Baia del Silenzio

"Between Siestri and Chiaveri descends -- A river beautiful, and of its name -- The title of my blood its summit makes." - Dante, The Divine Comedy

“A month and little more essayed I how

Weighs the great cloak on him from mire who keeps it,

For all the other burdens seem a feather.”

I have to say, while I am watching the markets each day, the two weeks I am spending in Italy, ending on the Italian Riveria, certainly make ‘all other burdens seem a feather’.

I am not the only one enjoying the beauty of this country. Even before I took off, there were no less than four families near me that were traveling to Italy this summer. Now that I am here, the country is packed with students and tourists, of all ages, and from all over. Yes, there are a lof of Americans. In fact, as we stood on the bridge over the Arno the other day, I did here someone say “so many Americans!” as they walked by. However, I hear plenty of British accents too. I have seen scores of license plates from Germany, France, Netherlands, Austria and Switzerland. I even saw two cars from Norway in my hotel lot in Lake Garda. The 2 EUR per liter petrol prices do not seem to be scaring too many off from driving right now.

The guides I have had and the locals I have spoken too have all confirmed that this year is beyond crazy in its busy-ness. Typically busy in June-July and September-October, most of them have not had a day off since April and do not expect to given they have good visibility into the people arriving and services already requested. No one is complaining though. After a tough couple of years, it is a welcome relief.

I am not the only one enjoying myself the last week or so since the FOMC meeting. The SPX had quite the week this week. Looking at the moves by sector, it very much had the feeling of short-covering and sector rotation, selling the only winner (energy the only sector down this week was the only one up before) and buying the most beaten down names in the most beaten down sectors.

Crypto markets held in there but were not quite as positive, ending the week pretty flat:

Don’t get me wrong. I do not think we are sounding the all-clear here. I think, much like taking a vacation during a busy work schedule, we can have a week, or two if we are lucky, where there is a reprieve from the relentless grind. However, when we return, it is back to the same old/same old. I always liked to measure the quality of my vacations by how long it took the good vibes to wear off once I was back. I can already tell this is going to be a good one. I am not so sure that risky markets will say the same.

Since I am not myopically focusing on every headline and every story, I like to step back and look at what I refer to as the “Fundamentals” of the market, to determine the guideposts of where a market can go to, how far from trend it can stretch. Clearly, the story globally is of food and energy prices that are too high for the person on the street. That was certainly the vibe I got as I went through Bologna, as I wrote this week on Linked In:

Chart of the Day - a little bit edgier. Today we drove back south into Bologna, a big university city in Italy. It is the oldest university in continuous operation in the world. Like many university areas, the tone is a little bit more progressive, maybe even edgier. Perhaps it is the heat is finally getting to everyone, but everyone we spoke to, tourist and local alike, was a little bit less patient than the rest of this trip. As we walked around, there were graffiti tags everywhere, again not surprising given the university town, but one that stood out was 'Smash Capitalism'.

It seemed consistent with a conversation I had earlier in the day with a gentleman who suggested, matter of factly, that we might be on the brink of a revolution. You see, over the last year, the cost of living has gone up by 50% or more but the wages has not kept pace. We are seeing very much the same trend in the US, though the magnitude may not be as severe. Hopefully, if we get a revolution in the US it is at the ballot box this Fall. I would hope for the same in Italy but it seems they are not voting again for a couple of years. That is a long time when people are feeling pain.

There is quite a bit of sensitivity to import more Russian oil and gas regardless of the war. You see, people need to take care of themselves. They certainly are not happy when politicians in Rome, much less in Brussels, tell them they have to pay more and deal with it.

Much has been made of the growth in M2 around Covid. The Marshallian K measures M2 vs. GDP. WHen money is growing, but GDP is not, the money has to go somewhere and it tends to go to financial assets. Thus, when Marshallian K grows, it means risky assets grow. The wealthy are benefitting from the growth of money as we saw in 2020-2022. However, lately, the money growth and GDP growth have been about flat. At the same time, risky assets are going lower. There are many potential interpretations, but one of those interpretations is that the pendulum is swinging back. It is swinging back away from Wall Street and back to Main Street.

In the last 9 months, as stocks are slowing down, the Atlanta Fed wage growth tracker in orange, has spiked higher. This looks to me like money coming out of financial assets and going into the real economy. Maybe it is Millennials selling stocks to buy a house that is paying construction workers more. Maybe Boomers are selling down stocks to pay for long-term care for parents. Either way, in the last year or so, money has come out of financial assets and gone into real people.

