Agenda:

How can we not discuss ‘the fiasco in the Oval Office’?

What does all of this mean for financial markets?

How is the average investor meant to navigate these markets?

Fiasco in the Oval Office

Unless you were really not paying attention, you couldn’t have missed the Trump/Vance/Zelenskiy showdown in the Oval Office. Even if you did, you certainly heard about it. I take great pains to not discuss politics, primarily because I don’t like politicians on either side of the aisle, or either side of the Atlantic. I also think being a-political is a better way to invest. However, there are times when you just know that the events are going to impact markets, so you have to sort out what the impact may be.

As I read through X, watched geopolitical videos on YouTube, and got through plenty of Substack reports to determine what was actually happening, I quickly realized that this was in a Rorschach Test in many ways, where we see what we wanted to see. More cynically, it was really a case of people on the Right and the Left interpreting events exactly as you would expect (Zelenskiy planned this vs. Trump sabotaged the meeting) without trying to sort through the facts, but pretending they did so by prefacing their tweets with “if you watched the entire 40-minute video you would see…”

It is interesting because as I sat in Church today, the gospel was about seeing faults in others while not being able to see faults in ourselves. As Jesus said, “How can you say to your brother, ‘Brother, let me remove that splinter from your eye’ when you do not notice the wooden beam in your own eye?” I think that is so apropos to the discourse on this event and in politics in general. That said, I tried to find perspectives from all sides that attempting to lay out facts and events and help explain what the path may be going forward.

The two perspectives that helped give me more context came from a left-leaning economist and public policy expert from Columbia University named Jeffrey Sachs. Of course, he can be considered controversial as well, but I thought this timeline of events give a lot of perspective.

Wanting to explore another side, I found the view of the more recent timeline of events from Victor David Hansen, a right-leaning historian and political commentator, also quite information.

Finally, as an American, I do want to listen to our own Administrations depiction of events because the US will play a critical role going forward, even if it is a different role than it has played the last several years. This comment from Secretary of State Marco Rubio on George Stephanopolous’ show useful. I don’t agree with the tweeter that he ‘schooled’ George; I do think it gives some context on the diplomatic behind the scenes here.

Suffice to say, the Trump Administration is taking a decidedly different approach. I wrote about that on LinkedIn this week, because even before the events at the end of the week, there was discussion of the Mar-a-Lago Accords (MALA) going around in some corners of FinTwit.

Chart of the Day - not about NVDA

We get NVDA earnings after the close today. That is all the market cares about as it should. It is the biggest stock on the biggest theme in the market that had the most momentum but where that is shifting perhaps

The expectations are high for the coming year with revenue growth of over 100%, only slightly less than last year. Even two years out the revenues are expected to grow more than 50%. Thus the bar is quite high but NVDA has consistently beaten the high bar

But that is not what I want to take about today. I want to talk about the Mar-A-Lago Accords (MALA). What, you say? This is a topic that has been bandied about it some corners of finance social media

Much like other 'Accords' in the past, it is aimed at a major reset on global trade. There is some precedent here as in 1985, the global world order decided at the Plaza Hotel in NYC that there should be a reset as well and a weakening of the US Dollar

The idea behind this is based on a paper by Stephen Miran when he was at Hudson Bay Capital. He is now the Chair of the Council of Economic Advisors. I think a really good primer on it is an Odd Lots podcast interview with Jim Bianco

There are a few main points to the idea behind a reset:

1. US trade deficits are too high and too persistent - we've heard this since term 1

2. We need to rebuild US manufacturing - consistent campaign message

3. For manufacturing to be globally competitive, we need a lower dollar - more on this below

4. The US has taken on too much debt over the years funding defense around the world - think about the comments about NATO

5. Other countries need to start paying for that and one way they can is to buy new 100 year zero coupon bonds which will help the US fund its deficit - Treas Sec Bessent keeps telling us to focus on long rates as the benchmark for the Admin

As you read through that, ask yourself how much of those points have already been made by the President, if not how many executive orders have been signed to this point

So while there may be no actual meeting in which there is an agreement or Accord, are we possibly moving toward these goals anyway?

