Demystifinance

This week, I take a step back to answer a very more basic questions

When I started this writing adventure at the beginning of 2022, my goal was to demystify finance. In fact, the first blogspot, before I moved to Substack, had a URL of demystifinance.blogspot.com.

You see, there were friends, family, students etc. that were always asking me questions about finance. Sure, I also had debate and dialogue with professionals in the investment management industry, but I wanted my writing to decode the things the professionals discussed, so that the regular person could make sense of it and therefore make better decisions.

While the readership has grown (thank you very much, really, I do appreciate it), I still hear from many ‘I was only able to follow about half ….’ I heard it again a few times over the past week. If this is the case, I am not doing what I set out to do. While I love the readers who are professionals, and I do want to write something that appeals to them, I also want to make this accessible.

It is with this in mind, that I reached out to my family. I said to them, ‘if you could ask me one question right now, what would it be?’ Then I attempted to explain it. This week, I am going to answer those questions. I hope this can help demystify for others as well.

If you trade or invest for a living, you may not feel there is much in this week for you. That is okay. I will still be building on a few of these things in my LinkedIn/Twitter this week. Thanks for being patient.

First question, from my wife, who always gets to ask the first question. “What do you think of the housing market? What are mortgage rates going to do?”

The first thing I would say is ‘shame on you’. I wrote about this on my Linked In on Thursday called “39 Steps”. Why don’t you read my Linked In every day?

But seriously, this is a major topic to consider. I have written about this several times. Housing leads the economy into and out of recessions. The multiplier on housing, both new homes and existing homes, is huge. Just think about it. When someone buys a house, there is painting to do, new furniture, landscaping, maybe some new fixtures etc. The people doing this work then take the money and buy coffee in town, or buy lunch. It follows on.

This relationship is so predictable, Kantro at Piper dubbed H.O.P.E which is housing → (new) orders → profits → employment to show how policy decisions flow through the economy.

What policy decisions? Primarily Federal Reserve interest rates, but also quantitative tightening. I am not going to get into the minutiae, but let’s just say when the Fed is making it easier and cheaper to obtain money, things will get better, but with a lag. When the Fed is making it harder, things will get worse, with a lag. How long a lag? 18-24 months for the most part. This means that it should be getting worse near the end of this year and into next year.

Back to housing more immediately. I am going to show one chart. It has the 30-year mortgage rate in white, new home sales in blue and existing home sales in blue. New homes are in thousands so 697 thousand new homes sold most recently. Existing are in millions so 4.16 million. You can see there are a LOT more old homes sold than new homes. Existing homes are usually 85-90% of all homes sold.

Looking at the chart, you can see the mortgage rate is the highest since 2000. This means it is going to be really expensive for people to buy a house. Their payments are much higher. If you could get a 4.5% mortgage instead of 7.5% mortgage, your monthly payment would be $1000 per month less for a $500,000 mortgage. This is a lot.

Now new homes have held up better because home builders offer incentives. They will offer a 2-year teaser rate on financing. They will throw things in to ‘lower’ the price without lowering the price. Thus the blue line has done a little better. Existing homes? Sellers won’t do that. In fact, sellers don’t even want to sell their house to move to a new one because they have a low mortgage and don’t want to give it up.

For me, this means that housing is going to continue to be a drag. Sure, you will see ‘Under Contract’. People will still buy and sell. Jobs change. People get old and families sell the houses. Millennials are hitting that age when they want to move into a house because kids are coming. However, the pace of all of this happening is going to be a lot, lot slower than it was in 2021/2022. This means the economy will get a bit slower.

One other thing I would add to this. People want to own real assets when there is inflation. You see the mega-rich buying property and land all over the United States. Why? Because the government is inflating away our debt. More on that below. Real assets do well in this environment. This is another thing that will limit inventory though.

Second question, from my mother-in-law, “Should I just keep my money in government bonds because I can earn over 5% now?”

Yes. You. Should. First, because of your age, you should have your money in the least volatile and most liquid assets in case you need to use it. Second, you are not being compensated to take risk right now. Sure, the stock market is up a lot this year. However, that is really not being driven by a wide variety of stocks. You wouldn’t own many of these A.I. names. The boring dividend paying stocks, are not up nearly as much. In fact, the DVY etf is down on the year still.

