As we approach the 4th day of the seventh month of this year, I wanted to share the 11 charts that I think are the most important right now. For those in the US, I hope you have a Happy 4th and enjoy the extended time off. For those outside the US, understand that next week’s markets are going to be pretty quiet and pretty illiquid with many people on vacation for a good part of the week. For everyone …

Stay Vigilant

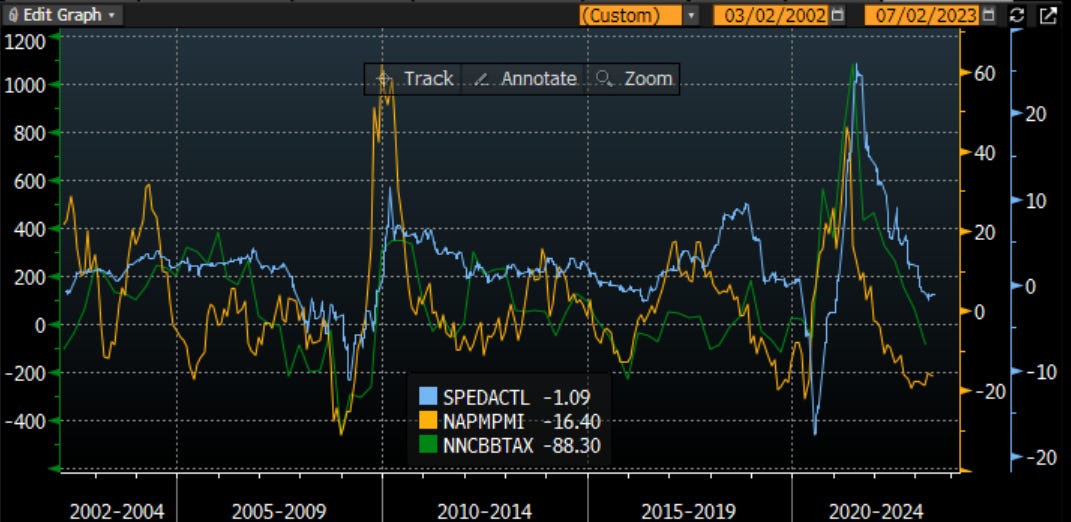

ISM and markets:

On Monday we will get the next release of the ISM. This is the best measure of US growth expectations because it is coincident with the stock market and both lead the real economy. If we look at the yoy change in ISM vs. SPX vs. Barclays Global Aggregate, we can see that asset markets are anticipating an improvement in ISM. Will we get that this week? We can see that markets are not typically ‘forward-looking’ in regards to ISM, while both are ‘forward-looking’ in regards to measures such as GDP

Jobs:

I wrote this in my LinkedIn this week: “The debate for what seems like an eternity has been around a hard landing vs. a soft landing vs. no landing. I am not even sure most can or even try to define the differences between them. A Forbes article had this to say:

“The term “soft landing” was first coined by Professor Herman I. Liebling in 1973. Liebling worked at Lafayette College and was a top forecaster at the U.S. Treasury when he predicted a soft landing in the mid-1970s, which turned out to be horribly wrong. The recession of 1973-1975 saw unemployment peak at a whopping 9% and there was a 3.2% decline in GDP.”

The key on the hard vs. soft landing debate hinges on the jobs mkt & whether the FOMC can maintain full employment while bringing down prices. The strong labor mkt has given the FOMC more leeway to continue to maintain its hawkishness. However, that may be changing as data we have see of late could suggest

The chart today shows 3 measures of the job mkt. The orange line is the NFIB small business employment changes. I have inverted it to match the other two series. The white line is my preferred measure - weekly jobless claims. Timely, not revised, hard numbers

The blue line is the unemployment rate we get when non-farm payrolls comes out. This is the number that is most often talked about. It is where the focus constantly is. It is also the laggiest and noisiest of them all

We can see from this chart over 30 yrs that jobs begin to weaken right before the recession starts. The small biz number weakens first. Jobless claims is next and unemployment rate is the last to tick higher. Once the unemployment starts to move higher, it typically trends for some time

Small biz have been struggling for some time. Covid hurt them much more & the recent bank crisis leading to a tightening of standards will also impact small biz more. Many have shrugged off the weakness in small biz though

It is harder to ignore jobless claims. The trigger point for this number was a move above 250k per week. This happened earlier this month & every wk the number has come in above this threshold

The last shoe to drop will be non-farm payrolls. This number comes out next wk with most of the market on holiday. It has been better than expected for 14 straight months (hat tip FG). Will it continue to impress? If not, will we finally start thinking hard landing? Or will the mkt rally because the Fed pivot will be back?

