How bad is it going to be?

I listened to a podcast with Dr. Doom who is forecasting permanent stagflation, a deep recession and another financial crisis. Is it really going to be that bad?

TLDR: Nouriel Roubini, who is credited with predicting the Great Financial Crisis, is back at it again, predicting the worst of the 70s with the worst of the GFC. While I agree we will see a recession, I just don’t see a financial crisis worse than, or even on a par with, the GFC.

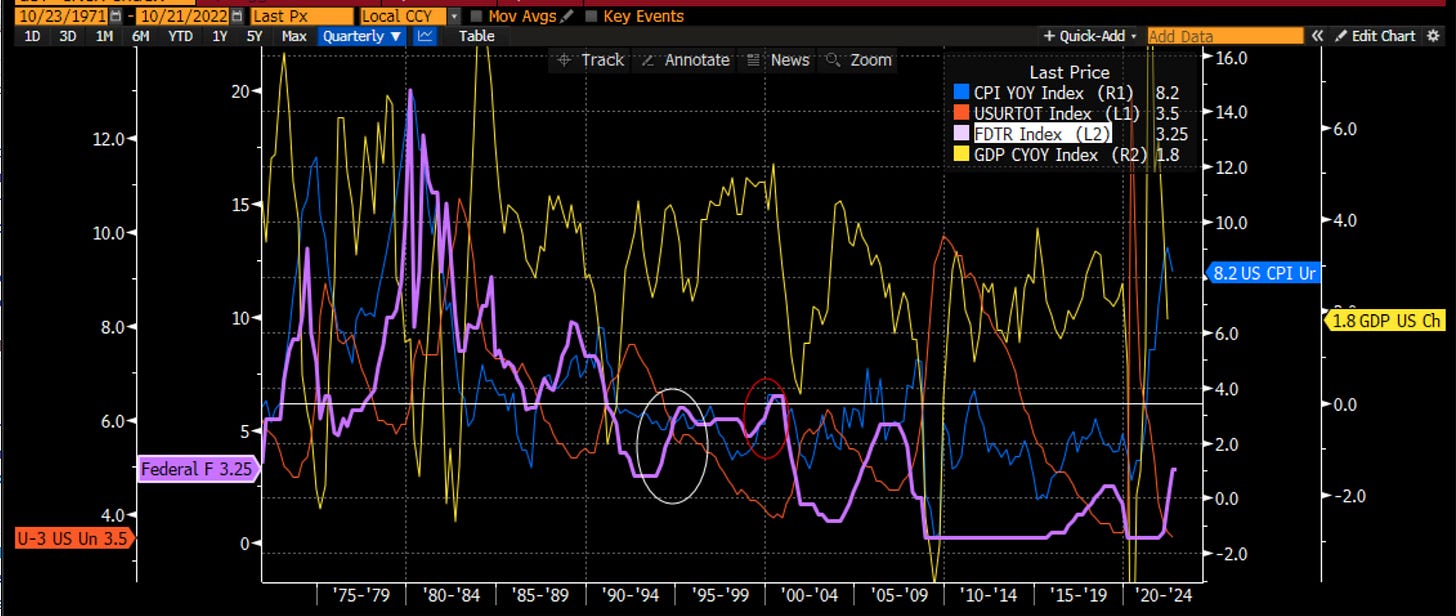

A debate in the market has been whether the Fed can engineer a soft-landing of the economy. A soft-landing in the business cycle would be characterized by GDP growth slowing but not going negative, while the Fed was normalizing short-term interest rates. These are rare with the only instance in the last 50 years in the mid to late 90s. This is circled in white and red where the Fed hiked in 94 and then paused. It actually moved back lower in the late 90s when we had the Asian and then LTCM financial crises. It hiked again in late 90s/early 00s. You can see above in this period, growth slowed meaningfully but never went negative.

