With so much focus this past week on the FOMC and interest rates, I tried to spend some time identifying where there may be the best opportunities for indexes or sectors that are most-levered to interest rates. With a higher weight on financials. small caps certainly benefit more than large caps. In fact, there are a lot of reasons why small caps benefit more than large caps. However, if you look at a chart of both the e-mini S&P 500 futures and the Russell 2000 futures, one index looks to be in a healthy trend higher while the other appears to be struggling quite a bit.

However, things may be changing. I wrote about that on LinkedIn this week:

Chart of the Day - is it time again?

Long-time readers know that after the election, I asked in several posts if it was time to look at small caps. This index, this collection of stocks had lagged their larger cap brethren for over 4 years

That timing was not a coincidence. There is no doubt that small cap companies did not benefit and did not feel very optimistic under the Biden Administration. They struggled under the weight of much more regulation and much higher input costs, particularly labor

Since the Trump election, we have seen a massive shift in the optimism of small cap management teams. The Natl Federation of Independent Businesses has their optimism index which has risen since the election and has not been this high since ... Trump was president before

Back in late October/early November, we also had a Fed that had cut rates and was looking to cut more. A slightly more hawkish Fed squelched the small cap rally in December and the large caps took over again

Interestingly now, the risks seem to be more of a headwind to large caps if we are to believe the Deepseek news. That still has to play out and there has been quite a bit written about whether the risk is real, but are there more headwinds to large caps now?

The headlines from the FOMC yesterday say hawkish pause. The stories say Powell was dovish. More importantly to me, the futures have nudged rate cuts forward a bit

The white line is Russell vs. SPX, the blue line the NFIB but the orange line is the Fed Funds 1 year futures. Small caps need not just optimism but rate cuts in order to work on a relative basis here. Was yesterday a catalyst?

Earnings will have to come as well. Right now less than 20% of the index has reported and things are just meh. However, the combo of optimism and rate cuts can move the index before the earnings come. Just a question of whether the Fed will accommodate

What do you think?

Stay Vigilant

I wanted to dig a little deeper, though, because I know that a much higher percentage of small cap stocks fall into the ‘Zombie’ category than for other indexes:

Chart of the Day - zombies

Yesterday I asked the question of whether it was time to reconsider getting long small cap stocks. After all, optimism is improving. They just need a supportive rate environment

However, when I think of small caps, especially the Russell 2000, I also immediately think of my Zombie screen. That is because 15% of the R2k is consistently in the zombie category

Zombies are companies for whom their last 12 months EBITDA is less than the last 12 months interest expense i.e. companies that are not making enough to even pay off their debt expense. You know, kinda like the USA

Anyway, I like to use this measure of the walking dead, and their performance, as a way to gauge the the sentiment of the market. If these stocks are doing well in absolute or relative terms, investors are willing to take risks

They are willing to anticipate that either growth is strong enough to improve EBITDA sufficiently or that rates are coming down enough to lower interest expense or both

You can see the performance on the chart today. YTD this index is up 1.6%. On a 3 month basis it is up 6.2% and on a 1 year basis up 3.7%

That means that YTD it is lagging slightly behind the overall R2K index and SPX index. However, on a 3 month basis, the zombies are outperforming both the R2K and the SPX. On a 12 month basis, zombies are lagging quite badly

This suggests that the mood might be shifting over the last few months compared to the last year. Sure, they have lagged a little this month but there has been quite a bit of noise this month

I mentioned earnings will ultimately be the driver. If we look at the bottom up consensus, 10% earnings growth is expected in the SPX after earnings grew over 8% the past year

R2K earnings are expected to grow 26% this coming year which is a high bar. However, earnings were DOWN 22% in the past 12 months so it is coming off a base

We all know the best time to buy stocks are when things are bad but are starting to improve. This is particularly the case if sentiment is shifting and there is a catalyst. Is that the case in the small caps? In the zombies?

Stay Vigilant

Speaking of earnings, these are the expectations for the coming year or two. As I referenced above, the Russell earnings were -22% the past 12 months so are coming off of a lower base. The bar may seem high for this index, but if companies are able to achieve it, we can see looking out a year or two, the index looks pretty fairly valued for this level of interest rates.

The bar appears lower for the S&P 500, but this index, primarily driven by a few names, has also delivered high single digit/low double-digit earnings the past couple years. The multiples we see for the S&P 500 reflect this, and interestingly we see the S&P 500 trading at a P/E premium to the Russell 2000, which is not the common case for the last 25 years.

Looking at the earnings season so far, companies are delivering in-line earnings. Small cap Industrial companies are really leading the pack on a sector basis. Looking at the bottom of the chart, we see two things. On the bottom right, we can see that the reaction to these in-line numbers is not positive at all, thus the story from management still doesn’t sound as optimistic as we might expect with the NFIB number. The lower left suggests why this may be the case. It shows how earnings have been coming in the last several quarters, which has been consistently negative. Thus, the skepticism of fund managers is to be understood. What could potentially drive a change in sentiment in these stocks?

