Inflation?

Get used to the topic of affordability, because it's the new narrative

Don’t get me wrong. There is still a LOT of buzz about AI.

Many bears are wondering if this is it, if this is the big one. Has AI gone too far, with 80% of FCF being spent on capex? What used to be cash-rich companies that did not resemble the risk characteristics of the rest of tech, have now become a levered bet on whether the pursuit of AGI even makes sense. Michael Hartnett of BAML says the trade of 2026 is to short the bonds of the hyperscalers:

There has also been discussion about strains in the money market. However, people I talk to and indicators I watch suggest this is still much ado about nothing. Unwinding too much government errr I mean central bank heavy-handedness in the markets can be a little stressful at times.

However, maybe at the next layer, the narrative has again turned to inflation, more like the problem of inflation. As we turn the clock in the new year, a mid-term election year after the GOP has been smoked in some special elections, the Democrats are going to highlight any problem they can find, and money market stress is not a big topic on voter minds.

NPR highlighting that Trump is failing to keep his election promises. What a surprise that NPR would find a weakness in Trump and try to exploit it, right?

The NY Times is also willing to highlight this topic of affordability. You can already see that this is going to be a talking point as we head into the mid-term elections.

Well, it isn’t just the liberal media that is highlighting the issue. Fox News is also highlighting it, further suggesting this is going to be an election topic. In fact, this video clip including Peter Navarro tells you the Administration is forming a plan to address this.

However, AP News wrote an article that suggests that maybe this is not just an easy fix. While the President might chide ‘Too Easy’ Powell, there are likely some more underlying issues in the economy than just the flow of money. Fed policy probably only exacerbates this.

Dallas Fed’s Logan saying she does not see signs inflation getting back to target. I couldn’t agree more with her.

The Kansas City Fed’s Schmid not only highlighting that we are drifting from the 2% target, but tells us the problem is spreading, the Fed’s commitment is being called into question, and more cuts could actually be a problem and not a solution.

Cleveland Fed’s Hammack also highlighted that we have been above target for several years and they need to use policy to finally cool this down. Don’t forget that when the rate cuts started a few years ago, Jay Powell told us they might even have to intentionally slow the economy to cool the inflation. Perhaps Beth Hammack read my Stay Vigilant when I compared the current environment to the Nifty Fifty Era?

The St. Louis Fed’s Musalem does highlight the problems with monetary policy. He has been on the stagflation bandwagon all year long. He explains to us the difficulty of deciding Fed policy when jobs are weakening but inflation is rising. Earlier this year he had indicated that in this environment, he would lean toward what consumers say they are more worried about. In the latest University of Michigan survey, consumers still see inflation as a problem.

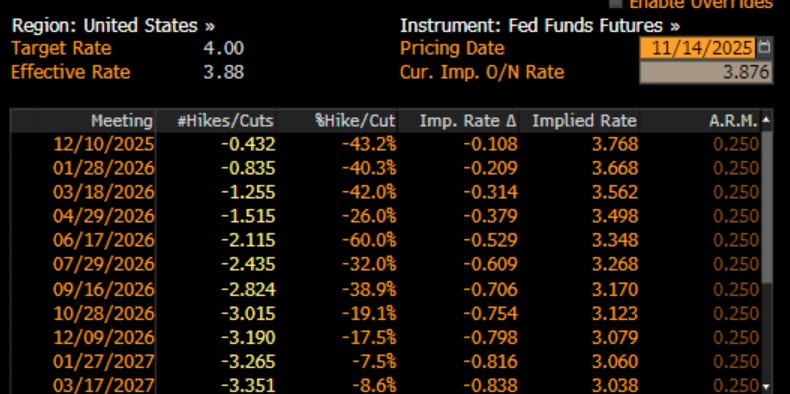

This may well be why the market started pricing rate cuts out of the market this week, even when there were worries over AI earnings going on as well. The odds of a rate cut for December are now well below 50-50 and the next cut isn’t expected by the market until maybe March.

