Action Jackson

This week global central bankers convene at the Jackson Hole Fed meeting. What is the set-up into that meeting?

Before I dig into a series of charts this week, I would like to try something new next week. I want to try a ‘mailbag’ where I try to answer, from my perspective, any questions you have. Please email me, DM me, or put in comments, any questions that you have and next week post I will go through them. If nothing else, this should give us a good idea of where sentiment is.

Now, let’s dig into the charts. I had posited in my writings over a month ago that the Fed could pivot at this meeting. My thought was not that the Fed would stop with rate hikes, but they could slow up on QT if the economic data and earnings performance were showing signs of strain. The market ran hard with the Fed pivot idea, so much so that it really has taken the possibility of a pivot off the table. Equities had a 20% bounce from the lows and the bond market started to price in cuts to 2023. Since the July FOMC, Fed speakers have come out increasingly hawkish, telling the market in no uncertain terms that it is not appreciating how much the Fed plans to hike rates.

As I wrote on Linked In this week:

“Chart of the day - road trips. I have the car packed to the brim as we head out today to drop the youngest off at college. This reminds me of long road trips as the kids grew up. We always started out excited about the journey. However, there was always that point where people became impatient. That is when parents usually turn to the tried & true "if you don't stop doing that, I am going to..." Typically for my wife & I, the threat was a removal of an incentive. Maybe we wouldn't stop at the ice cream capital of the world etc. Right now, I get the sense the Fed is trying to do a lot of parenting on a road trip.

Bullard & George were the latest to come out very hawkishly & state in no uncertain terms that they do not see any rate cuts on the horizon in 2023. The mkt has been pricing in cuts in 2023 for some time, directly at odds with the Fed dot plots. Since the July FOMC, a slew of policy makers have come out & tried to talk to the mkt about changing its view, about understanding the strong intent the FOMC has on squelching inflation. You can almost hear the FOMC saying "If you don't take those rate cuts out of 2023, I am going to..." Since the rate cuts ARE the incentive, the FOMCs job is a little more difficult. That doesn't mean they won't try. Whatever trick they have up their sleeve, it might come out next week at Jackson Hole.

You see, this is what is driving equity mkts right now. The top chart shows the 1 year rate hikes priced into the Eurodollar curve in white vs. the SPX forward earnings yield (inverse of P/E) in orange. As the mkt was pricing in more & more hikes, the earnings yield was rising, P/E was falling. As the number of hikes has come down, the earnings yield has fallen (P/E risen). The Fed is trying to jawbone the number of hikes priced in for the next year higher. What does this mean for the earnings yield? What does it mean for P/E?

If we look at the bottom chart, this matters. This is a plot of the SPX forward P/E vs. the SPX itself. You can see the mkts ebbing & flowing this year is primarily attributable to the changes in the multiple. Yes, earnings were good in Q1 and better than expected in Q2. They are expected to fall in Q3. All in all, we will see a small gain from earnings in 2022 but a decline in expected earnings in 2023. The earnings driver is pretty flat now. The mkt is moving around on multiples or, said another way, investor sentiment. When sentiment is strong, multiples rise & vice versa. The June to July move was really a bounce on epic pessimism. The July to August move is more on people getting excited about the mkt again. The FOMC seems intent on squelching this. There is an old market maxim: Don't Fight the Fed.

Mkts are still thin & relatively understaffed. There are more people like me taking kids to college. However, next week at Jackson Hole, things will get real.”

The Fed is certainly pivoting, and it is pivoting toward being more market unfriendly, and not the market-friendly Fed we have been used to for the last decade. The questions for me become: Does the market realize this? Does it care? Which markets are most out of touch with the Fed? What does this set-up mean for the markets in the post-Jackson Hole world?

Let’s take a look.

I mentioned the change from pessimism in the markets, however, that has not been the case with businesses and consumers globally.

China is in the worst place right now. I wrote about this on Linked In this week:

“The chart today shows it playing out that way. You see in purple the Chinese housing data. After a major spike coming out of Covid in late 2020-early 2021, You can see it has plummeted. I can't even fit it on the chart. Consumer confidence, as a result (in orange) has also plummeted. The leading indicator and the PMI have slowed over the past year into recession territory, but have held up better than one might think. There will certainly be those that think it is manipulated but you can see these measures fell sharply in 2020. The thought now is they are about to again, just like at that time.

