An epiphany

As we begin the new year, the market searches for an epiphany to answer the hard vs. soft-landing question, which is critical for risky markets.

This morning I was listening to a talk by Robert Barron where he spoke about The Feast of the Epiphany. As he discussed, the word epiphany comes from the Greek ‘phanein’ which means ‘to appear’ and the Greek work ‘epi’ which means ‘on top of’ or is a way of intensifying the word. Thus, epiphany means something that has appeared but in a very intense way.

The market is looking for this sort of epiphany or very intense news that will highlight the direction for risk-taking in 2023. You see, there is very little disagreement about the direction of the economy and inflation at this point. Both are pointing lower. However, there is a debate on the direction of the market right now, and that is predicating on the soft vs. hard landing of the economy. If it is a hard landing, we should expect still lower stock prices and still wider credit spreads. If it is a soft landing as even Bullard from the Fed suggested, this could me we have seen peak Fed hawkishness and therefore are open to a better market environment. This is the key discussion right now.

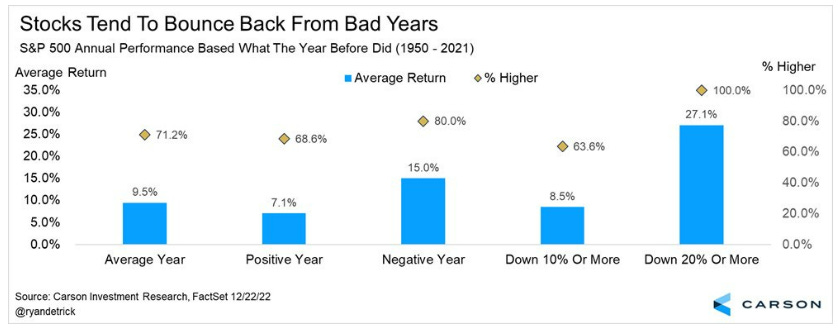

You see, as highlighted by Ryan Detrick (via Callum Thomas at TopDown Charts), following a year in which the market is down more than 10% (but not down more than 20%), the market is up about 63% of the time (vs. about 54% of the time in all of the data). Thus, it is still a bit of a coin toss right now for market players and investors.

Fortunately, the market gave us an incredible amount of data this week and will continue next week. This is a time when we could get an epiphany. Based on the move higher in risk on Friday, one would think the market bulls, at least, have gotten said epiphany. Let’s take a look.

The big data Friday was the non-farm payroll data. It is always the highlight of the month even though I do not feel this way. It is too subject to adjustments and revisions for my taste. That said, the market follows it closely, the pundits follow it closely, and therefore we must all follow it closely. However, the best I can tell, there wasn’t really the epiphany that many who were buying the market saw.

The next couple of charts come from Nancy Lazar at PiperSandler. She is the best economist on Wall Street and so I always listen to what she says. This doesn’t mean I always agree with her, and I tell her when I don’t, however, she is a voice to be heard. In her first chart about the data on Friday, she highlighted how the labor market is still very tight. The headline number was 23k above consensus with only small revisions to prior months. Importantly. the household employment number, which Nancy highlights is always more accurate at inflection points, jumped by 717k which drove the unemployment rate down to 3.5%. In previous months Nancy has pointed to weakness in the household survey as reason to see a recession. However, this month there was a bounce back suggesting the Fed has still not weakened the labor market as much as it might want to.

A big source of the disconnect comes from the breakdown of the data. We see the big headline news of layoffs in tech, with Amazon announcing 18k layoffs just this week. The tech sector was a major beneficiary of Covid and work from home. The tech industry responded by being the most aggressive on the hiring front. Start-up companies flourished with 0% interest rates pulling even more people into tech. That is all unwinding. There is still a shortage in leisure and hospitality with wages there climbing. We have all seen the food inflation at restaurants as a result. In addition, manufacturing jobs are still strong as companies are making their supply chain redundant by adding more capacity in the US, where we also have access to the cheapest natural gas in the world. Finally, believe it or not, retail jobs are holding up. Remember, the Fed has particularly highlighted services ex housing as the source of inflation that it is most worried about. This part of the economy is doing okay still.

That said, wage inflation has peaked even if it is still at very high levels. Average hourly earnings were up less than expected this month. Perhaps this is the news that gave the bears some hope. The annualized rate of gain would still be the highest in 40 years ex the previous year, so it isn’t as if wages aren’t still moving higher. Thus, as Nancy points out, the Fed still has work to do in slowing employment.