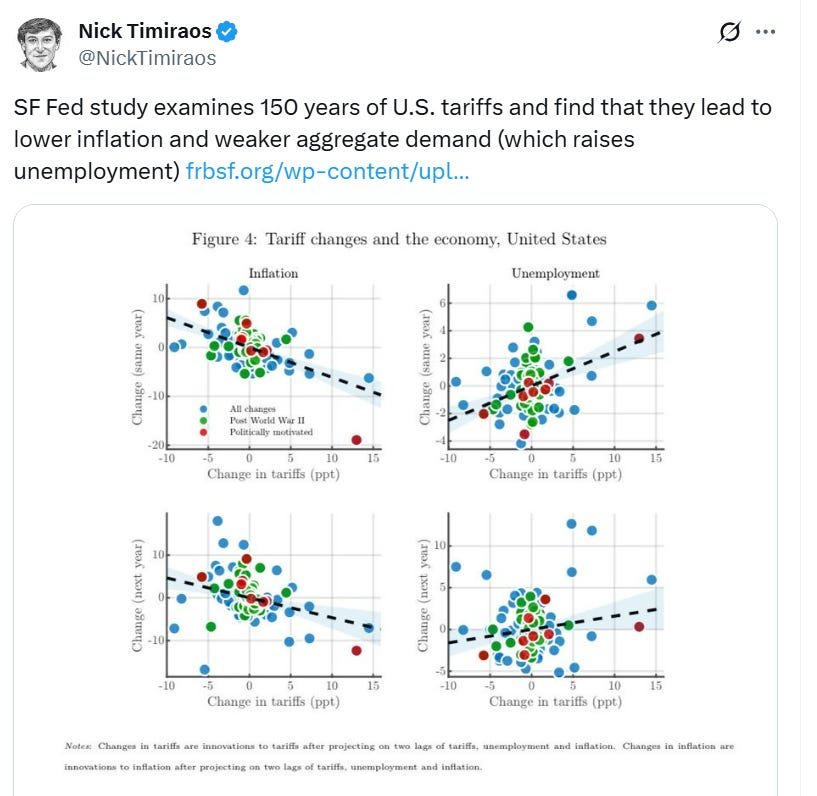

Not to fret, the San Francisco Fed put out a white paper, a white paper, that seemed to get the FinTwit all frothy. I was shocked how many people were sharing this on X to either rip on the President for his tariff policy, to rip on the scores of other Fed officials for discussing inflation, or to rip on people in the market who don’t agree with their views. The punchline to me is not a surprise. Nancy Lazar, the II #1 economist from PiperSandler has said all year long that tariffs are a tax. When we get a tax, we get less of whatever is being taxed, in this case, economic growth. The paper suggests growth falls so much inflation comes down. However, again, it would likely be the inflation in the things being imported. Is that what is causing the ‘affordability crisis’? Do Fed rate cuts help with the problems the consumers are suggesting?

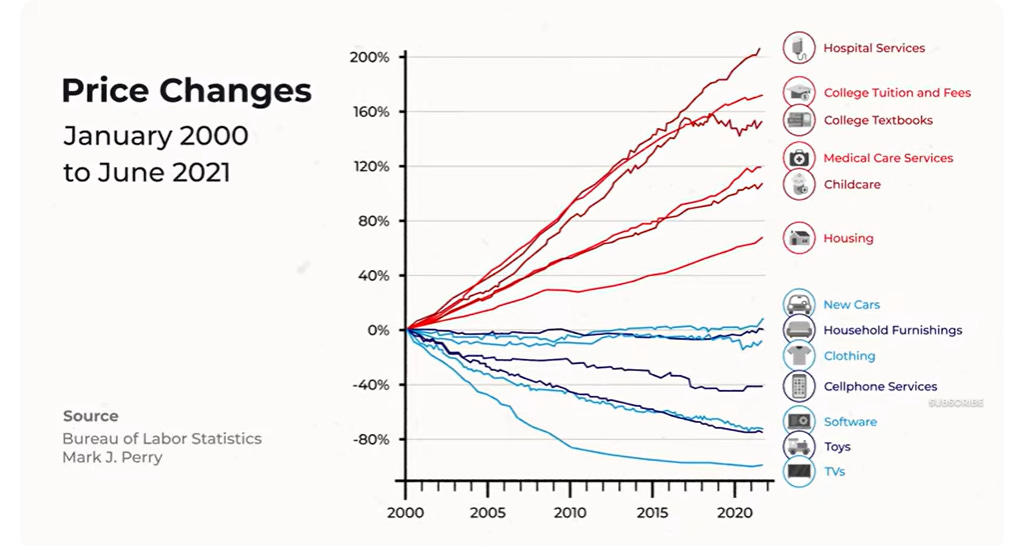

Justine Underhill on YouTube (does really good long-form work, like she used to at RealVision) highlighted why the economy is broken for consumers. It has nothing to do with inflation in ‘stuff’ that is being imported. In fact, we already see prices falling for the things we import. The problem for consumers, the affordability issue, has a lot to do with structural issues in the economy that are broken. She highlights medical services, college costs, childcare and housing as the biggest issues for consumers, all of which are due to the brokenness of the system. Whether it be zoning issues, or monopolistic behavior, these are the biggest expenditures for consumers and these prices are still a problem.

