Predicting the weather when the winds are shifting

Pulling together the three pillars of the process to gauge the pulse of risky assets for the coming month

The last three weeks I have gone through my three pillars of the investment process, which I refer to as the three body problem of the markets. As I went through each piece I came to the conclusion that it was negative for risky assets. I want to go back through each with one or two charts to remind us.

Before I do, I want to include my comments from LinkedIn today because I think they summarize well the debate that we are seeing play out in the market right now.

To wit: There is a chance of tornadoes. In the Midwest, in the Spring, we know there are chances of tornadoes because the dominant wind pattern goes from the cold, dry air from Canada to the warm, moist air from the Gulf of Mexico. When the warm, moist air is lower near the ground & it swirls with the cool dry air above, the conditions for a tornado appear.

We may be seeing that in the markets right now. The cool, dry air that has been with the markets all year long, providing a chill that has lasted longer than normal, is the macro headwinds the market is facing. The combination of central bank hawkishness, war in Europe, & rising costs for basic needs for people globally has put a chill on the appetite for risk-taking.

The warm, moist air we are feeling, that tells us maybe the worst is behind us and we can look forward to golf season in the mkts are the earnings coming through better than expected. The economy drives earnings & earnings drive stocks. We are about 20% thru earnings season & companies in every sector have reported. In aggregate, earnings are better than expected, telling us better times could be ahead.

However, we are at that point where the air could be mixing, meaning the conditions are ripe for a tornado. The chart today shows a measure for risk in major asset classes - implied volatility. The risk in 'macro' assets of foreign exchange (purple) & US Treasuries (white) is moving higher, telling the mkts that we are not out of the woods yet. There are still problems. There is still a war in Europe, & both the 10yr bond & Japanese Yen have broken out of 35 year channels, moving into parts unknown. This is all potentially destabilizing. The risk in 'idiosyncratic' asset classes of equities (blue) & credit (orange) are back to the lows, telling us it is time to put away that winter gear & enjoy what is ahead.

I discussed this before class with a student yesterday using Tesla as an example. Earnings were terrific (even bears must admit) overcoming fears of China lockdowns etc. However, Tesla also traded at 200 P/E which means it is heavily influenced by changing discount rates. Investors battled all day with these mixing forces as the stock opened 10% higher on eps, but then sold off all day on the 10yr getting near 3%, closing on the lows. Tesla investors feel like I do as I head out to play golf - thought we were all clear but now not so sure.

In the Midwest we prepare for a tornado by heading to the basement. In the mkts we prepare by adding convexity to the portfolio. However you choose to do it, we have to acknowledge the conditions are ripe.

Right now on the Fundamental side there is a debate on growth and inflation. This debate is critical in the US because the Federal Reserve has a dual mandate - full employment and stable prices. Right now, there aren’t too many people who feel prices are stable. In fact, whether you choose to look at CPI, PPI or PCE (as the Fed does), measures of inflation are well above the highest levels of this century and at the highest levels since the 1970s. However, there are some signs this could come lower, which is the base case of Jay Powell and the doves at the Fed. If you look at the blue line, it is the yoy change of the CRB Raw Industrials Index or the price of commodities that are not traded on exchanges and therefore subject to speculation. This measure has moved lower on a yoy basis for several months. The idea here is that growth in the economy will slow which will pull down inflation with it:

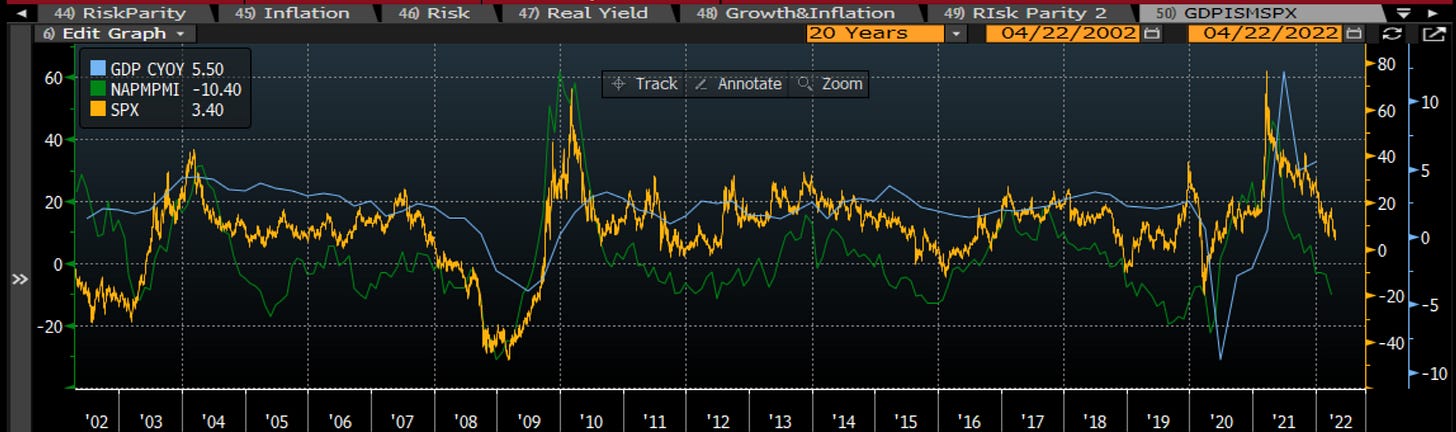

In fact, if we look at the US ISM changes yoy, they have moved negative. Historically ISM is coincident with changes in stock prices and both lead changes in GDP. This suggests growth and stocks could continue to head lower:

This all sounds fine right? Growth moving lower and taking particularly aggressive Fed rate hikes out of play. The problem is, of course, that Fed-engineered soft-landings are not that common. In fact, in 11 of the 14 Fed rate hike cycles, a recession has ensued:

As I have shown before, the economy leads earnings whether those earnings are for S&P 500 companies or for economy-wide profits:

So we are back to those shifting winds - how much will a slowing economy impact earnings (negative) and keep the Fed at bay (positive)? If the economy remains strong and earnings come through (positive), how aggressive does the Fed hacve to be in order to stabilize prices (negative)? It is a high-wire balancing act and the odds of success are not that high. We should expect volatility.

