It's a critical juncture

There has been a lot for investors to digest since coming back from the summer, and there is more to come. Now may be the most important time of the year for portfolios.

Investors have been hit with a lot of information in the past month. They are about to get hit with a fair bit more in the next month. While investors span a broad range of holdings duration, right now is a critical juncture for investors of all kinds. The data that comes out now may dictate the rest of the year. The Fed actions (next week) in response to this data, may set the tone for much of next year as well.

Last week was the culmination with the CPI report that came in slightly higher than expected but led to a more than 3 standard deviation drop in equities. This is concerning on a couple of fronts. First, sharp drawdowns in the market are never one day events. The losses incurred and the spikes in volatility impact capital allocations across hedge fund and prop trading pods that will dictate the type and amount of risk taken in the near term. Second, a 3 s.d. move to a small disappointment in economic data is not known to lead to this magnitude of a market move. Does that speak to fragile market microstructure? A guest of mine on a podcast this week spoke about the possibility the market is inherently and largely concave right now. By this he meant that the primary liquidity providers and allocations decision-makers are in a position where they need to respond to price action, selling as we go lower and buying as we go higher.

This is not the sign of a healthy market. That is especially true when we are in the midst of a fair bit of news. With that said, we need to understand the framework and trend for the economy, the market, the positioning, and the sentiment, so we do not have to react to the moves, but instead can take advantage of the moves. Back to the three-body framework.

Fundamental - does not look good

The trend for the economy and therefore for risky markets has not be good all year long. It has not turned, yet, into a disaster, but it is going in the wrong direction. It comes down to the pace of the decline and the place where we may ultimately bottom. As I have said many times, I favor the ISM and believe that the ratio of new orders to inventories anticipates the ISM. In addition, the regional Fed surveys give us an early look, by a week or two, of the next ISM. Right now, these are all still pointing to an ISM that is going to continue lower, albeit slowly.

Housing also leads the ISM. This week we will get the latest updates on NABH, New home sales and existing home sales. While I have felt, and still feel, that housing will not crater as it did in 2005-2008, it has also shown no signs of bottoming yet. It will be very interesting to see where it comes in this week. Housing leads new orders, which leads the ISM, profits and employment. Anecdotally, I continue to see a more normal market and nothing seizing up. I am in the suburbs of Chicago. I fully recognize that other parts of the country will be in a different place. However, rates are not so high that houses are not selling. I watch this closely given I am a landlord too. Things are still moving though at a much slower pace. This week’s numbers will be interesting and will set the tone for how much damage the Fed hikes have already done.

As I mentioned, CPI was the number of the week, setting the tone for the negative mindset and positioning all week. My simple model, which uses the CRB commodity index, M2 money supply changes, the Goldman Sachs Financial Conditions Index, China PPI and University of Michigan inflation expectations, has moved lower. I thought this would mean CPI would come in weaker this week. I still thought the Fed would go 75 at the next two meetings regardless, so I was leaning negative, but I was wrong on the direction of the number. I still think inflation should come lower but I recognize how difficult it is to forecast.

The level of CPU is also dictating the number of hikes priced into Fed Funds futures for the next year. We have gone from under 4 in July to over 7 now. If CPI cannot slow, the Fed will not be out of play. I wrote a post on Friday about the necessary precondition of the twin peaks in CPI and in Fed expectations. You can find it here:

As rate hike expectations go higher, multiples go lower. For the last year, the market has been driven entirely by multiples, which in turn have been driven entirely by the Fed. For the record, the Fed does NOT care about multiples. There is no Fed put for a market going lower because of multiples. The Fed will only consider pausing if the market goes lower led by earnings. We have not gotten there yet (but see below).

My framework is built on the dual notions of growth and inflation and what that means for asset allocation, country allocations, sector selection and style assessment. Let me show you a couple of examples of similar frameworks that others use because I think their diagrams really bring the point home. Matt King from Citi put this chart out in 2019 showing you that quadrants of inflation vs. deflation and boom vs. bust. You can see that an economy with still positive growth, but not a boom, and still high inflation has a certain allocation. If growth moves toward bust and/or inflation moves lower, that allocation changes.

