Gong Xi Fa Cai

This weekend we begin the Year of the Water Rabbit. What does that possibly have to do with the stock market? If not, what else really matters?

For those who celebrate, Happy Lunar New Year! This celebration brings back fond memories for me from many periods of my life. My parents would take us to Chinatown in Chicago every year for the Lunar New Year parade and it has stayed a tradition for us to this day. It also reminds me of the 6+ years I spent living in Singapore which were some of the most enjoyable of my life. A short time in Hong Kong (pre handover) showed me some of the subtle yet important differences between the Mandarin and Cantonese cultures, not the least of which is the New Year prosperity greeting: Kung Hei Fat Choy

Given the interest in the Chinese zodiac and Feng Shui in these cultures, and increasingly in many of our own, I thought I would start by taking a look at what the Year of the Water Rabbit means.

Per German media company dw.com:

“If you were born in 1915, 1927, 1939, 1951, 1963, 1975, 1987, 1999, 2011 or 2023, you're a rabbit.

Notable rabbits of pop culture include American founder and CEO of Amazon Jeff Bezos, Argentinian footballer Lionel Messi, Chinese martial arts actor Jet Li, Colombian author and winner of the Nobel literature prize Gabriel Garcia Marquez, French singer Edith Piaf as well as German-born physicist Albert Einstein and the recently deceased Pope Benedict.

Each animal year is further associated with one of five elements — wood, fire, earth, metal, or water. So more precisely, 2023 is the year of the water rabbit.

Considered the luckiest animal in the Chinese zodiac, they are seen as trickster animals in some Native American cultures, while in Aztec mythology, they are associated with drunkenness and promiscuity.

However, most cultures seem agreed on one thing: the rabbit is overwhelmingly seen as a symbol of prosperity, abundance and fertility — the latter for the animal's renowned reproductive prowess.”

It looks like Lionel Messi front-loaded his good fortune into the previous year, but I am sure Jeff Bezos will enjoy seeing the calendar turn given Amazon was down 50% last year which follows losing $25-30 bb in his divorce in 2019. You see, happiness may be relative and not absolute.

Another view of the Year of the Water Rabbit, this time per ChineseZodiac.org:

Approach challenges and opportunities calmly and rationally, and be more in touch with our emotions and sensitive to those around us. It is hard to argue against this advice regardless of the year. However, perhaps two other famous rabbits - Volodymyr Zelensky and King Charles III - need to particularly pay attention to this advice given the varied challenges they and their countries are facing now.

From a market perspective, I wanted to see how the Hang Seng has performed in previous Years of the Rabbit as the years above seemed a bit ominous - 1987 and 1999 in particular. Below you can see the 2011 year was a slow bleed lower all year with a slight recovery at the end. 1999 was quite the opposite, with a strong year from start to finish. 1987 touches on both of these with a strong start followed by the crash to the lower line. Obviously, no pattern here.

Lest you think that is only the Hang Seng, the outcomes in the US are not a lot better. If history is a guide, should we expect more volatility?

Trying to be a little more serious, these analogs clearly do not have enough data to support them and are predicated on superstition, not a part of my investment process. However, Chinese New Year is a major event not only in China but throughout Asia. Could this be the first year in several where there is some sense of post-Covid normalcy returning? Images of the Shanghai train station from this weekend certainly seem to suggest that people are: 1. allowed to travel 2. thus traveling 3. don’t seem particularly worried about Covid given the crowds with few masks. Perhaps there is something to the China re-opening trade that is a hot topic of conversation.

If this is the case, it is not yet showing up in the ‘official’ data. The primary index I look at is the Li Keqiang Index which measures bank lending, rail freight and electricity consumption. I have also included the price of hot-rolled steel which I have historically found is also a useful guide. Whether it continues or not will be a function of the importance of real estate in China’s future.

Another great measure to consider is, of course, copper, given its uses throughout the economy. Copper has been very strong of late and is not showing any signs of the global recession that many are calling for. If anything, it is looking on the overbought side and prone to a small pullback. Dr. Copper is thought to have a PhD in Economics and so we should not ignore this price action or the implications.

