In the US whenever we utter the word stagflation, people’s minds immediately harken back to the 1970’s. While this was indeed a period of stagflation, it was probably the worst case of it in the US. It is like thinking of every recession as the Great Depression. While it is technically true, there are other examples that have the same elements, but just not as extreme. I believe, after the data this week, that we are entering a period of stagflation. The bond market wants to debate recession or not. The stock market wants to debate reflation (high growth, falling prices). However, I think both markets are missing the point. I think this can create risk or opportunity, depending on how you approach it.

First, let me explain why I am thinking of stagflation. Within the ISM data this week, we did see stagnant economic growth and high inflation. I wrote about it on LinkedIn:

Chart of the Day - stagflation?

Today we got the ISM Services data so we complete the full look at the economy. The headline number was much worse than expected. So were the new orders. Surprising on the upside? Prices paid

The chart today shows the ISM economy-weighted services and manufacturing number. It comes in at 49.8, below the 50 level of expansion/contraction. Recession on this index has historically happened when it falls below 48.5. Not far away but not there yet

The other two lines on the first chart are the prices paid for manufacturing and services. Both are moving sharply higher. This should not surprise us based on the JOLTS data. Services companies are laying off workers which tells us their costs are going up quickly. Blue collar jobs can't find workers, so they are clearly needing to raise wages and thus prices

The combination of falling growth and rising prices is stagflation. No one ever wants to refer to this because it reminds us of the 1970s, maybe the worst time most of us who are living can remember since many of us were not around for the Great Depression and WWII

In stagflation, historically, we have seen sectors like energy and healthcare outperform the index. Energy because rising prices in high fixed cost businesses finally give them some pricing power. Healthcare because demand is inelastic and it is easier to pass on prices

However, the second chart shows that these two sectors have been the worst performing sectors in the market. Does this make sense? I don't think so

The best performing sectors - tech and consumer discretionary - typically do the best when growth is rising and inflation is falling. The market appears to be pricing in exactly the opposite of what is occurring

Sure, the move from the lows in April to the end of the month was short covering. However, I am showing the moves just in the last month, after that move already happened

It seems to me the opportunity in the market is in sector rotation, as the best sectors the last month are the ones most at risk in stagflation, while the worst ones historically do the best

Finally, as I have covered before, Fed speakers have told us how they will respond if there is stagflation - they will do nothing. They will say data dependent. They don't want to risk runaway prices and will wait until we have a recession until they cut. We aren't there yet. We are just in meager growth and rising prices

All eyes will be on non-farm payrolls this week but we have already gotten enough data to know what the Fed will do imho. There is opportunity out there, if you are looking in the right places

That leaves us thinking about the jobs market. On the one hand, you may say that we got the non-farm payroll number on Friday. We did. I hope you noticed that this ‘hard data’ that so many prefer, had massive revisions to the previous two months that wiped out any strength in the headline number itself. This is why it is important to consider all of the jobs data we got this week. I wrote about a particular measure that is important:

Chart of the Day - JOLTS

After the data came out yesterday, I read a few reports that pointed out how the JOLTS data pointed to sharply higher job openings, indicating an economy that is more than strong enough. At first blush, this makes sense

But then I questioned the data because if there are so many job openings in the economy, why do all of my very talented students tell me that the labor market is very difficult right now?

The answer is that there is a skills mismatch in the job market. While we are training scores of talented college grads looking for new white collar jobs, the likes of McKinsey, Microsoft, Google et al are laying them off by the thousands

Instead, the area of the economy that is in dire need of workers is more of the blue collar variety, as a look inside the BLS data shows it was health care and social assistance that was the source of the excess new job openings. My recent college grads are unlikely to fill these roles, as those have likely been filled by new migrants to the country, where now there is a shortage

Digging into the JOLTS data a bit more, I focused on the ratio of layoffs to quits. When the job market is strong, there are fewer layoffs and workers are more likely to quit as they have a new offer. When the job market is weak, at least for white collar jobs, the opposite is true, with layoffs rising above quits

