Anecdotal evidence

The core themes stay the same, but there are several data points that corroborate what I have said for some time

It has been a busy few weeks for the markets and for me. Conferences are in full swing. Economic data has been fast and furious. The FOMC delivered the negative news as expected. The rest of the world is looking weaker than ever.

We are approaching the end of the quarter and the September quarter-end options expiration. It would not be surprising to see an acceleration of trends, exacerbated by short gamma positioning of market makers, in the coming weeks.

However, the market is still bearish. You ask how can I know that. There is hard data, there are surveys and then there is anecdotal evidence. I am going to show you a little of each. It is important, because it is this bearish positioning that may in fact be a reason why the pace of the move is not accelerating as much as some would have expected or hoped for.

First, the hard data:

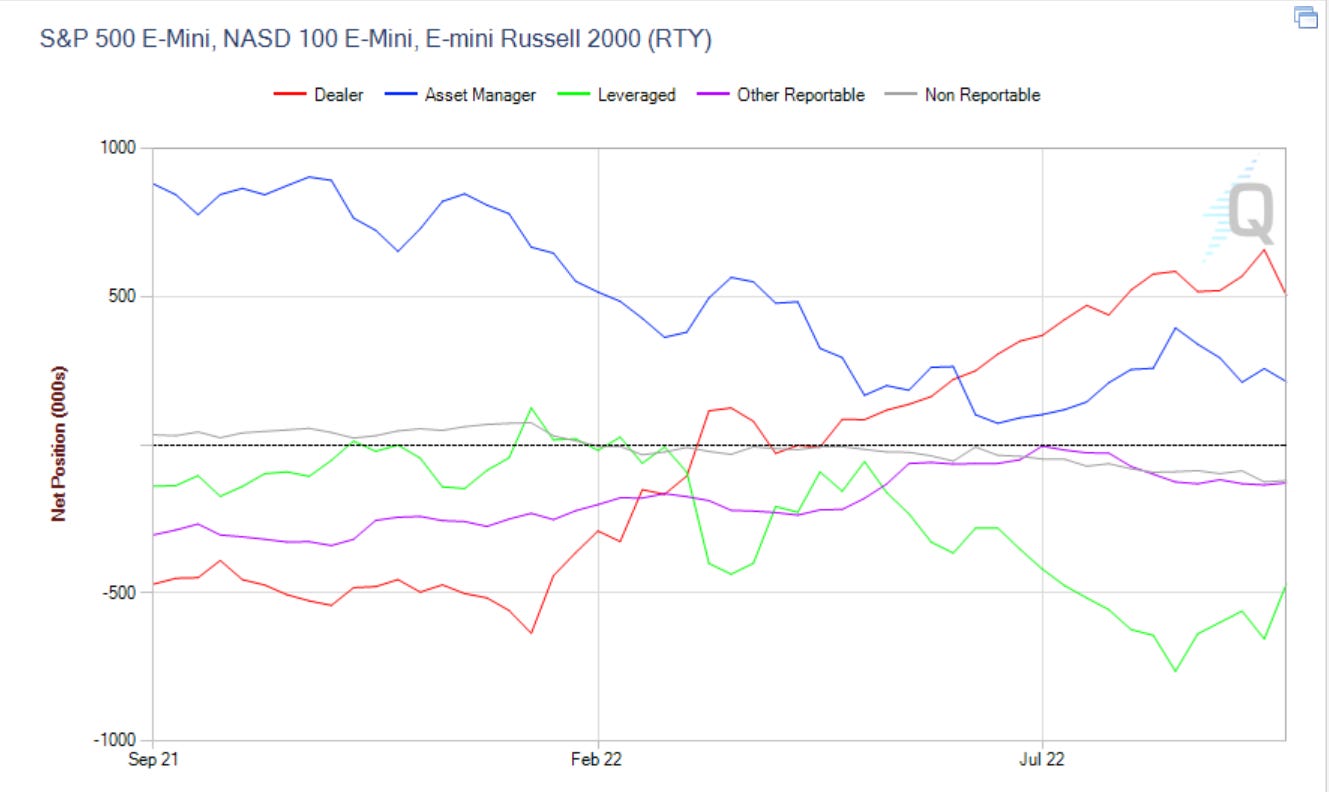

We can look at the Commitment of Traders Report that comes out each week showing futures positioning. Across the equity futures world, leveraged accounts - the fastest moving, directional traders, are net short near the peak of this short for the last year:

The short has also grown in the economically sensitive Nat Gas market. Yes there is some seasonality in this as we are out of the air conditioning season and not quite to the heating season, but this short is still building and the net is more short than last year at this time:

There is a bit more indecision in copper, equally as economically sensitive, and in spite of weakness in housing in both the US and China:

Total US market short interest has also grown to 5 year highs:

As has the 20 day moving average of put volume over call volume, not quite to where it was during Covid, but back to where it was during the Fed-induced slowdown in 2018-2019:

Next, the survey data. Many people do not care for this, yet it has a reliable track record. I look at the net difference between bulls and bears in the AAII data. Some will only show one or the other. Dispute it as much as you want, but levels on either side in excess of a net 20 are a good short-term trading tool. Levels we see now are as bearish as the GFC:

I would argue no one does a better job than Michael Hartnett at BAML. He speaks to more investors globally than any one person that I have seen. He definitely acknowledges that there is an extreme level of bearishness. He still sees downside to risk, but also points this out:

Finally, the Credit Suisse Fear Barometer measures the cost of a downside put vs. an upside call. Specifically it says how far out of the money a put would be struck if you used the premium from a 10% OTM call. When people get bearish, they no longer need to hedge for the downside, because they have already sold their stocks:

In my latest podcast (which I will post here when done editing) with Fred Goodwin gave me a new signal. He mentioned looking at the ratio of University of Michigan vs. the Conference Board consumer confidence. When it falls to low levels, a recession is near. It is below levels before that have shown a recession. Fred is outstanding at identifying risk, which is one reason they call him Mr. Risk:

Finally, the anecdotal evidence that I mentioned. Two of my LinkedIn posts, that many of you probably already read, where some of the highest engagement posts I have had this year. The first was of a chart that I had gotten from Twitter many years ago. I am not sure who first put it out there. The picture is good but the concept is as old as markets. The idea is that there is an investor behavioral response to bubbles. The view was that we are not yet at that level where the real pain is felt yet.

