Can anything happen that will change people's minds?

Look through the potential catalysts in the markets to get a sense of what can change the narrative we are now forced to deal with

As I have detailed, I look at the markets in three parts. This helps me break down what the drivers of price action are, when I can see what the important narrative is. Depending on the portion of my work that seems to be the narrative of choice, I have an idea of the staying power. For instance, I start with the Fundamentals. Of course this can and does have the longest tail to risk-taking - positive or negative. When this is positive, we still have volatility and noise, but we have a sense of where the trend is going. When this is negative, we know that rallies are to be sold and we tend to see a waterfall like decline.

The second portion is the supply and demand of markets. I use a number of different measures to try and assess the behavioral mindset, and importantly positioning, of markets. I looked at that last week but have updated that a bit this week given the price action. Both of the first two parts of my process are negative.

The final area I try to explore is what I call catalysts. We may know a trend. We may know where people are leaning. However, what will get anyone to change their mind? For this I explore the economic surprise data, the earnings surprise data, and the geopolitical risk index.

I will get to that, but first I want to update with some charts I have put on Linked In this week. The first two charts were posted on Thursday. I showed some possible paths for the NDX Index the last two days - the first was a path to a 30% decline as the bubble bursts, the second a path to a 30% move higher if the news is as bad as it can get. While neither case is what I think is likely going to happen, both are possible. Importantly for me, I found that people globally were about 5x more interested in the downside scenario than the upside scenario. I then looked further at other measures of bearishness in the markets. I looked at the AAII bulls less bears measure. It is the most bearish reading this century. Think of all of the bad things that have happened in the last 20 years. That is saying something.

In addition, in the bottom chart I look at the 20 day moving average of the Cboe equity and index Put/Call ratio. When we look at end-user demand in equity or index options, we know that bullish investors generally don’t trade options (bullish traders do but we all know buying options is an instant gratification position). Investors who think we are range bound sell call options to generate yield. Only when investors are really bearish do they buy puts or insurance. Why? Because the premium paid (which like most insurance is usually spent with no payout) is a drag on returns. Thus, looking at the volume of put options vs. call options can be telling. Again, I look at this 1 month moving average for the last 20 years. We are at a magnitude in percentage terms that is the largest move higher we have seen. This includes suicide bombings, financial crises, debt ceiling debacles and taper tantrums. Yet, investors are at the most bearish we have seen:

Another measure to assess this is the CNN Fear and Greed Index. It measures a number of different market instruments to come up with the reading (see the website for the measures). Right now, it says we are in extreme fear:

We see this in the most popular of assets. Yes, we have had quite the debacle in Terra/LUNA this week. I am not the guy to explain all of the inner-workings on this, but readings of news stories suggest it could be an attack on the peg ala George Soros and the British Pound in 1992. However, it was something that, in hindsight of course, one might have seen coming. As this was a presumed stablecoin that has crashed, it has brought doubt into the entire crypto space, including the gold standard of crypto - Bitcoin. A technical analysis of Bitcoin itself suggests we could have ultimate downside to 20k or so before we find the true bottom. If we do that, we might expect another crypto winter as we saw throughout 2018-2019:

Turning our attention to the economy, I want to look at how the data have been coming in relative to expectations around the globe. Two weeks ago, I looked at the trend of the economy in the fundamentals section. This trend is toward a weaker economy. However, that is not new info. I think everyone is forecasting a slowing economy to some degree. We are coming off the fastest growth in almost 20 years after all. Markets move on the margin, though. The economic slowdown direction is priced in. The degree of the slowdown is the variable. As data comes in worse than expected, investors get more nervous of a recession and act accordingly. If data comes in better than expected, perhaps our worst fears will not be seen and risky assets can rise. After all, risky assets are driven by earnings or cash flow, and earnings are driven by the economy.

Using the Citi Global economic surprise indices, we can see how the economic data is coming in relative to consensus. This doesn’t tell you whether it is good or bad in absolute terms, only whether it is better or worse than expectations. We can see, that as bad as the trend has been this year in global economies, the data had been largely surprising to the upside, especially in the US and China, the two biggest economies in the world. That is, until this month. The last 2 weeks the data in the US and China have been much worse than expected. This has surely led to the negative sentiment developing in the markets.

