Two weeks ago I was happy to have a long-time friend, Fred Goodwin, join me on the CFA Society Chicago Investment Exchange Forum podcast. We spoke about growth and inflation but also about the risks of the market. The podcast is linked above.

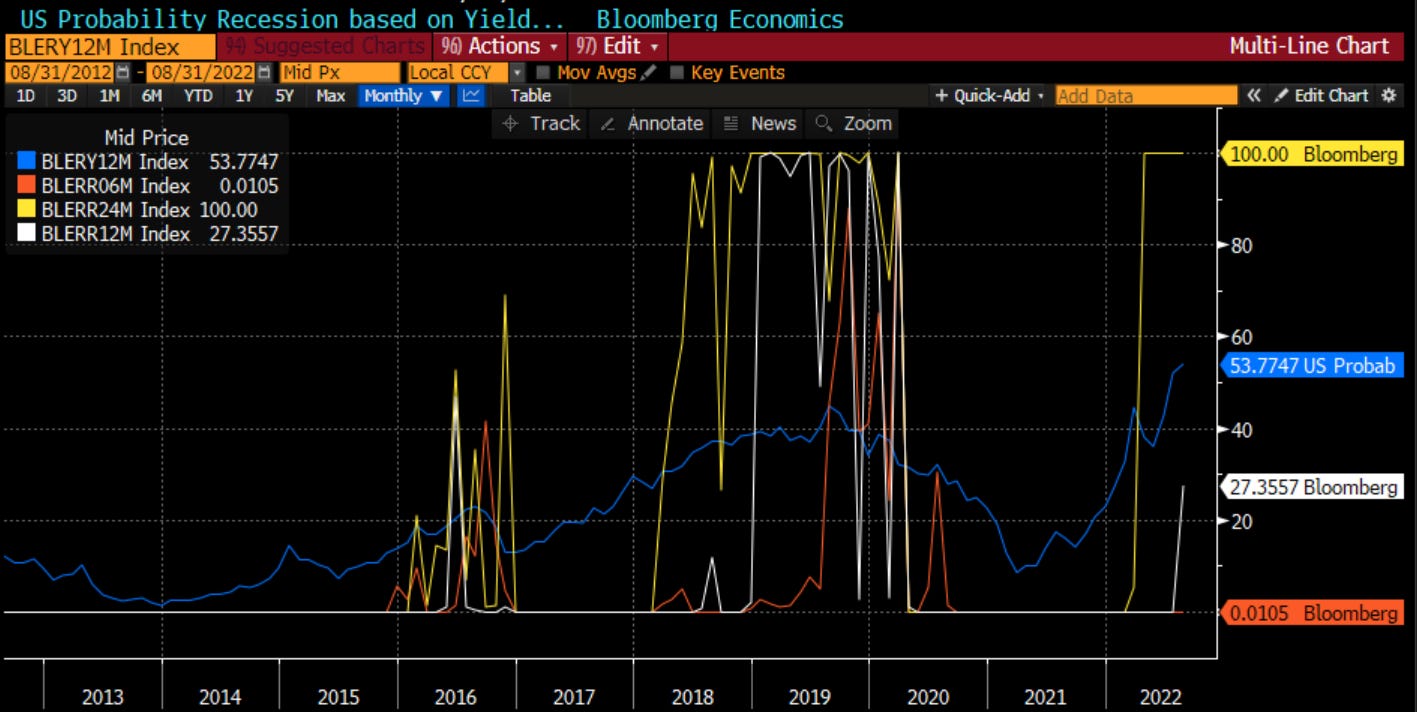

A couple things that Fred referenced were the probabilities of recession. Bloomberg economics puts out a number of different models that suggest the probability of recession. the line in blue comes from the yield curve. The others come from a “model uses a range of financial market, real economy, and economic imbalance indicators to gauge the N-month risk of recession.” You can see that this one model predicts with 100% odds a recession in 24 months, but only 1.05% odds of a recession in 6 months. Whether or not we get a recession matters greatly for the direction of stocks at this point.

There are other models on Bloomberg too. One uses consensus forecasts. The others come from the NY Fed and the Cleveland Fed. These latter models matter to me not so much because they will be correct, because there is no reason to think they are any more accurate than other models. They matter to me because it shows that the Fed is thinking there is only about a 25% chance of a recession in the next 12 months, which surely impacts its thinking when it comes to raising rates. The market is not nearly as sanguine.

