The Spring is well and truly hitting the Midwest. While the weather continues to fluctuate between the mid 80s and the mid 30s, the trend is clear that plants are blooming and new growth is here. People are outside preparing houses and gardens for the coming summer. I, too, have been very busy preparing for the coming summer with many projects that have been put off in a busy Spring semester needing to get completed before we get to the unofficial start to summer.

The market is also preparing for new growth and better times. Unlike the seasons, it isn’t entirely clear that the trend is for new growth and better climes ahead. Much like the temperature fluctuations between summer and winter weather, the market still has its fits and starts of bullish and bearish news flow and price action.

It is at times like this that I go back to basics, look through my 3-part process, and see if my core beliefs are still valid or need updating. Fresh from a weekend of house projects, now it is an afternoon of market projects, trying to better prepare for what is to come.

FUNDAMENTAL

The first step for me is to start with the fundamentals of the economy. The economy drives earnings and earnings drive stocks. Understanding the drivers of growth and inflation in the economy will help us understand not only how risky assets will do, but how various asset classes, countries, sectors and styles will do.

For all of 2022 and into 2023, the concern was inflation. This had the market in a tizzy, because when we are worried about inflation, bonds and stocks will be positively correlated. Portfolios - from risk parity to 60-40 - are not sell up for this positive correlation. That is why 2022 was so painful to most. We can see in the shaded areas, when CPI changes are high, bonds and stock returns are positively correlation. This was the 80s-90s and 2021-22. This century through Covid, the opposite was true:

We can see inflation is cooling, maybe not to the Fed’s target but it is slowing, but much like the Fed predicted, it is cooling off growth to do it. The yearly change in ISM is in the -20 range, which has suggested recessions in the past.

Other measures of growth are also pointing to lower levels still for ISM. The one outlier in the data of late was the Empire Manufacturing (NY Fed) which was strong across the board and led by new orders. However, the Philly Fed, the NFIB Small business survey and continuing claims data all suggest still lower levels ahead.

Again, why do I care about ISM? Referencing a chart from CS a few years ago, the ONLY period of negative returns for stocks is when ISM is below 50 and falling. Where are we now? Below 50 and falling.

You may say ‘well, what about 2022? The market was already down a lot in 2022’ I would counter that in 2022, we were only really working off excesses of 2021. In fact, the market from the beginning of 2021 until the end of 2022 was up on a total return basis. We have not given up anything other than the sugar high of too much monetary and fiscal stimulus:

If we are not worried about inflation, this takes the Fed out of play right? That is why stocks are rallying after all. However, in the last week or so, the odds of another Fed hike have gone up to almost 90%. A month ago, would you have thought that?

In spite of this, the market is still far more dovish than the FOMC. The bond market still sees rate cuts in 2023. It isn’t clear this is what we will get in spite of the slower growth.

Part of this reason is the labor market is still firm and wage gains are still positive. This is what the Fed is fighting and many argue, and I would agree, that it is fighting a battle on trailing data. We can see the ISM employment and the Job Opening and Labor Turnover data have already rolled over. The Unemployment Rate (inverse here) has yet to and the FOMC is too focused on this measure of labor market tightness:

In fact, a good proxy for the Unemployment Rate is the Re-hire Rate or the difference between the average Jobless Claims and Continuing Claims, normalized by the Jobless claims data. It has shown turning points in the past (hat tip to PiperSandler for this).

So, inflation is last year’s problem. Stocks are rallying because this presumably takes the Fed out of the picture. However, the Fed doesn't appear to be out of the picture because it is fighting yesterday’s war. This creates a scenario where growth is set to slow even more yet the Fed is tightening policy further into this. I don’t even need to get into the credit tightening that will go on at banks (covered a month ago, I will update in the coming weeks). The one chart that ties together what I think this fundamental backdrop means for risky assets is this chart:

This chart is the yearly change in ISM vs. the yearly change in SPX. There is a clear disconnect between them. The SPX is rallying on a positive outlook. The ISM is still falling (and expected to further). Something will give. I still think this is the SPX returns.

Editor’s note: Some will point to the S&P PMI data that came out last week. There are some calculation methodology differences but both get at the same thing. Why do I prefer NAPM data? It may be more a question of why do we trust S&P data? ISM data goes back over 50 years. S&P data goes back 3 years. I am going to run with the O.G. until it gives me a reason not to.

FUNDAMENTALS = NEGATIVE

BEHAVIORAL

The next critical section is the Behavioral section. It is one thing to know trend, but what do the Supply and Demand tell us? I tried to parse through this on LinkedIn Friday:

“Chart of the Day - changing catalysts?