Bianco made a great point on the podcast about the Dollar. Many people, myself included, look at the DXY Index for a broad measure of Dollar strength or weakness. This is weighted by global GDP & not by US trade

There is another index called US trade weighted dollar that weights this way. The chart today shows both. It shows how the dollar was moved lower after the Plaza Accords. Since then? The DXY is roughly flat which just means the EUR and GBP are just as bad as the USD

The trade weighted dollar has gone up by over 300%. This has made goods from Canada, Mexico and China much cheaper for US consumers. However, it has also made US mfg uncompetitive

Where has the focus on tariffs been from Trump? Maybe MALA isn't too far off

What does all of this mean for financial markets?

As you know, ever since the election, I have been toying with different ideas for what the next year or more could hold. Back in the Fall, I was starting to see green shoots of change in the price action and sentiment surveys in the small caps on an absolute and relative basis. This made sense as small business owners were becoming optimistic for the first time in many years. Could this portend a change in performance for small caps? It did not at all, and now the sentiment surveys are rolling over some, perhaps because we haven’t gotten to the de-regulation and tax cutting portion of the program yet.

Small caps in absolute terms look quite weak, even if a bit oversold here. Earnings have been a mixed bag in small cap and, with some sectors doing quite well (Financials & Staples) while others have been horrible (Energy & Materials). Too early to see small caps leading any change:

The real changing of the guard may be toward international stocks vs. US stocks, especially if the Trump Administration is able to lower the Dollar. I haven’t mentioned what I feel was an incredibly important signal two weeks ago when President Xi met with Chinese tech leaders including Jack Ma. On this week’s Macro Matters podcast, I was able to ask my co-host Tony Zhang about this meeting and other catalysts. He is my China expert, and I was very interested to hear his comments on this, toward the last 10 minutes of the podcast.

I also wrote about this rotation into European stocks and Chinese stocks on LinkedIn this week:

Chart of the Day - rotation?

Yesterday I had a couple pieces of content out. In the morning on LinkedIn, I spoke about MALA & the dollar that was too strong by some measures

In the afternoon, I did a podcast & one of the topics of the podcast was the rotation we were seeing within the US mkt, but also from the US market to other mkts around the world potentially

Today, I want to dig a little deeper into that. The chart today is busy on the surface but more simple when you know what you are looking at. There are 4 lines: SXXP vs. SPX or the outperformance of Europe vs. US; FXI vs. SPY or the o/p of China vs. US; EEM vs SPY or the o/p of emerging mkts vs. US; & the trade-weighted US Dollar but inverted

As you can see, there is a very good co-movement among all of these lines. When the $ strengthens, it is a sign that money is flowing into the US & US assets like the SPX. When the $ weakens, the opposite is happening

This move on the $ historically has been a function of investor outlook for global growth. The US stock mkt has traditionally had a lower correlation to global growth. If anything it is seen as more defensive. Foreign mkts have had a higher beta or correlation to global growth

Thus, higher expectations of global growth means money flowing to the mkts outside the US & the $ weakening. When investors get nervous, money flows to US stocks & bonds & the $ strengthens

There is a view that beginning with the 2019 tariffs with China, Covid & then the AI boom, that these long-term relationships have changed. However, while noisy, when we zero in, we still see the same thing

So I ask you: are investors getting more positive about global growth?

We can see from 10yr US yields that bond investors fear a growth slowdown in the US. The Citi economic surprise index has fallen sharply & now there are fears that DOGE & cuts to fiscal spending will negatively impact growth in the US even if these cuts are necessary long-term

However, I believe the tone is quite different outside the US. I highlighted the meeting President Xi had with tech leaders in China, with an aim toward stimulating the Chinese economy. Now China is looking to re-lever its banks. There is reason to be optimistic about Chinese growth

Germany had elections & the new Chancellor Merz has a willingness to spend more money on defense. Germany has a lower debt to GDP than any other developed country. There are implementation issues such as Maastricht Treaty, however, awakening this sleeping giant is positive for European growth

EM names are largely facilitators of this growth. Many EM country indices are filled with commodity heavy names. More growth, stimulus & construction in China, Germany & others is positive for them

It is easy to be US-centric as a US investor. Its been the right call for a decade or so. However, the news outside the US may be shifting in a different direction as the news inside the US

I also had to write a report for Eurex this weekend about what happened in European volatility markets this month. Two things stood out as I looked at it from an index perspective. First, the European markets continue to be off to an amazing start to 2025, even as there are threats of tariffs and worries of a peace deal falling apart. The Dax is up over 13% YTD adding over 3.7% this month, SX5E up over 11% YTD adding over 3.3% and SXXP up 9.8% YTD adding over 3.25%. This is happening not necessarily with a major rotation at the index level but more to some single stock stories. Why do I say that? Because implied correlation within the index has been historically low in 2025, only recently perking up.