In the past week, I have talked to three students. One recent grad can't find a job, one had her offer rescinded & a third, who had been on the job less than a yr, was made redundant. Let's face it, these are among the cheaper employees in spite of talents & yet they are struggling for work

Perhaps labor weakness will be contained to fincl services & tech where we have seen the negative headlines. If so & you are doing well & need some talented students, reach out. I know where to find them”

FOMC and the economy:

We spoke about this on the Macro Matters podcast and on Substack last week. Jay Powell and the FOMC are still hawkish. This is in spite of their own data telling them there will be a recession. What does that tell you about the commitment to squelching inflation, which Jay said this week will not get to target in 2023 or 2024. We NEED to get use to higher for longer.

Fed Funds and multiples:

If we are higher for longer, what does that mean for multiples? The market multiple has moved with expectations regarding Peak Fed. When the market thought the Fed was finished, the multiple expanded (lower earnings yield here). In February, JayPo was hawkish and the multiple contracted. The multiple has recently expanded again. Does this make sense in light of JayPo’s hawkishness?

Earnings and markets:

That’s okay because earnings will drive the markets I hear. The expectation is that we have seen the worst of the earnings slowdown and it will improve from here. The economy leads earnings and earnings drive stocks. Whether we look at full economy earnings in green or SPX earnings in blue, both have been slowing but have more to go if the ISM is any guide. Once again, it will be a big day seeing what the ISM does tomorrow. If it improves, the bulls will be on attack.

Jobs and asset allocation

I know all eyes will be on non-farm payrolls this week. I am watching jobless claims. While they improved this week, the 4 week trend has not been good. We can see that jobless claims trends lead the relative performance of bonds (Treasuries) vs. stocks (SPX). This could come from bonds doing well in a flat stock market, or it could come from stocks selling off. Unlikely to see both go up and bonds go up more. I still think this is an indicator and a trend to watch.

The government and the economy

Folks in D.C. are unwilling to take ownership that they are responsible for the inflation we have seen. The last time we saw the monetary and fiscal stimulus that we saw in 2020-2021 was WWII. We saw persistent inflation then that lasted a decade. One might think with the Fed trying to slow things down, inflation will follow suit. However, what we are seeing now is more of an LBJ guns and butter type of fiscal stimulus given the bills passed by Biden. This is making JayPo’s job a lot harder and another reason he is staying higher for longer, because he needs to offset the fiscal spending we still see. It is pretty amazing - growth is still positive and inflation persistently high yet D.C. still sees a need to spend but then blames inflation on companies.

Options and the SPX

All eyes were focused on 4320 in SPX because that was where the JP Morgan Hedged Equity strike expired on Friday. It ended up largely being a non-event though dealers needed to buy futures to take off their hedge and this drove stocks higher. I am focused on different options. For me, the best technical indicator is the 10 day moving average of the put-call ratio. I invert it here and we can see that changes in and trends of this indicator lead SPX returns. It is pointing lower right now.

Daily Ichimoku chart

The stock market has been technically quite strong all year long. However, it had gotten quite overbought and now the MACD has rolled over. Traders have ignored this sign and the market continues higher. This makes a case for a strong bull market, as bull markets can stay overbought for quite some time. Is the AI theme driving a handful of stocks enough? We shall see. July will be a big month for earnings. This should bring into focus the level of stocks.

