It has been an interesting weekend for sure. Starting with weather that was negative on Friday morning and touched 40 degrees by Saturday afternoon. While we are somewhat used to wild weather swings in Chicago, perhaps I have been impacted by the lack of volatility in markets and so when I see volatility elsewhere, I always find it a bit surprising.

Then, I had a text on Sunday morning with a long-time reader (hat tip PC) who is at a banking conference and said KBW’s CEO Tom Michaud in the keynote, laid out the idea that the US economy is not only not having a hard landing, but it won’t even have a soft landing and will have no landing. Michaud is not alone in thinking the US will not have any sort of landing. In fact, if we look at the BAML Global Fund Manager Survey from last week, these odds are rising quickly and may soon become consensus.

For a year now, about 80% of the voters in this survey have seen soft landing or no landing. We are getting to the point where there are basically no voters left that think there will be a recession when we see only 5% of people thinking there will be one. These odds are as low as the ‘no landing’ odds back at the start of 2023, when many voters thought there would be a recession and very few thought it could be avoided, as it ultimately was.

We may look back and realize it was the fiscal spending that we saw not only in 2020, but consistently throughout the last 4 years. We see the fiscal deficit has run above the long-term averages even though there was no recession. In 2020, the magnitude of fiscal and monetary stimulus aimed at offsetting Covid was something we had not seen since WWII. That is understandable. However, the persistence of fiscal stimulus and now the return of monetary stimulus could present problems. This is especially true if we see no landing. Will the FOMC really look to normalize rates if the economy doesn’t land? Will inflation become much more persistent, as it was for a decade after similar stimulus in the post WWII period?

