition, financial conditions largely went sideways the rest of the year. As I look back, while I think I was accurate in what the transmission mechanism could be, I should have paid more close attention to financial conditions. Steps from the Fed were offsetting some of the problems and thus it never had the impact I feared.

April

As we moved into the Spring I started talking about more specific technicals, like the short strike on the put-spread collar for the JP Morgan strategy that dictates price action. I know this is beyond many people. However, again, technicals were in focus. I did say that central bank balance sheet growth and positive seasonality were potentially good for risk. The fundamentals still looked negative but there might be some bottoming signs for growth. As always, technicals looked good. There was room for taking some risk but I suggested that I preferred to take my risk in crypto, namely Ether, instead of the Nasdaq. You can see that in April, that worked very well but for the rest of the year it is more of a mixed bag. Both have done well but the move the last month in stocks put NDX over the top. One last point, I wrote in a couple posts about the negative of Central Bank Digitial Currencies (CBDC). I still feel this way yet these ideas continue to gain traction. Please be very careful.

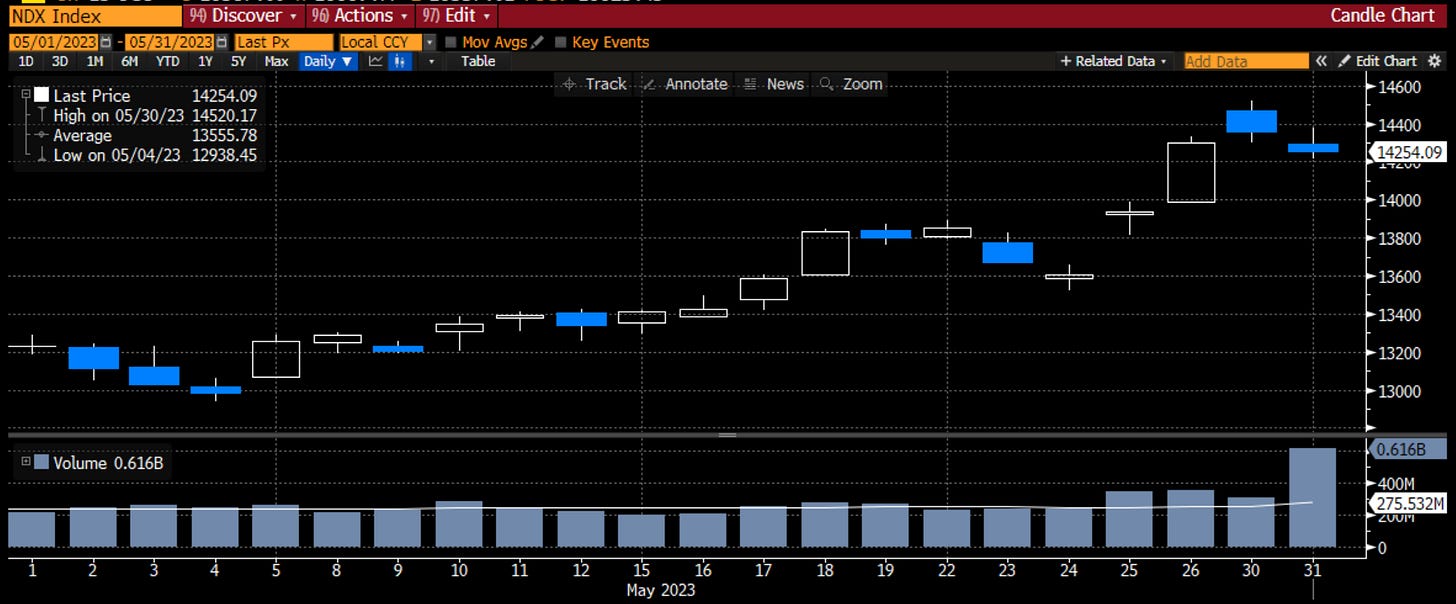

May

This month I had a lot of guests on the Substack. Part of this was to mix it up for the audience and see what you like. Please let me know in the comments if you like when I do podcasts with others and share those or if you find that a distraction. Two guests I had on that I have a lot of respect for were Jerry McNulty and Konstantin Fominkyh.

Jerry brought up some really good points about the seasonality of the third year of a Presidential cycle and how we should not ignore that. Given I had mentioned the positive technicals several times, highlighted positive monthly seasonality last month and even mentioned higher fiscal spending, I don’t know why I didn’t pay more attention. However, those who listed to Jerry did well. Konstantin spoke about the AI in his process and how he was positive. The mention of AI had me write a post the next week about the impact of AI in general, and NVDA specifically, on the markets. The posts were generally positive and the market, tech in particular, was strong in May.