Problems on another team, can become problems on your own team. Given the interlinked global supply chains, the need for multinationals to sell into China, & the impact a collapse in construction has on commodities, suggests the global economy, other teams, need to take notice. The last 3 years, student teams I work with build a model for US PMI & almost unanimously, a significant variable they find is the Chinese PMI itself. Perhaps that is slowly eroding as supply chains are rationalized, but I imagine it is still significant, & therefore pointing lower right now.”

It isn’t much better in Europe. The ZEW survey of economic expectations across the Eurozone are back at the lowest levels of the century. Suffice to say, there isn’t much optimism among businesses facing the high input costs and possible rolling blackouts.

It isn’t much better in the US either. The University of Michgan consumer confidence is running at Great Financial Crisis levels (blue). This survey is more impacted by inflation that the Consumer Confidence which is more impacted by jobs and is holding up better. Speaking of jobs, the largest employers in the US are small businesses and their level of optimism is back to the immediate post GFC period, but still falling.

How do investors feel about the economy? The BAML GLobal Fund Manager survey asks that very questions and you see 2/3 of investors are expecting a weaker global economy. If you think that percent is high, 80% expect a fall in inflation. Perhaps that is why the market and the Fed are so at odds right now.

Given this view on the economy, it shouldn’t be surprising that risk appetite is so poor:

In spite of this downbeat attitude, in the fact of a 20% rally, investors still had to reduce underweights in stocks. Notice, they are still underweight, but there was some reduction in underweight adding to buying pressure.

With this move, investors are net overweight equities relative to bonds

and reduced the overweight in commodities, completely consistent with the expectation of a fall in inflation.

Despite these moves, investors are still more than 2 standard deviations underweight equities, particularly in Eurozone and EM.

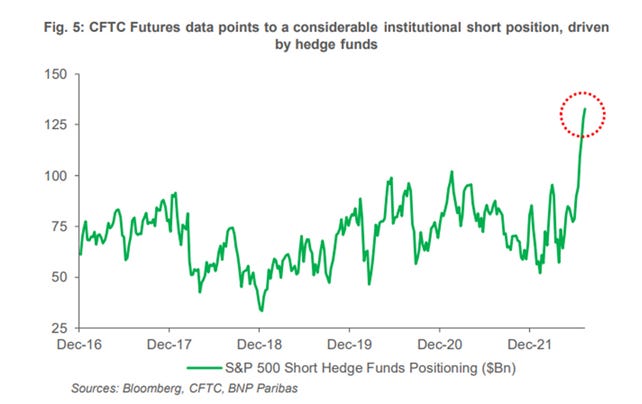

Hedge funds are getting short equity markets in very large size right now:

The reduction in equity short appears to have been done via the options market if you ask me. Why? Because when I look at the skew in the options market and it is among the most flat we have seen it. This is not consistent with HF being short. This is consistent with investors staying underweight but adding long calls as a way to protect their returns. This is not the action of convicted longs.

The commodity market reflect the exact same views. Oil is the commodity market view on future price levels. Prices are falling and we see a reduction in longs, increase in shorts.

The commodity market view on growth is the copper market. We have seen an even more serious reduction in longs/increase in shorts. The commodity market is clearly reflection the falling growth, pulling down inflation theme.

So we go into Jackson Hole with the so-called smart money leaning into the short side of the market, in both equities and commodities. Investors have reduced the underweight in equities but remain underweight. It looks to me like the reduction was view calls so there is not much conviction. However there is also leverage if there is a sell the rumor/buy the news. The key for me is to see how much focus there is on European inflation vs. the Chinese growth concerns and what this might mean for the path for Fed policy going forward. The news is certainly downbeat on the economy which hits the earnings expectations. An aggressive Fed hurts the multiples. What is an equity investor to do?

A useful way to think of this came out of the BAML report. Earnings right now are about $220 per share. There is still an expectation of eps growth and that is why we are now at 4230. If we assume that eps stays flat, and use an average 21st century multiple of 20, that puts the top end of the range at about 4400. If we assume the average of the 20th century at 15, that puts the bottom end of the range at about 3300. To move outside of that, we need some big changes higher or lower in eps expectations. For that, we will need to see an acceleration in the economy to the downside, or a pretty big turnaround.

We will cover the economy in the coming weeks. For now, we have Jackson Hole at the end of the summer.

Stay Vigilant

To what extent are current “supply chain issues” impacting the markets and how do you track this issues progress?

good article. Some rate tantrum pullback followed by markets finding their footing. I see 4400 eoy (barring ofc Putin nuking/china invading etc)