The second, which was even more popular, spoke about the amount of cash in the US banking system, which we can measure by looking at the amount of reverse repos. The Fed will be well aware of this excess cash because it must act daily to try and drain in. The implication is do not expect any relief from the FOMC until this cash comes lower. You can find those posts here and here.

Some other anecdotal evidence. I was a guest on The Yield podcast put out by Yieldstreet. This is a great platform with good information for investors. The entire podcast had a very negative tone, about inflation, the Fed, the weakness to risky assets. I will post a link when it is up but based on the tone of the questions, you can tell the readers of this platform are feeling pretty bearish.

I was also a guest on This Week in Futures Options hosted by The Options Insider Network. As we went through all of the asset classes, it was very clear that the big movers of the week were on the downside of economically sensitive - equities & nat gas - and on the upside if inflation-related - primarily ags. The punchline was to buy straddles on a range of products because even though implied volatility has gone higher, it may still not be pricing in the moves that we could see.

The last bit of anecdotal evidence comes from a weekend of discussions with some pretty influential people on the golf course. C-suite execs, industrial real estate owners, and financial advisors. The bottom line is the C-suite is very worried about a potential recession. We have seen this in other reports but the confirmation was clear and the concern was real. In addition, we are already seeing signs of very real inventory builds and requests to get out of leases early. Finally, investors are telling their advisors to build cash and stay in cash. No need to be a hero. Interestingly, US Treasuries do NOT look attractive to the Baby Boomers yet even at 3.6% yield. I asked where they might be and the answer was - not sure but well above 4%. There was nothing about any of these conversations that told me: 1. people are naively positioned to buy the dip or 2. those with the decision-making authority are looking to add risk any time soon.

One last tidbit. I was fortunate to be on a panel discussion hosted by NIRI. The panel was titled The Rise of Passive and Thematic Investing. The slides shown by my fellow panelists spoke about a few key themes: 1. Millennials caught the investing bug in 2020 and have skewed more bullish than other demographics. We will see how long that lasts 2. ETFs have become a major part of portfolios run by investment advisors and retail clients. With the ability to customize a view, there is a preference for ETFs over stocks 3. As a result, the amount of return for a given stock that comes from idiosyncratic factors vs. macro factors is less than 30%. This is important to consider as I, for one, am looking to see if earnings can be the catalyst to turn the market. It is not my base case but something I am considering.

A note of caution on that front. Historically, when the market has been weak into earnings, the reaction to earnings has skewed more positive. If we end this month on the weak side with earnings kicking off in October, be careful of how you are positioned. It could be time to add some call protection into your portfolio.

The options market has been one confounding market. The VIX Index has not moved higher with the same vigor as in previous meaningful equity drawdowns. There are a few reasons this may be the case. First, as I have said repeatedly, investors are bearish. You do not need to buy protection when you are already positioned for a down move. Second, on this latest down move, we have not yet moved into the area where dealers are really short gamma. That will happen below 3700 down to 3500. That is why this week will be very interesting. Finally, dealers presumably have a large number of autocallables on their books. These are structures that can either be done with high net worth clients via structured notes or more recently done via ETF providers like First Trust via buffered ETFs. The structures have been very popular for clients around the world because they essentially get all of the upside of the market up to some point (e.g. up 15%) and they are protected on a down move of a similar magnitude. The dealers essentially replicate this by being long futures with a put-spread collar overlay i.e. long an ATM vs 90% OTM put vs. short a 115% call. That is the client position. Dealers have the opposite, so on up moves or down moves, they move to their long option positions. Another way this is down is using barrier options so the structure goes away if the levels are hit. This again means the dealers are long on the way down until some threshold and then get short. That level is presumably near 3500. Maybe this is why the VIX has not yet spiked above 30.

Another topic I discussed on The Yield podcast and the NIRI panel is the changing market microstructure. The market is getting more concave through the years. With passive flows dominating and short-dated options all the rage, the market is subject to long periods of little movement with other periods of much larger than expected moves e.g. the 3+ s.d. move on CPI data. It is a market characterized by fatter tails. As investors, we need to know this and anticipate that we can get to areas where there could be air pockets. This really matters when the Fed is actively trying to break things.

I have used the analogy before that Chris Cole from Artemis has mentioned on several occasions. Volatility is like a forest fire. We do not know when one will start but we know when the conditions are such that it could start. We do not know when the markets will get extremely volatile. However, we know when the conditions are such. We know when the Fed is actively hiking, when this is causing problems among dollar borrowers around the world, when there is a potential FX war, EM countries are failing, war is still raging in Europe, inflation is causing real pain. We add to that mix the dealer positioning, the quarter end investor flows and economic & earnings catalysts. It is a time to seek the insurance for portfolios. it is a time to …

Stay Vigilant

Just finished to listen your interview at The Yield, always a great insight Richard! Thanks

Please keep these podcasts going, they are extremely helpful.