It's been a busy week

Time to take a deep breath, assess what we have seen, and prepare for another busy week

It has been an incredibly busy week and weekend for me, as I work through the end of a semester at school, a major set of meetings on a capital campaign I am working on, and heading to St. Louis this weekend to help my son move apartments. It has been a bit chaotic and I am looking forward to a couple weeks from now when things slow down.

There are probably many in the market that feel the exact same way. We had a crazy busy week of earnings this week and next week we will get another huge week. Layer onto this a slew of important economic week with ISM, non-farm payrolls and an FOMC meeting. When it is like this, you just keep grinding away and get through one things after the other and then try to step back and see what has amassed.

I am going to try to take an interim look right now though I now a lot could be different this time next weekend after all of the news we will get. However, I think it is worth taking a look right now to level set ahead of the important week.

Earnings

I wrote this post early this week ahead of what was set to be one of the two busiest weeks:

Chart(s) of the Day - earnings set up

A lot going on in the chart of the day. In some ways I think this is a pretty critical 2 week period for risky assets and I think these charts characterize what is so critical about it

First, I would encourage you to read my Substack this week called 'Ruh-roh' https://lnkd.in/gX5XATmy

It discusses how the changing expectations for US interest rates are going to continue to pressure the multiples that investors will pay for US stocks. This eliminate a tailwind but does not spell doom as long as companies can continue to grow earnings

We spoke last week about how large caps have been able, in the early going, to show some growth while smaller caps have really struggled. This has created a bifurcated market right now

Second, in my Macro Matters podcast yesterday, https://lnkd.in/gVDMK6S2

Tony and I talked about a range of issues but one that stood out was the rotation we are seeing over the last 8 weeks into sectors like energy & materials, with money moving out of tech. This was further suggested by the outperformance of the value factor over the growth factor

You can see this rotation in the bottom chart today. Money tech largely but also communication services, basically the Mag 7, and into energy, materials, staples & utilities. Students in my portfolio management class, which focuses on top-down investing might suggest the market is positioning for stagflation & I think they are right

Something else may be afoot though. The top four charts show the earnings growth expectations for four sectors. On the top are tech and communication, where the growth expectations are the highest in the mkt at 16% & 22% respectively

In the middle two panels are the growth expectations for energy & materials where the growth expectations are the lowest in the mkt at -1.7% & 0.2% respectively

The money rotation we are seeing would benefit by:

1. moving from crowded to uncrowded sectors

2. moving from sectors hurt by inflation to those helped by inflation

3. moving from sectors with high expectations to those with low expectations

I can tell you the expectation is the Mag 7, after a disastrous 6-7 days, were expected to bounce yesterday. It was not surprising to see Wall St come out & pump the stocks into earnings. Buyside accounts are overweight these names so they know it is a friendly audience

However, the key driving forces - sentiment, expectations & inflation correlation - may favor a continuation of the flows we have seen

These next two weeks will be critical to see not only WHAT is reported but HOW the market reacts to the news