This may not be a healthy trend for the markets overall. However, if people are on edge, and there is revolution in the air, it may be a pretty good thing that is happening.

In the US, the Biden Administration, facing mid-term elections this Fall, certainly hears these complaints from the American people. What isn’t clear is if the Administration, or frankly any politicians, understand any bit of economics or finance whatsoever. What are the plans we have seen so far? Elimination of student loan debt - because putting more money in consumer pockets will fix a problem that was caused by putting too much money in everyone’s pocket - or the elimination of gasoline taxes - same idea and this was even rebuked by the CEO of Target:

“In an address Tuesday at the Economic Club of New York, a non-profit, non-partisan business group, Target CEO Brian Cornell called the gas tax holiday a temporary “mini stimulus” that does nothing to fundamentally change the supply and demand curve for fuel and transportation.”

Of course, Biden and other politicians want to critcize the greedy energy companies who they say are gouging consumers. They must not understand that: 1. oil is a global commodity which has its price set by a global market of consumers 2. oil companies have some of the lowest margins in the entire world 3. Apple Inc makes more money than all of the oil companies combined yet no one complains about being price-gouged on their iPhone 4. Oil companies profits are up this year but if you look over the last 3 years, in aggregate, the profits are barely above zero.

Don’t let the facts get in the way of a good story, especially in an election year. While this may play a little in one’s own party, it isn’t fooling consumers or small businesses. Biden’s approval rating is the lowest in his term and also as low as the worst for Trump, Obama and Bush.

Last year I often referred to what we were about to see as a return to the 1970s. You see, anyone who lived during that time recalls it to be one of misery. The Misery Index was created in the 1970s to measure the pain consumer were feeling from a combination of unemployment and inflation. While we are approaching levels seen during the Covid panic, and the Great Financial crisis, we are a far cry from the 1970s pain largely because jobs have held up quite well, so far:

Many scoffed at me and told me how far off I was from reality. I was referring to stagflation in early 2021. I was told we would never see that. In fact, I put out this overlay in April 2021 on Linked In as a follow-up to me stagflation comments, plotting what I thought the path for risky assets could be:

Here is that same chart updated, showing that we are indeed following that path of the 1970s, and that things can in fact get worse going forward:

This doesn’t mean they hav to get worse, only that they CAN get worse. We could start to see jobs negatively affected, which would surely bring in more upside to the Misery Index, and more downside to the SPX vs. Gold ratio. It would also put a lot more downside into the President’s approval rating too but that is the least of our worries. For now, going back to the Marshallian K chart, if money is rotating out of financial markets and into the real economy, and jobs can hold steady, we can avoid the worst of this chart and a repeat of the 1970s. I think that is the metric we need to be worried about.

I spoke about this growth slowdown and risky assets this week on Linked In. Too many people - from other geographies or other asset classes - simply look at the S&P 500 as a measure for what the ‘market’ is saying. This is only part of the story. The real story is the internals of the market - how are sectors performing? styles? factors? The intramarket rotation gives a sense for how equity investors themselves are feeling, and not just how the battle between equity investor longs and macro shorts is faring. This is what I wrote:

Sometimes we are focused on the small things and sometimes the larger things. Someone asked me today my view on IWM - the Russell 2000 etf. I watch this a fair bit because the portfolio we have in IMA at UIUC tracks the Russell 2000. So, I try to have a view. However, one cannot really view the Russell 2000 on its own. My first instinct when asked about the ETF itself was to look at its relative performance vs. its large cap peers. I knew instinctively that small caps have lagged meaningfully. This is particularly true of the Russell 2000 even more so than the S&P Small Cap 600. However, when one compares to the SPX, we can see that we are back to the 2020 lows on a relative basis.

In fact, if we look at the relative performance of small vs. large and compare to the economic growth as measure by the ISM, we can see a pattern. There is intuition to this pattern. You see, the small caps should be more domestically focused companies vs the large caps being more multinational. Thus, on a relative basis, the small caps should react more to the good and bad news on the US economy.

There are some that will say this is not necessarily the case. However, I submit the chart today which compares this over the last 10 years. In fact, I get the same view if I look at the 10 years before the GFC. The GFC itself distorts some things. So the price active backs up the intuition. You might say, that the relative performance of the small caps vs. the large caps suggests the market is pricing in an ISM in the low 40s already.

