Promises, promises, promises

There have been a number of broken promises in D.C. that are starting to have an impact on markets. Let's look at a few

There have been a number of news stories, podcasts, research reports and blogs I have come across lately that have highlighted the broken promises of our officials in D.C. Of course, this is nothing new. Politicians have rarely kept their promises. However, I don’t know if it has ever been so brazened which is particularly surprising given how easy it is to search on what was said or promised, and how that hypocrisy is so blatant.

Normally I would chalk it up to politics and let it go. However, increasingly, these broken promises are starting to have an impact on markets, and this gets me much more interested.

This week I am going to go through the few that I have come across. I encourage you to share with me any others you have found (particularly if you see this same thing happening in Europe or Asia where I am not as close to the situation). I would also encourage you to like/share/subscribe as you see fit.

The first case of this surrounds the historic ouster of Kevin McCarthy as Speaker of the House in the U.S. Speaker McCarthy recently stuck with D.C. custom and passed a continuing resolution giving Congress 45 more days to pass the debt ceiling bill. This should not be a big deal, right? I think this was the 47th continuing resolution since the fiscal year was changed in 1997. This is why the Speaker pronounced himself the ‘adult in the room’ in doing just this.

However, if we go back to the deal that Speaker McCarthy struck with the Freedom Caucus back in February to become Speaker, we can start to see a problem. According to the L.A. Times, one provision of the deal was to make new spending easier to block:

So now we start to see the problem. The Speaker had told the Freedom Caucus and other members of the G.O.P. that there would be a line-by-line discussion on spending in appropriations so that the members could vote up or down on the individual spending the government is doing. The debt ceiling deal back on Memorial Day had already breached this trust and began the shaky ground on which he treads. The Freedom Caucus felt betrayed. This CR was the final straw. Thus, we should not have been surprised that 8 or 10 members of the House took the action they did.

More importantly, this should give us an idea of how the next 4-5 weeks are going to play out, with a relatively powerless interim Speaker, who will now want to go line by line in approving government spending. This puts the debt ceiling raise into more doubt than otherwise in my opinion. Perhaps this is what other investors are thinking as well.

That may be why the bond market is starting to become unglued. At first it was in the 10-year bond, which some could blame on hedge funds getting short or the Fed continuing with quantitative tightening. However, if we look at the 30-year, where a lot of the trading and central bank machinations are factored out, and real money plays a bigger role, we can see that yields are breaking out. In fact, if I showed you this chart without labels, you would say this is an asset you want to buy. It looks like it is breaking out of a consolidating range and all of the moving averages are turning higher. The problem is, 30-year yields breaking out is NOT a bullish development for just about any asset class.

Stepping back, this move higher is part of a much larger, longer term move where yields have broken out of a 40-year downtrend. In fact, I dare say that anyone actively investing now has spent their entire investing career in a bond bull market, with lower and lower yields and the tailwind that has been for risky assets and the economy.

This looks set to change. Yields have broken out decisively, and if I only looked at this technically, could stabilize in the 6-8% range over the next 10 years. I know that is anathema to say to many who see the negative demographics in the West and think that yields must go back lower. However, I think it is a possibility that we must consider.

In fact, I had this discussion of a multi-year bond bear market with Mike, who’s industry may be negatively impacted by such a move. These were my thoughts to him, I wonder what you think about this:

“I totally hear you that a 20-year bear market (in bonds) would suck. I just think that we have too much debt in the government. There are 3 ways out - restructure it (not going to happen, we saw that in Illinois and it is even harder at Federal level), default (gosh I hope not, seems when we get to the debt ceiling people agree this is not a good option), or inflate our way out of it. This is the easiest way. However, this means structurally higher rates.

I bought a house with an 8% handle mortgage. My parents did with a double-digit mortgage. Problem is, prices need to adjust. That is ironically less of a problem in Illinois than it is on the coasts or in Florida and Arizona given the price disparity.”

We went on to discuss whether people are doing well or not right now. I continue to hear very mixed stories on this, and I think a lot of this has to do with where people fit demographically. Boomers and retirees seem much more upbeat to me. I heard from some just this week of how they are happy to roll their holdings at Treasury Direct and lock in these rates. Millennials who can’t buy a house or Gen Z who can’t get a job, seem much more downbeat. I continued:

“On whether people are doing well or not, I totally agree. I think it is generational. I think Boomers are doing okay. Their house price has gone up and they are now earning 5% on their savings. For a Boomer with $1mm that’s another 50k to spend. For Millennials trying to start and raise a family, buy a house, in their prime spending years, they are getting screwed and feel it is my guess.”