Another commodity that would be meaningfully affected is oil. The thing about oil is that it is a global commodity. As we are seeing, the supply we thought was coming offline from Russia is still making its way to the market, simply getting ‘laundered’ through many outlets - Saudi Arabia, Malaysia and China to name a few.

Oil came down in the back half of 2022 with a combination of concerns of global recession but also a release from the SPR by the Biden Administration. The Administration will have to re-fill the SPR at some point even if it refuses to now. However, even if it doesn’t, you can see the net of international supply and demand has bounced from the -2mm (2%) level and is moving higher. Historically, I have found that changes in this supply/demand, especially more than 2%, do matter for price.

Looking at demand (white) and supply (blue) separately, we can see that demand outstripped supply from the middle of 2020 until early 2022 which had a lot more to do with higher oil prices than the spike from Russia/Ukraine. That balance shifted in the last 6 months but could potentially be set to change again as demand has moved back to pre-Covid levels and is rising.

Nancy Lazar at PiperSandler has some good high frequency data from China and we can see both city traffic but also property transactions are moving higher, another good sign for China.

It may be hard to see on this decade long chart, but the stock market notices this. The relative price of FXI (China ETF) vs. the SPY is quite interesting. The outperformance of China since the end of October (since the National Party Congress) has been 50%. That is hard to ignore. Capital is clearly flowing in that direction. However, even though it has been large in a short period of time, we can see the massive underperformance for the past decade.

It isn’t just China either. As we can see, as China’s economy goes, so goes Asia which has a big influence on the EEM ETF. It has gone up by 20% over the last 3 months but also has massively lagged for a decade. While we have moved above shorter-term moving averages, it is a bit early to call for a major trend change but it is worth noting.

MSCI World ex-US, also called the EFA ETF, is seeing very similar performance, up 20% relative the last 3 months, but in a massive hole for the last decade. How will long term asset allocations consider this, as we think about the headwinds in the US in the coming year?

As I mentioned last week, for the US itself, it will all come down to earnings. There was some good news (e.g. big tech) late in the week, but there were many other reports that left investors lacking - Goldman, Delta, Tesla, Disney, Alcoa, Discover and Vornado to name a few. From a cross-section of some very big names with a very deep look at the US, the news was clearly downbeat. Don’t get me wrong, many companies still beat the expectations given the game that management and Wall Street analysts play, but the magnitude of the beat is still fairly weak.

If we look at the absolute growth numbers, thought, and not those relative to expectations, we can see that nominal revenues are still growing, but inflation is eating into margins and we are seeing a negative affect on earnings growth across a number of sectors.

Back to the previous comment about Europe and Asia outperforming, how are they doing on earnings? It is still early for earnings in Europe and Asia (only 8 of 442 Stoxx600 names have reported) so I will have more on that in the coming weeks.

A big part of understanding the market is watching the reaction to news and not just the news itself. I will also continue to do this on the earnings front, but this week was perhaps a sea change on the reaction to economic news. I wrote about this on LinkedIn:

“Chart of the Day - bad news. I was speaking with a friend yesterday who asked me why the market as down so much. I said, "It's because we got some bad news on the economy." He said, "I thought the bad news was good because it puts the Fed on pause." I shook my head and told him he was so 2022.

I am being facetious but this is honestly a question that gets asked on a lot of buy and sell side trading desks throughout the year: is good news good news or is good news bad news and vice versa.

It is not always easy to answer but when you get a clear signal from the mkt via price, you should take notice. Price is the intersection of supply and demand and so when one of those overwhelms the other based on news, it is important.

This is why I encourage, if not plead, with my students who are covering names in our various student portfolios that they need to stay on top of those names every day. We can learn a lot from the reaction to news.

Yesterday we got bad news on retail sales, industrial production, Empire services (after a brutal mfg the day before) & indus prod/capacity utilization. One might argue the PPI was good news.

Yesterday struck me as the day we went from 'bad news is good because it means the Fed will pause, that the bond mkt is right and JayPo is wrong." to "bad news means a bad economy which means bad earnings."

Companies corroborated the story by reporting bad earnings. We have now seen bad news from the likes of Goldman, Disney, Tesla, & Delta. Last night we got more from Alcoa, Vornado & Discover. These are bell-weather names that all had a very downbeat view on the economy.