Of course others will look solely at the SPX and say there is now way this is the case. This happens all the time where people focus on one measure alone for equity performance and do not look at the internal movements.

However, when we look at those small things, that slowly get bigger on the horizon, we can see a pattern. The patterns suggests that the growth slowdown, or recession, is largely getting priced in already, just as everyone is out in the media saying we are going to have a recession.

More importantly, what we see is that the yield market is now solely focused on inflation and not growth. This has important repurcussions because a market focused on inflation and not growth is one in which bond and stock prices are POSITIVELY correlated and not negatively correlated, as is the expectation and basis for most portfolio construction from risky parity to 60-40 as I have shown before. If inflation is not brought under control, we haven’t seen the end of this pain in broader portfolios which are not made for this type of market:

However, there may be some reprieve. As money supply growth has slowed markedly, we have seen the year over year change in the CRB raw industrials price also come lower (with a lag). This has not yet affected the CPI number but you can see it follows (with another lag) both of these measures. More worryingly is the average hourly earnings are rolling over before CPI does. This is something further to watch.

Just a few more charts to consider. Developed largely by Alan Greenspan and criticized by many, the Fed Model simply compares the earnings yield of the SPX (inverse of P/E) to the US Treasury yield to get a rough gauge for what investors prefer. It is not meant to be a daily tool for asset allocation, but a guide to get a sense for how far from the norm we are. Given stocks and bonds are not positively correlated, investors have a decision between them, so it may be more relevant now than it has been all century when investors have combined the two in one portfolio. We can see the negative numbers during the tech bubble, showing how overvalued stocks were. We can see the numbers around 6% following the GFC to show how far out of favor stocks can get. The norm tends to fall in the 2% ish area and right now we are slightly above there, suggestng that stocks are not that overvalued right now:

An improvement was made on this by the economist Ed Yardeni who you may see on social media a bit. His improvement compares the equity earnings yield to the corporate bond yield so that credit risk is also considered. Again, on this basis, stocks do not look overvalued, and if anything look a bit cheaper than average on a relative basis:

Looking at the stock market itself, we can simply break it down into earnings and multiples. Multiples are the price investors are willing to pay for a stream of earnings. It is a measure of sentiment. It is much more responsive to events such as wars or central bank tightening periods. Earnings are directly the result of the economy. When earnings start to fall, multiples often expand, because the market has usually anticipated this. The forward multiple led the market out of the 2020 crisis and into the 2022 crisis. Earnings have still held up though most now expect them to fall later this year. How will multiples respond?