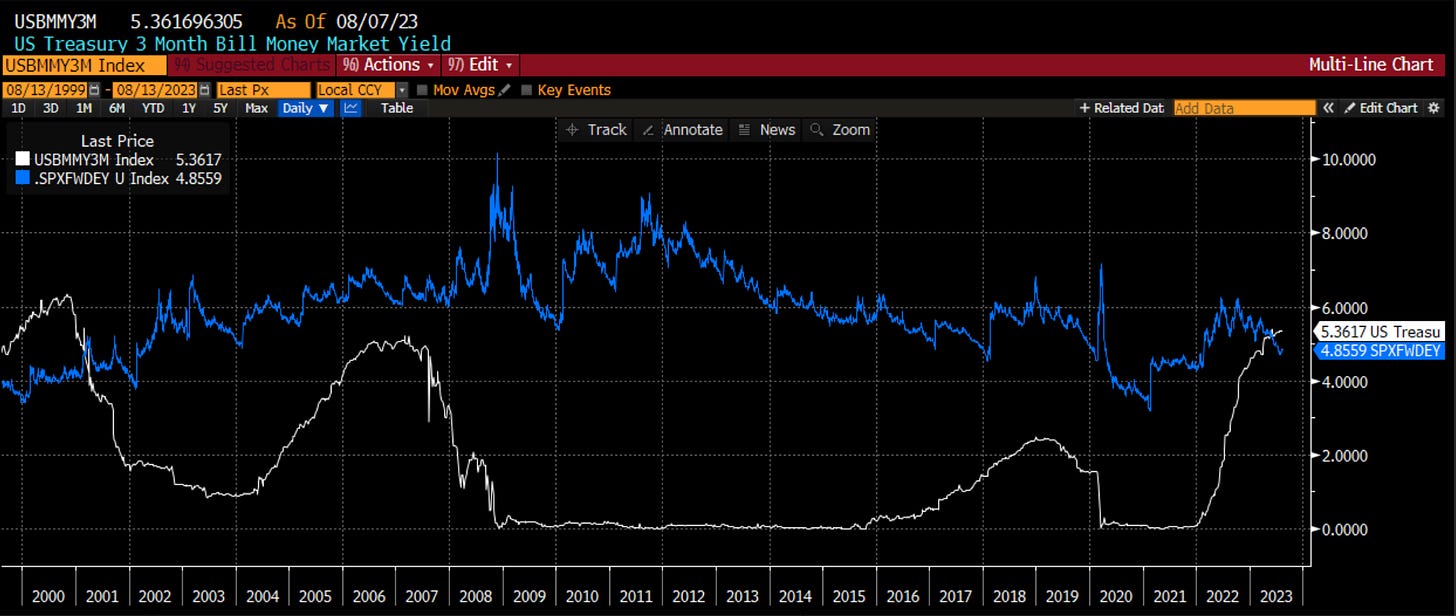

Yet you can earn over 5% in the risk-free rate. Risk-free. 3 month T-bills earn 5.36%. Let me show you one chart that matters a lot. It compares this risk-free rate to the ‘earnings yield’ of the stock market. This is just a way we try to value stocks and we convert it into a yield to make it easier to compare to bonds. The earnings yield on stocks should be higher than bonds because stocks are riskier. Yet right now, you can earn more in US government debt, not even corporate debt, than in stocks.

Yes, valuation is a horrible market-timing tool. As I tell my students, over the next 12 months, there is no statistically significance between valuation and stock or market performance. However, over a 10 year horizon, it is all that matters.

Right now, you are not being paid to take risk. Does this mean stocks can’t go higher the rest of this year? Not at all. They sure could. However, it means that now is not a good time to move off out of cash.

However, the fact you bring this up made me think of something I really haven’t appreciated as much as I should. Retiring Boomers as well as the Greatest Generation which has been retired, have been screwed the last decade plus getting nothing on their savings accounts. Now, they are earning 5%. For a Boomer with $2mm in their account, this is an extra $100k a year they have at their disposal. That is probably why there were so many happy Boomers listening to music, dancing and drinking wine at the vineyard my wife and I went to this weekend. While the Millenials are getting screwed (see housing question above), Boomers are probably better off. Interesting discussion there. Wonder what that means come election time. For another day …

Third question, from my youngest daughter, “What is a 401k and how should I invest it?”

Well, a 401k is a retirement account you have with your employer. The name comes from the section of the tax code that created them. These accounts are tax-advantaged. Whether this means you put in money before tax and it grows untaxed until retirement, or whether you put in after-tax money and then never have to pay tax again, depends on the type of 401k it is (regular vs. Roth). We can discuss that when you start working.

However, most companies match the 401k about $0.50 on the dollar up to some maximum (typically about $6000). This is basically free money to you, the employer. This is why I encourage people to max out their 401k as the first way to invest. You should pay off high interest debt (like credit cards) before investing, but you didn’t ask that.

