Fireworks

As Americans slowly get back to work following the 4th of July weekend, the onset of summer is finally here. The markets are ready for a summer reset too.

I finally made it back from an awesome 3 weeks of vacation. First thing I did? Head to the lake. You ever have one of those times when you needed a vacation from your vacation? What I really needed was just some time to loll around and get some rest after a whirlwind few weeks of sight-seeing.

Many family and friends were at the lake this weekend. It is always a great time for me to get a sense of where middle America is mentally, how people in different lines of work are doing, and importantly, what people think going forward. I wrote about it today on Linked In:

“After many discussions around the barbecue or the firepit about the state of the economy, I am sure my family isn't the only one that is thinking about what the next 6-12 months will bring us. If the amount of fuel consumption I saw on the lake this weekend is any indication, it doesn't appear many are worried about inflation (or climate change). However, beneath the veneer of summer fun, the conversations were all just a little more downbeat than they were last year this time, or even around Memorial Day this year.

The data corroborates the anecdotal change in tone as well. If we look not just at the headline ISM that was out last week (and weaker than expected) but instead look at the internals - the new orders vs. inventories ratio - we see a pretty bleak picture. The headline is in orange and the ratio in white. It has been presaging a slowdown all year long & still is. The slowdown is unfolding and has more to go.

Also overlaid here is the ratio of copper to gold. This is the commodity market view of the global economy, with gold as the 'store of value' and copper as the more volatile metal that ebbs & flows with the global GDP. This ratio in blue is also falling precipitously pointing to a recession as well.”

Piper Sandler tracks a real-time recession risk index, indicating the odds of trouble over the next 12 months as well as telling us where the biggest issues may be coming from. This index is synchronized so that each component is indexed 0 -100 and set up so that higher numbers (higher odds) are worse. Not surprisingly, the biggest drag on the economy is the persistently high inflation we have had for over a year. This is obvious in the CPI for energy, unit labor costs, 10 year yield and, as a result, mortgage rates. Not everything is flashing a yellow or red light, but collectively, many are.

In fact, if one looks at a time series of this data, when the index goes above 60, recessions have always occurred. Not sometimes. Always. Therefore, we should be alert to the idea that we are already in the midst of a recession or are very close to one.

I don’t think this should come as a surprise to anyone, however. A popular chart that has gone around on Twitter is one of the Google Trends index for recession. Not only is a recession likely coming, it is one that just about everyone can see on the way.

The bond market in particular senses this. It may not have appeared in the 10 year yield itself, but the short-term interest rate market can sense it. Another chart from Piper Sandler is quite telling on this front. It shows the difference in expected Fed Funds in 6 months vs. 18 months. Essentially, the bond market is still pricing in rate hikes for the rest of 2022. However, cuts are priced in starting in early 2023. The bond market can sense the Fed is going to go too far. Over the last 30 years, when we have gotten to this part of the cycle, where the market anticipates policy error, we have had a recession. This was even the case in 2019 ahead of the Covid economic debacle as few remember we were already headed for a recession before policy-makers sealed the fate.

This doesn’t mean the Fed understands this. It has hundreds of models. One can find many of them on the St. Louis Fed FRED database. One model, that it just updated on Friday, still shows very low odds that we are in a recession. However, one can also see that this model is really only good at stating the obvious, and not really predicting where we may be headed. This might give some pause that the Fed is possibly not looking at the right data and could choose to continue along its path too long. On the positive side, the Fed is responsive to markets and both the short-term rate market, and the stock market, are suggesting trouble lies ahead.

As I have shown before, the internals of the market - small caps vs. large caps, NDX vs. SPX, cyclicals vs. defensives - area all showing more pain than even the headline index itself.

