Returning again to the pillar of the markets - the Fundamentals

While still reasonably strong still, the anticipatory indicators of the economy are giving some yellow flags for trouble that could be ahead

We begin the cycle all over again, going through each of the segments of the analysis, assessing where risk markets stand from the viewpoint of Fundamentals, Behavioral and Catalysts. This week I will cover Fundamentals underpinning (or not) risk markets. I will focus on Behavioral next week and Catalysts in two weeks, which will be after we have started to receive some news on earnings from companies.

So we sit in the first week of April now. It has been quite the year. I imagine if I told you on January 1 that when I sat down to write on April 4 we would have a war in Europe, we would have 1 rate hike from the Fed with 9 more priced in, we would have an ISM that is falling, and we would have inflation that is still persistent, you might have expected the SPX to be down a bit more than the 5% or so it is down. I would have expected that. Risky markets have shown amazing resilience in the face of some pretty negative news all things considered. For this reason, it seems many have gotten even more bearish. We will analyze sentiment and positioning next week.

For now, we will focus on the Fundamentals that need to support the market as the first pillar of our analysis. Let’s get on with it.

FUNDAMENTALS

As I have said before, in macro investing, the fundamentals are not just for a single investment but for the market overall, for the risky market overall. I have found that the major drivers of the market can be categorized into four areas: relative valuation (of equities relative to other market beta), the economic trend (primarily in the US but I consider the globe too), the liquidity in the market (has always been important but has become increasingly so after the Great Financial Crisis) and the velocity (there can be tons of money but if no one uses it who cares).

As you know, I am a visual person. I like charts and I like overlays. I don’t use them with the expectation that the fit is perfect and the correlation is quite high. I use them to understand the current and expected narrative that always drives markets. In order to do so, I will work through the same categories I have looked at a month ago and see how the story has changed. Recall that at the start of the year, the Fundamental trend looked okay. Over the subsequent months, the trend has started to deteriorate. Let’s see if there has been any stabilization or if that continues.

(My source for most charts is Bloomberg but I also use the St. Louis Fed FRED database)

Relative Valuation

I always start with the relative valuation. You will notice I am not thinking about absolute valuation. I look at that in the Behavioral section. After all, the absolute multiple someone is willing to pay for an investment, a market etc. is driven by the overall panic or euphoria in the market. It matters, but not here. In this section, I am saying, if someone wants to add beta risk, would they add it in stocks or credit or commodities etc.

I like to look at the equity risk premia. To do this, I compare the earnings yield on stocks (here the SPX) to the yield on Baa credit. I feel the risk is about apples to apples. I have showed thirty year charts in the past. In the 90s, equities were favored. Since the financial crisis, credit has been favored. 2020 and 2021 were major years of credit issuance. With yields as low as they were, who wouldn’t want to raise permanent capital at the lowest rates in their careers. However, this time, I am going to look at a chart over the last 5 years, to see if that is changing at all. The key to me is the magic 0 line. Below this, credit is still favored. Above this, equities take control. We are still below that but we have seen a pretty major move of late. The move is not dissimilar to 2020 which initially favored equities in spite of the Fed directly entering the corporate credit arena. That waned over time. As they say, credit leads equities. I am inclined to believe that here. There has been an enormous pop in equities on a relative basis, and I think that is because it is the hedging vehicle of choice and investors are lifting hedges, perhaps thinking there is no more bad news, or perhaps they are just chasing returns. We are just past the big flows driven quarter end. I would expect hedges to come back to the fore and equities begin to roll over. However, if this normalizes because credit gets better, as we saw in 2020, I would need to change my tune in regards to the interpretation. For now, I see the equity-led relative move as nothing more than a short-squeeze.

Economic Trend

We can't begin a discussion about whether we should take on market risk or not without considering the strength of the economy. The economy leads profits, profits lead stocks, stocks lead risk-taking. We need to understand the trend.

