Sell in May and go away?

Is there credence here or is this trite expression as predictive as Punxsutawney Phil?

The "sell in May" proverb is said to have originated centuries ago in England when merchants, bankers and other interested parties in London's financial district noticed that investment returns generally did worse in the summer.

The entire phrase used to be Sell in May and go away, and come back on St. Leger’s Day. This is a holiday celebrated in mid-September in England. It roughly aligns with the Labor Day holiday in the US. The phrase has been shortened and people are meant to sell their stocks in May and reinvest for Q4. Does it work?

These are the monthly returns of the SPX (per Yardeni) for the last 40+ years. While the November to April period is the strongest to be in stocks, the summer time has some positive returns. In fact, September is the month you most likely want to be out of stocks. All of this is if you are a trader and are not worried about tax consequences of course. I am not a financial advisor nor a tax planner but I am sure most of these would tell you to stay the course because the short-term capital gains taxes and potential opportunity costs eat up any advantage you may get. However, it is still useful to think about so that behaviorally, you know what to expect and can react accordingly.

Is it more or less likely to hold this year? Hard to say. However, one way to assess that is to ask whether or not the buying/selling this year so far has been normal or extreme in either direction. Given the very negative overtone to this year’s events - Covid lock-down in China, war in Europe, soaring food and energy prices - it is not surprising to see that most people are very bearish. CNN’s Fear and Greed Index uses a variety of market measures to come up with a metric to determine where market players’ heads are. For most of the last 3+ months, participants have been in fear or extreme fear. Will still reside in that area.

Bank of America does a similar sort of exercise but it includes the positioning they see across their institutional and high net worth client bases. This measure is also reading extreme bearishness right now.

The American Institute of Individual Investors has readings of bulls and bears as well. I look at the difference between them as a sense of where individuals are. The readings a month ago were the most bearish this century, though in the last couple of weeks they are moving back toward neutral. Still not there yet but closer.

The Commodity Futures Trading Commission measures commercial (hedgers) and non-commercial (speculator) positions in the futures and options markets. Some may suggest that the speculators can use a variety of instruments including ETF and single stocks. However, this measure still captures quite a bit of activity since the S&P e-mini are preferred for a lot of futures overlays and macro trading. These positions had gotten quite short after the Russian invasion but are now in a fairly neutral position.

So, will investors sell in May and go away? Maybe not. A lot of selling and bearishness has already happened. Of course more could come. As I have said before, bear markets often have waterfall declines, where there are waves of selling interspersed with very sharp short-covering rallies. We might be in the midst of one of those short-covering rallies right now. If we go back to BofA data, the inflows to equities last week was the largest in 10 weeks and the 4 week moving average has now turned positive.

Another way to think about this would be the volume of stocks that are rising vs. falling. Is the heaviest activity in positive or negative performers? Are people selling aggressively or buying aggressively? There is an index that covers this called the ARMS Index. When this index gets above 2.0 it is usually a signal of being overbought. When it gets below 0.5 it is a sign that the market is getting oversold. Right now, we are seeing more volume in rising stocks vs. falling stocks but nothing is extreme yet. You can see the overbought market at the end of April and then the oversold market in middle of May. Right now, the index is benign.