Financials are clearly leading the way but the next group to move may be industrials, especially if the Europeans are about to spend hundreds of billions supporting Ukraine, either in a peace deal where European troops are on the ground, in rebuilding Ukraine, or in funding further war efforts. Almost regardless of the outcome, it looks like the fiscal burden is shifting from the US to Europe. The PM of Poland, Donald Tusk, said as much over the weekend, paraphrasing, “Why should 500 mm Europeans expect 300 mm Americans to defend Ukraine from 140mm Russians?” In addition, the new Chancellor Merz in Germany seems intent on fiscal spending.

Two of the bigger defense plays in Europe - Rheinmettal and Thales - appear to be sensing increased spending:

How is the average investor meant to navigate these markets?

The average investor is likely not going to be able to or even want to be investing directly into single stocks around the world, such as Chinese tech names or European defense names. That doesn’t mean that there is no opportunity to participate, however.

I want to preface this by saying that I am not advocating any positions or giving any investment advice. Not looking to run afoul of the SEC the way Dave Portnoy just did. They will eventually catch up to everyone who is. However, I do want to point out that there are some ways you can investigate, research and consider if you think there is any validity to the idea of rotation

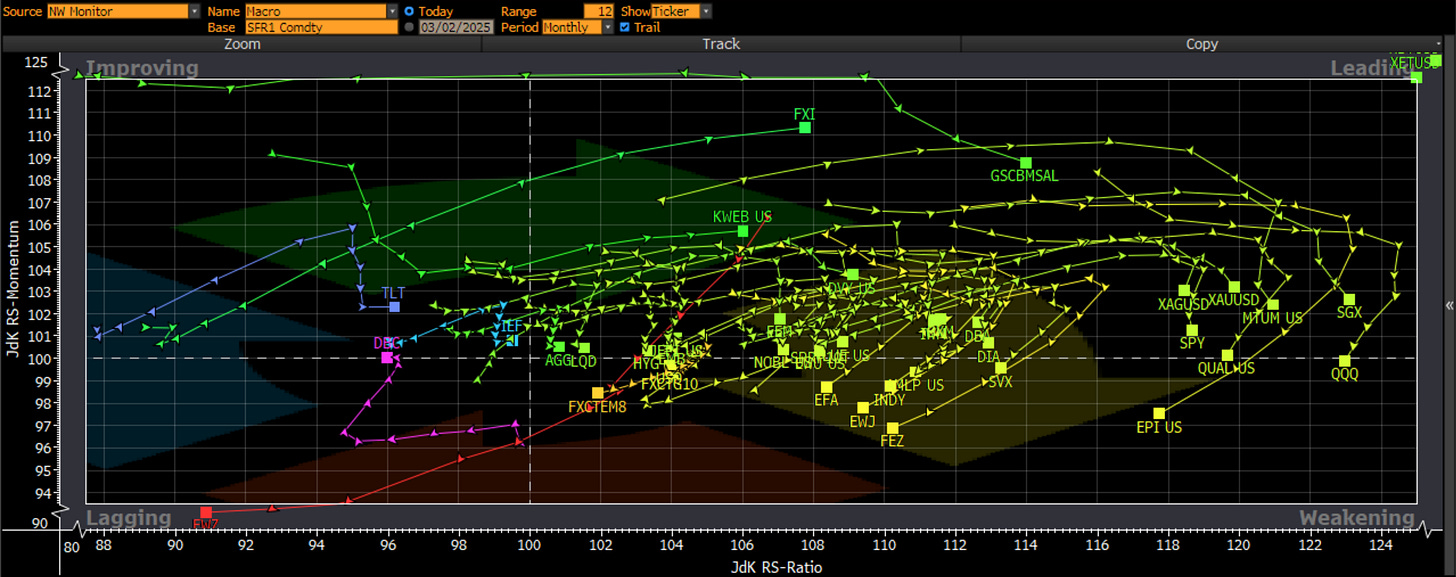

First, consider the relative rotation chart. I use a monthly rotation for the last 12 months. Remember, the important areas are the lower right (what has worked but is weakening) and the upper left (what has been a dog but is working). In the lower right, we see some recent darlings like Japan and India, but now we see other US indices like QQQ (US tech) and QUAL (US quality stocks which is dominated by Mag 7). In the upper right, we see US bonds.