Gavekal is a boutique firm that uses a similar framework. While this graph came from earlier this year, they were indicating we were moving from an inflationary boom in 2021 to an inflationary bust in 2022. We still are in a little bit of an inflationary boom though.

When I bring it together, with growth falling and inflation still high, we are in stagflation. This does not mean 1970s style stagflation, but it means growth slowing and inflation still high. Cash is the best asset, some commodities do well, equity returns are negative and defensive value is the best. If/when we move to deflation, where inflation starts falling, this will change. However, we are not there yet.

Over the last month, you can see the market pricing this stagflation scenario. Energy has done well as has defensive sectors like Utilities and Health Care.

IN a year to date basis, we have seen a classic stagflation environment. The question for me becomes “do we stay in stagflation or move into deflation?”

Referring to that graph above of the 1 year rate hikes, we can see that the market views of rate hikes changes from the middle of June until early August. This was on the back of the view that growth was not slowing (recall the better than expected ISM). Growth was coming back as was a positioning toward Inflation and not Deflation. This led to moves back into Consumer and Tech. The sector rotation this year has very much followed a top-down investing framework

The big story for me is the pace at which inflation and growth fall. Right now, even in a negative equity market, there are places to invest because we are still in stagflation and not deflation. If this changes, we would get another leg lower.

Behavioral - some good, some bad

For me, this is a very important chart in the near term. I think it encapsulates the investor sentiment in the market. We have been slowly moving into a tighter and tighter corkscrew from which something had to give. The bulls were in control July and into August. The bears re-asserted control from mid-August and through early September. We sat at a critical level when the CPI number came out. We dropped below the support showing the bears are solidly in control. The index is not oversold, there is room to add to positions, and we are not yet overly pessimistic. Bulls need to be worried right now.

It isn’t just equities either. Copper has struggled for many months, primarily on the back of the weakness in Europe and Asia. It sits at a critical level right now, at a time we are going to get more economic data. This could be another shoe to drop.

Oil is another commodity that is looking like we are moving toward deflation. Combined with Copper, I start to lean toward an eventual move into deflation which really changes the allocation out of commodities in a big way and into bonds. We are not fully there yet but looking more like it.

The CRB Index also has led CPI so this is something that bears watching.

However, people are getting pretty bearish. I know so many people hate the AAII sentiment survey. However, I still find that the difference of Bulls vs. Bears is a very good indicator. When we are above 20 difference, we are close to euphoric. When we are below -20 difference, we are close to capitulation. We had a move off the lows in March, May and June when we went below -20. We aren’t there yet but we are close.

However, the 10 day moving average of the ARMS Index, which measures down volume vs. up volume does not suggest we are oversold.

The McClellan Summation Index is a measure of breadth. As it declines, it suggests there are fewer issues that can take the market higher. It is declining which is a sign of trouble.

My favorite short term measure, though, is the 20 day moving average of the put-call ratio. When this moves higher, the market is in trouble. When it rolls over and moves lower, it is a good time to take risk. This measure is telling us to be careful.

All in all, there is bearish sentiment if we refer to the BAML fund manager survey, CFTC positioning, prime broker data etc. However, in spite of this, there are still enough negative thoughts coming from the behavioral section that I struggle to get positive. Charts are breaking down, the bears are in control, breadth is deteriorating, and put demand is rising. This is not a healthy sign for risk-taking.

Catalysts - what could change minds?

We still need to decide what could change people’s minds. Right now, I do not think economic data can do that. If it is good, there will be a fear of more Fed hikes. If it is poor, it will be proof the Fed is hurting the economy.

Stocks move on multiples and earnings. I showed why multiples are not going higher, however, earnings can still take us there. A weaker economy may not suggest it, but this is the one thing I worry could get the bears, of which I am one, to have to cover and change their positioning. What should we expect from earnings?