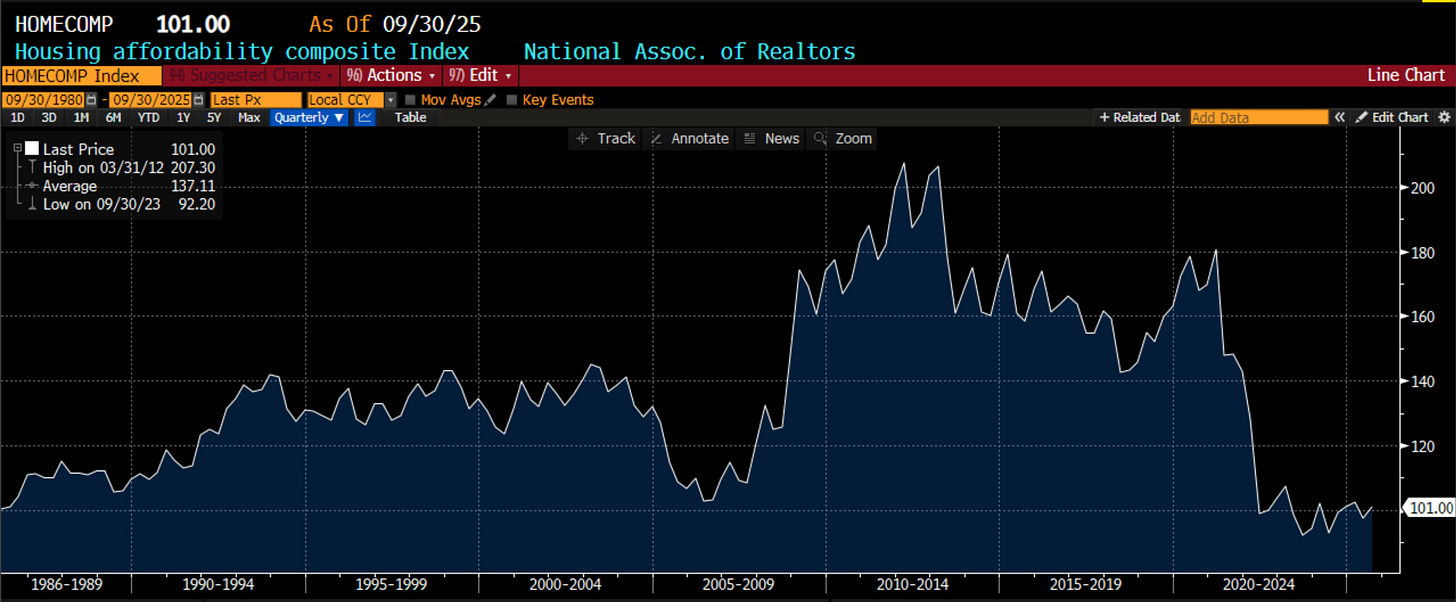

The one of these that I can track the longest is housing affordability. It is still the worst of the last 40 years. It has barely changed despite 150 bps of Fed cuts. It has little to do with mortgages. It has a lot more to do with the lack of supply of homes and the inability of wages to keep up with prices. Another 25 bps is not going to fix this. Do Boomers care about this? No because they already own a house and don’t want the price to go lower. Do Millenials care? You betcha. They are forming households and trying to get into a house. Which cohort swung the special elections? It was Millenials. That is why the structural issues need to be addressed.

However, Fed policy and economy narratives are important for market behavior. This was the point I was trying to make on LinkedIn. We are already seeing investors respond to this new narrative on affordability and inflation:

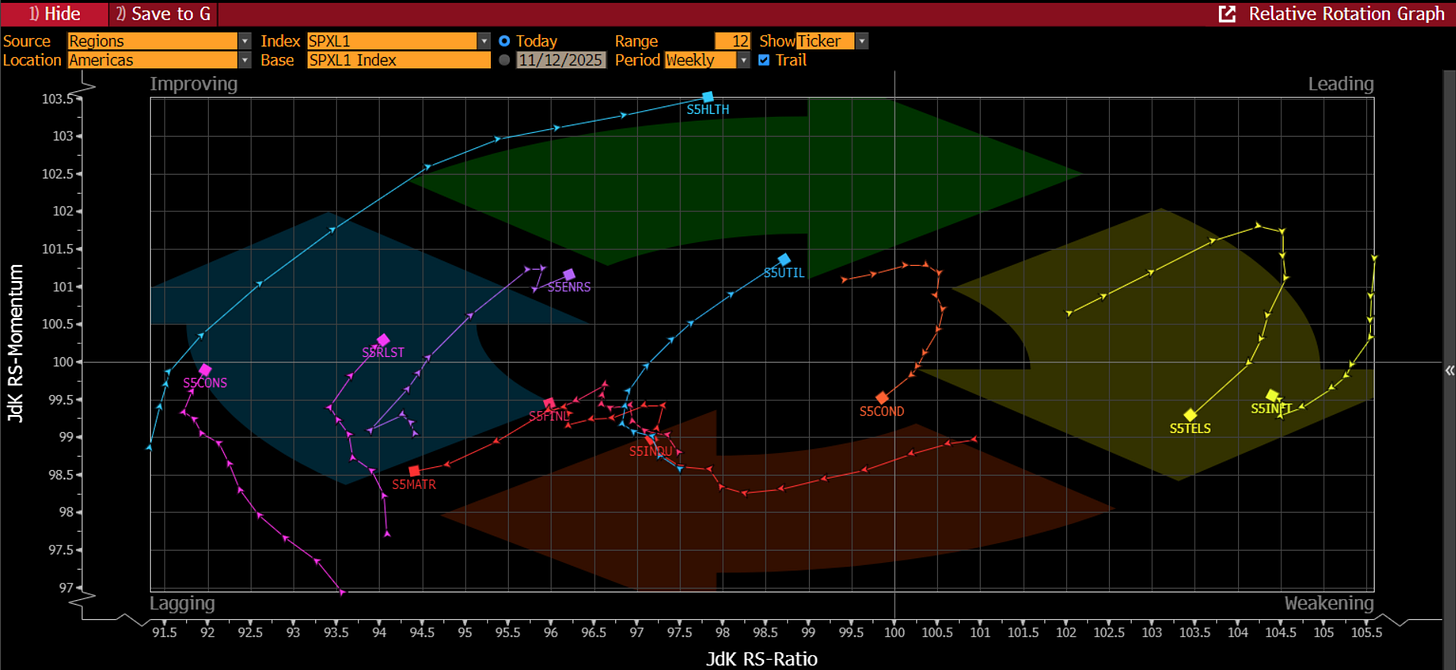

Chart of the Day - sector rotation

The last few weeks or so there has been pretty clear sector rotation. Maybe it is investors getting a little more worried about the valuations of AI names, or the cross-shareholding arrangements than resemble the Japanese Keiretsu

I think there might be a different driver. If you look at what is winning it is Energy, Healthcare and Utilities. If you look at what it losing it is Tech, Telecoms and Discretionary

Sure, the latter host all of the Mag 7 but I think there is more

In my portfolio management class, we talk about the matrix of growth and inflation. In each quadrant (rising or falling growth expectations, rising or falling inflation expectations) there are clear sector and style winners and losers

When the market is anticipating falling growth but stable or rising inflation, Energy, Healthcare and Utilities do the best and Tech, Telecoms and Discretionary do the worst

When is the opposite true? The opposite is true when growth expectations are rising and inflation expectations falling. That has been the case from early June until the middle of October

What was the catalyst? It is hard to say that was economic data because many will tell you we didn’t get any. In reality we got a lot of arguably better private data but no govt data