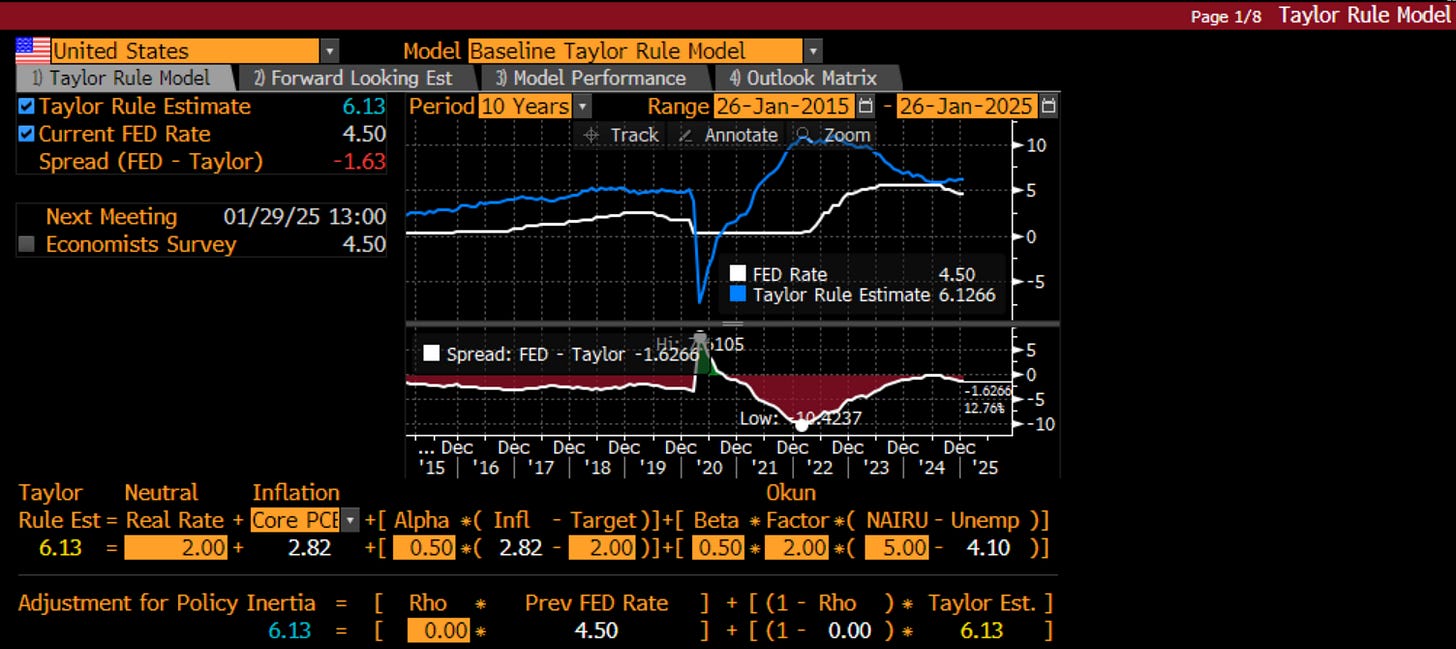

Using the Taylor Rule function on Bloomberg, one can see the estimate is for rates to be higher and not lower. While there is debate around the efficacy of the Taylor Rule, it is still debated in monetary policy circles which is why you still hear discussions about r*. We also hear discussion around PCE and NAIRU as well so while it is not the algorithmic choice for officials it does matter. If the FOMC decides to not cut at all, can we see this stock market rally broaden out or will it remain a rally driven by a handful of names? Does that essentially reduce the odds of no landing then as small businesses do not invest in people and capex? Investors are getting fired up about growth, should they?

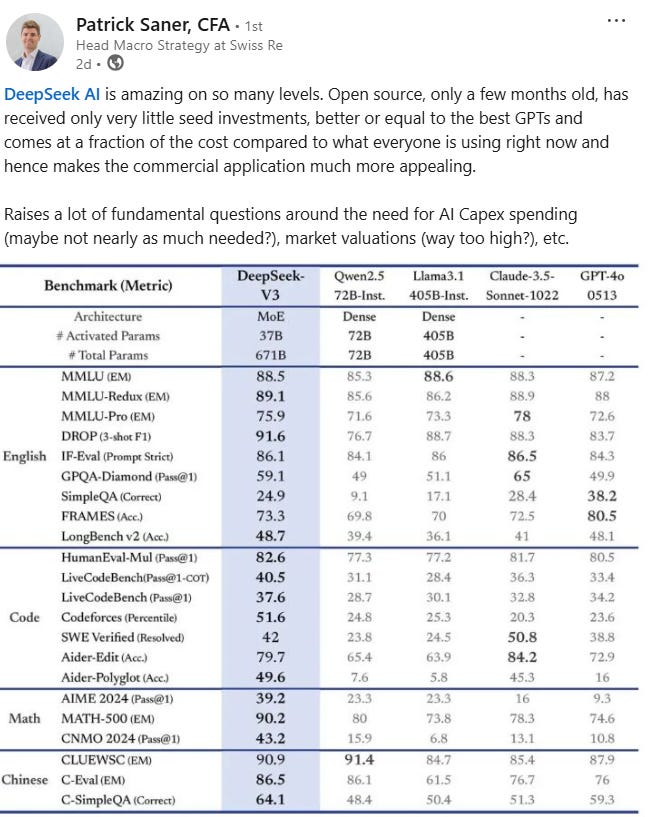

Speaking of a rally led by a handful of names, I saw other discussions over the weekend, this time about Deepseek. It first came to my attention by Patrick Saner, someone who is a great follow on both X and LinkedIn. Patrick is in a very senior risk-taking position at one of the biggest reinsurance companies in the world. He has to, and does, have to have an opinion and every major trend impacting economies and markets. Thus, when he posts things, I listen.

By the weekend, everyone on X was talking about how amazing Deepseek is and what that meant for competition for ChatGPT, powered by NVDA. This post by Poonam Soni pretty much summarizes the views of people on X, at least on my timeline:

Does it matter? Sure it matters for ChatGPT, but does it matter for NVDA or other Mag 7? Chris Bloomstran remined people on X how much of the earnings driving the markets really just come from a few companies. These few companies are all deeply imbedded with the ChatGPT revolution. Mag 7 was over 100% of net income growth the last three years. You know those people, like me, that said the low ISM would mean no earnings? Well, this was true for almost every company in the market, with the exception of the biggest 7 in the market, thus the headline indexes did very well.

Many people will DM me and say this is the tech bubble. I have seen many versions of this chart but it shows the recent run of the NDX vs. the tech bubble version of the NDX. Could 2025 be the year we peak? The tech bubble burst because we overbuilt fiber capacity and when sales slowed only some, the estimates came down everywhere. One could argue we have overbuilt GPU and datacenter capacity. All we need is for one of these names to miss by a little on earnings.

My counter argument, and I bring it up as a Devil’s Advocate, is what if we are only in 1998 and not in 2000? I can take that same chart using the same dates above and re-scale it and get a very different view:

On this basis, we are only at 1998 levels of expansion and could have two more years of bullishness. Heck, drawing the parallel further, the late 90s had the Asian Financial Crisis leading to the Russian and then Brazil financial crisis. Because the world was struggling but the US was able to have only a soft landing, investor dollars came from all over the world to the US. Are we seeing something similar now, with struggles in China, Middle East, Russia and Europe?