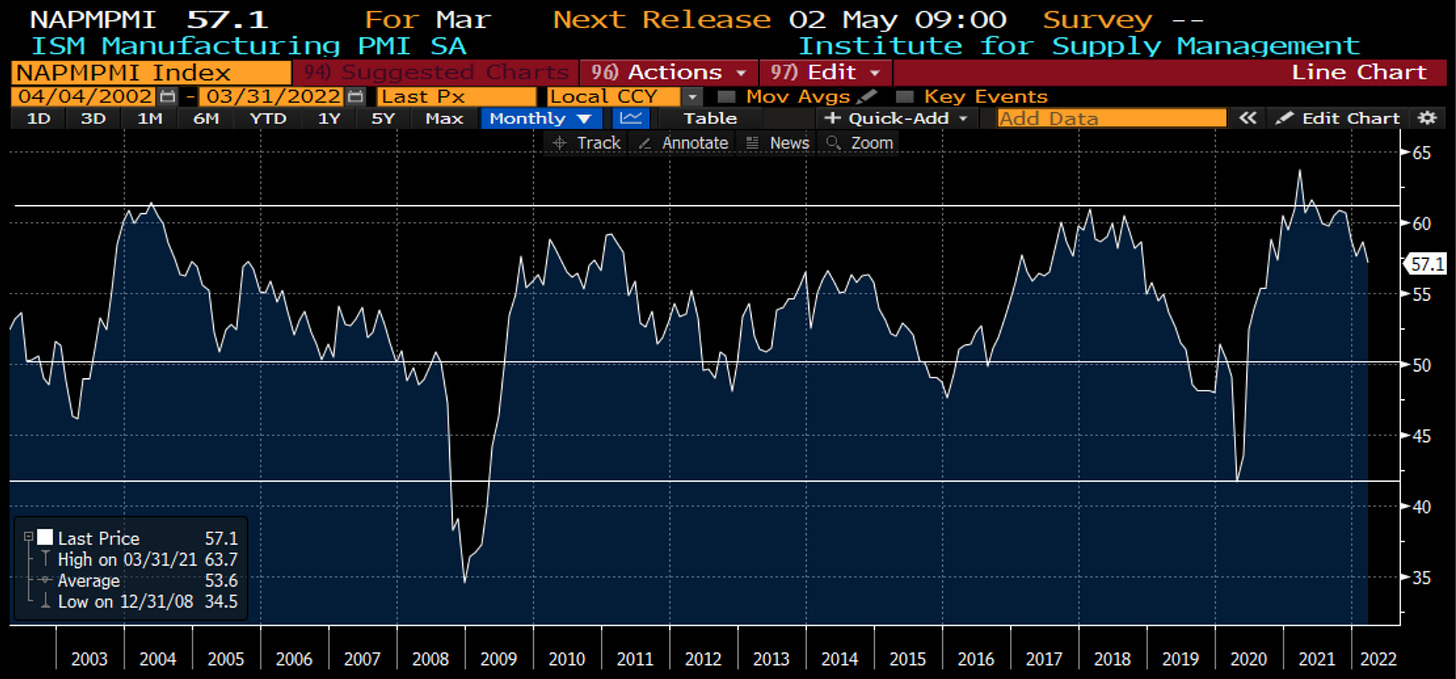

We started the year with PMI in decent shape but the expectation was a gradual decline lower this year. The PMI in the US (ISM) is still high in absolute terms but is starting to show some signs of weakness:

Of course we also care not just about where this number is but where it is going. I look at two other time series to help me anticipate where ISM is headed. The ratio of new orders to inventories has inherent logic. Are purchasing managers getting ahead of demand and increasing new orders or are they letting inventories build in anticipation of a slowdown? It has some very good anticipatory characteristics. The other measure I consider is the regional Fed surveys (Empire from NY, Philly Fed, Chicago Fed, Dallas Fed). These lead by only a few weeks and in this series look coincident. However, they tend to come out ahead of ISM so you can start to anticipate. The Regional Fed has been slowing but held up this month. The ratio of new orders to inventories is painting a pretty bleak picture for the end of the year:

Next, I want to put in a few more charts but I won't put as much commentary.