June

Back from a golf trip, it was time to revisit the three-step process. As I did, I still saw fundamentals as negative, technicals as positive and no discernible catalysts. I preferred risk and reiterated that I liked crypto more than tech stocks because I was still worried the Fed was in play and this could hurt tech more, even though both were affected. Credit tightening was happening, the Fed was still hawkish, and there were more signs of pain in tech with layoffs. I still liked cash. Well, tech ignored me but even a 50-50 portfolio of cash at 5.5% and Bitcoin which was up 50% would have outperformed the NDX which was up an impressive 15% the last 6 months. This position also allowed me to have some risk one but also have dry powder in the event something bad happened.

July

The focus this month was mostly about the economy. I talked about how the ISM vs. the SPX returns fit very nicely over time, but the SPX was rallying and it wasn’t corroborated by the ISM. I spoke about how the hard vs. soft landing debate all came down to jobs and the jobs market was looking like it was going to deteriorate, which it did. I brought up a second time the Jay Powell Recession Indicator which was flashing a recession signal yet the market was ignoring it. In fact, one could argue the FOMC was because it was still tightening. For the record, that indicator has only gotten worse since then. My last point was that there was really no margin of safety in stocks vs. cash, something that is still true. July was a positive month on average but the tides turned in August.

August

My focus in August turned to the bond market. My message in August was that we were set to see higher 10-year US yields and this was going to have an impact on everything else as all other asset classes are priced off of it.

I continued to reiterated that fundamentals were negative but the technicals were positive. I suggested that in the pullback in August, if one was in cash, they could start to buy stocks. I did tell others, if they had been in, it still made sense to own protection against their portfolio. This made sense as the yields hit a high of 5% in October. It was tough to put cash to work but for those that were disciplined, they were able to use the bond market troubles to add to some exposure.

September

The focus in September was on fund managers coming back from summer vacation. The ISM had bottomed the last two months in a quiet summer and so it was going to be difficult for them to not put risk on into the year end. Whether they were in cash or not, fund managers would have to chase performance. The ISM managed to peak and turn lower in October but the new orders to inventories ratio continues to plug higher, giving many the sense that we are still in the bottoming process. As I have said before, the when the ISM is below 50 and rising, it is the best time to own stocks. If you think the new orders to inventories says it will rise, you want to own stocks.

October

I was all over the place in October. My Ryder Cup post preferred US stocks to EU stocks and I think that worked out. I spoke about the broken promises across all of DC that would continue to impact bonds and that didn’t work out, at least not yet. I was really worried about the Middle East problems creating a bigger geopolitical risk, which surprisingly did not materialize.

However, I did say in October an into November, the focus for stocks was going to be on earnings. If earnings came through, stocks could do well. If not, stocks were in trouble. Recall at the start of the year, S&P earnings were expected to be $225. Some bulls saw a move up to 235-240, the bigger bears saw 170-180. I thought earnings would go lower but as we see below, after a drop in earnings earlier in the year, these have largely flat-lined at $215, and this has served to support stocks and the soft landing narrative. It is still a big focus for portfolio managers, but won’t be a catalyst until middle to late January now. It is surprising to see the resilience of earnings.

The last 5 weeks

After the earnings bounce at the end of October and early November, I sat down for a Thanksgiving post and then an early December post. I look through my process and I still feel the fundamentals are negative and technicals are positive. As for catalysts, I acknowledge the behavioral impulse of PMs into year end, but cautioned the FOMC could be a negative catalyst. As it plays out, it was quite the opposite. Catalysts and seasonality aside, I end the year precisely as I started it. I am still not as convinced the economy will have that soft landing. I acknowledge the technical trend of the market is higher. I look at three scenarios, and for me two of those are negative: 1. Soft landing, Fed cutting in 2024, all good for risk 2. Fed cutting in 2024 but because it is a hard landing, bad for risk 3. Soft landing but the Fed still in play, with no cuts in 2024, bad for risk but not as bad as scenario 2. You still get more than 5% in cash so there is no urgency to take risk when the earnings yield on stocks is less than 5%.

This is how I will leave it. There was some good, there was some bad. I don’t think I need to change my indicators, but I need to prioritize them better. To this end, I had a team of students work on some machine learning models to help me weight the indicators better. I will show you some of that work in 2024.

For now, I thank you again for sticking with me through the last two years. I look forward to more dialogue going forward. This is my last Stay Vigilant for the year given the holiday season. I wish everyone a happy holiday season, whichever holidays you celebrate, and a prosperous new year.

Stay Vigilant

It is a curious fact that capital is generally most fearful when prices of commodities and securities are low and safe, and boldest at the heights when there is danger." Bernard M. Baruch

Happy New Year, Richard. Looking forward to learning more about your students' AI models.