Anyone got a match?

While the market continues to climb the wall of past worries, there are new worries popping up that few seem to care about or even notice. Will they matter?

I was up at the lake this weekend for maybe one of the last times this summer. Life is getting busy and I am already preparing for school. Amazing to think that the sun is setting on the summer, though I always enjoy sunsets like above.

Could the sun also be setting on the recent rally? That is what some are saying right now, though there are still plenty of bulls out there. In fact, it is hard to find many bears anymore.

As such, I wanted to do two things this week. I wanted to level set where we are right now, what the market is pricing into risky assets. Then I wanted to look at a few issues that I think the market is ignoring.

This reminds me of an analogy that Christopher Cole from Artemis has used in the past (if you don’t read his stuff, you should). He is from California and says living there you never know when a forest fire is going to start. However, you do know seasonally when they tend to occur. You know if there have been drought conditions. You may be able to tell if there has been bad forestry management. So, while you can’t tell when or if a forest fire will start, you know when the conditions are such that any sort of spark could cause a disaster.

This is true in markets as well. Many of us who like to follow markets, particularly those indicators that have traditionally led the market or led the economy, have told you there were risks this year. We were telling you the conditions were such that a forest fire could start. One never started. Perhaps because there have been no matches. Perhaps because the Administration in DC has been turning on the fiscal fire hose early in anticipation. Either way, nothing has happened yet. However, are the conditions still such that something could occur? Yes indeed. So, we need to look at possible matches.

Level Set

We are about 20% of the way through earnings. They have been better than expected thus far. I will leave it to Jonathan Golub from CS who had a terrific summary:

Below is our 2Q earnings season summary.

2Q EPS growth is expected to be the trough for the business cycle, with consensus expectations of -7.4%. This compares to -3.4% and -1.5% in 4Q22 and 1Q23, and forecasts of +0.1% and +7.7% for 3Q-4Q23. Prior weakness, and an anticipated rebound in TECH+ earnings is the biggest contributor to the shift from contraction to expansion.

18.8% of the S&P 500's market cap has reported. 2Q expectations are for revenues and EPS decline of -0.7% and -7.4%. EPS is expected to grow +7.5% and +6.7% in Financials and TECH+, but fall -18.3% and -9.0% in Cyclicals and Non-Cyclicals.

Earnings are beating estimates by +7.0%, with 68% of companies topping projections. EPS is on pace for -1.7%, assuming the current beat rate of +7.0% for the rest of this season.

Value is delivering stronger revenue and EPS growth (1.0% and -0.1%) than Growth

(-3.5% and -12.0%). Additionally, Value results are surpassing expectations by +8.5% vs. +3.8% for Growth.

While the U.S. is projected to deliver higher revenue growth vs. EAFE (-0.7% vs. -1.5%), EAFE is forecasted to outpace U.S. on EPS growth (+2.4% and -7.4%). However, U.S. results are topping consensus by 7.0% vs. 1.7% for EAFE.

More globally-oriented S&P 500 companies are experiencing a greater decline in EPS growth than their more domestically-oriented peers: -9.5% vs. -6.9%.

Over the next week, 163 companies representing 38.9% of S&P 500’s market cap will report results, including Microsoft, Alphabet, Amazon, Meta, Exxon Mobil, Visa, and Proctor & Gamble. Today, 7 companies report results, including American Express, Schlumberger, and Roper Technologies.

Surprises have come across the board, particularly on the margin front:

This is good. However, the commentary has not been as great on the call for what the future holds. Just ask Tesla or Netflix shareholders. In fact, it hasn’t been great globally. As the global economy (orange) is decaying, the analysts earnings revisions (white) are also decaying. The one thing not decaying? Stocks in blue.

In the US, there is an expectation, as Jonathan says, that this is the trough of the business cycle. I guess we put him in the No Landing camp. Either way, this is clearly where the market is now in my opinion. However, earnings follow the economy and right now, the economy doesn’t look great. The yellow line is ISM which we get again in 2 weeks but where the last reading was poor. The green line is the whole economy profits. The blue line is S&P 500 quarterly profits. Hard to see the blue line trough if the other two lines are not yet troughing.

This is important because stocks are pricing in earnings growth. How do we know this? Let’s look at the earnings yield vs. the return on cash. This is the ultimate decision for equity investors. Why would you forsake the 5%+ risk-free return? Because you expect more growth. Growth comes from earnings. Growth comes from the economy. Is this consistent with the economic data?

