Sideways

“Maya: What's the title? Miles: The Day After Yesterday. Maya: Oh... You mean today?”

My inspirations this week come from a trip to Napa Valley. I can no longer think about California wine country without thinking of the movie “Sideways”. I also can no longer that about the markets without thinking about the inflation number that we got the day after yesterday, oh, I mean today. It was a doozy. There is no room to hide. In fact, the breadth of inflation within the number is so strong that the Fed could hike 100 bps or more next week and probably calm the market down.

The Fed watches Personal Consumption Expenditure more than CPI of course. However, these measures are not unrelated:

This is what bear markets feel like. We got our rally based on sentiment leaning a little too much in one direction, coupled with a little bit of good news. The risk was extrapolating this move too much. If we felt that it was a bear market rally, that we are in a waterfall decline, and that we looked for technical levels to sell, we probably handled that move okay. Ideally, we used some call options instead of futures or stock longs and had that embedded put.

Moving on, this is the week of the month when I usually speak about catalysts. I like to look at earnings, economic data and geopolitics. However, we won’t get earnings until next month. The economic data on all other topics is moot given these inflation numbers. The only geopolitics that matter right now to risky assets are what the central banks do. The ECB this week spoke about eventually, maybe finally doing something. However, as usual, the ECB left the market wanting. That set the stage for the CPI number. The market sold-off into the number on fears of a higher print (and because the ECB really messed up). The news was confirmed today. So now we get the Fed next week. 50 bps is priced in to the June meeting (as well as 50 bps in July and September). However, now the buzz is more, and more quickly, may be necessary. This is when the volatility tends to return to the market.

It is also the time when I like to step back and look at a number of my key indicators that can give me a lay of the land. This can help me understand the wider range that could happen so I have a sense when we see too much panic, or too much short-covering.

Here we go.

First up is housing. I have mentioned before the HOPE principle: housing → order → profits → employment. Housing leads us into and out of recessions. We have to start with this look. The key to look at is building permits, as these lead the housing starts. You can see from this chart that the 30 year mortgage is only loosely related to these in spite of the popularity of this number on #FinTwit. These numbers start going lower before a recession (red shaded area). If you look closely on the right, the numbers are stalling but not yet falling. Thus, we should understand a recession isn’t imminent because these numbers will lead it.

All is not well though. We do know the economy is slowing even if a recession is not imminent. To get a sense of the direction of the economy I look at a couple of indicators. The first you know about - the ratio of new orders to inventories in orange. It has been falling all year and signalling a slowdown. The second is the ratio of leading indicators to coincident indicators. One can look at this either in points ratio (blue) or percent change ratio (white) which is a little noisier but faster moving. These are just starting to roll over. Again, it points to a slowing economy, however, this doesn’t mean it has to happen imminently.

This doesn’t mean the consumers don’t already sense this, though. I get push back when I say everyone is already bearish. If I had to show one chart to prove my point it would be this. Whether it is sentiment on the economy (University of Michigan consumer sentiment in white) or sentiment on the market (AAII bulls less bears in blue) both are LOW. I mean, lowest of the 21st century low. Not a little bearish. MASSIVELY bearish. This gives me a little pause when I start to get too bearish myself. Consensus isn’t always wrong, but we should be aware when people are already where we are.

Is the market reacting to this? Sometimes the headline numbers don’t appear to react as quickly as participants think they should. This is because some things are always working in the market, even in bear markets. Energy stocks are having a great year this year. Many are up 80-100%. These stock mute the headline moves. However, if we look at the ratio of the more cyclical parts of the market to the more defensive parts, or to the overall market, we can see this bearishness. The classic ratio is the Dow Transports vs. the Dow Utilities. This is the classic that people have followed for 100 years. It is in white and is giving us a clearly bearish signal. Some suggest it is not relevant for the 21st century. I would disagree but okay, lets look at a 21st indicator. Look at the ratio of semis to the broader market (blue). Semis are in everything and we know what type of shortages we see when there are no semis. This number is also rolling over, signalling a down market (Dow in orange). The market is already getting quite bearish looking at the internals. The headline indices will follow.

One bright spot for the market has been the breadth of the market. For this I look at the Bloomberg advance - decline line. It shows the ratio of advancing stocks vs. declining stocks for the S&P 500. it does a good job of leading the market into and out of trouble, as we get a sense, again, of whether people are buying or selling the median stocks and not just the biggest. This ratio has held up better than the overall market, which is a non-bearish sign. I can’t say positive, as it doesn’t point to materially higher markets, but it does suggest more balance.

