Anticipation or anxiety?

Depending on your perspective, this earnings season will either be opportunity or risk. I try to set up what is going on in the market ahead of the wave of idiosyncratic news.

Let me start by saying that the events of the last week have been traumatic for all of us. Not only the horrifying actions, images and stories but also the fracturing and polarizing commentary I have seen across all forms of media. I would call it discussion, but we seem to have lost the ability to discuss anything much less to debate or even to argue.

I wrote about this on Thursday on LinkedIn:

Chart of the Day - love

I was at an event last night and the speaker's comments were all about love. In beginning the speech, he asked us all to think of the first song that comes to mind that has love in the title

For me, the song was "All You Need Is Love" by the Beatles. I am not sure why because I am not a huge Beatles fan though I have a great deal of respect for them. It was just one of those things where that's what popped in

The speech covered the topic from many angles and the one that resonated most with me is the definition of love as 'willing the good of another'. I think too often we only think of love as that for a partner and not for those around you and this definition strikes at that

I certainly aim to do that even if I fall woefully short too often. I teach college now because I want to help and have an impact on others. I write many different posts and blogs with the hope of being able to help others who are affected by but may not fully grasp what we see in the investment world

In short, I am trying to will the good of another. Like I said, I fall short too often but at least I try. Unfortunately, I see quite the opposite in much of what I read in social media. I see too many trolls, too many people that must feel that in order to build themselves up they have to take others down

It is part of the polarizing world we have become. We have seen this in multiple elections in the post Great Financial Crisis world. It used to be as long as the pie was growing, and I had a slice, things are fine even if someone else's was a little bigger

Now, my sense is the pie is no longer growing so everyone wants to take from someone else. This is a very damaging state of mind. It turns people against each other

We certainly see this in geopolitics. We might say it started with US/China frictions, but now we have Ukraine/Russia and Israel/Hamas. This may even grow beyond this. Governments that are taxed with deficits that are too large now must face multi-front conflicts & potentially even a slowing economy

For me, I see this all as risk - risk to world order for sure, but risk to investments. I see problems on the horizon and ask where the margin of safety is.

Much to my surprise, I must be the only person that sees these risks. When I look at the market measures of risk, most look benign to the point of complacency. Equity risk via the VIX or credit risk via credit spreads are near multi-year lows

FX vol is a little higher than the lows but nothing extreme. The only mkt that sees risk is the US Treasury market. Does this make sense? If nothing else, if the mkt that is the benchmark upon which we price others sees risk, shouldn't others?

I am not rooting for it, I just see it. I would prefer to see no risks. I would prefer to see people helping people instead of people bashing people. I would prefer to think "All we need is love"

In many ways, the equity market may be leaving aside this ‘macro’ risk, however, daunting it appears right now. That is because we are moving into earnings season, one of four times in the year now that investors focus exclusively on idiosyncratic events that will move stocks within an index or etf now just just the broader flows into an index or etf.

Nowhere is that perhaps more apparent than in looking at the relative performance within the SPX itself. If we look at the performance of the SPX this year in blue, we can see that it is up about 13%. However, I imagine that is not the performance of most investors’ portfolios. Why? Because most investors are not overweight the Magnificent 7 stocks that are driving the market this year. The index below in white is the SPX ex the Magnificent 7 stocks. We can see that this index is up only about 3%, less than cash. One of my themes all year long was that we were being paid to wait. If we could earn 4%, now 5%, in cash, the opportunity cost would not be that high. In fact, there is no opportunity cost short of not being invested in 7 stocks. This is even more stark when we look at the equal weight SPX index in orange. This index is actually down a small amount this year. Anyone’s portfolio down this year? I would guess that most people are closer to equal weight than market cap weighted in their portfolio. If so, you are probably not alone.

What does this mean for the relative valuation of the market. I have looked at the valuation of stocks compared to US Treasuries or to cash. I have highlighted that stocks do not look attractive at all on this basis. That may not be fully giving us the picture. If I look at the P/E of the SPX Index overall, it is over 20x which means the earnings yield is just under 5%. This means there is no risk premium relative to Treasuries and it is actually negative compared to cash.

However, if I look at the SPX ex the 7 in orange, or ex the 5 MAAGA stocks that has a history that goes back further, we can see that the P/E ex the top stocks is more like 18x. That means that the index ex the biggest names has an earnings yield like 5.5% which is still not super attractive relative to cash, but is getting better.

What about if we add onto this graph the Russell 2000 small cap stocks that have been beaten down considerably this year. Well, in spite of being beaten down badly, small cap stocks are still not cheap. In fact, the P/E of this index is 26x primarily because earnings have cratered much more in this index than in the others. So even though prices are lower, the Russell doesn’t look ‘cheap’. Remember, price is what you pay, value is what you get.