We get central bank meetings in the coming week. Is the risk-free rate going higher or lower? Right now the market thinks it is going higher but still sees cuts next year. In fairness, so do the Fed dot plots. However, I will show later why that might not be the case.

The expectations are more hawkish for the ECB meeting this week.

However, the technical trend for stocks is still very strong. This has been the case all year long and shows us that money is being put to work. Barry Knapp says to never ignore or fight a trend that is 3 months old. This one is. I respect his opinion. I spoke last time about the behavioral tendency for portfolio managers to buy stocks after Labor Day so they can hold onto assets/their job. I still see that as a risk (not an opportunity but a risk) given the backdrop. Share, we may be overbought near term, but the trend is still up and to the right.

However, I read from many that people are still too bearish. I read it today from Raoul Pal. I respect him too and he has had a good call this year. However, I am not sure where he gets that. Hedge funds are not bearish, because if they were, they would not be covering shorts so aggressively.

The American Association of Individual Investors sentiment measure just hit 30. While many think this no longer matters, readings above +20 or below -20 are pretty good turning points in the short term

The CNN Fear and Greed Index does a great job of looking across many indicators. It is still solidly in Extreme Greed and has been for some time.

So in summary, we have a strong technical trend. Bears are capitulating. The expectation across market is for earnings to trough this quarter and move higher. However, this is inconsistent with what we should expect in the economy (unless No Landing happens). It is inconsistent with central banks still hiking rates, given the lagged effect of rates. This all sounds to me like the conditions for a forest fire, even though there is no match apparent yet.

Is there a match?

Before we look at the possible matches, the Biden Administration is doing a good job of making sure anything that can produce a spark will turn into a damp squib. It has continued to pump fiscal money into the economy. I turn to Nancy Lazar for the graph on the dollars and the contribution to GDP coming from fiscal spending. The 12 month sum is over $6 trillion. You wonder why most think soft landing?

This leads me to the first match that I don’t think enough people are focused on. The pause on student loan payments is set to end in the coming weeks. Interest will start to accrue and payments will begin again in September/October. There are $1.8 trillion of student loan debt out there. This is about to put a drag on consumer spending into the important holiday spending season.

This will further erode the record personal savings that built up in the post Covid period as a result of this fiscal excess

These savings helped bail out consumers that saw their real wages in negative territory for the last 2+ years until very recently. Just as consumers are starting to feel a little better, student loan payments are about to start again.

Perhaps this is why we are seeing so many strikes occurring across industries and across the country. Just to name a few of the bigger strikes going on - actor and writer strike in Hollywood, potential UPS strike, Teamster truck driver strike. This go with the Amazon worker strikes we saw earlier this year. Workers are feeling pinched and want more from this. Here are a collection of headlines that I think are worth paying attention to:

Then late Friday, we got some bad news that futures seem to be shaking off. Yellow Freight, which was in negotiations with the Teamsters and had filed a lawsuit against the union, had their lawsuit thrown out by a judge. The immediate response is that this looks like it means bankruptcy for Yellow:

This is one of the largest if not the largest LTL freight carriers in the US which handles shipping for the biggest companies in e-commerce. Remember when those supply chain disruptions cause inflation for consumers and problems for the Fed before? Could this be starting again?

These are the negotiations that are not going well. In other areas, companies are giving in. Namely, the airlines, which are rocking and rolling right now with all of the travel, are paying their employees what they need to:

This isn’t going unnoticed by the other employees at American

and it doesn’t end there

So, expect your plane tickets to cost more. Expect your shipping costs to go higher. This is going to really complicate things for the Fed. The market is so focused on CPI falling, goods inflation falling and the lagging shelter component about to fall.

Are goods prices going to re-accelerate if shipping is disrupted? What about the cost of food? You see these headlines this week?

Well, what HAS happened to food prices since the deal ended? Wheat, which is most directly affected, started to perk up after being down sharply this year. Could this drag on inflation turn the corner?

You remember the start of the Ukraine-Russia war when wheat was disrupted, and this drove all food prices higher, which in turn took CPI higher? The market is so focused on the lagged effects of what is in the numbers and not so much what is happening that could affect the future.