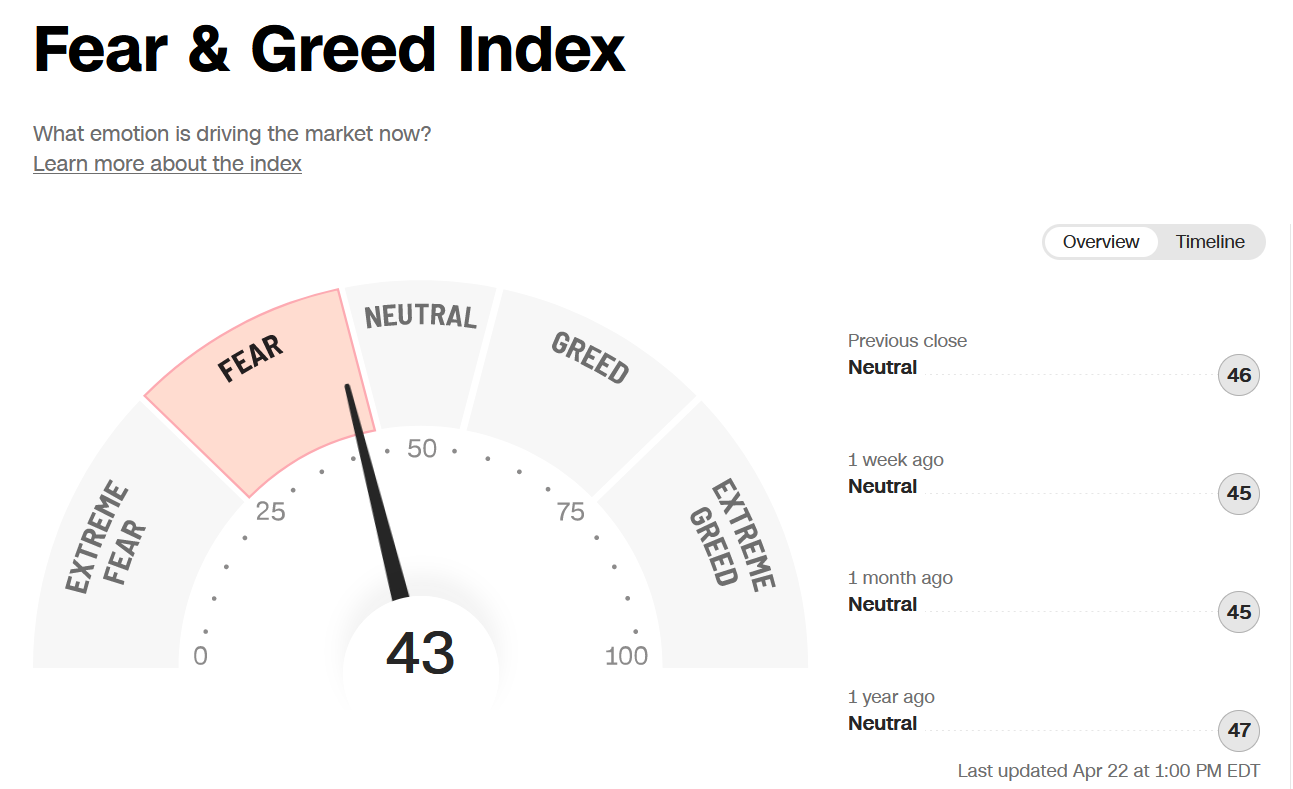

This volatility will be exacerbated by the changing sentiment in the market. I try to summarize these in the behavioral write-ups. However, to put a few examples of the measures of sentiment, I show you that if you feel this environment feels pretty scary, you are not alone:

CNN Fear & Greed Index:

The number of bulls as measure by the American Association of Individual Investors is at lows only seen in times like the 1987 crash:

However, while people say they are not very bullish, we had seen hedges generally unwound since the war in Ukraine, which was a driver of the move higher in stocks:

As I showed above, measures of risk such as credit spreads and the VIX were suggesting things were fine. However, lately, the VIX futures curve has started to flatten which is not a good sign:

As we discussed last week, what are the catalysts to get people to change their minds? What will turn the bears into bulls or vice versa? The geopolitical situation is clearly negative and does not look to be changing anytime soon. However, the market can become someone immune to events there. Unless there is an escalation, continued suffering becomes less of a driver of opinion near term. On the other hand, economic and earnings surprises can change opinions.

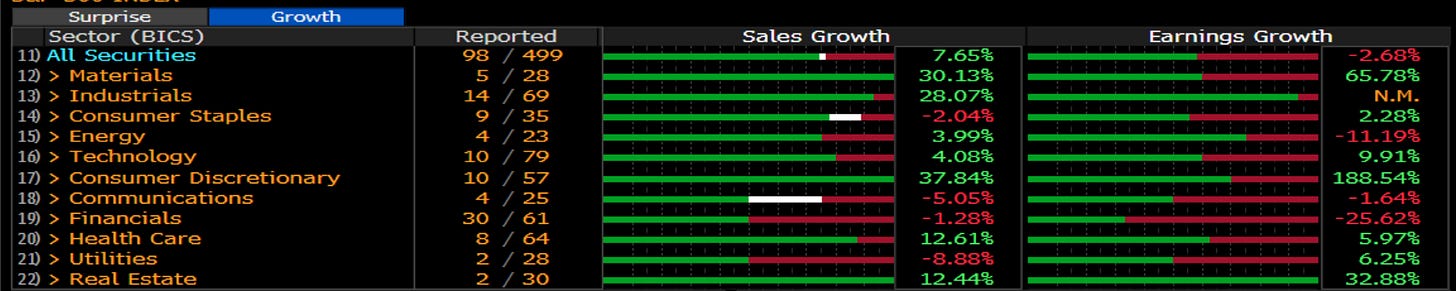

We are about 20% through earnings in the US. Earnings are better than expected; however, they are beating at a lower rate than usual and the commentary must not be that positive on the calls because the stocks are not reacting well. Admittedly, I haven’t listened to the calls myself. I am judging this based on reactions. I am endeavoring to find some NLP technology to help me assess. However, until then, I don’t think I am too far off:

I also think it has to do with the absolute earnings growth being negative. Yes, better than expected, but not positive in absolute terms:

Global economic surprises are holding firm, which is a positive sign:

But that also means the inflation surprises are staying firm:

Which means the number of hikes priced into the US short-term bond market is now close to 12 (25 bp) hikes:

Pulling this all together, it is always difficult to predict the weather, particularly when the seasons are changing. The seasons may very well be changing now. This means we are going to have some nice days and some not-so-nice days. It also means we are going to have days that are ripe for tornadoes. For me, the balance of the evidence is negative for risky assets. I think we will see the lows again before the summer. However, I also know that I am best served at times like this by adding convexity into my portfolio. Expressing long ideas via call options or looking to collar off my core positions. If I am short, I might add 1 by 2 ratio put spreads to lever ideas on the downside. The analogy I use in class is we never know when a forest fire will start. We do not know when a spark from a gender-reveal party will burn down half of California. However, we do know when the conditions are ripe for a forest fire. We can tell when there has been a drought and when there has been bad forest management. Whether it is a tornado or a forest fire, we need to seek shelter and safety. For portfolios this means looking to the derivative market for help in times like this.

Stay Vigilant