The ISM has a good fit with the number of companies that are surprisingly positively. The ISM is falling and so should our expectations of company surprises.

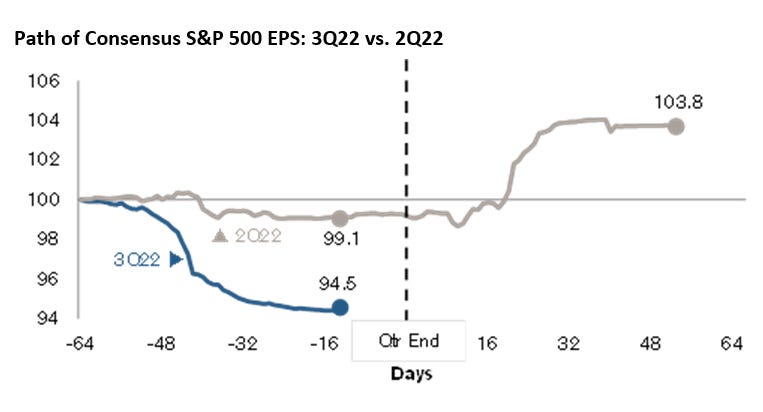

However, if I look at a few charts courtesy of Credit Suisse, the expectations for Q3 earnings are pretty low. The consensus path relative to Q2 is quite a bit lower at this point.

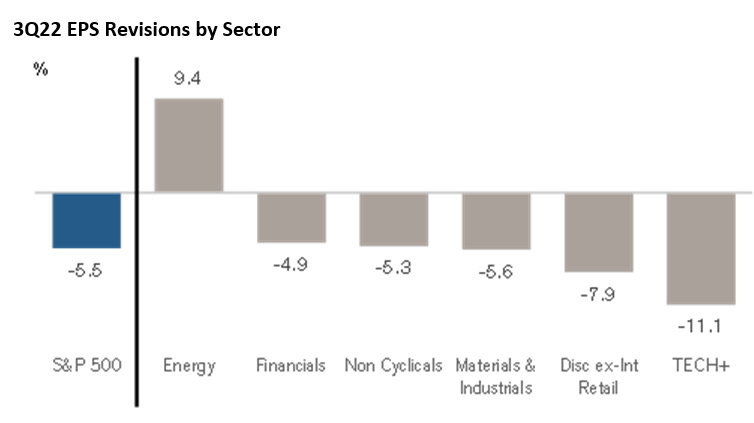

There is only one sector with positive revisions and that is energy. We should not be surprised that energy is leading the way for the market this year. In fact, the revisisons overlay well vs. the recent performance.

This is a different way to view the same data. If tech is not nearly as bleak as expected, there could be upside to those stocks, which could change the nature of the breadth of the market. That is not my base case, but something I am aware of could change the tone for risk.

Economic data, in the US, EU and China, has actually been a little better than expected. However, in the US, this just means the Fed is in play, in Europe, it is not seen to be enough to change the course of a miserable winter, and in China, it is usually ignored as not being real. I do not see positive economic news as a catalyst to the markets.

Seasonally, we are not in a good time for the markets. September is already proving that and historically, September is the worst point. However, that often can set us up for a relief rally in October and November. Again, that is not my base case but it is something I need to be aware of.

Finally, we have to appreciate that geopolitics are rarely a positive catalyst, but a negative that moves less negative can lead to a positive reaction. Ukraine having more success as it has in the last two weeks, is another potential reason for bears to have to cover.

Overall, these catalysts are not yet enough for me to change from my bearish moves. The core trend is negative, the behavioral aspects are negative too. I am aware of what could change the tone but I don’t see this near term. I will continue to monitor but for now, I will stay bearish, and ..

Stay Vigilant

Excellent write up! Thank you!

Fabulous write up and especially insightful given the critical state of the markets this month. Thank you!

I continue to believe that there is too much negativity already baked into markets and a spark or two of positive news will give us a short term rally. There is too much cash sitting on the sidelines just waiting to be deployed.

We might just have to hold our nose and get through Sept.