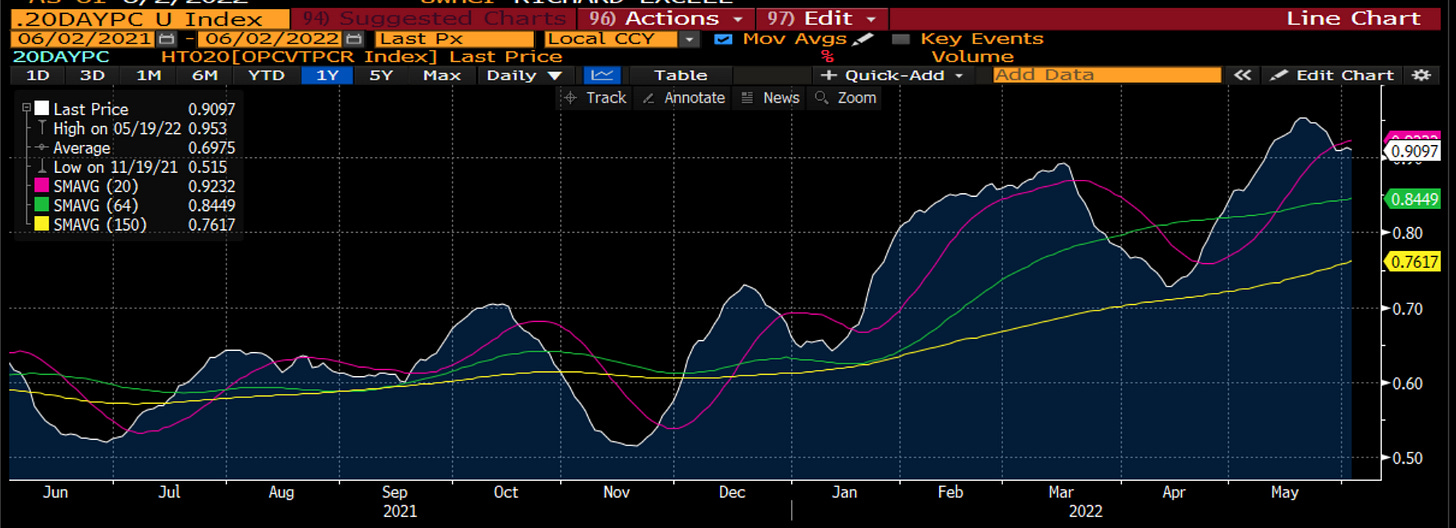

The last sentiment measure I like to look at is the put-call ratio. I use a 20 day moving average to take out some noise. This is a contrary indicator. When it is rising, it means more people are looking to put on hedges (buy puts). When it is falling, traders or investors are either tactically buying calls or unwinding their hedges. So a rising measure is bad for the market, a falling measure is good. The measure rose rapidly from the middle of April to the middle of May, a tough time for the market. It turned back over after May expiration as hedges were unwound and we got a nice bounce into the end of the month, coincident with the inflows to equities. It has flat-lined of late but it is well worth keeping an eye on.

What does this all mean? Traders and investors had gotten, and still are, very bearish. The flows have turned the last month and we have seen a short-covering or adding exposure (to underweight) type of rallies. Overall investors are still bearish but maybe not quite as bearish as before. However, what we have seen of late was a bear market rally. Can it and will it continue?

For that we must ask ourselves what is happening with the data. Right now, with earnings not coming out until July, the only data to focus on is the economic data. On June 1 we got some important data on the ISM (my preferred measure as I discussed last week) and the Job Opening Labor Turnover Index (JOLT). As I said on Linked In today:

Yesterday's economic data set the stage for the summer. It set the stage for the Fed & for the markets. Yes, tomorrows non-farm payroll number will get most of the press for this week. However, wiser mkt followers will focus more on two numbers that we were shown yesterday.

The first is the ISM. I told you yesterday how important I think it was for this summers activity. It came in better than expected at 56.1 (blue), an improvement from last month. I have also drawn a horizontal line across that series (white). You can see that for all of the fears of recession, the number right now relative to history is quite robust. There aren't too many periods when the economy is this strong. Those periods have typically been reserved to times when we are coming out of a downturn. All wasn't great, though. The internals, namely the new orders to inventories, rolled back lower. So the bears can still point to a slowdown coming. The question now is timing & depth. However, for now, the economy is holding up well & i think has tailwinds to continue for several months.

The more important number form yesterday was the JOLT number. This stands for job openings & labor turnover. It is a measure for the number of jobs available in the economy. It came in at 11.4mm. This is the second highest this century (white) with the highest being last month which was revised up to 11.85mm. The labor mkt is still very strong. Tomorrows number will be what it is but remember the NFP will get revised 2 more times before it is final. The importance of a strong job mkt is the Fed reaction function. The Fed has a dual mandate - full employment & price stability. Normally it must balance these with policy actions. Right now, the job mkt is strong enough that the data say - FOCUS ONLY ON INFLATION. CPI is in orange. Also the highest this century. As such, we saw the mkt price back in a full 50 bps in July. This is what hit stocks yesterday.

So the stage is set for the summer. The economy is still holding in well. Jobs look good. Inflation is still too high. The Fed is solidly in play for 50 bps in June and July. This means multiples are not expanding. For stocks to rise, they will need to benefit on where the economy is strong & where inflation helps. High valuation/low eps tech is not as attractive as old economy energy & materials in this environment.