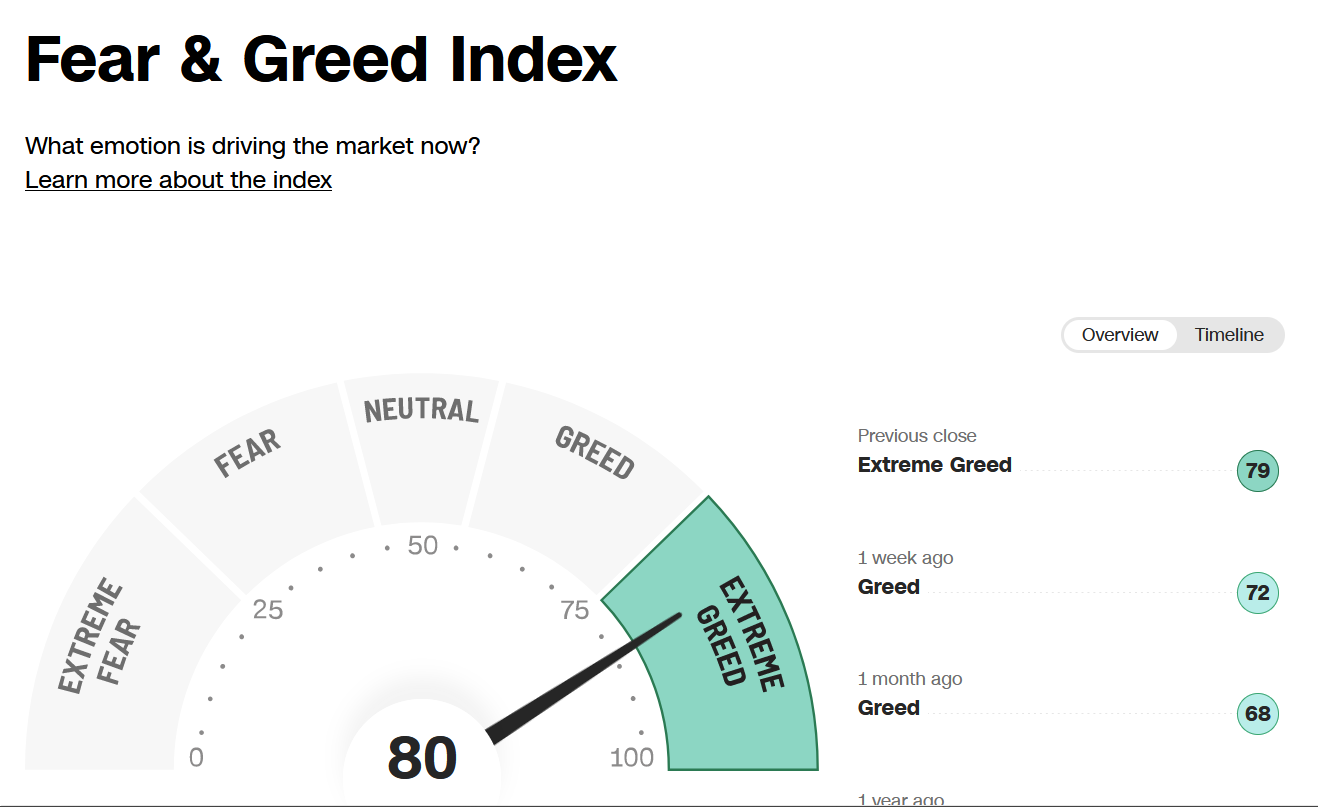

Sentiment

The market has been in greed or extreme greed for a month now. We see that in a number of charts. This doesn’t mean the market has to sell-off. It does mean there is not a big margin of safety for risk-takers. I like the CNN Fear and Greed Index because it aggregates a number of different market sentiment measures. Buyers beward.

Margin of safety

I want to leave you with one last thought. Cash is earning over 5%. The earnings yield of stocks is less than 5%. Thus, the risk premium is negative. This happened in the late 90s. It can persist for quite some time as we saw in the 90s. However, it tells you there is no margin of safety in stocks. Earnings may carry the stock market, and need to because valuations will not be able to continue to drive the market. July is big for earnings. This week is big for economic data that will drive earnings too.

Stay Vigilant!

Thanks for all the great insight. You prepared a 4th of July meal with something for everyone. Enjoy your family on this great holiday.