Thus, I think the debt ceiling debate, coupled with investor concerns over whether there is any leadership in the US right now, is becoming a major issue for the US economy, potentially even fracturing the population among generational lines, where higher yields are helping some (the savers) and hurting others (those forming households and in the higher spending years of their lives).

Continuing on with the dysfunction in D.C. (which increasingly seems to fit the moniker of Dysfunctional City), failure to keep promises is one of the rare bi-partisan actions we see. Trying to sneak it through without a lot of media attention, President Biden signed an Executive Order extending the southern border wall that was famously started by President Trump:

Well, not all of the media outlets ignored this. As I read in GZero Media’s “What Actually Mattered This Week”, this was a major broken promise by President Biden:

Ironically, if you follow the writings/videos of folks like Ian Bremmer, George Friedman and Peter Zeihan, geopolitical experts that know a lot more about this than I, President Biden’s foreign policy has, for the most part, continued most of the policies of the Trump administration.

However, there are differences in the domestic policy. In fact, this leads to another broken promise if you will. As part of the debt ceiling deal back in May, President Biden agreed with Speaker McCarthy that student loan repayments would begin on October 1. The Biden policy of student loan forgiveness would play out in the courts, namely the Supreme Court now. However, in the interim, people would have to begin to repay these loans. This is thought to be a negative potential catalyst for the economy (again hurting Millenials and Gen Z). However, just a few days ago, President Biden opened the Pandora’s Box again, this time forgiving loans for lower income Americans. One can only imagine as we go into an election year, he will push the envelope more on this topic:

This all leads to the concern that the Biden Administration is quite happy to use the purse strings for political ends. This riles the GOP but also makes Chairman Powell’s job a lot harder. The big increase in the deficit was during Covid in 2020. However, in 2021, we got the American Rescue Act. That was followed by the ironically or simply poorly named Inflation Reduction Act. Throw in the CHIPS Act, student loan forgiveness, border walls etc and we see deficit spending that is not only pro-cyclical but also at a level higher than we saw during the Great Financial Crisis. We wonder why the economy has been stronger than expected?

If we normalize this and consider as a percent of GDP, it isn’t quite at Great Financial Crisis levels, but it is close, it is set to grow, and most importantly, it is being done at a time when the economy is already thought to be reasonably healthy. Thus, we get the notions of soft landing or even no landing.

Speaking of that, the inimitable David Rosenberg highlighted in his writings this week, another broken promise, this time from Chairman Jay Powell. At the end of last month, Chairman Powell said:

No big deal right? Well, it isn’t unless you had said quite the opposite just at the end of last year:

Somehow, we have gone from ‘we have no idea if we will have a recession or how deep’ to ‘I always thought a soft landing was possible’. Chairman Powell sounds no different at all than most of the portfolio managers, strategists and economists who were thinking a recession would happen this year and now think we can avoid it. This, in spite of hundreds of PhDs with several hundred econometric models filled with the best data one can get. All of that, and his views are really not that different.

Perhaps, this is why the Fed always seems to hike until it breaks something. All along, I have felt a soft landing was a possibility, just incredibly unlikely. Dave Rosenberg points out the odds of a soft landing:

So, it could happen in theory. In fact, it may happen. However, it probably should not be our base case. This is particularly true because this hiking cycle has been the most aggressive in modern times (again from Rosenberg):

Perhaps it is due to this optimism, and some better-than-expected data, why the market has started to ever-so-slightly shift its opinion on whether the FOMC hikes in November (from the CME Fed Watch Tool):

Couple all of this together. We have larger and growing deficits with an Administration bent on spending more. We have a debt ceiling deadline coming up with a Caucus in charge that wants to go through spending on a line-by-line basis. We have bond yields breaking out of a 40-year channel and looking to be the beginning of a longer-term bear market. We have a Fed Chair that thinks a soft landing is possible now, which may impact whether the Fed still has another hike in it this year.