Inflation is the crux of the issue. It is new for us because it is a measure most investors in developed markets had not had to deal with in their careers, even if that career has spanned the last 20 years. However, it is here and has the full focus of the Fed and the markets. It also has the attention of consumers. As I said on Linked In yesterday:

Whether one uses the inflation expectations as measured by TIPS or the 5y5y fwd expectations in the swaps mkt (not show here as the history isn't as long), these expectations have backed off their peak. You can see this on the line in white. It is naturally more muted than the others because it is a 10 year measure. It I showed the U of M 5-10 yr measure it would also be more muted but still heading higher.

However, I want to show the number that I think matters more for everyday people & for the Fed right now. This is the 1 yr infl exp in blue. It is a new 30 yr high & not looking to pause too much. What is it that has consumers so worried about inflation? Perhaps it is their every day experiences. Your Starbucks coffee is up 40%. The grass seed for your lawn is up 70%. Airline tickets are crazy expensive with most domestic & international well into 4 digits now. But I think the biggest drivers are food & gasoline, 2 measures which most Wall St economists take out of their forecasts because they are too volatile. However, these are the areas consumers spend a lot of money.

Gasoline futures are in purple & have been a straight shot higher. I griped about gas being over $5 a gallon last week & it was over $6 a gallon yesterday at 1 place. Many states have already repealed any gasoline taxes to stem the rise. There was a release from the SPR to try to slow oil prices. The issue is a lot more to do with a lack of supply which is not changing any time soon. As long as demand is firm, expect higher prices. This will hurt.

The orange line is food prices broadly. Whether it is food you cook at home or food in a restaurant, the prices have gone vertical as well. Everywhere a consumer looks prices are higher. Recall, I said inflation is a mindset. That mindset is setting in. It is this inflationary mindset that the Fed is most worried about.

Biden said earlier this year that inflation wasn't a problem as long as wages kept up. They haven't. 3.5% raises are nice but not when inflation is 5-6-7%. We are seeing more workers look to unionize to fight back. This was a little easier when the labor mkt was super tight. With many layoffs, crucially Amazon laying people off, this dynamic will be interesting.

Inflation will affect behavior. We haven't had to deal with this in many decades.

Inflation will affect behavior and it will affect voting in the mid-terms in November. Politicians know this. I pointed this out earlier this week:

This year we have a mid-term election so the economy matters. Actually, what matters the most is the change in real disposable personal income.

A piece in the American Political Science Review in 1989 by Robert Erickson stated: "This analysis demonstrates that the relative growth of per capita income change is an important determinant of post WWII presidential outcomes."

In a Quartz article before the the last mid-term elections: "Real disposable income captures “the ‘lived’ economy,”political scientist Seth Masket says. It reflects “how much more money people have in their pockets than they did last year, which is something people have a strong sense of,” he adds. The average voter doesn’t experience the unemployment rate or GDP growth as directly in their daily lives."

So it matters. How is it doing in the US? Today's chart shows this measure in yellow below. You can see the Covid spike but subsequent fall before the 2020 election and we know how that turned out. Trumps approval rating in purple followed it. You can see the big spike in 2021 that is now falling back to normal (not below just back to trend) and we can see Biden's approval in orange slumping too. Most interesting to me is that this measure the last 5 years has correlated to the budget deficit the govt is running in blue.

I had shown a couple weeks ago that when you break down the GDP into C+ I + G it is the drag from the slowdown in govt spending (from high levels) that is hurting GDP. Here we may see a link between budget deficits and disposable income. Most political scientists think there is a link between disposable income and elections. It is safe to say both parties are aware of this. So what happens?

You will probably see an uptick in govt spending programs into the election. This will happen at the Federal level, as Biden is presumably looking to waive $10,000 of student loan debt as a stimulus to the economy. Incumbents nationwide will spend to get people feeling good.

Is this something that can go 'right' for economic growth?