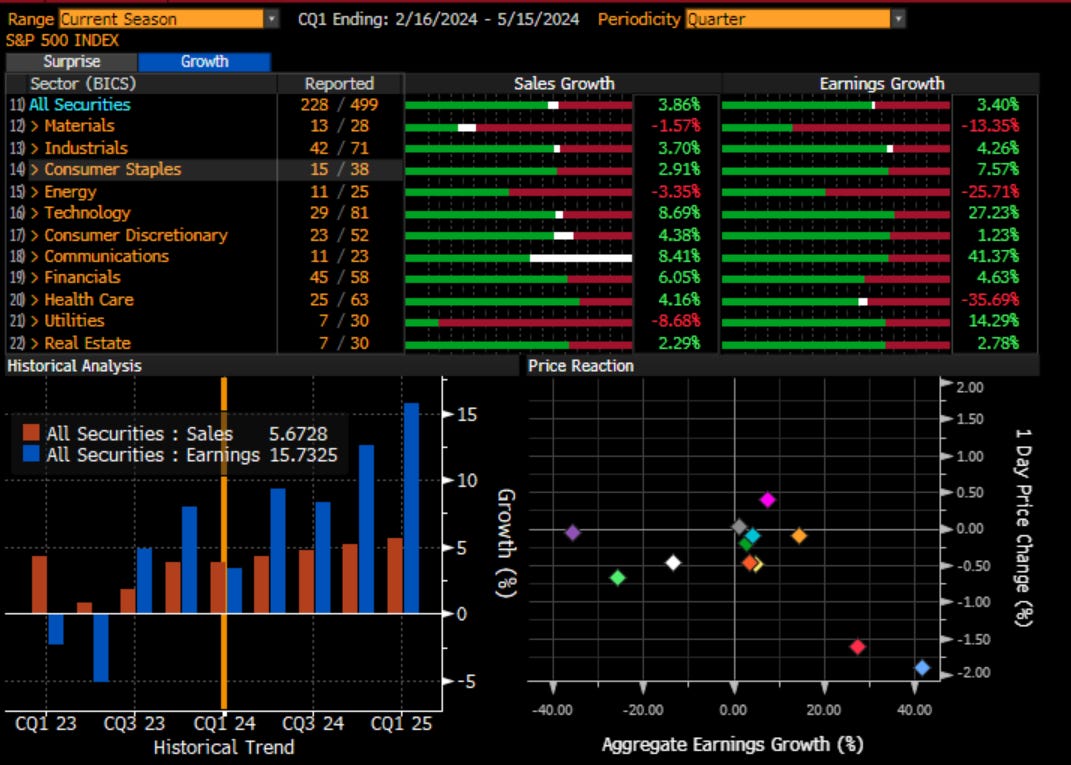

So, that was the set-up. How did things turn out? Pretty decent if you look at the headlines. The earnings surprise number is still over 9% this season. You can also see that every sector has had a positive surprise thus far with about half of the index having reported. In the lower left you can see that this level of surprise is higher than we have had the last several quarters. In addition, we can see that the sales surprise is much more modest meaning that companies are finding a way to expand margins. Perhaps inflation that has been falling has helped on this front. Maybe this will not be the case going forward. Interesting to me is the lower right chart. In spite of the positive earnings surprises, you can see all but one sector (consumer staples) has had a negative 1-day price reaction to the news. This tells me the commentary going forward is not as good as many had hoped. As I said in the post above, the bar is set pretty high.

If we look at the actual growth level and not surprises, it is not quite as exciting across the board, with many sectors showing negative growth at the moment, particularly energy and materials where the bar is low as we said but where the money has flowed. We can also see in the lower left that the expectation is these growth numbers will continue to improve quarter after quarter. The reaction to the news suggests some may be calling this into doubt.

I also want to look at the small cap universe which has struggled all year long. If we look at the actual growth in this index and across these sectors, the picture is even more negative. It is clear that there is a large swath of the universe that is struggling right now.

In order to understand why this may be, we should look at the availability of capital. The white line (inverted) is the Fed Senior Loan Officer survey of banks tightening lending standards to small and mid-sized firms. We can see that has improved since late last year but have yet to see much improvement in the blue line which is the Natl Federation of Independent Businesses survey of small companies looking to take on more loans. This line has yet to improve in spite of banks being a little more willing and perhaps this is because earnings growth is so negative. The differential of earnings outcomes may also be adding to this phenomenon to give us the orange line which is the relative performance of Russell 2000 index vs. SPX Index. Is the worst news being priced in for small caps right now?

Rates

Another critical factor for the markets is the multiple which is impacted by the cost of capital. The one asset upon which everything else is priced is the 10-year US Treasury yield. I wrote about this a couple weeks ago, suggesting we may be at an important juncture. I think we may have seen this begin to play out and not in a favorable way. I wrote about this on LinkedIn this week:

Chart of the Day - 5%

In all of my classes, the students know that the most important market measure they should watch is the 10-year US Treasury yield. They need to know where that is at all times. I tell them everything is priced off of it

I looked at it today as I know if has moved above the critical breakout area I spoke about a week or so ago. Looking at the chart now, it seems to me this is headed to 5% probably by June some time. We have moved above & have re-tested both 4.3% & 4.5% levels. The channel higher is well-defined

There are some reasons & some implications that I think are important to understand. This yield links together many markets around the world that have their own drivers too

1st, the market has priced most rate cuts out of the curve at this point. There is still a rate cut priced in for September, but given it is so close to the election, I would doubt that happens. This has ripple effects across the curve

2nd, the Treasury will be issuing over $1 trillion in coupons over the next few months. This issuance does not look to slow any time soon with a recent $1.7 trillion in spending just passed in the past month

3rd, Yen, Yuan & Pound are all at or near the weakest levels we have seen since last summer when yields were 5%. Their level matters because this is the buying power of the biggest foreign holders

4th, as we saw in the housing chart yesterday, these higher yields are already impacting mortgage markets & would be set to further erode housing which is critical to the economy

5th, yields are also weighing on gold & Bitcoin, each which have catalysts to move higher, but which are also impacted by higher yields given the longer duration nature of their cash flows

6th, higher yields mean lower multiples for stocks. Multiples are how investors bet earnings could be better. Thus it is current earnings driving stocks. While many are good, the outlook isn't as positive as hoped & the stocks are getting hit after the report. See Meta last night

7th, higher yields will hurt the smallest & weakest companies from being able to get funding. The Natl Fed Indep Bus credit conditions index is plunging. The returns in the last 1 month & YTD for zombie companies is deeply negative

8th, a big source of funding & success the past few years is private markets. Their portfolio companies have floating rate loans. Higher rates make it harder for them & they are coming up on a refi time

Finally, let's net forget comml real estate. I know many have come out & called the bottom in CRE. However, the wave of refi's is coming & yields are headed higher into that

Who is to say if any or all of this matters? However, there is the potential for some problems. All because of the 10-year US Treasury yield

On that third point, this week we saw continued weakness of the Yen and Yuan which I think is adding upward pressure on the yields. We haven’t fully seen it yet, but should we see any intervention, it may in fact lead to central banks in Japan or China selling down Treasury assets to complete the intervention. This is has the potential to become dislocating for markets. We need to watch this carefully.