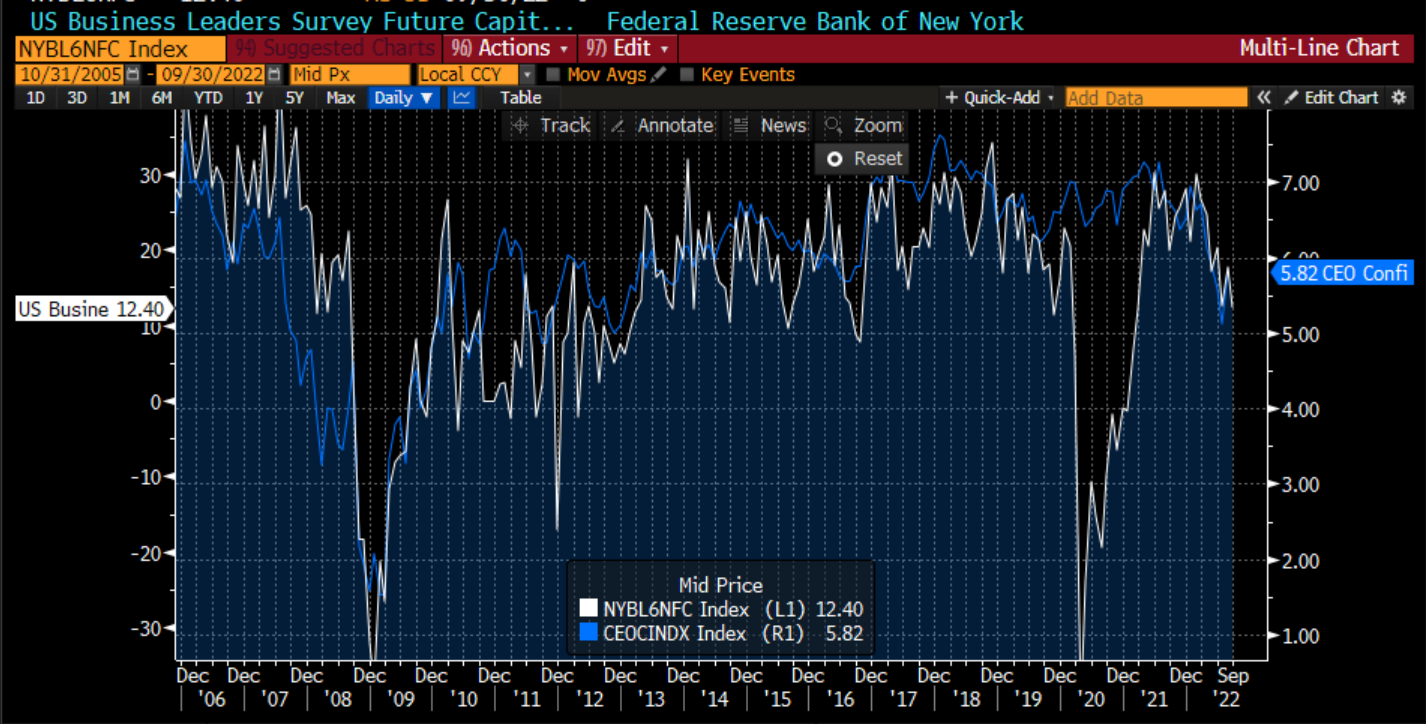

One other thing Fred and I discussed was capex spending and the CEO confidence Index. The latter index has plummeted of late, but if you widen the time horizon a bit, it is back to post GFC levels. You can see that NFIB capital spending intentions are correlated with CEO capex, which makes sense. This is surely something to continue to watch, but it is painting a less optimistic picture than the Fed models.

Speaking of less optimistic, the world, as I mentioned, has gotten a lot less bright and cheery. The price action in the UK markets in the last week was downright frightening. I don’t think many really were following that closely. Most saw the stories on the GBP approaching parity with the USD and probably thought it is a good time to go on vacation in London.