Another savvy market veteran is Francois Trahan of his eponymous research shop. Francois is in the Investors’ Intelligence Hall of Fame and so another person I listen to but do not always agree with. I shared his post on LinkedIn on Friday as I was traveling but here it is today. He refers to the JOLTS data (job openings/labor turnover) which came out on Wednesday. His overlay of this data, still showing 10.5mm net jobs open in the US, versus the Atlanta Fed wage growth tracker suggests this pullback in AHE this month may be the anomaly and that the Fed clearly has more work to do just based on its own data.

Another top-tier market watcher is Barry Knapp. I had Barry on as a podcast guest last year. He is another great follow on Twitter and Substack (Ironsides Macro). Barry is more pre-disposed to the positive market view right now (he is not a permabull) and had a very different and positive take on the data on Friday. The market appears to be more in synch with Barry’s view:

“This leaves services less rent of shelter, and the Chairman’s view that view that this component of inflation, despite two very tame CPI readings, is the major area of inflation risk due to unsustainably high wage growth. Assuming the Fed sticks to this framework the December employment report was a game changer. Nonsupervisory average hourly earnings for service providing industries eased from a downwardly revised 5.44% November reading to 4.88% in December and a peak of 6.99% in January. Disinflation in services wage growth is all the more impressive given the surge in demand for services in 2022 (3Q 3.7%, 2Q 4.6%) as consumption rebalanced from goods to services. While the unemployment rate fell back to 3.5%, the low for this cycle, nonsupervisory average hourly earnings, the employment cost index and Atlanta Fed wage tracker were all in the 3-3.5% range with a 3.5% unemployment rate pre-pandemic.”

As you can see, everyone looking at the same data, and everyone coming up with a slightly different view on the results, results which have a very meaningful impact on whether one should buy or sell risk right now. No epiphany or intense revelation that I can discern, but certainly strong opinions.

What is clear right now is that the falling inflation we are seeing, coupled with wage growth that is still strong, is boosting real incomes and supporting spending. Much has been made on Twitter of the drop in savings rates in recent months, ignoring the savings accounts still being flush (it is the classic stock vs. flow argument), however, with real incomes boosted here, we should see support for spending going forward. Again, this chart is courtesy of Nancy at Piper. She highlights the boost in real income and its correlation with consumer spending, suggesting the recession she still sees this year not happening in the first half of the year.

About that recession … As you all know, my favorite set of data comes from the Institute for Supply Management. The headline number is coincident with stocks and both are leading indicators of GDP. The components of the ISM data can give us insight into the direction of ISM itself, which suggests the components are leading indicators of the stock market. I wrote about this data on Tuesday on LinkedIn and here are the updated charts post the release. The headline index continued to fall below 50, as was suggested by the ratio of new orders to inventories. This ratio has been calling for this fall for all of 2022. In the last few months, the ratio itself has been showing signs of bottoming, leading many to think that perhaps this fall in the ISM will not be as deep. However, it took another leg lower this month, though it did not go to new levels. The ISM data itself makes me more, and not less, cautious of the market right now.

Why does ISM below 50 matter? I have shown this chart before on my LinkedIn and Substack. It comes from Jonathan Golub at CS. It quite simply and elegantly shows the average returns of the S&P 500 in different phases of the ISM. Right now the ISM is below 50 and falling. An astute observer can see that this is the one and only phase of the ISM that has negative returns on average. This doesn’t assure us to have negative returns this time around, but it does suggest there are some clear headwinds to taking risk at the moment.

Sagar Setia, another guest on my podcast, pointed out the Conference Board Leading Indicator to me in a comment on my ISM LinkedIn, suggesting we could go sideways for a while. I am not opposed to the sideways argument for the economy and markets in 2023. In fact, there was a Substack last year where I compared the current period to the post WWII period because this was the only period in recent times that saw the same direction and magnitude of both fiscal and monetary stimulus. That periodic overlay was pointed out to me by Fred Goodwin, yet another podcast guest. I am still sympathetic to this view for the full of 2023, though right now I am more myopically focused on the direction of risk in the next month and quarter.

If I look at the Conference Board Leading Indicator in blue, as well as the OECD leading indicator in white, and compare to ISM in orange, I still get the sense all are pointing lower still and not higher. I am aware of looking for when this can bottom and give a positive sign for risk to get us back in a sideways channel; however, for now, the direction still appears lower for me.