Will we start to see this economic weakness show up in earnings? It is a little tough to draw a straight line because earnings come out with a lag. However, we can read between the lines on the earnings reports and start to get some information. If we start with the headline data and look at the sales and earnings surprises, we can see that, for the most part, sales and earnings have come out better than expected. There is a fair bit of green on this screen. However, if we look at the lower left panel, we see that the magnitude of this surprise is less this quarter than in previous quarters. There is a game Wall Street plays where the bar tends to be set too low for companies. It takes an entire post to discuss. However, Wall Street analysts set the bar for companies to beat and those companies do. However, the pace of the beat this quarter is not as good as hoped for. We can see that in the lower right panel. In spite of the positive earnings surprise, the reaction in terms of price change was muted if not negative. This tells me the ‘whisper’ number was even better than the actual surprises we saw.

However, if we look in absolute terms, sales and earnings growth were very strong again this quarter. This certainly helps support a market that is struggling under the weight of Fed rate hikes which are a negative for the multiple investors pay for earnings (see last week). Thus, we get some churn and volatility as multiples compress but earnings are growing. This means some stocks are getting crushed if they don’t show positive earnings growth, but others can hang in there if not move a bit higher if earnings growth is faster than the multiple compression.

If we also look at Europe for comparison, on the surprise front, the data was even better than the US and better than previous quarters. The reactions weren’t entirely positive, but there is a war going on in Europe. I will say that in this latest sell-off, Europe is holding up better than the US.

Another measure to consider is the outlook for earnings going forward. Again I go back to Citi Global with tracks a global earnings revision metric. So what if earnings were good this quarter, how are analysts revising their forward looking numbers? Even if analysts are always bullish, marginal changes can give insight into their true views. You can see revisions were pretty negative in the latter half of 2021 and early 2022. This has been a period of declining stocks. This number is starting, or at least trying, to stabilize. It is too soon to have a handle on it, but maybe we are starting to see a peak in analyst relative bearishness.