I have focused on the disruptive technology battle this week, with what I think are clear positive and negative catalysts. I will watch to see how that battle takes shape in the coming months

As I wrote about this, another battle was taking shape in the market between bulls and bears. The SPX has been a battle between technical bulls and fundamental bears all year long

For the past 6+ months, we have been in a wider 3600-4200 trading range, which has narrowed to 3800-4200 in 2023. We are at the top of that range right now. Some thing a 2023 range trade is that which hurts the most people (bulls & bears) & I can't disagree

However, things might be changing here at the top of the range. Perhaps the less than exciting earnings are the reason, with TSLA the latest drag on hopes. However, that has not stopped people all year & we really have only gone thru the banks

Actually what I see is quite interesting. I have drawn three channels that the SPX has been in as it has rallied. The first thing of note is something I can't say I have seen before. All 3 are parallel. Life is usually not that symmetric yet on each rally, we have gone from the low end to the high end in the same fashion

The second is that we can see visually, as we have rallied, the range of the index has been getting narrower and narrower. Volatility is being squeezed right out of the market. What does that do? Drives people to sit on their hands. A friend of mine said this is the slowest mkt he remembers in 20 years

The third is that this may be changing. As I said, we are currently at the top. However, we just broke below the lower channel last night. In addition, the RSI is rolling over and the MACD is giving us a sell signal. This is not an attractive short-term set-up

The market has been constrained by a very large option expiration, which has seen buyers on every dip, and to a less extent, sellers on the rally. That goes away at 9am today. The mkt will be more 'clean' to take direction. Perhaps options are reset. We shall see

Bears will point to CDW, TSLA, TSM as reasons to sell. Bulls will point to cyclicals like JBHT and STLD. Economic data shows slowing but not collapsing & inflation cooling. Frankly, no one has a reason to change their mind

Perhaps this technical catalyst is the change to the price action which is determining the narrative for now. We are coming to the end of April and the positive Year 3 seasonal. Sell in May and go away will be the mantra

Stay Vigilant

#markets #investing #stocks #technicalanalysis #stayvigilant”

A great measure of Supply & Demand is the BAML Global Fund Manager Survey. This is a measure of where all investors globally and across asset classes are right now. It is a terrific measure of consensus. This doesn’t mean consensus will be wrong, but it tells you where people are leaning. There is bearishness out there. In fact, I read this and feel I am still in consensus, and maybe this is the wrong place to be. It is worth paying attention to:

Investors are clearly down beat on growth, the most they have been in 2023:

Cash level are very high. In fact, cash has not been this high since the DotCom Bubble. It is interesting to me because many think the bursting of the Work-From-Home Bubble will be reminiscent of the DotCom Bubble

Finally, investors are very overweight bonds, just as we are about to heat up on the debt ceiling debate. While most think this will be resolved in the 11th hour, there is a non-zero chance it isn’t. In fact, PiperSandler (Andy LaPierre and DonSchneider) put the odds at 10-15%. I don’t feel they are prone to hyperbole

The last thing I will say on the supply/demand/technical/behavioral side is the seasonality. I spoke before about how Year 3 of a Presidential Cycle, April has never been negative. it doesn’t look to be this time either. In fact, April is often positive. However, the May-September period is usually quite negative. Every hear of ‘Sell in May and Go Away’? This is why:

Finally, I mentioned the vol market has been crushed and it seems no one is looking to hedge. If I look at the 20 day moving average of the Put-Call ratio, it still suggests better times for the SPX:

Thus, BEHAVIORAL = POSITIVE. Too many people are bearish and so risky assets do well.

CATALYST

What will get people to change their minds? I usually look at 3 areas: earnings, economic data and geopolitics.