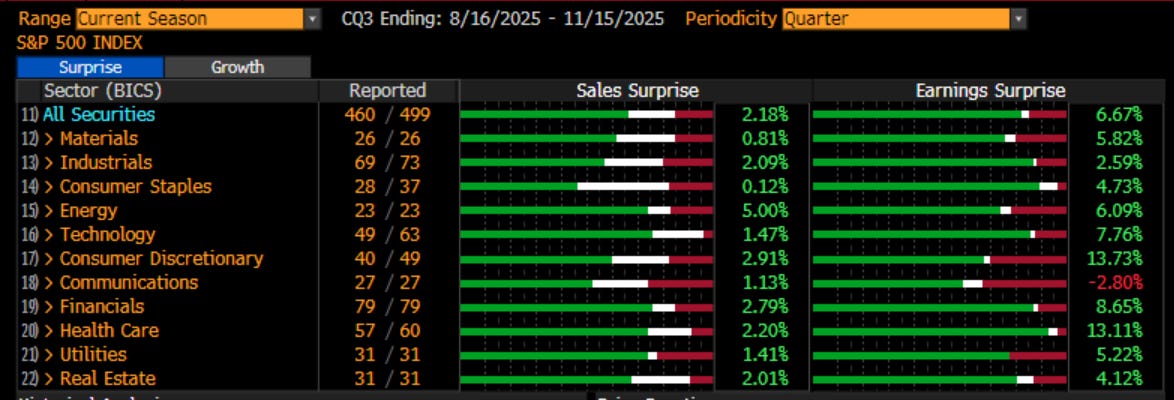

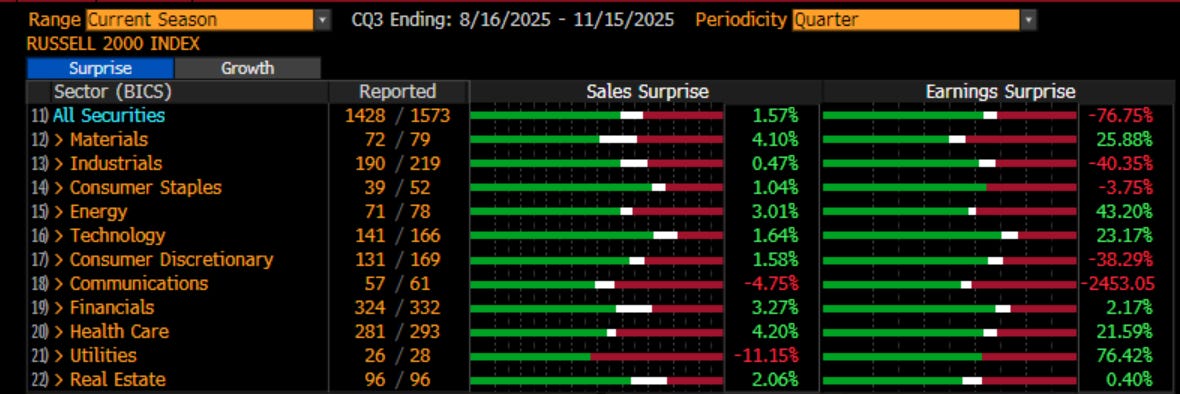

It could have been earnings and company guidance. I do think there is something to that if we look at the breadth of earnings relative to expectations across all indices

It also could be the actual govt shutdown and investor perceptions that this is going to be a drag on growth but keep inflation rising because nothing was actually accomplished

For whatever reason there is a clear change in perception in both growth and inflation and that is impacting sector flows. Can this continue in the face of large passive money which is over 50% of AUM and 90% of volume in a given day?

Hard to say but it is interesting to see this happening as we are approaching the holiday season when markets will naturally get less liquid

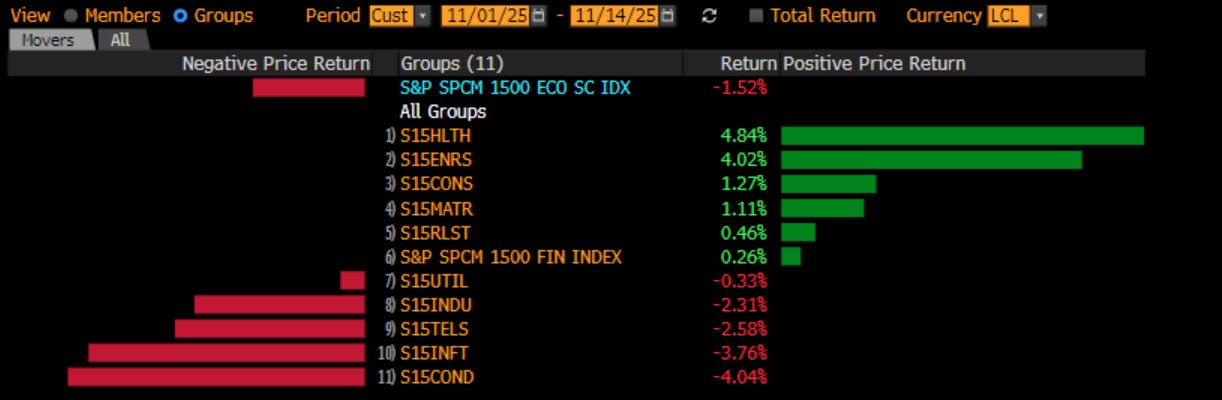

In fact, if we look at the month of November, admittedly only 2 weeks old, it could not be more clear that investors are rotating into Energy, Healthcare and Staples and out of Discretionary, Tech and Communications. This is classic rotation from a reflation mindset (good growth, falling inflation) to a stagflation mindset (falling growth, higher inflation). I know, I talk about it every semester in my Portfolio Management class. This isn’t based on some out-of-date academic textbook. We update the empirical results every semester. For the record, my class in the Spring forecast stagflation for the end of this year. My class right now is still forecasting stagflation through Spring of next year.