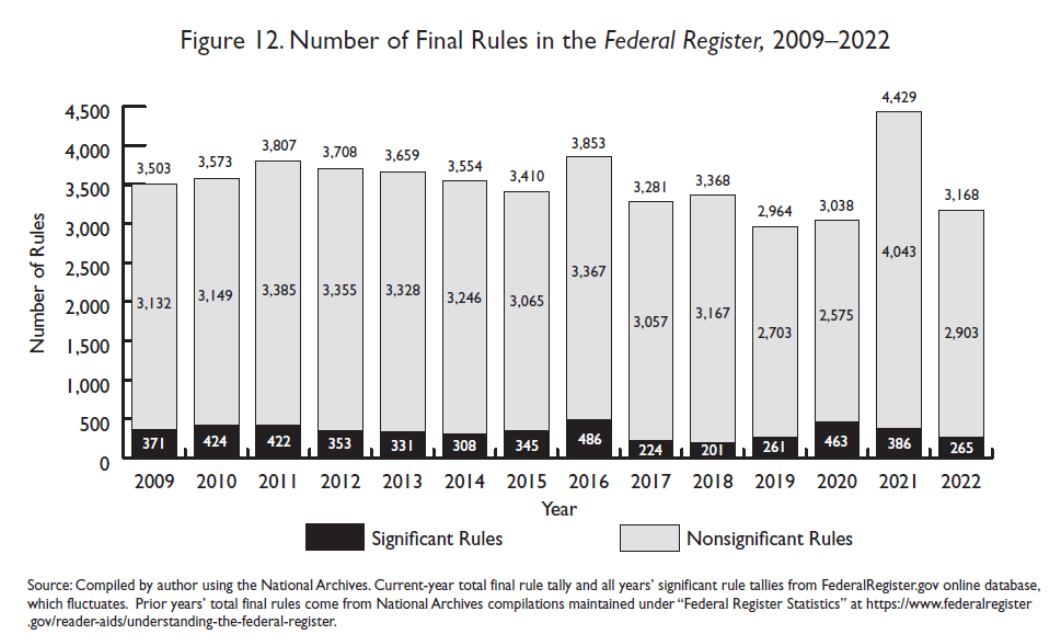

Perhaps it could be falling regulations. That has been the mantra from the new Administration, perhaps because they have listened to their base and understand that regulations have been consistently rising and squelching the productivity and profits of small businesses more than large businesses which have the infrastructure to deal with it. The chart above shows how US companies are having to face a regulatory environment that has increasingly gotten more and more difficult. In the last 50 years, there has been almost a doubling of the number of pages of regulations. Reversing this trend could potentially unlock quite a bit of productivity. I think about the financial services industry alone, where in the last 15 years, the growth in headcount has been in regulatory and compliance roles and not in front-office income or alpha producing roles. We know how that has impacted profitability. Should we be surprised the rest of the economy is doing the same?

The hope is that the Trump Administration changes this path. There are some signs this was the case over his previous four years, though when Covid hit, trends did reverse somewhat. This data only goes to 2022, but we can see under Biden, with both Covid rules early, but then environmental rules later, the pace of significant rule changes went back to what it was like in the Obama years, a time when small cap names struggled. Lessening the regulatory burden is a catalyst for small caps.

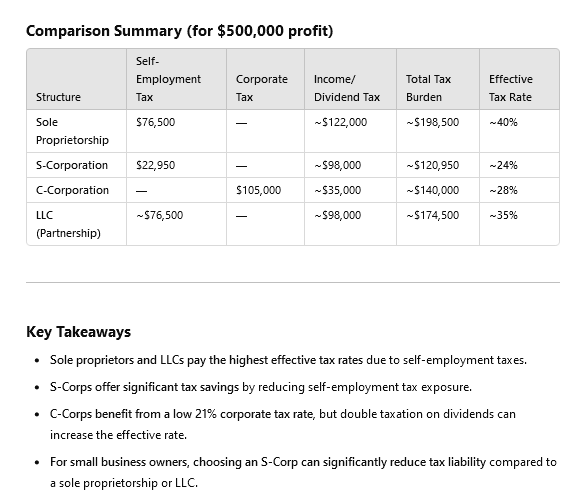

Taxes are another burden that impacts small companies more than large. The Tax Cuts and Jobs Act expires this year, and it is a top priority of the new administration, though many in the GOP may force it to ‘pay for it’ and eliminating the Inflation Reduction Act will not pay for all of it. Thus, DOGE can play a big part. While many on the left believe that this is unfair that corporates pay such a low rate, and Kamala campaigned on raising the tax rates on companies, the US has only an average tax rate when looking around the world. There are many places, primarily in Asia, with lower rates. This gives large cap companies that can allocate costs to manufacturing in Asia an advantage when it comes to tax. Maintaining the rates in the TCJA is another positive catalyst for small caps.

How and why do small caps pay a higher rate than large caps? I asked Chat GPT for a summary of this which you see above. Given many small cap companies are 1-5 person companies set up as an LLC where income flows through to personal taxes, the reality is individual rates matter a lot too. However, as you see, the effective tax rates for those business structures are quite high compared to the tax rates you will see the Mag 7 reporting last week and this coming week.

May be too early, and the technical charts tell us it is, to buy small cap stocks. However, as I look at the horizon, there are many potential catalysts that can potentially get the tide to turn. When it does, this could be a multi-year trade, and not a 1-2 month trade, which is why I have this on my horizon.

As Ant-man says, 2025 may be time to “look out for the little guy!”

Stay Vigilant