Leading indicators - good but rolling:

Chinese economy: I use the Li Keqiang Index which measures electricity consumption, freight traffic and bank lending. This is better than the PMI numbers that can be manufactured. China is facing the law of large numbers. It will not see growth rates as high as it did early this century (you see the downward trend). Even within that, growth is middling. With zero Covid policy lockdowns going on (Shanghai was just locked down), I would take the under on this number in the near term:

Eurozone economy - good but weakening. The PMI hasn’t been around that long. I compare it to the German IFO business expectation survey and the Belgian economic sentiment survey. I look at the former as this is where the main driver of European manufacturing companies are and the latter because it is a primary source of capital to the markets in Europe (the hypothetical Belgian dentist). Both of these expectations survey point to lower PMI levels (much lower), which should not be surprising given the war that is going on:

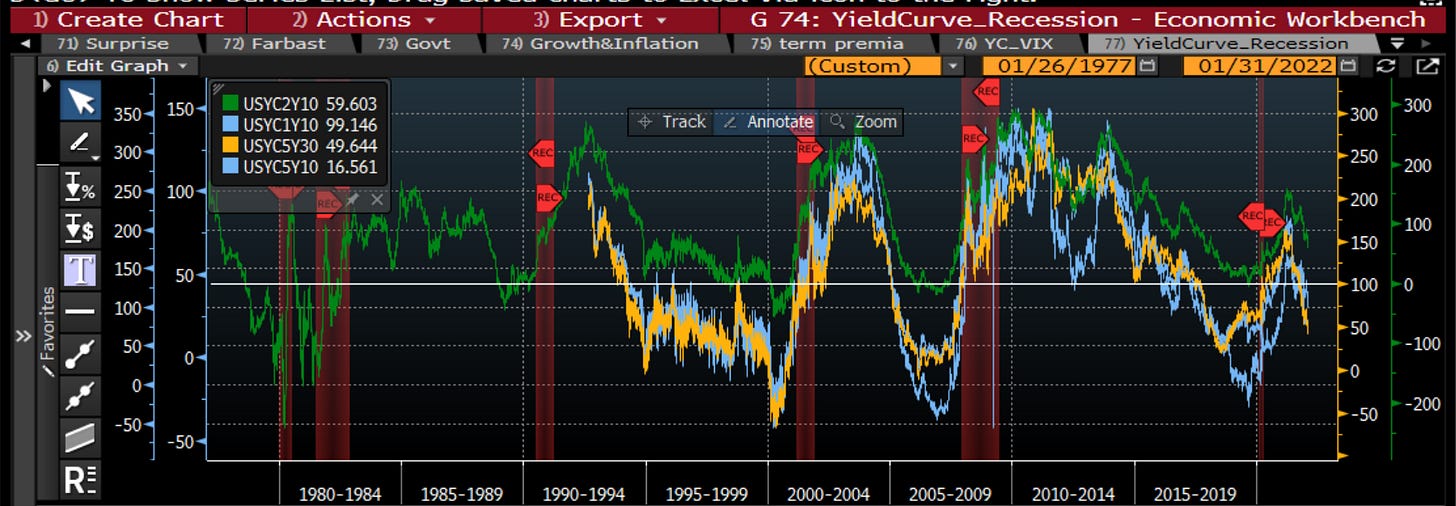

Finally, the US yield curve where here has been much wailing and gnashing of teeth. I am a big fan of the yield curve as a logical and intuitive predictor of the economy. The 2y v 10y is the classic. The best, especially now, is the 3 month vs 10 year. I know everyone wants to talk about 5y/10y or 5y/30y or 10y/30y. These are a bit more manufactured to me. The logic would seem to be to get outside the area where central banks manipulate rates. However, those manipulated rates are still available to the market. Either way, all point to a material slowdown in the economy (recession in red below). However, with yield curves, the lag time from the signal to the event is long and variable (1 to 2 years) and risk markets often rally in the interregnum period so user beware:

I do not want to spend a great deal of time on this section as we are all well aware of the abundant liquidity that has been in the system. However, this is coming out of the system. The question is how quickly it will. Monetary policy acts with a lag of about 12 months. The Fed has only started oh-so-slowly pulling some money out. There is still a good deal of cushion supporting the US economy. One negative is that emerging markets central banks have been tightening for about a year. Thus global liquidity is not as robust as it has been. Interestingly, the BOJ has decided it wants to import inflation and is therefore maintaining its easing policy, weakening the Yen in the process.