There are two other characteristics of this time that stand out. First is that the unemployment rate was very low around 4%. We are similar to that now, if not lower. This is the argument for why a soft-landing can occur. The other thing that stands out to me is that inflation is also low, near the 2% level. This is very different to now. Over that entire period from 94 to 00, the Fed hiked from 3 to 6.5% or a total of 3.5% over 6 years. This year alone the Fed has already hiked 300 bps with expectations it will hike another 200 bps by early next year. This is why some, myself included, suggest the Fed is unlikely to engineer a soft-landing.

Even though I see a recession in early 2023, I still do not expect a financial crisis. In my LinkedIn posts of late I have highlighted how I consistently see anecdotal evidence that no recession is imminent. I took the picture above in Saugatuck, MI, where I spent the weekend with my wife and another couple. Everywhere we went, shops, vineyards, restaurants, boat rides, it was packed. The crowds were a cross-section of Millennials with young kids, Gen Xers like us, and retired Baby Boomers. All were out and about and spending money. People have jobs and they are spending like they have jobs. I made the comment several times: I am not seeing signs of a recession now.

However, I still hold that we will see one. The effects of monetary policy are lagged. The changes in policy this year are extreme. It will have an impact. However, the strength of the starting point of the economy, and the persistent strength of jobs, suggest to me that this will be a relative shallow recession.

Nouriel Roubini disagrees. Vehemently.

On the way up to Saugatuck I listened to the “Odd Lots” podcast put out by Bloomberg. You can hear it here. You can read a summary of the book in question in the NY Post here.

Dr. Doom, as he was called when he predicted the financial crisis, has a new book out. Since he is touting a book, I take some of what he says with a grain of salt. After all, you don’t sell many books if you say things are going to get a little worse but not catastrophic. Especially if people know you as Dr. Doom.

However, the reviews of the book by no less than Nassim Taleb and Martin Wolf, both of whom are known to be good thinkers and a little bearish, suggest that Roubini is onto something:

“Roubini cuts to the real problems like a hot knife through butter, with a clarity of mind that is rare among economists. I have never seen a more lucid and nuanced account of our financial condition. Not only will the reader be better off after reading this book, but the world will be a better place when central bankers absorb its message."

—Nassim Nicholas Taleb, author of The Black Swan and Skin in the Game

“No economist is better able to curdle the reader's blood than Nouriel Roubini. What makes his views significant however is not that they are scary, but that they generally prove to be true. With this book, alas, he has surpassed even his high standards: the ten megathreats he details are as scary as they are plausible. Forewarned is forearmed. Read and pay attention."—Martin Wolf, Chief Economics Commentator, the Financial Times

The book is called: “MegaThreats (Ten Dangerous Trends That Imperil Our Future, And How to Survive Them)”. From the podcast, this is a summary of the 10 threats:

Protectionism and deglobalization

Immigration policy/restriction of migration

Reshoring or friend-shoring of manufacturing

Aging of population

Decoupling of US and China

Climate change

Cyber warfare and other geopolitical risk

Further pandemics

Backlash against inequality

Loss of dollar hegemony

As you can see, there is quite a bit of inter-linkage between many of these. Roubini’s point is that any exogenous supply shock is enough to lead to inflation. Central banks will respond to this inflation threat and lead us to stagflation if not recession. Because there is too much debt in the system, this will lead to a financial crisis.

He suggests that central banks will want to act harshly so that inflation expectations do not come unmoored which leads to a wage price spiral. However, in doing so we will get asset market volatility and collapse, which will lead central banks to blink. In the 70s, the central bank blinked and inflation moved higher again, leading to a double-dip recession.