Probably the most positive sign for the equity market is the credit market. Credit markets lead equity markets because these markets are concerned with the return OF capital and not the return ON capital. If these players are worried, we should all be worried. If they are not, we should know the downside is limited. I use the Moody’s Baa corporate spread vs. the 10 year Treasury. Yes, credit people will tell me there are better measures. However, this one has the longest history by far and gives me the same signals. In white is the inverse of this spread, so as it gets tighter (better news for corporate borrowers) it moves higher. This is a good market for risk. Lately, it has been moving ever-so-slightly higher. In absolute terms, it is a lot closer to the tightest in history (1.5%) to the widest (6%). Credit investors are not worried yet.

I have also looked before at what is my version of the equity risk premium. For this I look at the ‘yield’ of the market (the inverse of the forward P/E) vs. the yield on credit. I want to see what investors are preferring. When this number is deeply negative, we know investors prefer stock (left side of graph). When sharply positive, investors prefer credit markets. Right now it is as middle of the road as it can get.

So is liquidity in the markets robust or not? The main measure we can use is the growth of M2. The Fed doesn’t create money, banks do. This is why M2 didn’t grow with QE after the GFC but it did during Covid. We can see the historic rise in the M2 number (white) below which led to the market rally. However, it wasn’t just the M2 that was the driver. You see there is a ratio of M2 to velocity of money in the economy called the Marshallian K. When this number moves higher, it means money is growing overall, but it is not being spent in the economy. Thus it will move into the financial markets. When it falls, it can fall for two reasons. First, because M2 itself (numerator) is falling. Second, because velocity of money int he economy (denominator) is rising. We can see this number (orange) has fallen much more than M2. This means that, yes, money growth is slowing. However, it also means more money is being spent in the real economy. So it can come out of the market to spend in the economy (think sell your stocks to buy a house at the extreme). This is not a good sign for the markets, but is a better sign for the overall economy. It is healthier for all when the money created is used in the economy than financial markets.

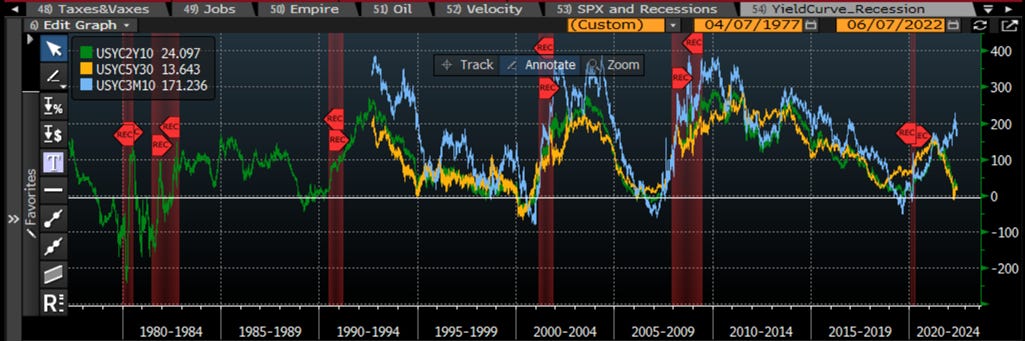

Another way to measure the liquidity in the economy is the yield curve. The yield curve has a perfect record of predicting recessions. However, it does so with a variable lag (6 months to 2 years). An inversion of the yield curve (long rates below short rates) is a proxy for bank margins and suggests banks slow lending. This will slow money growth. It is also a sign that the market thinks Fed policy is starting to get too restrictive, as the 2 year is what the market thinks of Fed Funds over the next 2 years and the 10 year is the view over the next 10. We must be careful of being sure we use the right part of the curve. The 2 yr vs. 10 yr is the most predictive of recessions. Many have started to use the 5yr vs. 30yr because they say it excludes the Fed manipulating. it also helps them spin a more bearish yarn. However, it simply isn’t as predictive. I personally like the 3 mo vs. 10 yr for banks relative performance. It is still steepening and so I think banks can still outperform. However, it is also not as predictive of the economy. Remember, when the 2y vs 10y inverts (it has not yet), we still have 6 months to 2 years before a recession. Flattening isn’t great but inversion is the key and we will have time. For now, things are okay.

The Fed has focused its policy on real yields. I have the constant 10 year real yield in pink. It has been tightening and is above zero for the first time in a while. I plot it here vs. SPX total return (yellow) and commodities (green). Easing real yields are clearly positive for these markets. Tightening are not clearly bad until they get above 1%. Not quite there yet but we need to be watchful. Liquidity is coming out of the market.

