Looking at the three body problem in unison

Yes, oversold conditions and extreme bearishness is leading to a bounce, but the trends still suggest we sell the rallies

The last few weeks I have embarked on showing you the three stages to my investment process - the three body problem - in which I look at the Fundamental and Behavioral drivers of the financial markets and what Catalysts may be out there to change investors minds.

In order to remind you of the summary, let's go quickly back through the data.

Fundamentals:

The economy matters. It matters for jobs, it matters for consumption, it even matters for politicians. However, it especially matters for risky assets. The economy drives earnings and earnings drive stocks. Yes, there are times (not now) when multiples expand in anticipation of good growth, and there are times when they contract in anticipation of slower growth. However, over the long haul, earnings drive stocks.

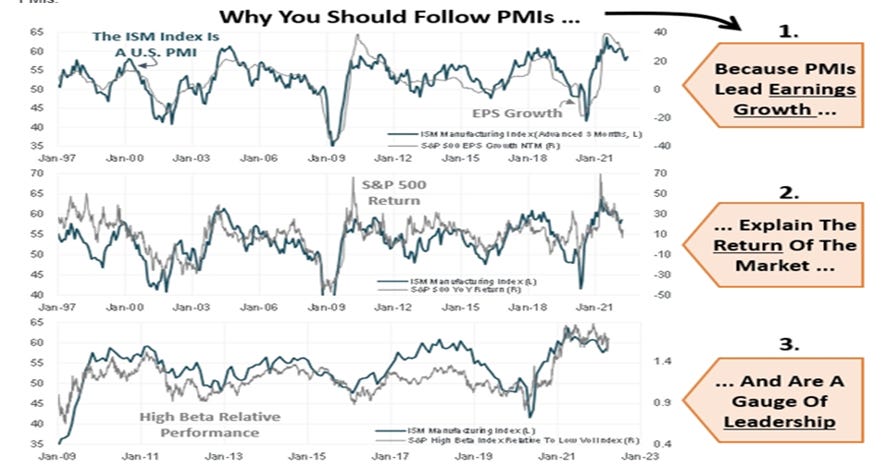

Take this series of graphs from Piper:

If I put it another way, we can look at the total GDP of the US and compare to the relative performance of stocks vs. bonds:

The punchline is that we must anticipate the direction of the economy. A few weeks ago when I wrote about the Fundamentals, I said the trend is negative. Over those last few weeks, we have gotten a number of positive data points: non-farm payrolls, housing starts, building permits and Markit PMI have all come in better than expected and suggest the economy is still in good shape. How long can this continue especially with prices continuing to move higher for all goods and the Fed taking away the easy money? This is ultimately the question. The regional Fed surveys have pointed to lower levels. The ratio of new orders to inventories point to lower levels. The key question for investors is not whether the economy will slow or not, really, but whether it will tip into recession. Why? This is the performance of the stock market when the ISM is rising or falling, above or below the 50 level (indicative of recession):

As a fund manager, you just need to be sure you are out of the market when the economy is falling into recession. This is the key to watch this year. For my money, given the problems caused by the war in Ukraine, the materially higher inflation in all goods and services, and the tightening policies of not just the Fed but all central banks, the Fundamental trend is still negative.

Behavioral:

Yes, the trend is negative. However, what if everyone knows that and everyone already sees it that way? Can you make money if you are solidly in consensus? It is more difficult. This is why I look at the behavioral drivers of risk, the near term supply and demand, to see what impact this has on the markets.

Using the BAML global fund manager survey as the basis this month, as it is the gold standard of surveys for the market, we see that while the trends are still negative, consensus is solidly aligned with that view:

This is the percent of investors that view the economy as late-cycle i.e. a recession is imminent:

Said another way, this is the view that growth will slow:

As a result, the positioning in cash is not only high, but also triggering their contrarian bull signal:

This was echoed by the CNN Fear and Greed Index which a month ago was in extreme fear but has backed off that since, given the move higher in the market:

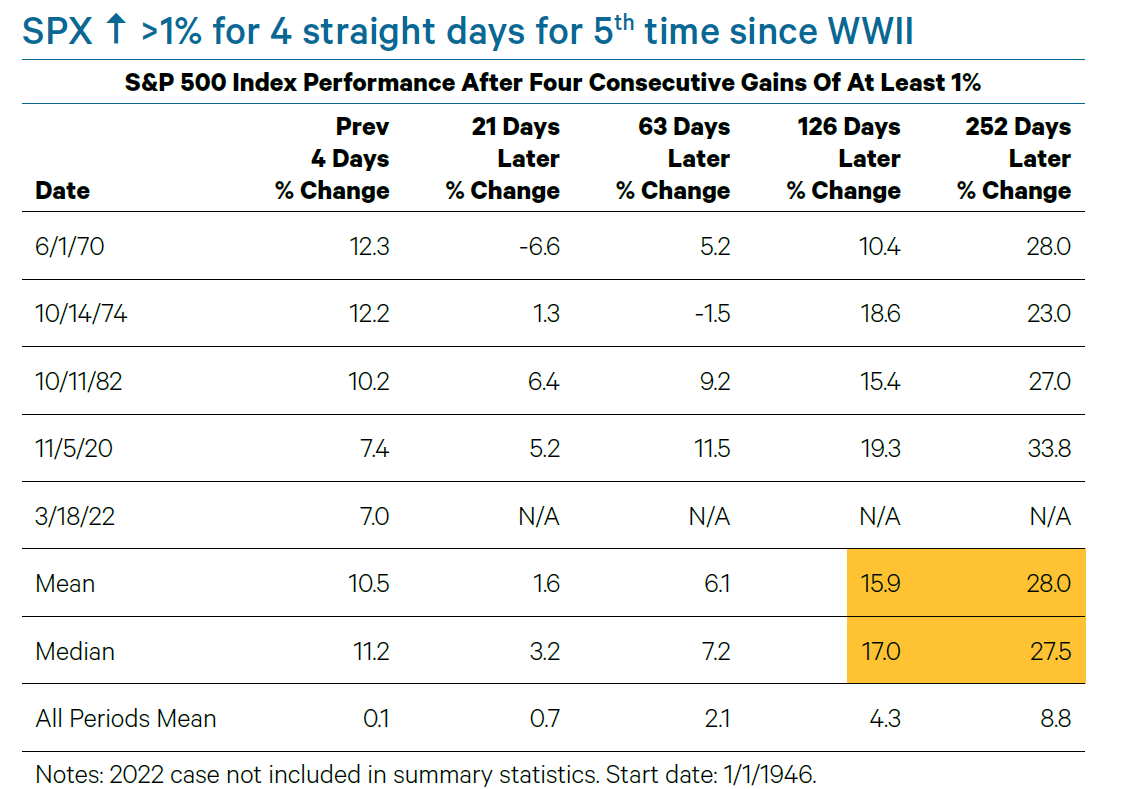

Ned Davis showed a breadth indicator that suggests this powerful rally we have seen from the oversold lows could portend some higher prices in the near term as well:

I had shown the Put-Call ratio and VIX curve indicators a couple weeks ago. Both were, and still are, pointing to higher prices in the near term. With a month-end and quarter-end next week, positioning is the key issue to watch. As such, all of these behavioral measures suggest that investors had gotten a bit too bearish and that is why we are seeing higher prices. This could continue in the near term and we need to look from here when they get over-extended. For now, the Behavioral section is Positive, and this serves to neutralize the negative Fundamental trend.

Catalyst:

The last section is the catalysts. I look at three categories - earnings surprise, economic surprise and geopolitical risk.

I am going to work in reverse order. In no way can we suggest that geopolitical risk is anything other than negative and rising. The war in Ukraine is horrible and the fact it is getting bogged down gives one chills to think what a Putin painted into a corner might do. The impact on prices in energy and food is already being felt and this will impact the poorest among us. With income inequality objectively at extreme levels in most, if not all countries, this is kindling in search of a match and that match might have just been struck. The Arab Spring in 2014 started when there was a Russian drought affecting food prices. This is even worse.

On a slightly positive note, the economic surprise data globally has been positive. Yes, trends are negative in the economy, but at the margin, the data has come in better than expected which has led to the rally in risk. I am not sure this offsets the negative of higher geopolitical risk, but it does soften the blow somewhat:

Finally, I consider earnings surprises. Earnings will not begin again in earnest for a few more weeks. Last quarters earnings surprise data is old news right now. However, thanks to a reader - Mr. Blonde - we have the Citi earnings revision indicator which measures analyst upgrades vs. downgrades. This can give us an idea of what to expect. The picture is not positive at all.

For this category, I would paint the catalysts as negative overall. Any positive on economic surprises is being offset by the earnings revisions. Ultimately though, the first major land war in Europe in 80 years is the biggest story and one we cannot ignore.

So Fundamentals = negative, Behavioral = positive, Catalyst = negative. Overall, this gets me to still lean more negative on risk. Given we are at the end of a month and quarter, and positioning is a major driver of moves in this type of market, I might put a slightly higher weight on the Behavioral for now. However, I still view this as a ‘sell-the-rally’ market and one where you should look for levels to exit risk and not enter risk. If the facts change, I will change my mind, for now though …

Stay Vigilant