If I simply plot the outperformance of US stocks (S&P 500 total return) vs. US bonds (Bloomberg aggregate), we can see it plots very nicely vs. the JOLT data. When jobs are growing, the economy is doing well, and stocks benefit. When the opposite is true, the economy is usually suffering, and bond investors anticipate a slowing of growth. So, if you only invest in the US, consider that US bonds may be interesting relative to US stocks right now. Also consider that the actions of MALA may be good for bonds and good for stocks long-term but cause some growth concerns for stocks short-term.

In the upper right of that RRG you can see that China is clearly leading the way right now. It started with Tepper being a cheerleader. I was critical at the time. This meeting by Xi changed my opinion. I still want to see some catalysts, but I am more open to the idea. I wrote about it on LinkedIn a week ago:

Chart(s) of the Day - China valuation

On my post this past Monday, I highlighted the meeting between President Xi and several high-profile tech leaders in China. The aim of the meeting was for these tech leaders to help promote the domestic Chinese economy

I highlighted that I thought this was an important meeting from a signaling perspective. Coupled with the recent DeepSeek headlines, I asked if China was turning on a relative basis

I suggested China was undervalued vis a vis the US and there was some pushback on that. Interestingly and coincidentally, a couple of charts speaking to the relative valuation of China vis a vis the US have popped onto my radar in the last 24 hours

The first is from Chen Zhao at Alpine Macro. Chen is a good follow and has several interesting and thought-provoking charts. The top chart is his and he shows the forward Price to Earnings ratio of the Mag 7 US tech stars vs. the Chinese Terrific Ten, most of whom were at that meeting with Pres Xi

You can see that the P/E for the Chinese names is half that of the US names. Of course there would be some follow up questions such as: 1. what are the relative eps growth rates of each of those baskets 2. how believable are the eps in each of those companies 3. what is the driver of those eps and how sustainable are they? At first blush, though, there is more margin of safety for similar trends possibly

The second chart came from Max Bartuch from HOLT who spoke to my IMA class yesterday. As a student asked about BABA, Max went in to discuss country level discount rates in HOLT, which feed into the stock level discount rates. A higher discount rate means more risk is priced in. A lower discount rate means less risk is priced in

His point was if you look at Chinese stocks - here I have the China H shares and the Hong Kong Index overall - you can see the discount rate is a little off the highs, but is very similar where it was during the Great Financial Crisis and in 01-02 period after tech crash

If you compare the US discount rate. you can see that it is instead near the lows we saw in 2021 at the peak stock mkt or in the late 90s at the peak of the market

Thus, investors see a lot more risk in Chinese shares than in US shares. Of course, price is what you pay and value is what you get. One still needs to determine what cash flows and earnings they would get from either set of stocks

But it is very interesting to see the wide disparity in relative valuation in one major economy vs. the other

While the Chinese tech ETF looks overbought and about to roll over in the short-term, it also looks to have broken out and may be showing signs of a trend higher. You might want to do some research in anticipation of a buyable dip.

Another breakout with a possible change in trend, that is extended short-term is Germany, proxied here by the EWG ETF, which includes financials that are strong and German industrials like Rheinmettal. Remember as well that Europe is a bank-centric economy, not a capital markets-centric economy like the US. This means if the politicians and central bankers want to stimulate the economy, they need to do so through the banks, which provide the capital to business. Thus, the countries with a big banking business, and those with a big industrial base (read Germany) where the debt to GDP is only 40% (vs. 130% in the US), have some room and ability to do so and could benefit. While the short-term looks overdone, if we step back, it is only a small move in the grand scheme of things.

It is difficult to watch the news flow and the price action in the month of February and not think there might be some changing of the guards. This phrase invokes the ceremony that many of us have waited to watch while in London, the inspiration for the picture in today’s post.

Whether this changing of the guards is intentional and engineered by the Trump Administration, or the unintended consequence of America First and an abrasiveness toward our allies probably depends on your preconceived bias. The reality is likely somewhere in the middle. I would encourage you to consider the beam in your own eye before seeing the splinter in another’s. I know I try to do that, and it really helps me stay more objective.

Objectively speaking, the opportunities in US bonds, Chinese tech, and the German index look more favorable to me than the US stocks which have worked so well for so many. Maybe there is a changing of the guard.

Stay Vigilant

Make Russia great again? sheesh.