How should you invest it? First, you shouldn’t try to time the market, even if you read my LinkedIn and Substack and think you are good at it. You should do what we call ‘dollar-cost averaging’. This means you save and then invest a little bit every month. The same amount. You invest it in broad market index. The 401k will have a selection of these. The default will probably be a target date fund. That’s okay but may not be the best option. As Warren Buffet said, just look for a low cost broad market index fund.

If you do this, you do not and should not ever worry about market fluctuations. If the market goes down like in 2022, that just means your saving is buying more shares. If it goes up and looks expensive like now, that just means you buy fewer shares. You are young and should not worry about these retirement savings until you are going to retire. That is probably going to be in 50 years. Sounds like a crazy long time, but the good news is, if you save and invest this whole time, you will be able to enjoy your retirement. You will be able to dance to live music and drink wine like the Boomers.

This is how much their retirement savings are now. That is $40 trillion.

Fourth question, from my middle daughter, “Am I going to be able to get a job when I finish grad school in 16 months?”

The short answer is yes. This is the chart of the unemployment rate for college grads and higher. You can see it is 2%. This basically means you all have a job. Even in Covid, the worst time ever, it was only 8%. In the Great Financial Crisis it only peaked at 5%. This means that the worst case is 92% of people your age with your education will have a job. That is the short answer.

However, I think your question was more because you hear of some of your friends getting laid off. Those working in financial services or tech are going through a bit of a cyclical slowdown. These are high-paying jobs. These are companies where a big piece of their cost base comes from these employees. These companies over-hired comoing out of Covid. As they worry about an economic slowdown, they look to cut costs. We can see this in the jobless claims data. This is where people get unemployment insurance if they were laid off and can’t get a new job.

You can see it has been moving higher of late. However, bear in mind that this weekly number around 250k people is still near all-time lows. In bad times, this number will get up to 600-700k people. In Covid, it hit 6 million. However, that was an anomaly.

Cyclically, things might be getting a little worse over the next 12-18 months. However, know that companies still want younger employees by and large. You are cheaper and more technologically savvy than other employees. This means you are more productive. This means you effectively cost the company less money in the long-term. So relax, you will be fine.

Fifth question, from my son, “Should I invest in ETFs or mutual funds? What about thematic ETFs?”

Good question. There are a few ways I would answer this.

First, I would refer to the great Peter Lynch who managed one of the most successful mutual funds ever. He said buy what you know. Warren Buffet is of a similar mind in his own investing in that he will only buy companies he can understand.

If you are working in an industry where there is cutting edge work being done and you see some companies that you know are changing things and becoming popular, it can make sense to buy some shares in these companies. It shouldn’t be a core part of the portfolio, but it can augment it some.

Let me give you an example. Early in my career, I worked at a really forward-thinking derivatives firm. We were ahead of everyone on most things. One summer we noticed we changed over all of our computers to these things called Sun workstations. Once we started using these things, we realized how amazing they were relative to the PCs we were using before. However, even with this knowledge, I did nothing. I knew this company would gain market share. We were one of their first major orders and we could see how much better. That stock went on to be one of the best performers in the 90s.

Second, I want to get back to your question on ETF vs. mutual fund. This is a question more for your mother, the accountant. You see, ETFs are more tax-friendly than mutual funds. When the person running the mutual fund buys and sells stocks in the fund, this creates capital gains taxes that you will have to pay. That doesn’t happen with ETFs.

On the flipside, ETFs only change their weights rarely, sometimes once a year. This means that stocks inside these ETFs can get very overvalued. We might be seeing this now.

However, the benefits from tax to ETFs and the higher cost to transact for mutual funds have meant mutual funds have largely performed worse the last 10 years or so. This is why $4 trillion of assets have left mutual funds and gone to ETFs.

Now, onto you other question about thematic ETFs. I would say be careful. Often you are paying higher fees and not getting much in return. You know I am a big advocate of ESG investing. That said, the ESG etf is not particularly great. You can see that it is almost perfectly correlated to the SPY over the last 5 years. This is shocking. Did S&P 500 just happen to perfectly pick the best ESG names? Not at all. For the benefit of this extra selection into ESG, you pay triple the fees. For no extra performance. Like I said, I am in favor of ESG investing, just not investing in the ESG ETF.

No what about an ETF that picks high growth tech stocks that you favor. Let’s look at the ARK Innovation Fund. This was super popular back in 2020 and 2021. How has it done over the longer time frame? If I compare it to the NDX Index, also a high tech ‘fund’, you can see that the NDX is much less volatile and has performed better through the full cycle of up, down and back up again.

I would just tell you to be careful in what you are buying. Look at the companies involved. Look at the manager’s track record. Make sure you aren’t just buying a good marketing program but instead buying a better investing program.