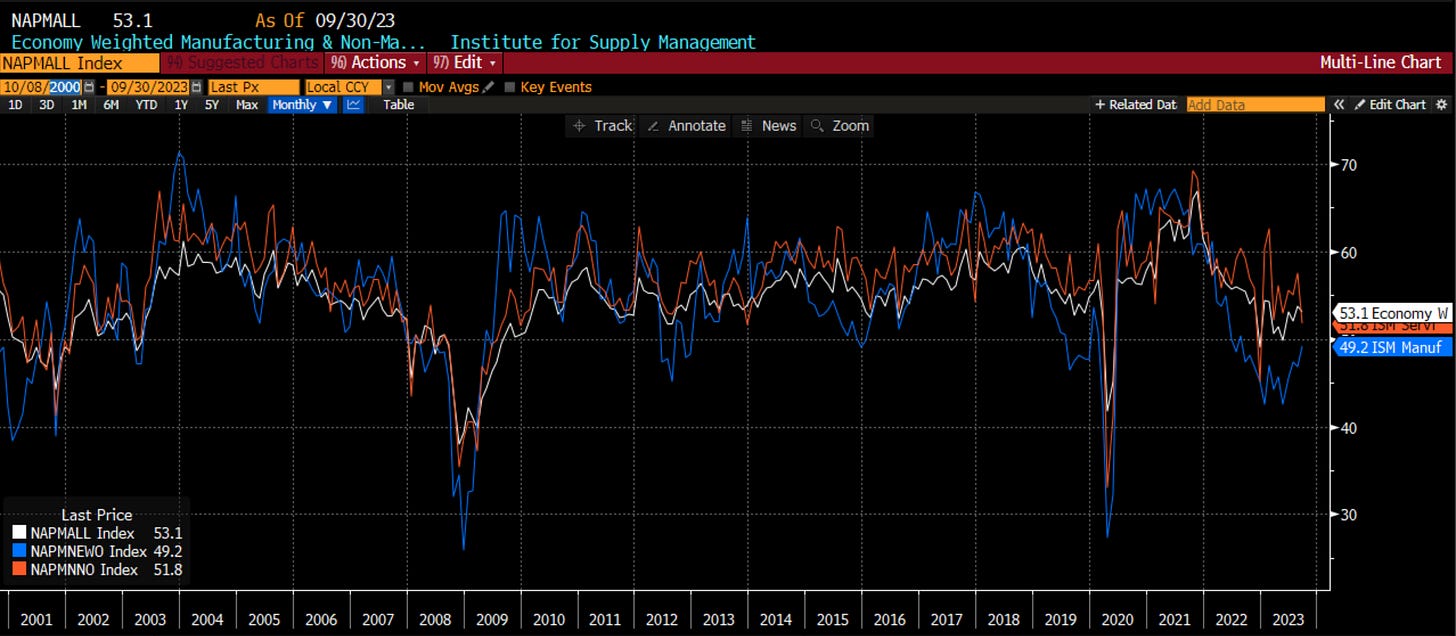

I want to end with a quick look at the data that has come out in the last week. While on the surface, it has been better than expected, there are some signs that all may not be optimal. Take for example the ISM. Readers know I favor the ISM and I tend to focus on the ISM Manufacturing because there is a larger multiplier on manufacturing than services. This week we got the services number, and this allowed for the combination of manufacturing and services into the ISM All Index. It also continues to move higher and is clocking in at 49.2, just shy of the 50 level of expansion or contraction.

Readers also know that I like to look at new orders, or new orders to inventories, as an indicator that leads the headline index. Manufacturing new orders in white have continued to slowly tick up. However, this week, we saw a big drop in services new orders. While this series is more volatile, it is something we want to take note of. This goes back to my discussion about who is doing well and who isn’t in the economy. Millennials are in the household formation phase of their lives. They need to buy ‘stuff’ however, they are not feeling as strong right now. Services have carried us because Boomers who are flush with more cash, are going to restaurants, traveling, staying in hotels. We have seen a downtick in these services. While it is still to early to call this a turn, it is worth noting and keeping an eye on.