There may be other reasons for Russell underperformance instead of simply valuation. In fact, for most indices, valuation is NOT a good signal over the next 12 months. However, it is the ONLY thing that matters over the long run. One of those reasons in the short run could be the confidence of small businesses themselves. The National Federation of Independent Business (NFIB) puts out an optimism index. It has been plunging new depths since the heights of 2021. In ability to get workers followed by a massive tightening of the cost of capital has disproportionately impacted small versus large businesses. As those have been the bigger stories the past two years, I guess it should not be surprising that the Russell has therefore lagged the SPX. The relative performance tracks this optimism index pretty closely.

Digging into the higher cost of capital rationale, a common theme I have pointed out for several years now has been the Zombie company theme. Zombie companies - dead men walking - are those that are not earning enough to pay their interest expense. This has become particularly acute given the interest expense has been trending higher for some time. As I have been looking at it the last few years, the Russell 2000 has more Zombies than any other index at about 15% of the 2000 companies in the index. When I run a simple screen for these type of companies in the RTY, I still get almost 15% of the index that falls into this camp.

In 2020, as stimulus hit the market in a big way, these Zombies were the best performing names. In 2022, as cost of capital hit, they were the worst performing names. We can see below the top performing of the Zombie names. Yes, I know many are single digit stocks that have leapt a bit (looking at you Carvana) and there are a number of blockchain names at the top of the leaderboard which makes some sense as Bitcoin is the top performing asset this year (didn’t know that did you). If we look at the aggregate across the 280 names, we can see the P/E is 104x, much higher than the index and surely having an impact, and the return is almost -10%.

The Zombie return this year is much worse than the RTY Index itself which is down about 2%. Both are much worse than the SPX even ex the Magnificent 7. Not a place to be this year. I bet a lot of investor portfolios are overweight small caps and wondering why their portfolio isn’t up double digits. Those portfolios are probably not overweight Energy and Industrials which are the best sectors in RTY too.

If we look at the number of Zombies in the SPX, it is a very different story. There are only 4 names out of 503 (there are some companies with more than one share class). While the SPX always has fewer Zombies (a good thing), this is near the low end of where it has been the last few years. This suggests a bit more health in the large cap names.

These Zombies are actually outperforming the index up 18% this year. Their P/E is up there with the big boys, well above the index level as they also under earn. These are not random names as I think many are familiar with Western Digital and Micron Technology (hard drives), Arch Capital (reinsurance) and Moderna (Covid).

The performance of the industries is also surprising. Sure, there is a lot of tech at the top. However, who would put autos at the top and hotels in the top 10? Again, guessing those are not in your book.

It is not just the cost of money impacting these stocks, especially the Zombies. It is also the availability of capital. I have showed this before, but it is the Fed Senior Loan Officer Survey that shows the percent of banks tightening standards. The white line is tightening standards for small and mid-sized firms and the blue line is for large firms. In each case more than 50% of banks are tightening standards and trending higher. We can see that every time the last 25 years this has moved above 40%, we have had a recession. Sure, private markets are stepping in to fill the void on some of this but that is for transactions not for month-to-month business. Something to keep in mind.

Let’s move on to the earnings set up. I talked about the high bar for earnings recently but here it is again for several indices. For the SPX, the growth for the next two years is double digit. I know this is calendar years and many companies have different fiscal years. Given that we are in Q4 from a calendar perspective, analysts/strategists will be adjusting these numbers based on what they hear this quarter. The argument that the index is not expensive is predicated on the growth of earnings, as you can see based on T+2 numbers, the SPX P/E or EV/EBITDA is not that expensive. That’s if we get those earnings. That’s a big IF.

Turning to the Russell, we can see that earnings growth next year is even a higher bar at 27% growth. Two years out the growth rate is not as high, but this is a very high bar. Again, if we achieve it, the index doesn’t look that expensive. If we don’t, it sure does.