Not only that, but the base effects are about to make it more difficult to see CPI fall. We had been lapping higher prints and so declines were easier. This is not the case going forward. From Forbes:

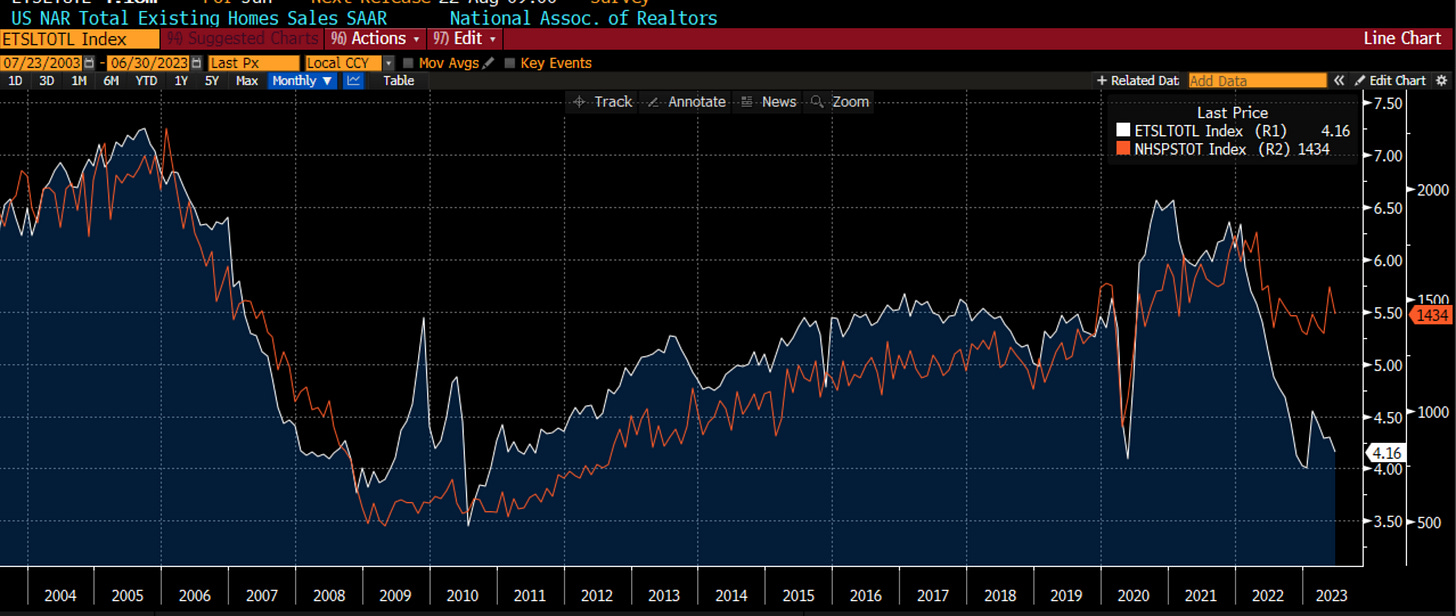

Back to the shelter component, the one thing that should continue to come lower because it has been lagging so badly. If we look at housing, sales of existing homes continue to plummet because people locked into low mortgage rates have no interest in moving. Sure, new home buyers have bought the supply builders put out there. However, with existing sales dropping, housing starts will also fall (we know this from the building permits data that leads too). This is a drag on the economy. Remember HOPE?

So I see the Fed needing to continue to battle for four reasons: 1. fiscal spending is still high 2. wages are going higher across the board 3. potential supply disruptions will re-ignite goods prices in the short-term 4. food prices may move higher as well

However, I also see drags on the economy from the resumption of student loan payments and the slowdown in housing finally hitting as a result of high mortgage rates. it has only been 16 months since the first Fed rate hike. Policy happens with a lag. The lag might finally start to kick in.

This all sounds to me like the potential for a stagflation discussion to resume. I don’t want to get ahead of myself though. In fact, I have no idea how any of this will in fact play out. I just know that with high interest rates and banks unwilling to make new loans, the conditions are ripe for bad things to happen. Company earnings have held up because of margins, yet labor is seeking a bigger piece of pie. Can this put further pressure on earnings? Do stock need earnings higher in order to rally? Yes, they do.

Anyone got a match?

Stay Vigilant

So like the rest of us, you are confused.com! Pandemic uncertainty continues to roil the ability to hold conviction...The bearish view that I have talked about for the past 6-weeks has been epic fail and I would be lying if I did not confess that Barry's 3m adage is whispering in my ear...