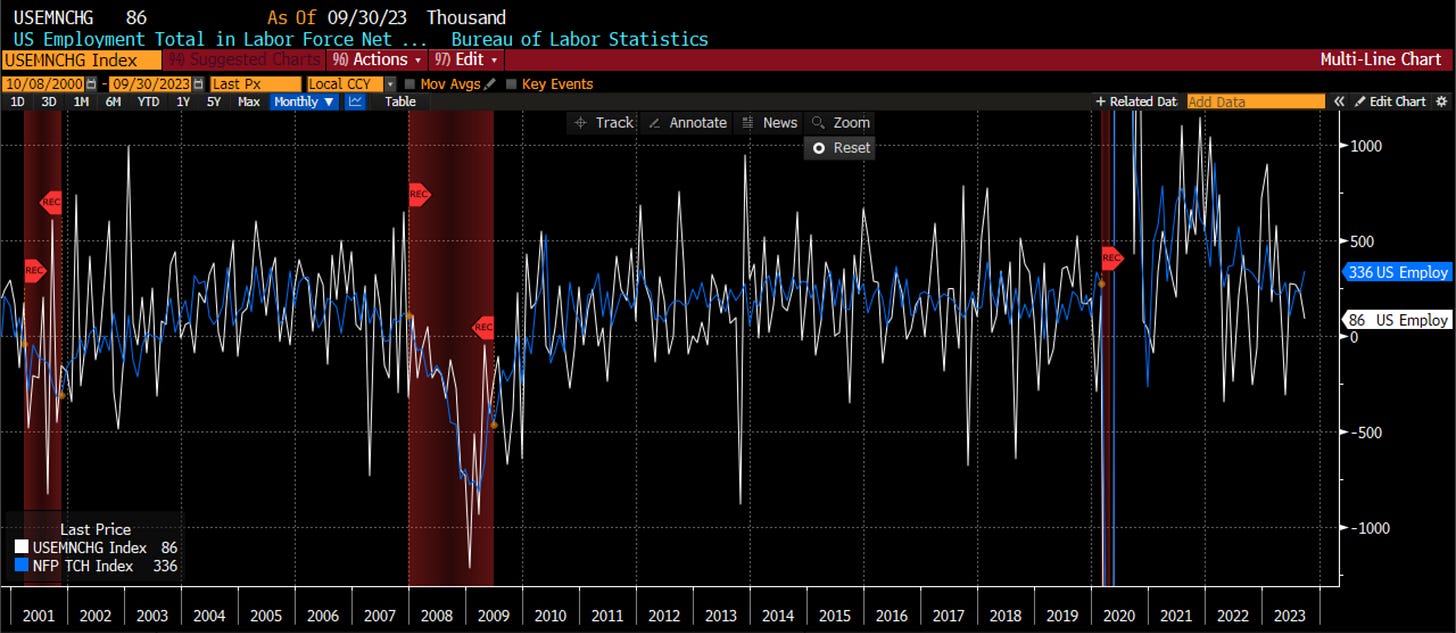

Briefly on the jobs number from Friday. Readers know my disdain for the non-farm payroll report. It is lagging data which is then subject to revisions for the next 3 months. From a market standpoint, it is really quite useless. However, one must acknowledge that journalists, pundits, politicians and the like myopically focus on this number. Thus, it has the ability to move markets in the very short-term. Personally, I do not get caught up in it simply because we have SO MANY other measures of jobs that combined give us a pretty healthy look at what is happening. On this front, even ahead of the number, I could look at an expanding ISM employment (both services & manufacturing) and a historically strong jobless claim number and tell you that the weaker ADP number which came out this week was not capturing all of the dynamics. The job market appears to still be healthy (further strengthening the case for an FOMC hike imho).

Not all is terrific though. Within the NFP number there were a few signs of weakness. First of all, almost all of the gains came from the government and not from the private sector. Within the private sector, the gains were from healthcare and education while the discretionary jobs in the private sector shrank. Finally, of the job gains we had, the bulk were in part-time work. This actually can be corroborated by the ADP and jobless claims data seeing a different picture. People may not be employed as much at Fortune 500 companies. However, they are not seeking unemployment insurance because they are taking multiple part-time jobs. We can also see this in the weaker household survey which also came out on Friday. It is also quite volatile but has largely been weaker than non-farm payroll all year long. I have also drawn in the recession periods, and we can see that at inflection points, into and out of a recession, the household survey does a better job than non-farm payrolls of telling us how the economy is doing.

So, the FOMC may feel it has air cover to hike again, particularly if it sees no recession. However, the economy beneath the surface may not be as strong as hoped. This brings in the possibility of a policy error. I believe David Rosenberg would tell you this is exactly why we have only had 3 soft landings out of 14 hiking cycles.

If rates continue higher, those Millennials forming households will continue to be frustrated. Why? Mortgage rates got to almost 8% last week. As I told Mike earlier, I bought a house back in 2000 and had a mortgage at 8%. However, the trend in yields was lower and I was able to refinance several times. If bond and mortgage yields are heading higher longer term, this will put a drag on consumers.