But in the 70s we didn’t have a debt crisis except in Latin America. Today not only will we have a recession but a debt crisis. We will get the worst of the 70s and worst of GFC. I do not agree on the debt side. Here are a few charts:

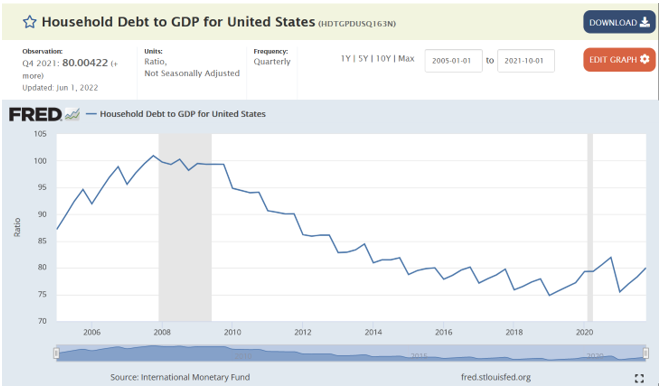

Total US debt to GDP is seen to be around 265% if we include the government, corporate and household debt. Roubini puts the number at 350% but let’s not split hairs. It is a big number. This number was 225% of GDP at the GFC so I can see why we could be worried.

However, if I look at the biggest drivers of this increase, I am struck by the increase in the purple color below. If I expand upon that, I can see that in the GFC, the government debt to GDP was about 70% however, since then, it has almost double to 135%. The major growth in leverage since the GFC has been on sovereign balance sheets.

If we look at household balance sheets, they are under less pressure than during the GFC. This is due to a combination of the inability to get loans at the same level, pace and quantity as pre-GFC, but also because consumers until Covid were not buying houses at the same clip either. Household debt to GDP has actually fallen by 20% since the GFC to 80% from 100%. I don’t see or sense the same stress here.

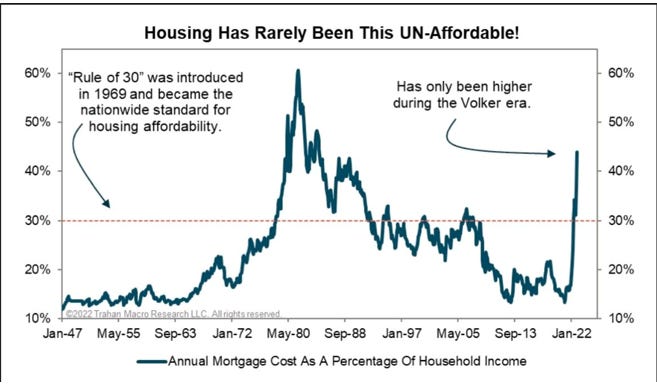

Don’t get me wrong, the increase in mortgage rates is palpable. Francois Trahan shared the following chart on LinkedIn today. It shows that housing has not been this unaffordable since that 1970s/80s period.

However, I have made the point several times this year that it is not just rates but also jobs that matters for consumers. No one bought a house in 2010/11 even when affordability was historically good because they did not have a job that was paying much. Housing only got better when incomes improved. My experiences in traveling the Midwest this Fall indicate to me that incomes are still pretty good. The chart below suggests that debt levels still remain relatively affordable as they are only about at the mean of the last 40 years. Yes, they are higher than the 2021 lows. They are lower than in 2019 though too.

Roubini does admit that household debt has come lower but does suggest lower income borrowers will be hit hard. I simply don’t agree. Well, yes, lower income people always get it harder in a recession. However, in the latest economy, those people haven’t been able to borrow. This was very different than the subprime borrowing before the GFC. In addition, BAML’s CEO Monahan on his earnings call this week said people with less than $2000 in savings have seen their savings levels move up by 5x since Covid. Those with savings above $2000 have seen them go up by 3x. This tells me we will see more Saugatuck good times and less Dr. Doom crises.

If we look at corporate debt, we can see that it has grown. It came in about 45% as a percent of GDP before the GFC, a level it also hit in the tech bubble of 2001 and the recession in the early 90s. There was a big spike up to 57% around Covid, mostly as debt levels remained the same and GDP shrunk. This number is coming back lower but still stands at 50% of GDP, so it is elevated.