After all, the economy drives earnings and earnings drive stocks. Particularly when we are in a higher for longer rate environment. In my Substack I talked about the big difference between bulls and bears right now is $170 vs. $230 in S&P earnings for the year.

If we say the Fed is paused and 17.5x P/E is correct, then if you believe the 230 number you can justify 4000 S&P. If you believe in the 170 number instead, you think the S&P should be 3000.

Investing as well as trading is about having a margin of safety, about a good reward to risk ratio. Your entry level should be a function of your perceived downside risk vs. your target price.

Yesterday, the feeling that 230 for the year (roughly flat) might be a bit optimistic started to crystallize in investors minds. A buyers strike ensued. Stocks are all going to hinge on the view of earnings for the year and much less on Fed policy.

The chart today is the SPX vs. the Economic Surprise Index. You see early last year bad news was bad news. Then the bad news became good news as the hope of a Fed pivot came into play. JayPo then got all hawkish at Jackson Hole and good news was bad news. We are back to bad news being bad news.

Whatever your view of the Fed it is probably not the marginal driver from here. It is all about the economy and earnings.

Stay Vigilant

#markets #stocks #economy #earnings "

As I mention in the piece, I feel the bull vs bear debate on the US stock market is coming down to where one feels 2023 earnings will come in. One of the bigger earnings bears I speak to is Nancy at Piper. She has some interesting and compelling charts that point to a fair bit of downside in S&P 500 earnings. Her first looks at the US $, 10-year yields, global short rates, and Brent Oil. This is pointing to a fair bit of downside in the coming quarter.

Another model she uses simply looks at CEO Confidence. There is an intuition to this, of course. CEOs aren’t going to be confident if they know there are headwinds to forthcoming earnings. This measure is also pointing to downside in earnings.

Earnings in my estimation are all that matters for the stock market. We can debate if the Fed goes 25-25 and stops or 50-25 or 25 and 0 etc. We can debate if the Fed will cut later this year or not. For now, though, the interest rate and therefore multiple effect on the stock market is muted. The driving force will be the economy and earnings. This is very different than last year, as I wrote about on LinkedIn this week:

“Chart of the Day - what is driving the market? I want to build on my post from yesterday where I suggested the Fed may be out of play for now and what matters is the economy in general and earnings in particular.

The Fed matters. As I showed in the comments yesterday, every recession has been preceded by a Fed hiking cycle. Perhaps this hiking cycle will not lead to recession. It has happened. 3 times out of 14. Not impossible. Possibly unlikely though.

Last year, the Fed was ALL that mattered. The market moved on expectations and reality of Fed action. It moved higher on expected Fed pivots. It moved lower on actual Fed hawkishness. Peak Fed was one of the Twin Peaks I have discussed.

You can see this play out in the chart today. The purple line is the 10-year yield, which is just an accumulation of expected Fed policy for the next 10 years. As these rates moved higher (inverse here so lower), the market multiple, the forward P/E in orange moved lower.

The blue line is the actual SPX moves. These moves in blue were entirely driven by the changes in forward multiples. A multiple is a measure of investor sentiment. Tighter expected policy dampened sentiment and drove stocks lower. Easier expected policy was the opposite.

You see earnings in white. These actually were still moving higher as the market moved lower. How can that be? Earnings are a lagging. Remember HOPE - housing, orders, profits and employment.

Now, however, with Fed expected to slow, pause, stop or reverse, it is not the major theme. The major theme now, as we saw the last 2 days, is the economy. The economy drives earnings and earnings drive stocks over the long haul.

You see the white line which is actual quarterly earnings finally succumbing. The news this quarter has been far more downbeat than previous quarters. Earnings are expected to fall, certainly by the bears. Bulls think they can hold up.

In a higher for long rate scenario - a flat line - there probably wont be a big move in the multiple. Simplistically, P = P/E * E. If P/E is flat and E is falling where does P go? If you expect a higher P, you must be expected a higher E.

We get a few more weeks of earnings. The early results aren't great. We need to keep watching and listening.

We need to ... Stay Vigilant

#markets #stocks #economy #earnings ”

In fact, we can visualize this by looking at both the 2020 rally and then the 2022 sell-off. The market preceded the earnings move. It was all driven by expectations and multiples. Many will say, that multiples and sentiment always lead earnings. That may be true at inflection points. Once the trend is in place, the changing earnings forecasts should matter more. We can see from these forecasts in blue, there has hardly been a budge so far.