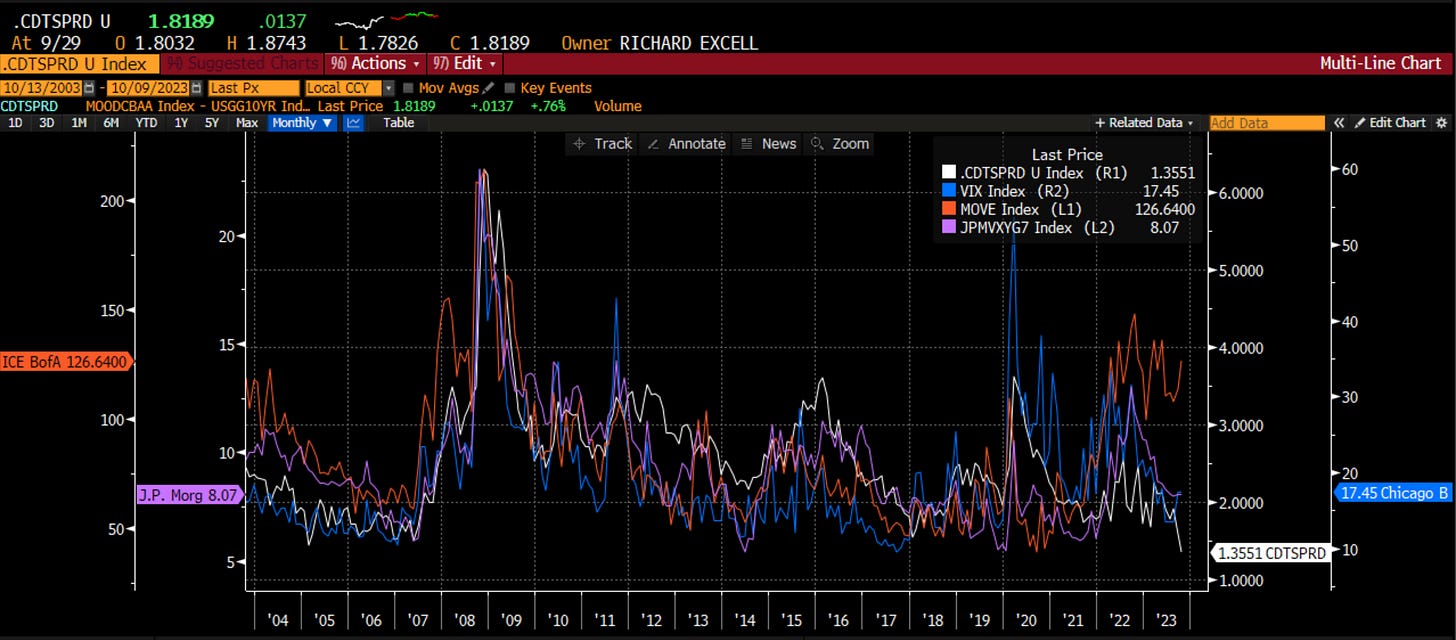

It isn’t just the cost of money but also the availability of money that will hurt. The same is true for corporates. We can see here that corporate bond yields are over 6% but not only that, the Fed Senior Loan Officer Survey about tightening standards for either large or mid/small businesses is north of 50. While the corporate rate is not at the 16-year highs the US government bond rate is (more below), this SLOOS survey has signaled a recession every time it has gone above 40 and we are now at 50. Money may not be super expensive, but it isn’t really sloshing around. That may have a lot to do with banks owning bonds that are being marked down.

Finally, I want to touch on the corporate credit market. We see that the corporate bond yield is just over 6%. High yes, but it hasn’t gone up as much as Treasuries. This means the credit spread has come lower. In fact, if we look at it here in white, it is at the lowest in the last 20 years. The corporate credit market sees little to no risk in the economy. We should not be surprised that the other measure of idiosyncratic (company-specific) risk, the VIX Index, is also still relatively suppressed near 17. Even FX volatility is relatively low. The one market that feels there is a lot of risk in the market, in fact as much risk as we had during the Great Financial Crisis? The US Treasury market (orange).

Perhaps that is because Speakers didn’t keep their promises which has led to an ugly caucus in charge ahead of a debt ceiling or Presidents who didn’t keep their promises on spending or Chairmen who didn’t keep their promises on the economic view. This will have a lot of impact on the government bond market and ultimately all other markets. Seems like a really good time to …

Stay Vigilant

Still believe that wage pressures will continue to drive rates higher and keep prices going up on certain commodities. People have to get used to higher rates. God forbid these politicians start a war, you think 8% is high, lol.

I love your balanced writing in this post regarding how both major US political parties are prone to spending/budget cutting to support their extreme agendas. I could not agree more and this has pushed me to recently become an independent.

Also the American dream was never about the government creating ideal conditions for US citizens/residents to flourish. Nothing has ever been ideal in this country - we have had our fair share of tragedies, black swans, crises etc. The American dream has always been about people working hard and succeeding inspite of these challenges...where nothing is handed to us on a silver spoon...we create something out of nothing...we design, we build, we export, we handover the reins to the next generation.

Unfortunately, we are seeing a growing sense of entitlement, that has plagued other emerging countries, creep into our society.

e.g. recent labor movements and strikes which are doomed to fail after UPS workers got their sweetheart deal

e.g. everyone asking me for a tip nowadays...even when I buy take out food and pick it up myself.

Cheery thoughts for Friday 13th!

Stay well, Richard.