Inflation also matters not just for equity portfolios, but also for portfolios that are built in more traditional ways across assets, for example 60-40 or risk parity. I have mentioned this before, but I updated that as well on LinkedIn:

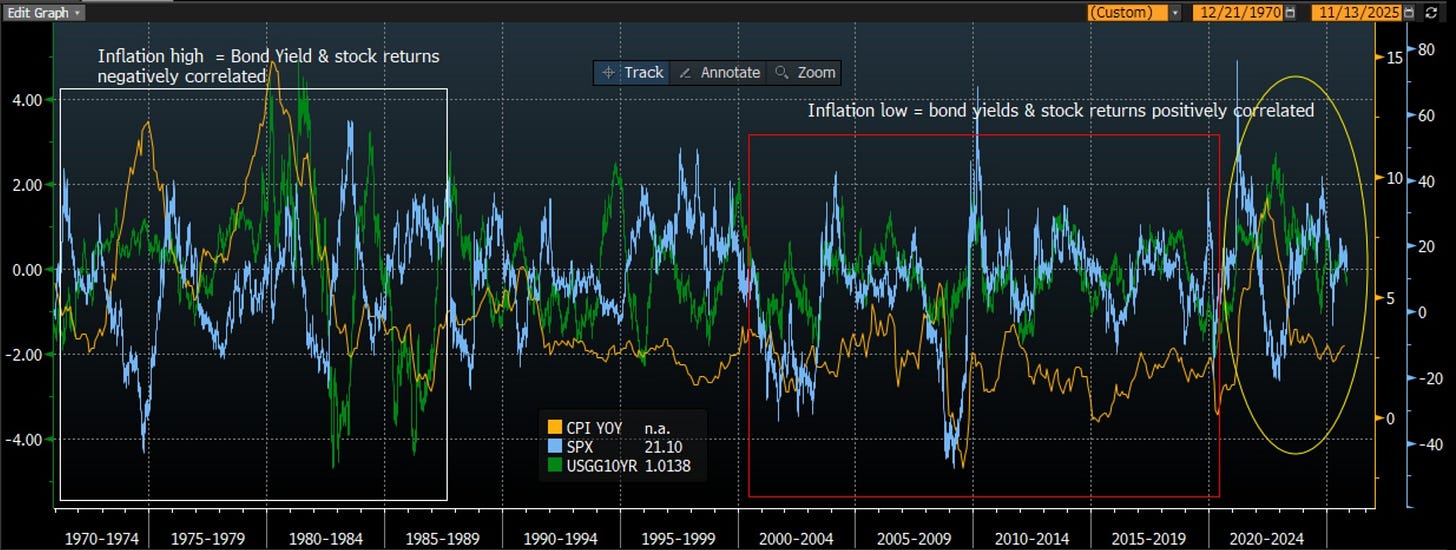

Chart of the Day - inflation & portfolios

The 60-40 portfolio for retirement accounts, or the risk parity portfolio for institutional accounts, has become the standard portfolio construction for those who invest across asset classes

The premise is that stock and bond returns are negatively correlated, therefore, when stocks go lower, bonds are going higher, softening the blow, but when bonds are at risk, stocks are moving higher. So this is thought to be an “all-weather” portfolio

The data supports this ... kind of

You see, this negative correlation between stock and bond returns (or expressed another way, the positive correlation of bond yields and stock returns) has worked this century. However, it has not always worked as we see in the chart below

Back in the 1970s-80s stocks and bond returns were positively correlated. It wasn’t until the 2000s that they became negatively correlated. Why the difference?

When the market is focused on growth, strong growth numbers mean stocks will go higher on expected earnings growth but bond returns will suffer (yields higher) because there is an expectation the Fed will raise rates. When growth struggles, stocks will suffer on earnings fears but bond returns will be good as yields go lower

However, when the market is focused on inflation, as it was in the 70s-80s, when inflation is high, stock returns will suffer as margins erode and bond returns will also suffer (yields higher) as the Fed is expected to hike. When inflation falls, stocks get margins back and bond returns are strong with yields falling

From late 2021 to early 2023 we saw this positive correlation between stocks and bonds return even though it was not there from 2000-2020. Inflation was the focus. In 2022, stocks AND bonds went lower. Risk parity and 60-40 did not do well

I would posit this year has again been an inflation concern year. At the start of the year. From early March until mid April, stocks and bonds went lower on higher inflation worries from tariffs. From mid April until mid October, both markets rallied on the TACO trade, with tariffs backed off

The last month? Both markets are again heading lower

Today we heard from the Fed’s Beth Hammack and Alberto Musalem that the Fed should not lose sight of inflation. Jay Powell himself said December is not a done deal. Its about inflation concerns

