All of my kids came home from their various locations around the US for a very fun-filled Thanksgiving and early Christmas celebration. From the exciting meal preparation to bowling with extended family to the Illinois football game, we had a great time, even when the wind chill was close to 0 degrees Fahrenheit. That is what the holiday season is all about after all, spending time with family and friends and being grateful that we are able to find these ways to have fun.

The stock market has been having some fun of late too. It began as a post-election rally, and now it is turning into a full-fledged seasonal rally. Thus, it should probably not be too surprising that small caps are leading the way. This has been my focus even leading up to the election, and so far, it has proven fortuitous timing to say the least:

While November is often a good time for small caps, this year’s double-digit performance is bringing back memories of the end to the year in 2023, when the Russell ripped higher. Is this a similar, short-covering-led rally that ultimately proved unsustainable as January rolled around? There are reasons to think the market, at least, feels this is a bit more sustainable. There has been a pro-cyclical shift in market thinking, looking for a re-acceleration of growth in the coming year:

That consumer discretionary performance may look surprising to those who have seen the headlines on companies such as Target or Kohl’s or Best Buy. However, the performance was driven by Tesla for obvious reasons, but also the travel websites and cruise lines. In fact, consumer sentiment has been rising too. Nancy Lazar and team at Piper Sandler do excellent work on the consumer, and right now all of the news looks quite positive, just at the right time of the year:

Are consumers breaking out to the upside here? The Conference Board measure tends to be more impacted by the labor market than inflation. The University of Michigan consumer sentiment number is more impacted by inflation. It has also risen but not quite as much. Perhaps this is something the Fed needs to take into account.

Are the markets good at anticipating the economy though? There is no one sector that always leads, probably because the nature of economic strength will look different cycle to cycle. Here I look at outperformance of Industrials (XLI), Consumer Discretionary (XLY) and Financials (XLF) vs. the ISM number. Industrials led back in 2016. Consumer stocks led in 2020. This time Industrials and Financials are leading the way. Is this pointing to a higher ISM in 2025?

Back to Nancy and team. They see a turn higher in the ISM next year using a model that has rates globally primarily. Looking at the ratio of new orders to inventories as well as the regional Fed surveys, there is reason for optimism into next year, even if the housing market has not been as robust as many were hoping for. The housing market seems plagued more by a lack of inventory than price. I can tell you I have listed rental properties in the last couple of months and both were gone in a day at prices that well exceed the past couple of years. Even with affordability to poor, houses are moving.

This global rate story is a powerful potential driver. This is a big reason I like small caps. They all definitely benefit from a lower cost of capital more so than the large caps which have been benefitting from their larger cash balances of late. It isn’t just the Fed in a cutting cycle. Michael Hartnett at BAML has some great charts that highlight the major global rate impulse that is potentially driving markets. The left chart shows how many rate cuts have happened in 2024 and are expected in 2025. On the right, we can see that by the end of the year, the global policy rate is expected to fall by another 100 bps, which will only help to further support ISM and the pro-cyclical move.

If we are seeing a pro-cyclical move impacting sectors like Industrials (XLI) and small caps relative to large caps (RTY vs. SPX), what is missing? What has been left behind in this rally is Emerging Market stocks relative to the US. This is being driven by a move higher in the Dollar and the expectation that the Trump Administration will have an America First policy complete with tariffs on all of its trading partners. This makes sense to be sure. However, if China and Japan are trying to stimulate their domestic economies, does this have some positive potential for EM stocks?

It is definitely contrarian to think that stocks outside the US can do well vis a vis the US. I showed one of these charts last week, but you can see at this point, the expectation and reality of Europe vs. the US is some of the worst on record. The reality is not that great, particularly when we look at the current problems in France. When is this priced in? What is the catalyst?

One thing I learned in trading Emerging Markets back in the 90s, when crises were quite common, is that Emerging Market stocks, bonds and FX are all highly correlated. EM bonds, FX hedged, have been crushing US bonds. In addition, EM countries have built up massive FX reserves. This has tended to be positive for EMFX and EM stocks. So far, the expectation is all quite negative, because of tariffs primarily. The market is not irrational, but even the absence of a negative could be quite positive for EM stocks. Chinese stimulus could also be quite the catalyst.

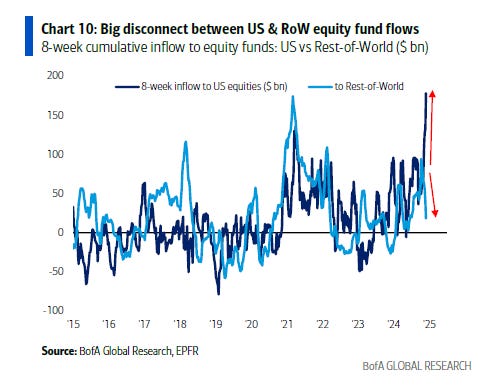

Back to Hartnett. I tell you, thinking outside the US is incredibly contrarian. Look at the 8-week cumulative flow. It is almost entirely into the US with almost nothing into the rest of world. Again, it is difficult to make a huge positive case because of problems overseas, however, the rest of the world is cutting (and expected to continue to cut) more than the US. Fiscal spending is expected to pick up in China and expected to be cut in the US. And no one, no one, thinks the rest of the world can outperform the US.

So many exciting things to consider as we move into 2025. For now, though, investors are focused on ending a great year in positive fashion. Markets tend to get less and less liquid as portfolio managers try not to mess up their bonus. As Billy Ray Valentine would tell us, they want to be able to buy the GI Joe with a kung fu grip. (Look it up if you don’t get the reference, it is a must-watch movie on markets).

For now, let’s all focus on celebrating a great 2024. Returns like this are very rare in markets believe it or not. Let’s make sure to give thanks, use our good fortune to help those who need it, and celebrate with family and friends.

Oh, what fun indeed!

Stay Vigilant