The yield is incredibly important for housing, which in turn is incredibly important for the economy overall. I wrote about that this week:

Chart of the Day - housing

Housing has been top of mind for me lately as a couple of unsolicited bids for some investment properties I have came in of late. As I work through those, it made me think that the housing market must be doing pretty well right now

We know how important housing is to the economy. It is the sector of the economy, and the market, that leads into good times & into bad times. The money flow impacts this sector first, & due to its multiplier, it impacts other sectors meaningfully

Thus the acronym H.O.P.E. for housing -> orders -> profits -> employment As housing does well, we would expect to see new orders for goods that leads to higher profits that ultimately drive hiring

As an aside, that topic came up with a student yesterday. He asked if I thought Inv Banks would hire more this year because IPOs & other deals are picking up. I suggested it wouldn't happen until bankers cashed a bonus check as they never hire in anticipation of making money, only after. He was a little surprised but my experience suggests employment never comes until there has been money made & it is expected to continue

I took a look at the national housing data today to see if things all over were 'as good' as they are around me. Again, it does seem the activity around me has slowed, but it is still there, I think the high cost to build new combined with the low inventory is creating a new dynamic

You can see today the 30 year mortgage rate in purple (inverse) not quite back to old highs but close to 7.5%. The blue line is the Mort Bankers Assn purchase index which continues to head lower in a sign it is more inactivity than collapse plaguing the market.

The orange line is the building permits data, the leading indicator if you will, & while noisy within a range the last year, recent readings were quite poor

The white line is the Natl Assn of Home Builders real estate index. More of a summation of all activity. It has held in okay of late giving hope that things are fine. However, can it continue to hold in with the other data we are seeing showing signs of weakness? This is the key right now

Recession is such an after thought to most in the mkt now. About 10% of investors think it is a possibility. I am not suggesting it is the base case. I would suggest if we are going to have a recession, we will see it in housing first. Keep an eye on this sector as we exit the spring season

This week we will continue to get earnings data and we will get ISM data. I show you below how housing (above), earnings and ISM are all inter-linked. There has been some unclear direction among the three so far this year. We will need to watch to see how this plays out this week.

Summary

Looking at the market, it often can be portrayed as something pretty simple. After all, Price = Earnings * P/E. All we need to do is forecast earnings, and forecast multiples to have a sense of what will happen. From a bottom-up perspective, we can see that we just went to the point where we started to get the next year’s numbers in consensus. You can see the gaps early each year where the estimate for earnings we focus on shift. You can see the resulting move in the forward P/E at these inflections. Right now, the forward earnings are $242 and the forward P/E is 21x to get us to the current price.

So let’s think first about earnings. It is easy to say that consensus is always too bullish. However, what we do see is that the drift in this forward number, whether up or down, is led by the ISM. In early 2020, we had our year ahead jump but as ISM collapsed, so did expectations. In early 2021, w had a jump and then a drift higher as the ISM accelerated all year. In 2022 and 2023, we had the big jump and then the drift lower as the ISM fell. Right now, the ISM has moved higher then last couple of months. If this continues, I would expect earnings to continue to drift higher. The economy leads earnings and earnings lead stocks. However, a slowdown in the economy, perhaps because of housing rolling over, or small caps continue to struggle, will hurt the ISM which will hurt forward earnings.

What about the multiple? The forward multiple is a measure of investor sentiment but also linked to the cost of capital. All of this is tied to the 10-year yield. I have the P/E inverted here to overlay vs. the 10-year. As we move higher in yields, the P/E will struggle even if earnings stay flat. If earnings stay $242 but the P/E falls to 18x, that puts us at 4350 in SPX which would be a 15% correction. If yields go to 5%, I do not think it is a stretch to think we see the forward multiple drop as such. Thus, we better hope that is coming because the economy is stronger than expected, and not for a myriad of other reasons.

It has been a crazy busy week for all of us. Next week looks set to be just as busy. It is too early to have a big call on what to expect from here, but I think my reaction function will come down to my expectation for forward earnings and my expectation for forward multiples, based on what I hear from companies, from the FOMC and from the market.

Stay Vigilant

The rotation into energy I thought was interesting. Any thoughts or commentary on natural gas?