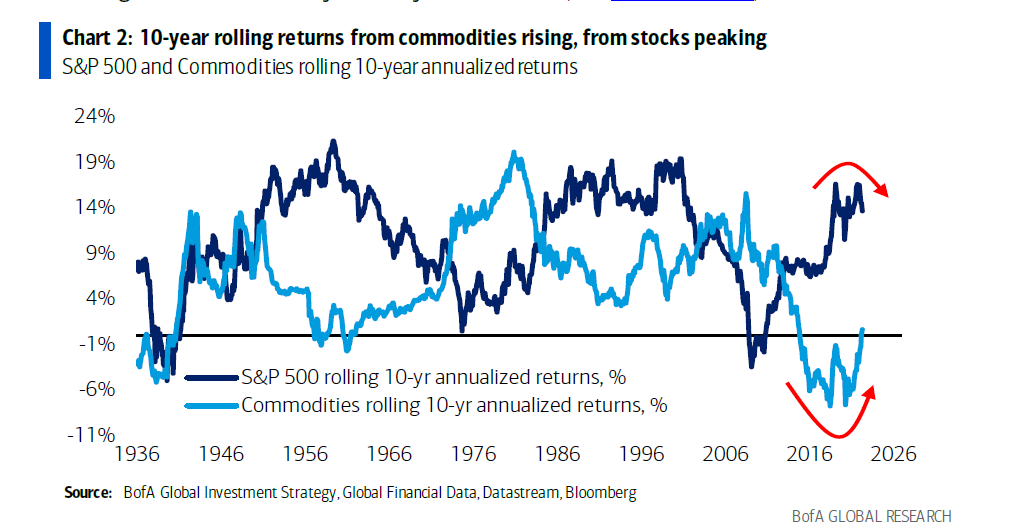

The economy is holding strong so far, but inflation is still a big concern. The Fed is solidly in play but perhaps the government spending can step in and soften this blow in the near term. Growth slowing but still positive, inflation staying high. This is an environment that followers of the Investment Clock philosophy would call Stagflation. this has a negative connotation for market pundits as they immediately think of the 70s. That is one version. What we are seeing now is the same thing but in more benign form because growth is insulating consumers and investors a little more. However, the top-down investors will know that this environment is one in which energy and materials companies and commodities as and asset class do much better than technology as a sector and equities more broadly. This also coincides with the rolling 10 year returns of equities vis a vis commodities also rolling over (per BofA):