There are two components to the economy - growth and inflation. I have discussed the growth vs. inflation phases that I teach in my top-down investing class. The Fed also cares about both via jobs and CPI. Finally, anyone following the Quantity Theory of Money (M*V= P*Y) also cares of both. This week we will see the CPI data. I am not entirely sure the headline matters now because the market is convinced we have seen peak inflation. Remember the Twin Peaks? One peak has been achieved and we await peak Fed hawkishness. Right now there are signs of this. Well, based on a component of the ISM, the prices paid index, the CPI should continue to head lower.

However, my CPI forecast gauge, which looks at commodity prices, M2 money growth, inflation expectations etc. is actually pointing to a higher level. It had run below the CPI all of 2022 but did call the turn. However, at this point it is suggesting we will see sideways prices and not falling prices. How would the market respond to this?

It matters for Jay Powell and the Fed. Remember, JayPo said he is watching financial conditions. He wants these conditions to continue to tighten. Higher stock prices and tighter credit spreads caused financial conditions to loosen in the past week. That said, given the lagging nature of CPI and GDP, the tightening we have already seen in financial conditions would point to falling growth and inflation this year.

One last potential driver of inflation we must consider is China. Depending on who you follow on Twitter, China is either in a complete disaster state with bodies and coffins stacked up in the streets, or it is opening up and returning to normal. The truth, as usual, is somewhere in between, but the success of the re-opening of China will have a big influence on inflation globally given its demand for food and energy resources. In fact, I have always looked for useful proxies for CPI growth in blue because of the challenges with Chinese data. One measure is the Li Keqiang index in green which measures rail freight, electricity consumption and bank lending. It is still heading quite a bit lower. Another measure is the hot-rolled coil steel price index in yellow given the impact of construction on the Chinese economy. It had fallen precipitously in 2021-2022 but has recently started to stabilize. Finally, the pork price PPI measure in purple is also useful. As consumers do better, they demand more protein and this comes out in the price of pork in China. It has gotten noisy around Covid and lockdowns for obvious reasons. It is pointing marginally higher. Thus, quite the mixed bag on the success of the re-opening in China. I will hopefully get more local reconnaissance when I speak to my students in a couple of weeks.

I started the process of looking through the data this week with the hopes of an epiphany, of an intense revelation in what has occurring. You see, I had been on vacation in Florida all of last week and so I was only casually paying attention to the markets - once in the morning and once after the close. I did not understand why we got the big move on Friday.

Having looked through the day, I am still not sure. Yes, I can understand Barry’s interpretation and the sense that we may be in a soft-landing phase and therefore peak Fed hawkishness, the second of the Twin Peaks. However, reading through the work of others like Nancy and Francois, I do not see how the Fed can take its foot off the gas yet. On the plus side, this is because the economy is still strong. On the negative side, it means we are not yet at peak Fed hawkishness which means the move on Friday was a headfake.

This week, with the CPI data will be important. Even more important is the level of the market. As Callum at TopDown charts points out, we are again approaching a critical inflection point

There has been news, there have been revelations. I personally do not see any appearance of positive news in an intense (no one can deny) sort of way. I see no epiphanies. For now, I still see the confusing picture on the depth of the slowdown, the uncertainty of when the Fed peaks its policy, the muddied picture of China re-opening, and the critical juncture for price in the markets. I see this as a time to …

Stay Vigilant

Great article! It sums up how much uncertainty and conflicting data there is at the moment. I'm decidedly less bearish than I was a few weeks ago but I'm still pretty far away from being bullish. I just don't have a clear bias right now because it feels like pure guesswork.

The key to risk rally remain: a bottom in ISM and Fed pivot. The former, despite the bad reading in Dec, has a couple of leading indicators that point to Dec being the low in the cycle. First, ERB (earnings revision balances) bottomed in Nov. Second, look at cyclical/defensive, meaningfully off lows. One might also mention a third that is your chartpack above. New Order / Inventories is not making a new low. On the Fed pivot, I still like the 1995 scenario or peak hawkishness has come and gone. That is when terminal in the forwards was above 5.25%, now backed off. I feel good about stability of risk trade, but am still wondering if it could just be a dull year, rangy, as you suggested, because am opening up to the idea that the decade long outperforance of US vs World might be ready to take a rest and who knows even reverse. In a no recession outlook wondering if credit might offer better IR than equities?