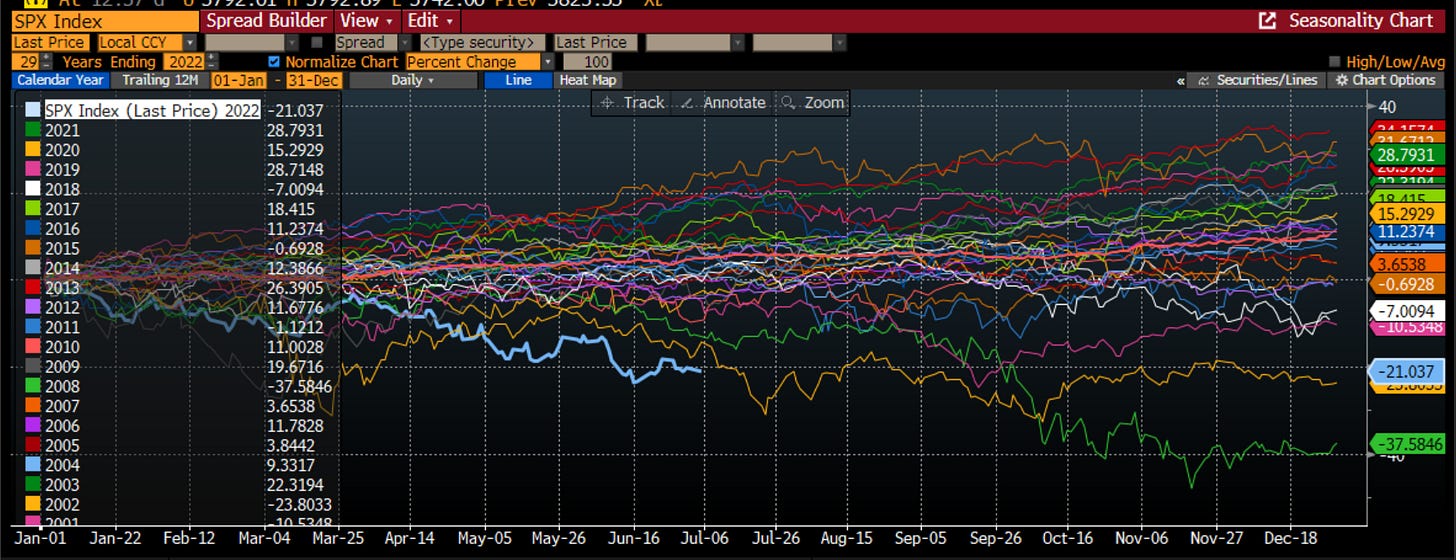

That headline index has had the worst start to the year in 30 years. Worse than 2000 and 2008. The bond market has as well. Thus, the markets are anticipating bad news. Enough? That is a good question.

Let’s go back to the new orders to inventory ratio that I mentioned above. We know that the economy leads earnings, and we also know that this ratio leads the economy. Thus, it should give us some sense of what we can expect to see in earnings data that begins in earnest in the coming few weeks. The actual earnings for the SPX are in orange. New orders to inventories is in white and the ISM itself is in blue. Even if we just consider the headline, it would suggest a 20% reduction in earnings going forward.

However, as I showed, the vast majority of people see this recession coming. These investors understand profits will be impaired by the slowdown in the economy. In this graph I look at the Citi Global earnings revision index vs. the actual S&P earnings. This graph suggests that many investors are already close to where they need to be in anticipating what may happen with earnings going forward.

Another place we can see this is in the multiples investors are willing to pay for earnings. After all, the price of a stock or an index is just the fundamental data * the multiple investors are willing to pay. For simplicity sake, we can use the P/E multiple * earnings. Of course this is too simple. Not every sector uses earnings and P/E as its metric. P/E also doesn’t include money available to all forms of capital or leverage. However, there is still some information in this. We can see from this chart that investors reduce their multiples at the same time they are revising their earnings expectations that we looked at above. Both of these have been happening for almost a year at this point.

The second thing that we can see from this, which was most obvious in 2020 but which we can also see back in late 2015/early 2016, is that multiples bottom well before actual earnings do. Investors anticipate the bad news but also the good news. So, as earnings collapse, we may start to see multiples move back higher, especially if the market senses that the Fed is about to stop. Multiples also bottomed before earnings back in the Great Financial Crisis. One thing to note on the positive side, is the market predicts bad things perhaps more often than they occur. We can see the multiple reduce without a change in earnings back in 2011 and again in 2018. These were also times when there was concern of central bank policy error.

It isn’t only the US that is at risk right now. Rates and energy prices are also weighing on the Eurozone economy. Having just returned from 2+ weeks in Europe, I can tell you that foreign visitors are doing their best to hold up the economy, but locals from Ireland to Italy to the UK all have a sense that the 75% change in petrol prices year over year, or the change in food prices, are going to weigh on the economy and not allow it to grow. We have already slowed markedly, and the models suggest the economy could have even more downside from here.

Investors sense this as well. Investor confidence in both the current situation as well as the expectations going forward are quite bleak. We are starting to get into the territory have the Covid and Great Financial Crisis negative sentiment. We should remain aware of when things might start to get too downbeat. However, for now, we are still in freefall.

One upshot of the Fed potentially backing off at some point could be a move back lower in the trade-weighted dollar. On the positive side, the move higher in the dollar is certainly going to help consumers with inflation here stateside, as their dollar buys them more goods. In fact, in Europe, I didn’t notice the inflation as much myself because the EUR was close to parity and the GBP was at decade lows too. The strong dollar doesn’t help multinational US companies with earnings, though. This is another drag on earnings this quarter and next. With the strong dollar, and recently expectations for this to continue given the relative central bank stances, investors have, on a relative basis, preferred US assets to global assets. However, if this is about to change, it may be time to look at overseas assets on a relative basis at least. As an extreme example of this, I have plotted the relative performance of EM to US and overlaid vs. the dollar. Periods of strong dollar lead to sustained underperformance of EM vs. SPY. The converse is also true. If, when, we see the dollar fall, this may be the place to look for beaten down names to go long.