The biggest question for markets may then be: investors are still fired up about US AI leadership and earnings growth, should they?

The final question that came up this weekend came when I was reading the Substack of Dr. Pippa Malmgrem, another great follow and must read when it comes to geopolitics. I have talked to her and followed her since when she was at RBC and I was in the industry. Well, the first part of her writing was interesting because it gave an opinion on the $TRUMP coin, which I discussed last week, but came at it from a completely different perspective. Dr. Pippa writes:

Izabella Kaminska, who always writes unmissable missives on her Blind Spot, has done a huge amount of work on the history of this kind of currency event. She suggests that $TRUMP may be very like the coin issued by Gaius Octavius after he defeated Cleopatra and Mark Anthony at The Battle of Actium. That victory transformed him from being the mere nephew of Julius Caesar into being Augustus, the first Roman Emperor. The Battle of Actium Coin commemorated the simultaneous victory over the foreign threat (Cleopatra) and the domestic threat (Mark Anthony), and, as such, it served as a critical piece of propaganda. It marked the end of internal and foreign wars and positioned Augustus as the savior of Rome and founder of a new era - the Pax Romana (Roman Peace). The message went wherever the coin went. This currency, like all currencies, includes elements of seignorage. This might require another essay, but, in short, Trump knows a lot about branding. He is slapping the Trump name on the USD just like he slapped it on buildings. People may dislike the brand. It’s loud. It’s big. It’s gold. But, it seems to always work for him. As he shifts the USD into $TRUMP and Bitcoin, he is also constraining The Federal Reserve, forcing them to stop inflating away the currency in their effort to remain popular. He is also building a war chest that allows him to circumvent Congress. If they don’t fund his ideas, he now has a way to fund these ideas himself. He financed his own transition team much to the horror of the opposition because they could not track what they were up to.

This was interesting, but this wasn’t the question that threw me for a loop and took me down a You Tube rabbit hole. It was in a later paragraph that I was blown away:

Notice also that a few days ago, The Speaker of the House fired the Chair of the House Intelligence Committee, Congressman Mike Turner, without warning and without announcing a successor. This is highly unusual. Then, only two days ago (the timing of all this has been carefully managed), several senior members from the highest echelons of the US Special Forces Community (STS-24 the Air Force’s Special Ops Tactical Unit that supports the acclaimed Delta Force) issued an interview. Most missed it because it was on the high weirdness subject of UAPs. But, for those who understand that Trump and his team seem committed to revealing many classified secrets around this issue, the interview marked an important sea change. It was not just a whistleblower interview. Instead, it constituted something more like a community threat from the most lethal operators in the US military to the powers that be. The message was clear. These Special Ops teams are no longer ok with the immense secrecy around an issue that is putting them in harm’s way. They are not cool with the ongoing efforts to shill for more wars. Jake Barber’s revelations included the physical damage he and his team incurred from being exposed to something that is so super-secret and strange (a weird egg) that even his team did not know what they were dealing with. Several colleagues backed his story, including Fred Baker, a “legend” in the Air Force combat controller community who has Four Bronze Stars. I agree with Matt Pine’s assessment that these Tier One Operators are now opposing the legacy UAP programs and opposing the secrecy, the danger, the illegality, and the opaqueness. These people have incurred death threats, and some have been murdered in an attempt to silence them. The politicians and military people who have been trying to shut them up are learning a hard rule. If you train a highly lethal force of the world’s most competent and patriotic trained killers, it’s not smart to threaten or kill them.

WHAT?!?!?! Ex-special forces operators are coming out and saying ‘we are not alone’ and there is ‘non human intelligence’ and UFOs? The more I watched these videos, the more I felt like I was either being spoofed or punked, or that this was the biggest news I had come across in a long, long time. My experience in meeting or working with ex-special forces people is that they are not inclined to joke around. If they are coming out and risking their reputation, it is because they believe this. Also, it is not the only report of this nature that I have come across lately. Before the end of the year, on the Shawn Ryan Show, another great listen, Sam Shoemate talked about the manifesto of the ex-green beret who presumably blew up in the cyber truck in front of Trump Tower. This is also worth a listen.

So, as the weekend ends, I am left with three completely different questions, where I think the response from people can either be: “You are crazy” or “I can see that”. All I am left to do is to ask all of you: of all of these stories, which is most likely to be true?

Stay Vigilant