This is also why energy & materials are higher (do well in inflation) well tech & discretionary are lower (do poorly in inflation)

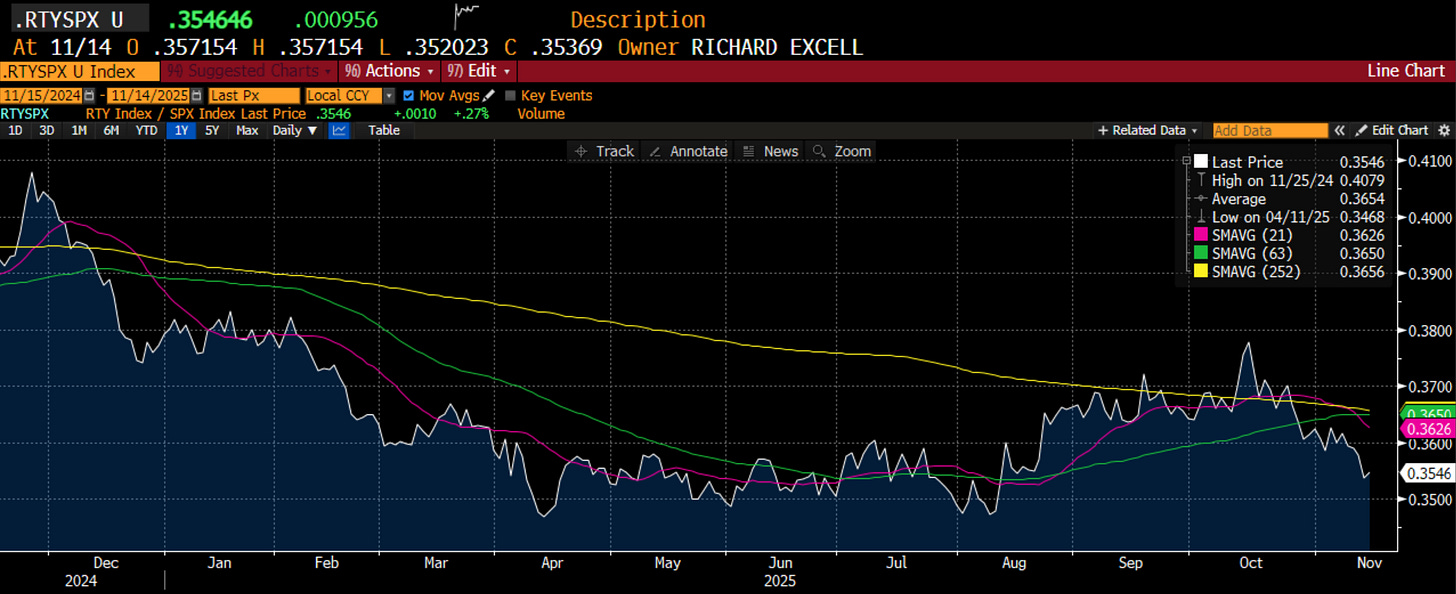

Speaking of portfolios, I have favored small caps into Q4 of this year. I was feeling pretty good about myself from that point in August until midway through earnings. As we see above, the recent market turbulence has been tough for the SPX, but even tougher for the Russell 2000. I am in names that you would find in the S&P 600 instead, which are higher quality. Within small caps, the Russell 2000 had been outperforming the S&P 600 as well, I know because we track the S&P 600 in one of my other class portfolios. However, while taxes and regulations help small caps, the unwind of rate cut hopes may be the bigger issue.

The final earnings season tally I will give. S&P 500 earnings were again quite good, as they always are. The biggest miss was in Communications, likely Meta. Overall, pretty good breadth across the sectors and seeing earnings and revenues come in not only positive, but better than expected.

This was not the case in the Russell 2000. Midway through earnings, they were looking quite good. The last two weeks of small cap earnings have seen some bad misses. Also the communications sector, which is worth highlighting. However, earnings did not carry small caps. There were positive surprises in the S&P 600 (not shown) but I highlight the Russell 2000 as this is where the index/ETF money usually flows. With no rate cuts and earnings like this, it is hard to see why anyone shifts 401k money to small caps in January.

There might be some places investors want to consider putting their 401k money if they are worried about the problems in the US market. After a mad rush into Chinese stocks early this year, even on the pullback, FXI relative performance has held well versus the SPX. If this were a stock, it would be a good time to buy. It is not too late to move some money from the US market to the Chinese market.

The preferred vehicle form many has been a clear shift into EM, of which China is a part of course. The performance of EEM vs. SPY has been more pronounced and this relative chart is now breaking out. If you want to shift anywhere on some nervousness in the US, EM broadly speaking is the place to look.