Another way to look at this is to look at the growth in M2 in China vs. the growth in M2 in the US. Because of some outsized moves around the GFC, this chart gets a little distorted. However, relatively stronger growth in M2 in China vis a vis the US should be good for Chinese stocks relative to US stocks. The opposite is also true and this is largely what we have seen for over 10 years. At the far right of the graph, though, as the US is slowing credit creation and therefore M2, while China is trying to re-stimulate the economy following Covid lockdowns, we have seen China M2 move higher vs. US M2. This could bode well for FXI vs. SPY.

I had another Linked In post last week where I spoke about Galileo and his impact on the region I was visiting. This had me thinking about rotation of the Earth. Markets also see rotation, and it is usually at changes in the economic cycle, changes in relative expectations, where we see this. Some of this rotation we are seeing is based on what I am talking about above:

“Rotation can be healthy and natural i.e. the earth rotating on its axis & revolving around the sun. It can also be unproductive such as tires spinning in the snow or mud. In markets, rotation can occur for offensive or defensive reasons - to take advantage of opportunities of relative valuation or to move into a posture that can withstand an environment.

There are two charts today that show the rotation of the market. I have based them against gold because that takes out the effects of FX moves as well. We can see in the top graph some rotation out of the assets that have worked well this year & into the assets that have struggled on a weekly view. Commodities are falling into the weakening relative zone & assets like Emerging Markets - the earliest & hardest hit - moving into the improving zone. This is much of the price action we have seen lately. Perhaps some of this is offensive, as some faster moving traders want to be there for the bounce in beaten down assets.

The bottom chart shows a different picture of rotation. It is the same view but on a monthly basis. In this view, the risky assets like equities & credit are still solidly in the weakening phase. This all suggests to me that there is some short term position-squaring occurring but the core trend is still lower for risky assets & a defensive rotation ahead of recession. I wouldn't completely fade the position-squaring bounces. They can be 15% in size and get people to think it is all clear.”

Back to the US, though, it will all be about earnings in the coming few weeks. We shouldn’t expect massive policy change from the Fed over this time. We should also keep expectations fairly subdued for any fiscal policy stimulus, even though there are some rumblings of a scaled down package. Instead, we are in one of those months - January, April, July and October - where microeconomics matters more than macroeconomics, where idiosyncratic risk dominates systemic risk. Where being in the right stocks is what matters. It is still very early in this earnings season, with only 16 of the 500 names having reported. Thus, it is too early to see much of a pattern. If we do want to suggest anything so far, it is that consumers are still buying what they have to - staples - but clearly not buying or expected to buy discretionary items.

We are in the midst of the summer reset for consumers, for markets, for policy makers. Growth and growth expectations might finally be slowing enough to start to bring down inflation. This will have an effect on bond yields and those things that are affected by bond yields - everything from mortgage rates to equity multiples. This will set us up for the 4th quarter move at some point. Before we get to that, we have a few more weeks in July, where bankers will try to get some deals done before family holidays happen in August around the world. Portfolio managers will react to the earnings news and try to get their positions where they want them before trying to go on those vacations. Congress will want to get something done before the summer recess. Finally, central bankers will be re-assessing what needs to be done, before possibly announcing a change of intentions (or not) at the Jackson Hole Summit of central bankers in August. The reset can be a time of continued risk or a time of opportunity if you can correctly anticipate. It is definitely a time whene you want to be fully on top of the news and your portfolio.

It is a time to Stay Vigilant.

The recession call is proving so difficult. GDP negative 2Q in a row has always been at some later date been called a recession by NBER. Atlanta Fed is negative for Q2, but stdev this far out is like 1.5%, so a positive is not impossible. Meanwhile alternative measures like GDI were on the order to 2.4% in Q1. Meanwhile, credit is showing some, but not massive strain. Cuts are getting priced into the strip--nearly 100bps, which is saying recession is dead certain. There is not a obvious forced multiplier of a leverage accident in the banking sector, although shadow finance companies such as Rocket Mtg are seeing a bit of stress. I feel the way the VIX is trading as if market owns a lot of downside insurance. Sentiment is dire. Things can change but, is not the balance tilting towards a 15% rally in stocks, even if the recessions scenario and much deeper sell-off into 35% recession region is the ultimate destination...Meanwhile, liquidity is dire and remember it can work both ways...Oh btw, I love Piper Sandler since they got the Cornerstone guys, first rate, and nobody blames them for using historical parallels and thinking markets don't bottome without either a Fed pause (price in?) or ISM troughing (40ish)---of course in the midcycle slowdown thesis where ISM holds in above 50 and rebounds as confidence increases around peak in inflation, helped by lower commodities, might throw a spanner in the works...Finally on commodities---way too many times to count, arguments are made about commodites on supply that prove errant. For me its always about demand, which even if optimstic on avoiding a nasty recession, it will be key driver here....While I am not particularly bearish spoooz, I can definitely buy into $60 oil...

Richard, Data trek recently pointed out that copper might not be the best indicator towards a weakening global economy and it works on its own fundamental reasons more so and even its track record towards predicting a global recession is not stellar. Still a strong base case can be made for recession next year.