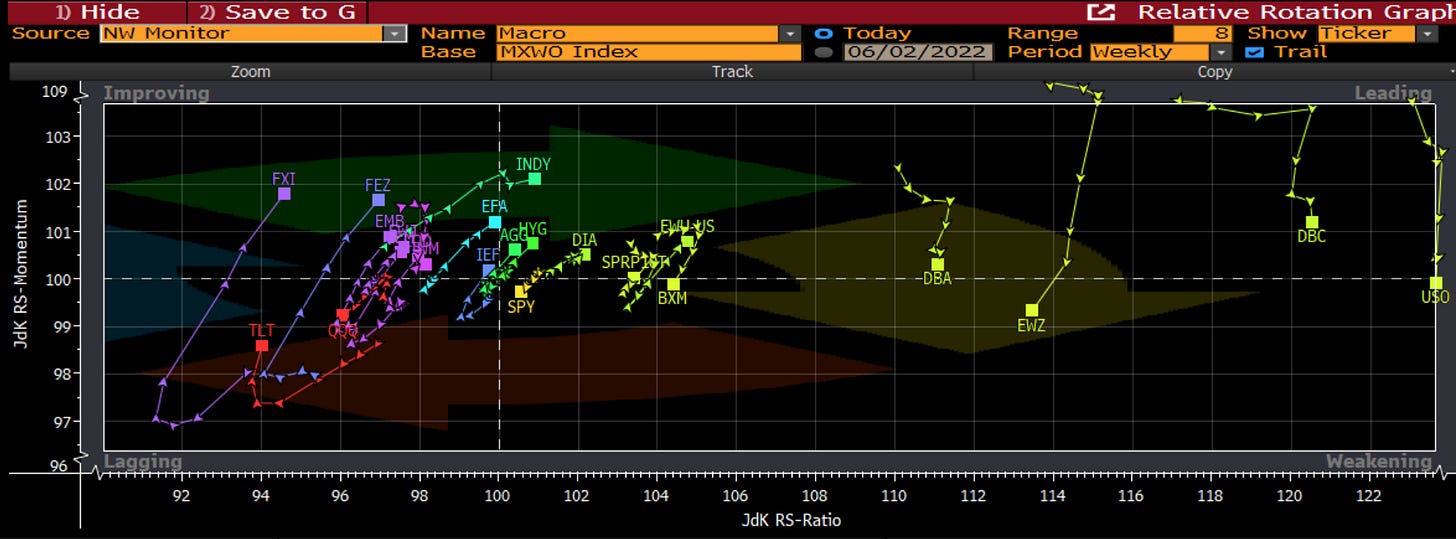

Is now the time to add to commodities, energy and materials? If you have a 2+ year view perhaps. However, if your time horizon is shorter, or if you want to be more tactical, you can see that on the relative rotation graph, commodities and commodity countries are rolling over into the weakening area relative to the global MSCI benchmark. Emerging markets like China and India, places that buy a lot of commodities, are in the improving or even leading area. Thus, while the commodity trade has more legs longer term, now would not be the optimal time to add. This may be another sign of position squaring (reducing long commodities, covering short EM) as we go into the summer.

Stagflation as I defined it is also a time when Value does much better than Growth, and when Quality does better than High Risk. You can see the YTD performance ona sector-neutral basis in Value vs. Growth (47%!) and Quality (Dividends, Buybacks, Profitability) vs. Risk (Dispersion, Volatility, Short Interest). Things are a bit more mixed on the 1 week basis vs. YTD. Another sign of some position-squaring perhaps.

There are lots of moving parts this week. After a trying first half of the year, there are many traders, investors and individuals that probably want a break. Many summer travel plans to Europe from the missed 2020 and 2021 summers. Others that want to get to that lakehouse, go to the Hamptons, or head to Tuscany and prepare for the post Labor Day/St. Leger’s Day period. There are many that think the Jackson Hole meeting at the end of August may be a time when central bankers have to pivot from their hawkish stance to something more neutral. This could be the time to watch.

For now, there has been some position squaring. This could have more legs. The economic data is such that it should have more legs until we get more single stock news. It is important we all step back and think about what is happening so we do not get caught up in the noise of the markets. Most importantly, it is time to …

Stay Vigilant

Heading to Italy this summer to see my daughter who is studying there. Been almost 10 years now since I was in Europe so I am quite looking forward to it. I remain divided right now as well because I understand and agree with the drivers of negative views. However, I still struggle with the idea that 90% of the emails/blogs/articles I read are negative as well. I don't even include FinTwit in here because I don't know if it is ever positive. Perhaps my narrow Midwest perspective does not capture bigger views, but the local economies here (Illinois, Wisconsin, Michigan, Indiana) are bustling. Friends from banking to insurance to tech to healthcare are all busy and still trying to hire. I imagine the views on each coast are not as positive since tech companies are announcing layoffs and the capital markets have stalled which affects everything from bankers to VC and PvtEq. However, I still think there are drivers that keep this from being a recession this year, which coupled with negative views on the street, lead me to think we could have a bigger rally than usual. Interestingly, you mention 1987 and I think about whether we could get a summer rally because ISM and other data hold up, only to see the market crushed in September when there is not a dovish pivot from the central bankers and we are now within 6 months or so of that low in ISM approaching. Perhaps I am trying to be too nuanced however. Appreciate your thoughts.

Ex- First question, where are you going this summer? That aside here a few comments. I looked at May low vs Summer high, 1980-2021, avg is 7.9%, and statistically, there is a 41% chance of a 10% rally. Bad news, is that from 3800 low, we already got close to the 10% move. On ISM, it was higher that all but two of the 63 economists polled by Bloomberg. It seemed on the surface quite an odd number, not consistent with a lot of things, namely the regional surveys. Yet, it was clear that markets, particularly the bond market, took it quite seriously. There is no sense in the near 20bp move higher that bond investors were discounting it as a fluke. Historically, ISM cycles last about 20 months in terms of high to low. Peak was March 2021. So low should be early next year. But what is clear is that the path of this one is following a very benign path which harkens back to the 1987 and 2011 paths, which also had shallow declines, and neither led to recession, which still is the big question as you know because the size and duration of the downmove in equities is going to be linked to whether those calling for recession are needly hyperventilating or perhaps they are accurately seeing into the future. I remain divided on this question.