Final question, from my wife again, “My friend I play tennis with works for Fitch. she said they downgraded US debt and a lot of people have been upset. Is this a big deal?”

Yes and no. Yes it is a big deal in that Fitch highlighted a lot of the problems we have as a country - too much debt, in ability to come to any agreement to solve the problems ahead of us.

The Treasury says that our current debt of $32 trillion will grow by $80 trillion over the next 75 years. 96% of this is due to the growth in entitlement spending - Medicare and Social Security. Medicare is 2/3 of this. Yet, Congress refuses to even consider addressing the issue - both parties agreed on this in the last debt ceiling discussion - because they won’t get re-elected if they do. Fact is, someone is going to have to do something about it before 2030.

This is a chart of the US debt to GDP. It is well over 100%. You can see what has happened to it over time. We have too much debt bottom line. When there is too much debt, there are 4 ways to get out of the problem. The first is to grow out of it. Politicians have used this excuse before. Fact is, we haven’t been able to do so. If anything, as the population ages, we are seeing growth rates stair step lower, not higher.

The second way out of the problem is to restructure the debt. Not going to happen. Politicians have no desire to do so. In Illinois we have major pension problems. Even when there was an agreement to restructure under Rauner and Emmanuel, the Supreme Court shot it down. At the federal level, no one is even trying. Restructuring isn’t going to happen until we have a crisis it seems.

The third way is to default. This won’t happen. We see this every time there is a debt ceiling debate. Even the biggest DC idiots understand this is a bad idea.

That leaves the last way out of too much debt - inflate the problem away. This is much easier for politicians to handle. Even President Biden, last year, made the comment that inflation isn’t a problem as long as wages keep up.

Employees see this. They are asking for more money. I wrote about this on Linked In Friday, but we already established you don’t read it, so here it is again:

Chart of the Day - wages

Preparing to send the youngest off to college for her senior year so we were out on the town last night. The conversation turned to some headlines that came across our news feeds

The first was an article that said there are more NBA players making $30mm a yr than there are S&P 500 CEOs. We can argue about how scarce the skills are for each job but suffice to say, NBA players are well taken care of

The NBA isn't the only place athlete salaries are escalating rapidly. Look at NFL with QBs over $50mm/yr. We are also talking about baseball players potentially $500mm contracts

A-list actors have been making $15-20mm/movie for some time now & increasingly we see the actors also serving as producers so they can keep some of the upside too

Then look at the college conference re-alignment. It is all about the TV contracts so the colleges can afford more NIL for the players & bigger contracts for the name-brand coaches.

This is not to distract from the discussion of CEO pay. For years now there has been argument that CEOs are making too much relative to the average worker at their firm. While some of this can be explained away with their pay in options, all of it can't

Well, the average worker is fighting back... and winning. Just in the last week or so we have seen the United Airline pilots get 40% raise over 4 yrs, essentially 9% per year, which will amount to $10bb. Flight attendants & mechanics are next

UPS drivers just secured a 55% pay raise that will pay drivers with 4 yrs of experience as much as $49 per hour or over $100k/yr. That is going to force FedEx to have to pay up too

The Longshoremen on the West Coast just inked a 32% raise over the next 5 yrs or about 6% per yr. Suffice it to say, it is going to cost more for your e-commerce packages to get to you. It will also cost more for you to go anywhere on vacation

As we had this discussion, I referred back to one I had on the golf course in the morning. That one went more like "CPI was in line. The market rallied as people think inflation is under control now & the Fed is done"

All I could think to myself later in the day is "how is inflation under control if we are seeing pay rises across the economy that are 6-9% per annum?" So I put a chart together today

The purple line is the CPI, which is falling as goods deflation sets in. Goods prices are falling due to lack of demand in many cases, but also because of the deflation in China

However, how are these wages gains going to impact? The blue line is the employment cost index. I prefer this because it measures total cost of an employee to an employer. It is still over 6% gains per yr

Perhaps this is why the Atlanta Fed sticky 12 month inflation is also still well-elevated above 5.5%. All of this makes me beg the question of what will the Fed talk about at Jackson Hole in 2 wks. After Jackson Hole last yr, the mkts had a rough go of it

Stay Vigilant

Loved your commentary on rising labor costs. A big reason why I avoid investing in companies with large labor forces. Additionally, these things play out in cycles...prices will rise, sales will decrease, labor force will be cut, layoffs, higher margins and then stocks will rise back again....cheers

This was excellent. Thank you! Can you explain in plain English for the pay person what it means to "inflate away debt"? I've never read a really good clear explanation of that concept.