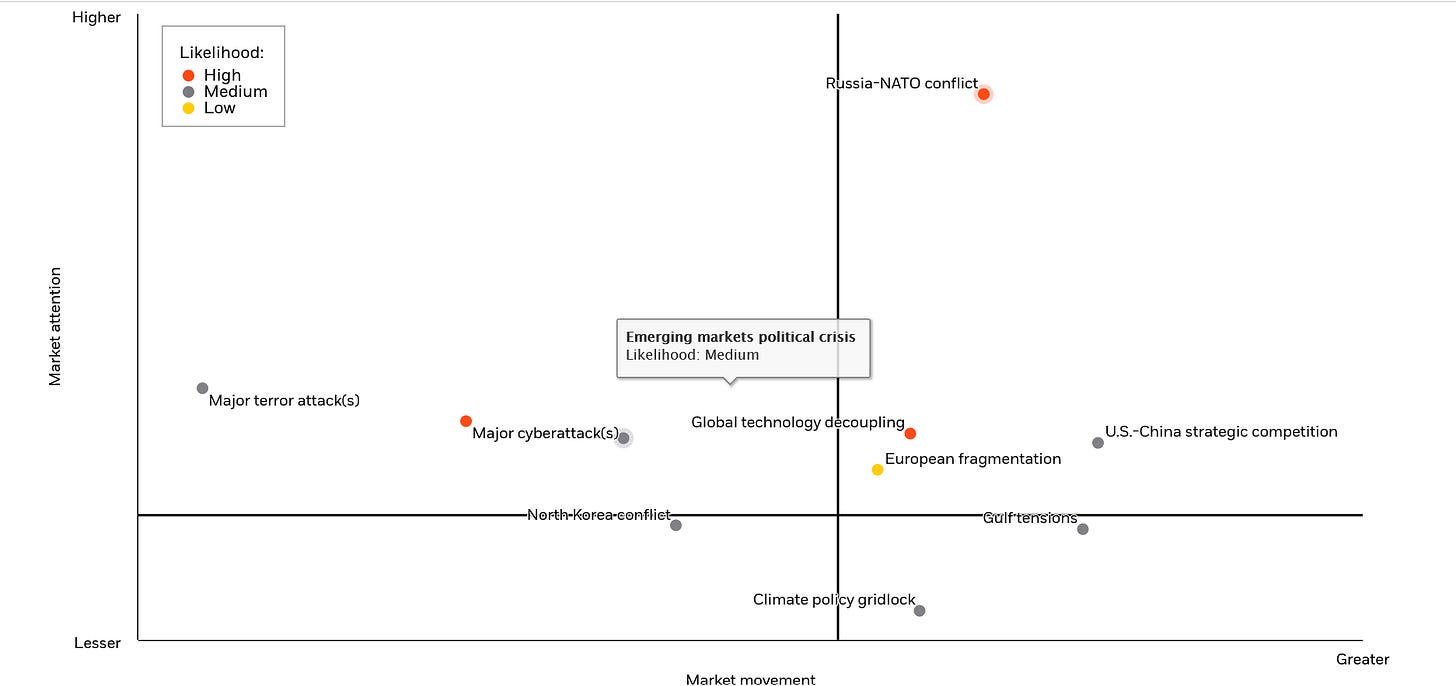

Finally, I like to look at measures of geopolitical risk. A full caveat is that this category is almost always negative. Other than the Berlin Wall coming down, there are few positive geopolitical events. I supposed advances in nuclear fusion could be one but I have been waiting for the for 50 years. As we seem to be embarking on the Second Cold War and a move to a multilateral world from unilateral world, there is a lot that can go wrong. I encourage you to listen to my Investment Exchange Forum podcasts on geopolitics. This topic requires a decade long view, not a days long view. It is certainly negative. Are we at the point that the market no longer cares? The market doesn’t always care about geopolitics. We didn’t ‘care’ about Covid until it hit London and NYC. Then it was all we cared about. As soon as these countries got vaxxed, the market stopped moving on Covid headlines. Will these happen with Ukraine or the China lockdown?

Blackrock Investment Institute does a nice job of categorizing what the big geopolitical events are, and how much the market cares. Right now, it is still all about Russia and NATO. However, if that starts to wane, there aren’t many major geopolitical events the market cares strongly about. I would watch for headlines (or lack thereof) on Ukraine. There might be less market impact going forward.

How do we even try to pull all of this together? There is a lot going on to be sure.

First of all, there does seem to be quite a bit of bearishness in the market right now. Perhaps that is the vocal minority and everyone is still a closet bull. I would suggest that may not be the case. That does not mean we are in for a V-shaped bottom that takes us back to new highs. Not at all. That means you should be careful of bear market rallies which can be the most savage rallies in any market.

Second, the surprise data - economic or earnings - is not encouraging. Markets move at the margin and the marginal news whether on economic growth, inflation or earnings, has not been what investors want it to be. So we can understand why people are getting pretty bearish. We definitely need to see the data on both the economy and earnings (we won’t get until July now) come in better than feared for the market to truly stabilize. That is why market bottoms are a process and not a level. Again, there is no V-shape. Just know what to look for.

Third, there are some signs of hope. Forward-looking analysts revisions might already be bottoming. It is a little too early to say this with any confidence, but we have at least slowed in the downward revisions. This is a measure I want to continue watching even more than waiting for the July earnings. Also, the worst geopolitical news might be at a crescendo. This by no means suggests we are past the worst part for the situation in Ukraine. It also doesn’t mean the struggles with lock-downs and their effects is over in China. However, as I said, the market has a way of moving on from events after a while. Market’s have rallied during very bleak periods of war and political strife before. They can again. The key is to watch the reaction to headlines on these topics. If we get a negative headline on Russia or China, and the market has little effect, you can start to get a sense of what is priced into the market.

I started by saying I look at this category to get a sense of what can change people’s minds and if we are seeing that yet. Better news on the economy, earnings or geopolitics would change people’s minds and take them away from being too bearish. We are not getting that right now. I am on the lookout for it. That said, sentiment and supply/demand is pretty bearish now. We could get sharp moves higher. However, until we get the catalysts that ultimately can get us to potentially see a change in trend, we still need to tread very lightly in the risky markets.

Keep your eyes and ears open and …

Stay Vigilant

Si

Si