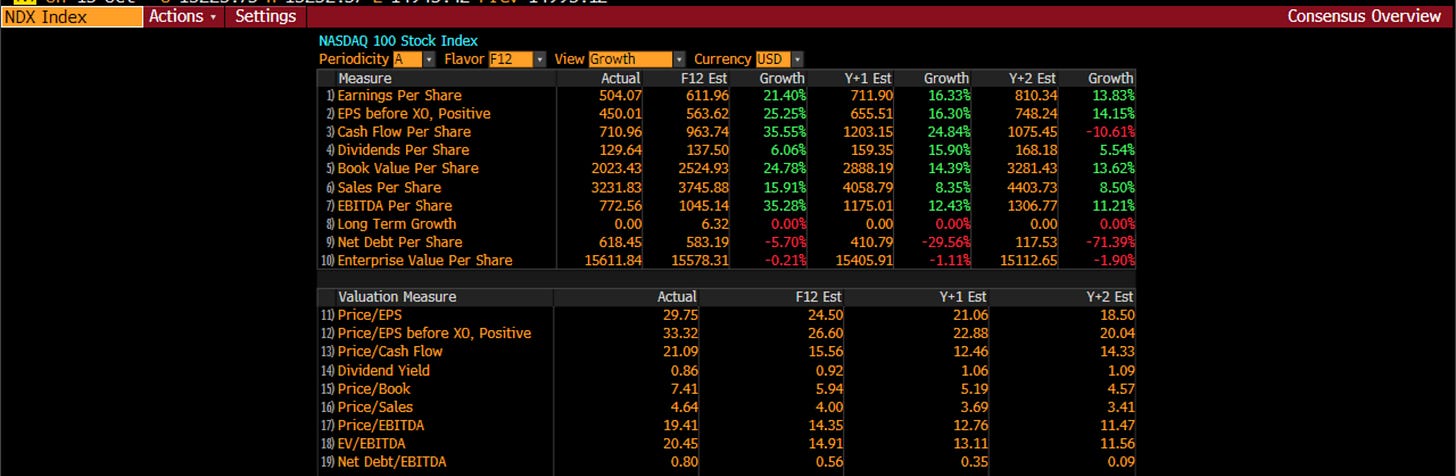

Finally, the big dog NDX has consistently higher growth expected this year and the next two years. Bulls on the index are looking for big time earnings growth. If it comes, stocks will not have been overvalued. This quarter is very important for setting that tone.

We are about to enter a very busy few weeks. The busiest week will be the week of October 23. However, with 41 earnings reports out this past Friday, including the big banks, the earnings season is now unofficially kicked off. This will be the vast majority of stock market news for the rest of the month.

I will leave you with my Linked In from Friday, where I spoke about the JP Morgan earnings report, the one most look to for the start of earnings, not just because it is the biggest bank, but because many investors dote on the words of Jamie Dimon, the rockstar CEO of JPM. This is what I said:

Chart of the Day - and we're off ...

JP Morgan & other mega banks kick-off the earnings season today. I have written before about how important this earnings season is for a fully valued mkt. There are a lot of Santa Rally hopes riding on how the next few weeks play out

Banks also give us a very good look at the economy - at consumer spending, commercial loan growth, credit costs & the impact of moves higher in interest rates. Investors particularly wait on every word from Jamie Dimon as one of the most respected CEOs in the mkt

JPM did not disappoint. It announced another record quarter of earnings & raised full year guidance which is not surprising given it has beaten earnings every Q this year. Net interest income was higher & charge-offs were lower. The CEO said to expect both to 'normalize' over time

Per Bloomberg, Dimon went on to say: "US consumers and businesses generally remain healthy, although, consumers are spending down their excess cash buffers ...

However, persistently tight labor markets as well as extremely high government debt levels with the largest peacetime fiscal deficits ever are increasing the risks that inflation remains elevated and that interest rates rise further from here ...

The war in Ukraine compounded by last week's attacks on Israel may have far-reaching impacts on energy and food markets, global trade, and geopolitical relationships. This may be the most dangerous time the world has seen in decades," Dimon said.

The CFO then took the lead & was a bit more upbeat on the performance of the bank, the integration of First Republic & the health of the economy. While JPM did great, we have to remember that this is the singly best positioned bank in the US. Refer to the chart today

JPM was the winner from the March debacle. As money flew out of other banks, it either went into Treasuries (oops) or into JPM paying 0%. Then JPM was given First Republic. It was clearly a net winner. This is why the stock is up 33% this year

The average financial stock is up 5% in blue. JPM leads the way but the other big holdings are Berkshire up 15% and Visa up 10%. Not every financial is so lucky though as it is clearly like tech where the biggest are winning and the others are struggling

We can see in orange the regional bank index. It is down 34% this year. Yes, most of that came in March but it has bled lower since then. If we look at it on a relative basis (purple) it is down 45% this year. Not a good year to be overweight financials (which JEPI the popular JP Morgan call overwrite ETF happens to be)

Investors will react to the positive earnings & comments from JPM. It will read into the rest of the economy & mkts. It definitely gives a good signal. However, as the one winner in this year's mess, for my money, I want to see what the commentary from others is. Small biz borrow from local banks

For now, I will ...

Stay Vigilant

#markets #investing #banks #economy #stayvigilant

Stay Vigilant indeed

Richard...I echo your thoughts on showing love and patience to others. Much needed in today's world. As an anecdote, my sister was traveling internationally and her flights were delayed a couple of times due to aircraft issues. There were 300+ angry people screaming at the ground staff about the cancellations, missed flights and delays. My sis and her two traveling companions were the few polite passengers who got rerouted onto another airline. Most of the 300 had a long 24 hours wait in the airport for the next flight. It pays to be nice to people.

On a macro note, what do you make of this recent WSJ article? https://www.wsj.com/economy/a-recession-is-no-longer-the-consensus-3ad0c3a3?reflink=desktopwebshare_permalink

What is your take on whether we get a recession or soft landing or something else next year?

P.S. God bless all you teachers and professors. My wife is a microbio, biochem, genomics professor. You guys have an over-sized impact on future generations and our economy.