Velocity

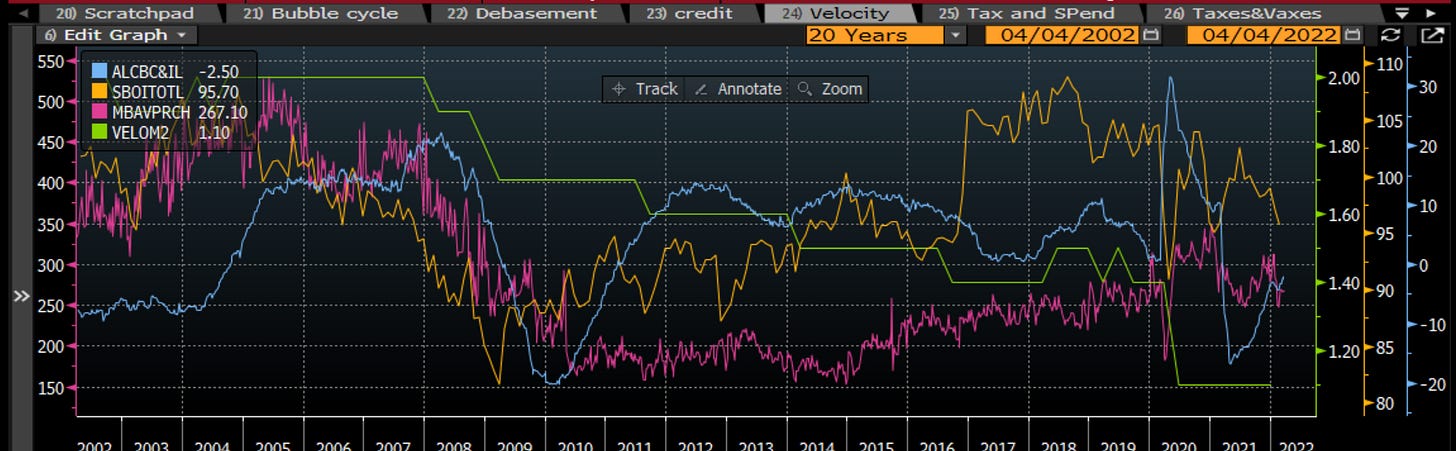

Of course, as we saw post the GFC, abundant money means nothing if it is not making it's way into the economy. Using the Quantity Theory of Money (M*V=P*Y), if velocity is near zero, prices and output will also be near zero regardless of the money growth. Post Covid, it has been a different picture than post GFC. Velocity has been much better, some of which is because the Fed is going directly into the markets and not leaving this up to the banks, but partly because we are seeing demand from companies and consumers to borrow money. This is a combination of opportunity but also the desire to lock in historically low rates. When I look at some of my measures that either proxy or lead the official velocity - C& I loans, mortgages, Small Biz optimism - they have been in a decent spot, much better than official measures of velocity. However, these measures are starting to roll over as small businesses feel less flush, consumers see the affordability of housing go lower, and bigger business do not want to borrow to invest:

Economy and earnings

Why do I care so much about the economy? The economy drives earnings, earnings drive stocks, stocks are the leading risky asset. Soros understood this and it is core to his view of reflexivity. When times are good, it can be a virtuous circle. When times get bad, it can become a vicious cycle.

This is important because the slowing economy will lead to a slowdown in profits, whether we consider NIPA whole economy profits or the SPX eps:

Pulling this all together, the first pillar of the three pillars that drive risky markets is looking shaky. This may not be as shaky as Samson pushing down the pillars and crushing the Philistines, but it is enough of a tremor that you might want to seek some protection. Even though the absolute levels of the economy in the US and EU are high, the anticipatory measures looking forward are quite bleak. Measures such as the yield curve or other leading indicators signal tough times ahead, even if we don’t know how long that will take. We know that this will pull down profits and so stocks that cannot growth eps will also start to struggle, suggesting this move higher we have seen in stocks in absolute and relative (to credit) terms may be something to fade. Financial conditions are tightening and this is not going to be the support it has been in the past. Times like this are when I look to add convexity to the portfolio. It is times like this that I especially try to …

STAY VIGILANT