If I look at the Moody’s Corporate Baa credit spread relative to Treasuries, there does not seem to be an indication of nervousness in the market:

While the spread is not stressed, the absolute cost of the Baa debt has spiked considerably. This will surely slow borrowing and cause some stress in the system.

If I look at the Chicago Fed ratio of high yield to Moody’s Corporate Baa spread, it is moving higher but is not stressed.

On the podcast, Roubini talks about high yield spreads going from 300 to 600 bps. I think he is referring to CDS levels. This is the cost to insure your portfolio. We have also seen the absolute cost to borrow go up. It has gone up by that amount. We are not seeing the spreads widen yet. The spreads are the market indication of risk.

This all feeds into the Chicago Fed National Financial Conditions leverage index, which has also moved higher but is not showing any signs of meaningful concern just yet. You can see the major spikes in this before the tech bubble and GFC. It even had moved up more than double the pace before Covid. Tighter yes. Crisis no.

If we look at the total that the public - consumers and corporates - hold as a percent of GDP, it is higher of late at about 130% of GDP (50% corporates and 80% households). However, before the GFC, the combination was closer to 145% (100% households and 45% corporates). The biggest growth taking us from 225% of GDP to 265% of GDP is the government going from 80% to 135%. I am not saying this isn’t a problem, but we just don’t know how a sovereign debt crisis plays out when it happens in a reserve currency country because we frankly haven’t seen it yet.

Now maybe, Dr. Roubini’s numbers are not the same as those I get from the St. Louis Fed data base. In fact, in researching this article, I did find a chart that suggests household and corporate debt is more like 225% of GDP which combined with the government debt of 135% gets us to that 350% number Roubini states in the podcast.

This number may include corporate pensions in it which is why the absolute number is higher. However, even this higher number is only on a par with the GFC and not above it. So even in the worst case, it may not be clear we have a crisis yet.

Back to Roubini’s prescriptions for what to do. He says we are damned if you do, and damned if you don’t. However, you have to do something and so he suggests the Fed and other central banks tighten to avoid unhinging inflation expectations. He says they should be willing to accept a recession and maybe even a crisis. Inflation expectations in the market have been choppy but are still not unhinged.

Though looking at the Fed’s collective measure of 21 inflation expectation indicators shows it has gone up markedly which is why the Fed is acting, and jawboning, so diligently:

Roubini feels central banks will wimp out and pause at the first sign of trouble. First example of this is the BOE. They will wimp out and go back to MMT. Interestingly, one of the creators of MMT thinks that what we are seeing right now, isn’t even MMT. You can hear the interview with Warren Mosler here.

The issue I have with the comment is that I do not believe the BOE blinked and chose to go back to QE and monetization of debt at all. I think the LDI crisis which I spoke about in “Bonds and Bombs” a couple weeks ago, was a temporary margin call among UK pensions and the BOE had to step in as the lender of last resort. It is the central bank’s job to ensure a functioning market for the risk-free asset. This is what the BOE did and even told the pensions there was a time limit to this support so get your house in order. That date has passed, and the Gilt market is showing signs of stabilizing.

He feels that when central banks blink and monetize the debt, the market will catch on to this and penalize the borrowers by widening the spreads. In a high debt economy, interest rate increases have a rapid transmission mechanism.

So, what should investors do? Well not only is Dr. Roubini selling you a book, but he is also working on an ETF that will solve all of your problems. Insert your cynicism here. He suggests the following assets: TIPs and short duration Treasuries, gold (which will finally do well when inflation expectations are unhinged), and real estate. These are instruments that are a hedge against inflation. He says cash is useless because it is destroyed by inflation.

Real estate is controversial, but he says in the 70s it did better than equtties. However, you need to be careful where to own. A lot of real estate will be stranded by climate change. Florida will be under water and Texas will be too hot to live in. Midwest real estate should do well. I agree with him here. I own a lot of Midwest real estate. I do so because I think all of the bad news is priced in wince it trades at 25-50% of the areas people want to move. I did not buy on the climate change hypothesis. He also suggests owning up into Canada. In the podcast he suggests we will see a civil war. In the NY Post piece, he suggests the US will invade Canada. I will leave you to discern these comments.