Three more graphs so stay with me. In my Applied Portfolio Management class, I teach top-down business cycle investing. We forecast growth and inflation and then define the economy as one of four quadrants: growth rising/inflation low, growth rising/inflation high, growth falling/inflation high, growth falling/inflation falling. Right now we are solidly in the growth falling/inflation high. We call this stagflation even though I know that has more negative connotation with some. Empirically, it has clear winners and losers. Stocks and bonds both do poorly in this period. However, commodities do well. The price action we see is EXACTLY as we should expect. Ladies and gents, welcome to stagflation.

This shows you a picture through time. Commodities do well, stocks and bonds do not as inflation rises and growth falls. It would show the same if I looked over 40 years, but it would be hard to read.

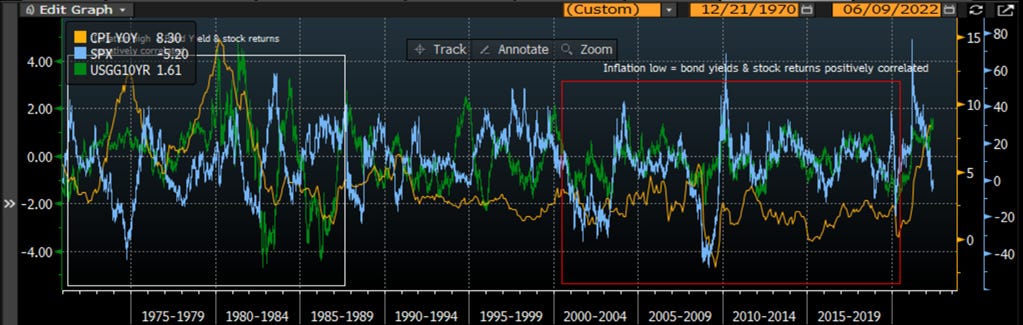

This is one of my favorite charts. This shows the correlation of stocks and bonds in different inflation regimes. When inflation is low and not a worry, only growth is, stocks and bonds are negatively correlated because the Fed only needs to hike or raise on growth issues. This leads to successful portfolios like risk parity and 60-40. However, on the left, we can see when inflation is high, stocks and bonds are positively correlated. This means those same portfolios that have worked are NOT going to work. This is a major risk to the market as both individual (60-40) and institutional (risk parity) investors are off-sides.

The economy doesn’t seem that bad. Yes, liquidity is getting tighter, but more money is going into the economy than the markets. In fact, most market participants are getting pretty bearish. Heck, consumers are getting bearish.

This doesn’t mean nothing will work. Energy and commodities have and should continue to work. It does mean many portfolios are offsides, though.

The economy will slow, but there is no imminent recession. We will get this sign and have months to react. The market will probably even start rallying ahead of that as it anticipates. That is what it is doing right now.

Overall, it means we are Sideways. The Fed is sideways on its inflation view. The market is sideways on its risk view (credit good/stocks bad). Consumers are sideways on the economy (inflation bad/housing still okay). This was all emphasized in that CPI number we got the day after yesterday. Oh, I mean today.

Stay Vigilant

Echo what "stuck in the middle" says on your note. A couple of comments. First on sentiment, we did get a 10% trough to peak bounce. Mark Hulbert noticed that generally when reversals are sustainable sentiment in his newsletters remains quite bearish during the initial stages and what he noticed was their was a fairly dramatic flipping. In addition, I would note that sentiment is important but not sufficient. It is terrible to use in calling tops, but is generally better at bottoms, but still not enough. I call it a pre-condition. That said, my final point is probably just obvious. Nobody understands inflation. Models are not working. The simplest model of inflation is for T1 is T0 + beta inflation expectations. So from that simple model if inflation is rising, there is momentum from last month. So if that is only model left to use, with all others of little use, then there seems to be a moment of throwing in the towel on inflation peak and path. This is frightening markets. Final point, I wonder if credit is being held up artificially by commodity sectors, or related ones, particularly energy. I continue to think oil is going to $70 not $170, but is only a theory that demand will collapse, and so far, shows no signs of materializing. Actually, one other point, it seems as if the still basic question is centers of path. Option 1 : liquidity squeeze, ISM to 40, and recession is dead certain. Option 2: Golidilocks 2.0, inflation peaks, Fed takes a chill pill post-Sept, and a supply side driven growth saves us from a US recession. I would watch the regional capex to confirm or reject this thesis. Does anyone find it strange that buybacks seem to be continuing, normally they would have been expected to recede as corps go into capital preservation mode, but maybe there is something in the composition of who is doing these buybacks that I don't quite understand.

good note, thank you. another good (better IMO) movie about Napa....Bottleshock

https://www.youtube.com/watch?v=hI2g8-7GnT8

enjoy, if you haven't already