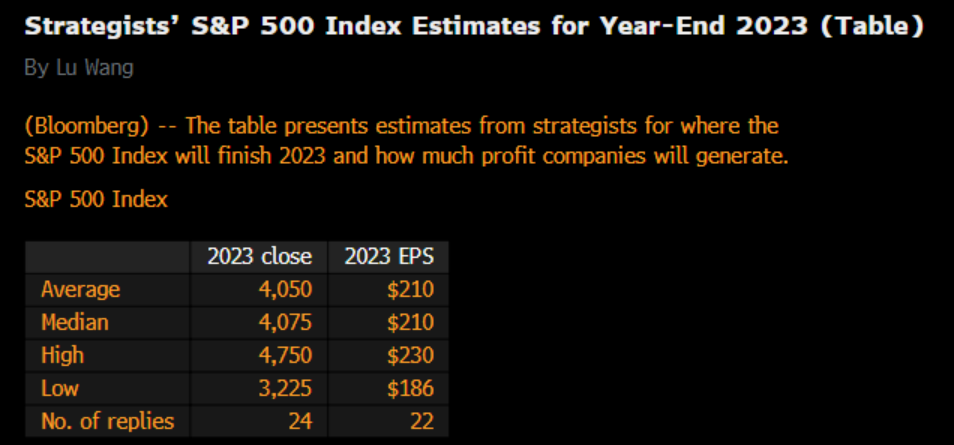

What do the Wall Street Strategists think? The average for this coming year is $210 (which is lower than the Bloomberg Best Estimate of 223 above) and that ranges from 186-230. This leads to a range of forecasts from a low of 3225 to a high of 4750 with a median of 4075 which isn’t too far.

Francois Trahan, a noted strategist himself, asked on LinkedIn about all of the perceived bearishness in the stock market with analysts so ‘bullish’. He put a poll on LI and the results so afar show that the respondees are slightly more bullish than bearish but not wildly so. I asked this same question in my classes this week, to students who are pursuing a career in investment management, and those who don’t even study finance and have no idea. Interestingly, my results echoed almost exactly those that Francois got, with a slightly bullish lean, very few tail outcomes good or bad.

Which brings us to that critical level we discussed last week. We are right back there even though we had a couple of down days this week. I personally feel the strong day on Friday had much more to do with the 4000 strike and options expiration, but either way, we are right back to that inflection point that could dictate a move to 4200 if the trend line is broken or a return back toward 3600 if not.

It is all about earnings in my mind. The next two weeks should be the biggest for earnings and we will get much more clarity on the debate.

Until then, I wish you prosperity and good health and urge you to …

Stay Vigilant

P.S. Thank you to everyone who commented on the logo. There were a few votes for old Mad-Eye Moody but the new logo won out. I will try to let Mad-Eye make a cameo appearance once in a while just for those that like him.

https://people.duke.edu/~charvey/Research/Thesis/Thesis.pdf

"There is a certain relief in change, even though it be from bad to worse; as I have found traveling in a stage coach, that it is often a comfort to shift one's position and be bruised in a new place." Washington Irving 1824.

My problem is that I don't see a lot of downside for earnings. Moreover, if ISM does bottom out and the Fed hits the pause button then multiples ought to head higher. Maybe earnings is less important. Last year, strategists nailed it--consensus earnings call in Dec 2021 was more or less spot on with the outcome. They were wrong because they did not see the multiple collapse. Let's not make the same mistake twice. Focus on the multiple. Yet, as mentioned, even if its about earnings, I think the forward looking models shown might give us a faulty signal. Of course, we are all going to be watching the SPX this week. It does seem as if that downward sloping trend line might not contain the market and next week we can discuss how it broke out to the upside. Honestly, I cannot believe I am bullish like this, it seems very uncharacteristic of me...Note---I did note that for a nanosecond, bad news was bad news as I am sure there were a flood of messages hitting inboxes with that one, but that seemed to dissappear into the OPEX, which seems to drive so much of short term moves that really make it hard to make any sweeping conclusions about a given days reaction to data.