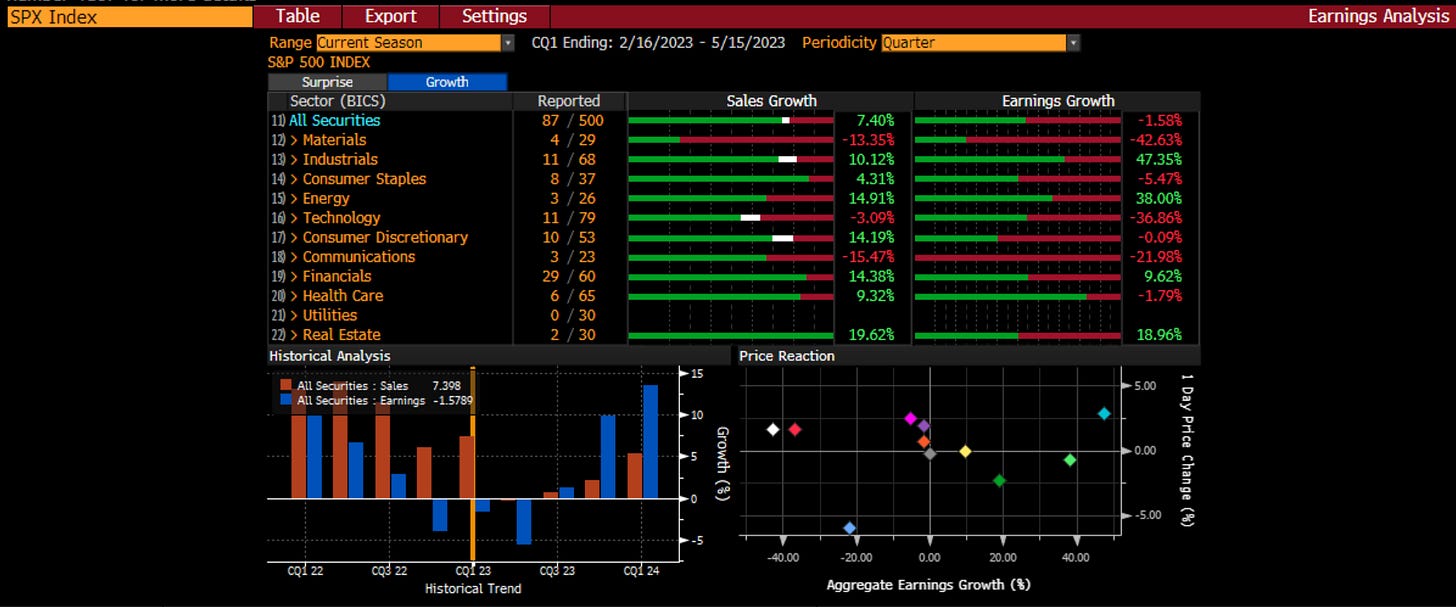

Earnings: With about 20% of the market having reported (this week is a big week), sales growth is still high (recall inflation means nominal sales are high) but earnigns are negative:

However, so far, this is better than expected:

Thus the market has generally responded well. There are some high profile misses - CDW, MU, TSM, TSLA - and some very cyclical beats - JBHT and STLD. We get to the meat of earnings in the coming week and so I will have more to say next week. For now, there is no reason for anyone to change their minds.

On the economic front, we are starting to see numbers miss to the downside. Given we are not focused on inflation, but instead on growth, I feel we may be back to the bad news is bad news range. In fact, if the Citi Economic Surprise Index continues to fall, this may start to bring stocks down with it:

The trend in the economic policy uncertainty index will continue to move higher as seen here:

Finally, we have geopolitical risks. These are the ones that Blackrock has highlighted are the ones the market is both most focused on and which could cause the most market movement:

I would highlight a few things: 1. The US-China strategic competition, called Cold War II by some, is only escalating. Two weeks ago China simulated an invasion of Taiwan. The US followed suit by sailing a guided missile destroyer through the Taiwan Straits. The odds of some sort of accident are increasing 2. The Russia conflict with Ukraine/NATO is still in the Spring escalation phase. Russia thought it could bring in a big troop number and walk over Ukraine. It couldn’t. We are at a stalemate and there seems to be no end in sight. What I do know is that this is going to disrupt another planting season in Ukraine and further disrupt the supply of energy to Europe for this year. Both of these are inflationary. We already see protests in Europe. This will get worse before it gets better. 3. US debt ceiling debate. The drop dead date sounds like middle of June right now. Most still think this is a lot of bluster and largely a non-event. I think it still may get worse before it gets better with a non-zero chance of something truly bad happening. This isn’t even on Blackrock’s list above. 4. One thing that is on the list is the global technology decoupling. With what we are seeing in the power of Large Language Models and AI, I think this risk is very real and much closer than we thought before. We can’t even determine within the US how to proceed, with many calling for a pause, and some for an end, while others still see this as the most disruptive and positive productivity enhancement in centuries. Suffice, this will not play out evenly across populations, domestically or internationally.

Yes, geopolitics are always a negative risk. There seem to be a few more imminent concerns. For this category, I am willing to wait for another week of earnings before definitively calling it, however, I think I am leaning toward saying CATALYST = NEGATIVE

In all, FUNDAMENTAL + CATALYST = NEGATIVE & BEHAVIORAL = POSITIVE.

This gives a weak negative signal. It is possible to change and move toward neutral if earnings continue to impress. It gets more negative if the technical picture worsens, even if that only means we move back to the bottom of the range.

For now, I will continue to wait and watch. Cash + tactical puts has been a good plan for me this year. Yes, perhaps you can argue I have missed some returns in the NDX. I haven’t missed returns in ETH though. That is in the risk bucket. For the core of the portfolio, I am happy to earn short-term Treasury yields. Less than half the market is up more than this level so I am still feel quite fine. There is still a critical period ahead. Best to …

Stay Vigilant

A lot of cash on the sidelines and "no one is looking to hedge". Reads as though institutions aren't willing to commit new $ but are willing to let lingering bets ride. Underexposed with maximum risk.

Very nice cover letter as always missed those deep dives on fundamentals behavioral and catalysts. Do you have in mind upgrading the 3 part process with more in-depth information?