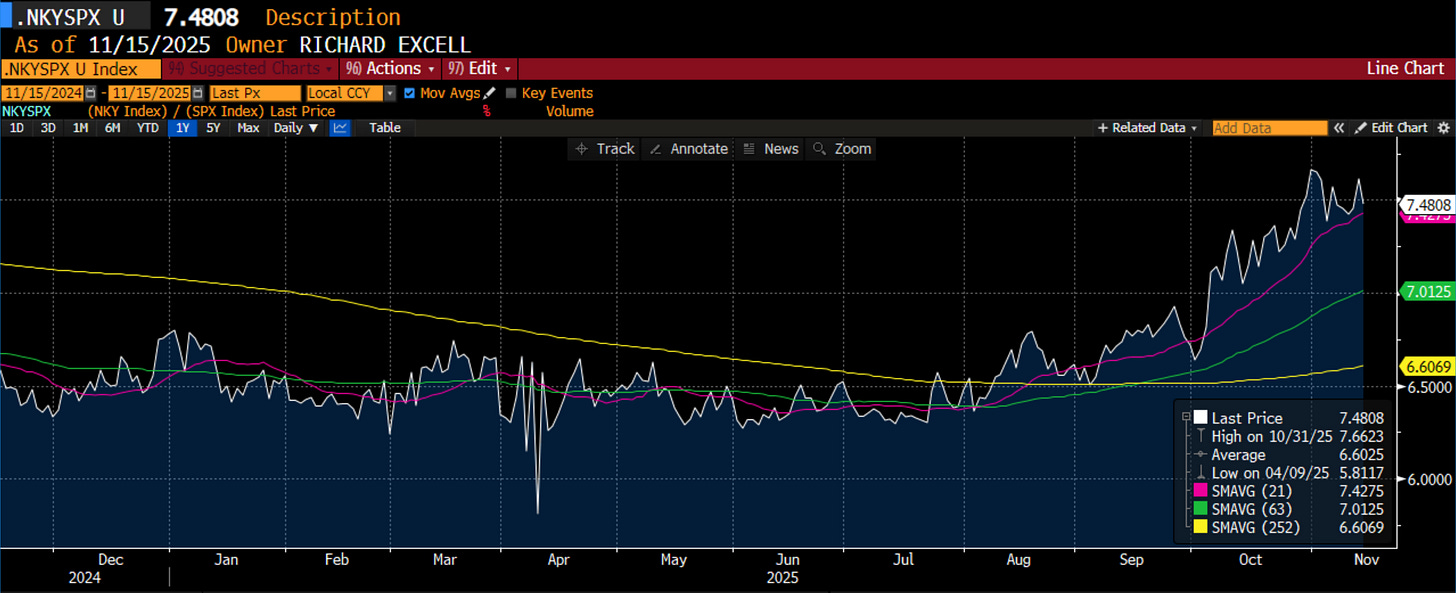

The developed world outside the US had a great Q1 but has really struggled the rest of the year. On the recent weakness, it has perked up some on a relative basis. This one might be more difficult for people to get behind. However, one trader told me this week that many clients, and even JP Morgan strategists, are saying international stocks will outperform the US over the next 10 years. Something to consider.

If you want a developed market that has decidedly broken out versus the US it is Japan. New Administration, new monetary and fiscal policies. This is not your parents Japan. Another place to consider for a rotation of assets.

________________________________________________________________

AI is still a major topic. In fact, I am sure I will again discuss it on my Macro Matters podcast on Monday because my co-host is a massive believer in the transformational ability of AI. Not just the transformation but also the deflationary aspect of it. However, as I will point out, will AI reduce the cost of homes? Unlikely. Will it reduce the cost of medical services? More possible but still not likely because doctors are already using AI but costs aren’t coming down. Will it reduce the cost of college? More likely here but it will take time as most schools don’t even have a defined AI policy yet. So, will it help with affordability? Probably not.

This is the problem for the Fed. This is the problem for the Administration. This is going to be the narrative we face in the market for the coming months as we turn the focus to mid-term elections. Make sure your portfolio is prepared for it.

Stay Vigilant

Looking forward to listening to the podcast episode on AI.

The shift from growth concerns to inflation worries is really insightful. Housing affordability remainig at 40-year lows despite Fed cuts shows how structural these issues truely are. Your point about sector rotation toward energy and healthcare while tech underperforms perfectly captures the stagflation mindset taking hold. The comparision to the 70s-80s positive correlation between stocks and bonds is particulary telling for portfolio construction.