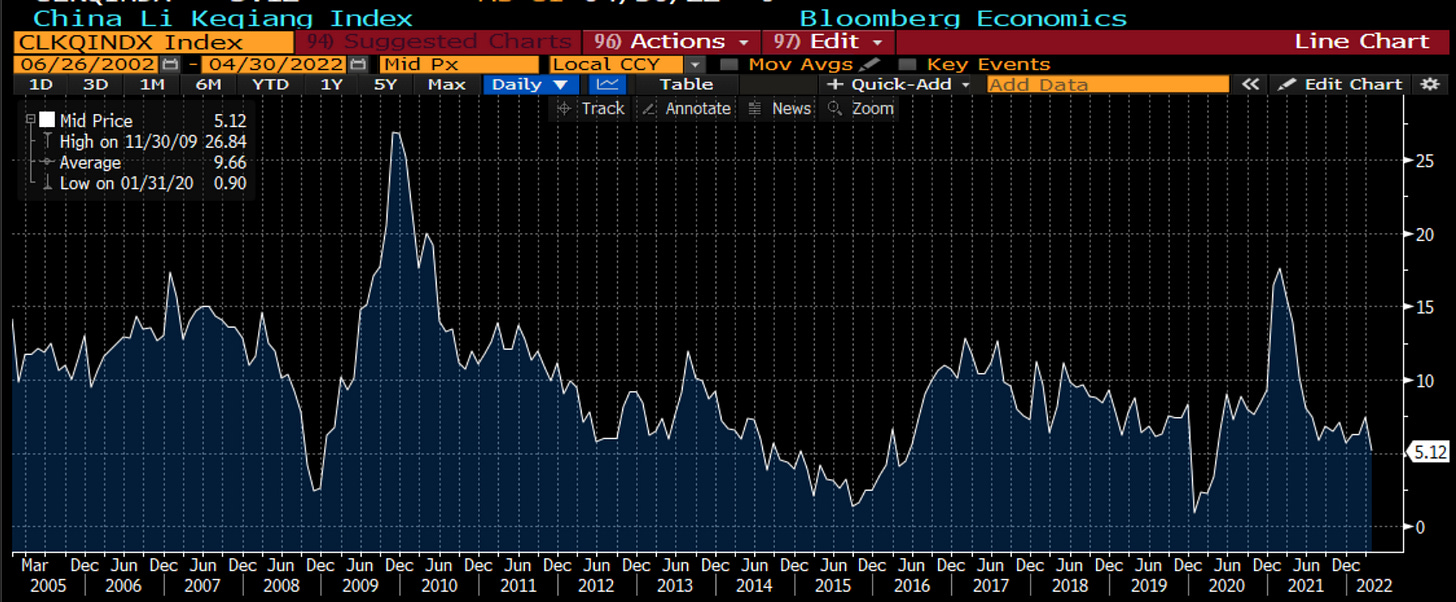

For the last two charts, I just want to look at the economic trends in Europe and China as it is easy to get to US centric. China seemed to handle Covid better in 2020, but this year has been having its Covid crisis amid the lockdowns. With the next plenum to choose leaders this Fall, you can imagine Xi Jingping cares about the economy as much as Biden or any politician. He doesn’t want to hear talk about relvolution as I heard in Bologna. The Li Keqiang Index measures the economy based on bank lending, rail freight and electricity consumption, to avoid the noise fro the numbers that are made up to suit the politicians. Things still appear downbet in China.

If we use Germany as a proxy for Europe, one could say the same about the continent. As much as I am seeing some good things on my trip, it is clear that businesses are much more worried about inflation and the war than those who are on holiday.

There is a lot to take in this week. There is good news and bad news. I am trying to stay positive as I am on holiday and don’t want to lose the good vibes just yet. However, we can see many measures that suggest things are bad the world over, and things can still get worse if history is a guide. It all hinges on the ability of central banks to control inflation without crushing jobs. On the plus side, risky markets are not overvalued and have taken a fair bit of bad news into account already. This doesn’t mean there cannot be more downside.

The market was on vacation last week. Shorts were covered, there was rotation out of winners and into losers. It is classic risk reduction ahead of a summer of holidays, which begin in earnest around the 4th of July in the US, and in August in Europe. Expect more moves like this. However, until there is clarity on inflation and jobs, we can expect the heavier weight to pull us lower as multiples will continue to pull down risk even ahead of earnings moves. I have mentioned many times the waterfall decline that we will see this year.

For now, though, the only waterfall I care about is the one I can hear from my balcony, so I will leave you to it to enjoy your time off.

Stay Vigilant

Ex - First you are a very bad, bad boy. Writing on your holiday! That is a big, big no! Having said that I enjoy your take. One possible correction, Italy has a general election in June 2023. We both have been waiting for the ripping short covering. It is hard to know what it means, but a 10% at least off the lows, and possibly more seems obvious. Of course, it already 7.6% up, so maybe we can get even bigger. 15%? It strikes me that you must keep feeding the intensity of inflation/Fed reaction each day to keep this as worry. We seem to have reached the point where the intensity is beginning to wane, and now with cuts priced in to curve next year, this is helping. Finally, I am not sold on recession, or if there is a downturn, it strikes me as possibly on the mild in. While true you never know who is swimming naked until the tide goes out, ahead of the Dotcom and housing bust, we knew there was valuation vulnerability (2001) and egregious leverage (2008). While there could be a surprise now it’s hard to think about what that is. We seem to be back in the old, old fear, that the Fed causes recession, which they really have not done for a long, long time, no matter how many people insist that is what is happening. Of course, there is one thing I do constantly worry about which is the negative convexity beast that is the equity market, fed by dominance of passive investing, which as a style I feel is peaking but also is a source of systemic risk. I cannot completely rule out a 90% decline, which forces authorities to close the stock market for a month, a crisis in ETFs ect...Sorry went a bit dark there, but that is purely in my imagination of crazy tail risks....Now Ex--drink wine, eat pasta, view the sites. the market awaits your return....

First thing I read this morning and likely the best thing I read all of today. I love your optimism re: the markets based on the signs you are seeing. Enjoy your vacation and the Tiramisu, the caffe, the gelato, the pizza margherita, carbonara, lasagna and of course the multiple digestivos!...shoot...now I am hungry. heading to the kitchen for a pre-breakfast snack.