One thing I definitely do agree with him on is negative correlation of stocks and bonds becoming positive correlation and the subsequent problems of 60-40 and risk parity portfolios. I have been talking about this for 18 months. He also says long duration equity hurts more than index level equity. Another topic I have spoken about for 18 months. This is why tech struggles so much right now.

I will leave it to you to buy the book if you want. I am not suggesting you shouldn’t. I do think the podcast is worth a listen. I listened 3 times because, while I did not agree, I want to avoid cognitive dissonance. I want to embrace the things I do not agree with and try to refute them. This is why I wrote this article. I do not know if I did at all.

I still think we could have a recession. I do think the labor market is in a unique phase and is strong enough now to allow this recession to be relatively mild. I feel a lot of the assets in the market have priced in the vast majority of the recession but not all.

Will there be another crisis at some point? Certainly. The economy has been characterized by crises since the beginning of time. Is this the next big one now? I don’t think so. However, we should still …

Stay Vigilant

The mistake most make (including you, sorry to say) is that they are operating on a linear (long common) framework/model extrapolating from the past. This is fatally flawed if we have transitioned, as I see it, to a high degree paradigm shift into a transformational societal exponential vortex system 'reset'. This is difficult for the vast majority who are 'blinded' by various biases/false beliefs. This process can be characterized by the saying "When one is paid not to see, one doesn't see". Also at play is the conditioned reflex of seeking security, giving rise to deep fears of the unknown, which fosters avoiding uncertainty. It's like someone who, when confronted with a very rare multi sigma asset valuation move, disregards it as 'impossible', or an anomaly not worth considering. Many are they who have been killed literally or financially by such flawed processes. "Just the facts, mam" Joe Friday 1. All debt based fiat currency systems have collapsed. This is a feature of the construct, not a bug. Given enough time, compound interest (which Einstein called a wonder of the universe) works its magic as it evolves into an exponential hyper inflation collapse. 'Printing' is the sure sign the end is nigh! 2. A hyper indebted everything bubble economic/financial system simply cannot withstand what has been characterized as a Monster - INFLATION. Even the MMT system so in vogue notes that 'printing' must be terminated and taxes raised immediately when the Monster is unleashed. This was not done, and so the Monster grew out of control. 3. Once the Monster is out of control, it is a genie that cannot be put back into the bottle. Now if the CBs continue raising rates, the system will collapse as it kills the Bond and real estate markets. If they reverse and 'print' with YCC/bailouts (Japan/GB/EU) they feed the monster which triggers runaway INFLATION and societal revolution collapse. Existential doom loop catch 22. That is what is now occurring, and just in time, as if TPTB get to institute their total control CBDC's, humanity will be doomed to unbearable lives of total slavery a la WEF 'green new deal'. Grub, Gold and Guns! Best. Don

You were ahead of the curve on inflation, long duration assets getting smoked, rates and much more; past performance no guarantee of future results but I think you will likely be right on your recession prediction, as well.

But as the market is always forward looking and we are always staying vigilant, I notice a tinge of bullishness in your commentary, but an aversion to committing to the optimism. What will it take for you to switch teams?

UPS reported today and showed us FDX is just lousy and people are actually still shipping many things, GM showed us the pent up demand for cars is only starting to be unwound, the banks have been slightly better than expected but those with auto and other subprime exposures appear to be cautious (how much higher should provisions for losses go? Many like ALLY at post-GFC / all time highs -- the banks want to put those deposits you have mentioned before to work), I don't have high hopes for big tech but don't necessarily care, and Buffett and bellwether BRK will show us rail is robust and I think there could be the deployment of a lotta Buffett Bucks to boot...

As a wise man once said, what could possibly go wrong?