However, the driver of the move in the GBP was the move in the UK Gilt market, which is the long-term sovereign debt market. Market participants p. resumably lost confidence in the government program to cut taxes and raise spending as a way to quell inflation. I will leave the politics aside because it is not my place to discuss, however, the price action in the UK 30 year bond market was shocking. It traded like crypto or meme stocks. You can see a move from 3.25% to 5.1% back to 3.8% all int he last month. In fact, in a matter of days it went from 4% to over 5% back to below 4%.

A major driver of this was liability-driven investing or LDI. UK pensions must match liabilities and assets like all pensions by regulation. Blackrock and other firms have found a way to use the swaps market, a large and little known market outside of the professionals. by using swaps instead of buying bonds, pensions were able to only post a fraction of the money, freeing up money then to be invested in stocks, commodities, and emerging markets. This works very well when risky assets and risk-free assets are negatively correlated. That would mean if the bond price fell, and swaps fell, the equities or commodities would be rising, offsetting losses. However, in a world of inflation, these assets are positively and not negatively correlated. As bonds and swaps fell, so did equities and commodities. Pensions then had to post more collateral against losses in the swaps market. Theis meant the need to sell equities in a falling market to raise money to put up more collateral. A vicious circle ensued and finally the Bank of England had to step in as a lender of last resort otherwise the pensions would all have gone bust. That means the retirees of the UK would have lost their retirement. We will see if the actions of the BOE to stabilize this market will work, but as I have said for 18 months, higher inflation is showing that portfolios that have been created to count on negative correlation are going to be hurt. This is yet another example.

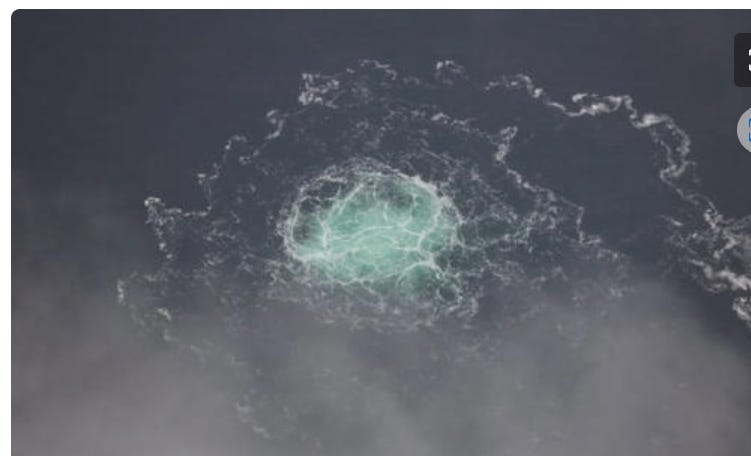

Finally, we must talk about the Nord Stream pipeline explosion. It was not an accident. This was a bursting of a pipe that was 100 meters under water. It is a 4 cm thick steel pipe that was encased in another 4 inches of concrete. It was designed to not break like this. All signs point to a state actor doing this. Some say Russia blew up its own pipe. Others say why would it do that when it could just shut it down. The theory is for two reasons: 1. as a way to show Europe the energy is never coming back 2. to show the new Norway/Poland pipeline that nothing is safe. Others say it was the US/CIA that blew up the pipeline. The logic is that US companies will benefit from being able to ship more LNG to Europe. Russia is also shipping LNG to Europe next year. Perhaps it was the Ukraine that managed to pull this off as a way to make sure Europe did not wane in its support of the war. Suffice to say, we do not know and may never know who did this. All parties agree that it was sabotage and an act of state interests. This tells me that geopolitical risk premia will stay permanently higher.

This patch is a kilometer wide.

The world has become a much riskier place. We are in a transition to a multi-polar world order from the uni-polar US world post the Wall falling. We had a peace dividend from 1990 to 2020 as a result. We will now see the opposite of that int he coming decades.

The world is also riskier because too many investment portfolios were built for a world of disinflation. Retirees and Millennials do not even know the risk of their pensions or target date funds. Is this the last time we will need to see the government step in?

Riskier world means we pay lower multiples on earnings. Said another way, it means we need a higher discount rate on any investment. That is a difficult place to be if you are a risk-taker now. It means the cash will stay on the sideline for now.

Stay Vigilant

Bonds and bombs