That is exactly what happened this past month as the layoffs number was much higher than expected but the quits number was lower than expected

In fact, the chart on the left shows that this ratio does a good job of leading the unemployment rate over the long term. There is intuition and empirical evidence to support the case

The chart on the right narrows this in for the post-Covid period. We can see that the ratio has been heading higher the last few years, indicating higher unemployment rates. While it had fallen since a sharp move higher in September, levels are moving back higher suggesting a higher unemployment rate

Perhaps this is the influence of AI as we see computer engineers, consultants, bankers and lawyers disrupted. Perhaps this is the influence of inflation as those are high human capital businesses and the only way to hold onto margins is to layoff workers

Either way, it is clear that the white-collar job market is not looking that strong, while the blue-collar market is showing more signs of strength. On the positive side, this could reduce income inequality we have seen

On the negative side, this could highlight a very sharp skills mismatch in the labor market, one that is not going to be easy to fix

For me, it appears we are meeting the three conditions of the textbook definition of stagflation. That first question to ask, then, how will the Fed respond? I have discussed this before in my posts, but I think it is worth repeating.

“We will not let a wage-price spiral take hold,” – Fed Chair Jerome Powell, 2022.

Chart of the Day - which of these doesn't belong?

There is a debate in the market, particularly the bond market, about whether inflation is rising or falling. Forget about whether tariffs are inflationary or not, because we don't know if we are going to get any more of them or when they would start

Let's look at the other data we have gotten:

University of Michigan 1 year inflation expectations - largely derided as soft data, noisy data, not collected well etc. However, looking back thru time, it does a pretty good job of at least being coincident if not leading CPI. When all is said and done, inflation is a mindset and not a number. If consumers feel there is inflation, they will act accordingly. Bernanke said the same about deflation. Not sure why we don't feel that about inflation. Voters told us inflation matters to them and this survey shows they think it is headed the wrong way

Unit labor costs - out today came in at 6.6%, almost 1% higher than the 5.7% last month and expected for this. Consumers feel the pain of price and want higher wages. They are getting them. Why? Not enough blue collar workers. We see the pain in the white collar labor as firms like McKinsey, Microsoft and even PG are laying off white collar workers to improve productivity

ISM price at both manufacturing and services - both sharply higher this week. Companies themselves are saying price is headed higher at every level of the economy

Yet, CPI is presumably drifting lower and everyone feels that it will hit the Fed's target and allow it to cut rates. There is talk of a recession.

Don't get me wrong, I think there will be a recession. However, before we get there, we get stagflation, with growth stalling because of higher prices. Then, as the Fed sits and waits, unwilling to cut in the face of higher inflation, the recession will come. Not right away, but after a period. Stagflation leading into recession as the Fed sits on hold

Why will the Fed sit? It told us in stagflation it will wait and make sure inflation starts to improve. In fact, remember back to 2022 when the Fed first started hiking? It said it was willing to bring about a recession to lower prices

Well guess what? I think we will see that. However, before we do, we are seeing prices head higher. We are seeing stocks that are hurt by higher prices - tech, consumer - where margins are hit due to high human capital actually outperform

We are seeing stocks that benefit from higher prices - energy namely - lag

I think inflation is not only sticky, but accelerating higher

I think the market is giving us an opportunity

“The historical record cautions strongly against prematurely loosening policy. We will stay the course until the job is done.” – Powell, Jackson Hole 2022.

While inflation is not cooperating, the STIR market is still acting like it will be gently falling back to target, enabling the FOMC to cut two times this year. I think that is a bit too optimistic. What happens if/when the FOMC doesn’t cut? What happens if/when the FOMC communicates to the market that it isn’t thinking of cutting because inflation is not where it needs to be? A quick summary of Fed papers on ChatGPT gives us an idea of how the Fed would respond to stagflation:

“In stagflation, the FOMC prioritizes reducing inflation to prevent unanchored expectations, even if it causes economic slowdown and rising unemployment. The Fed sees credibility and inflation anchoring as vital to long-run economic health.”

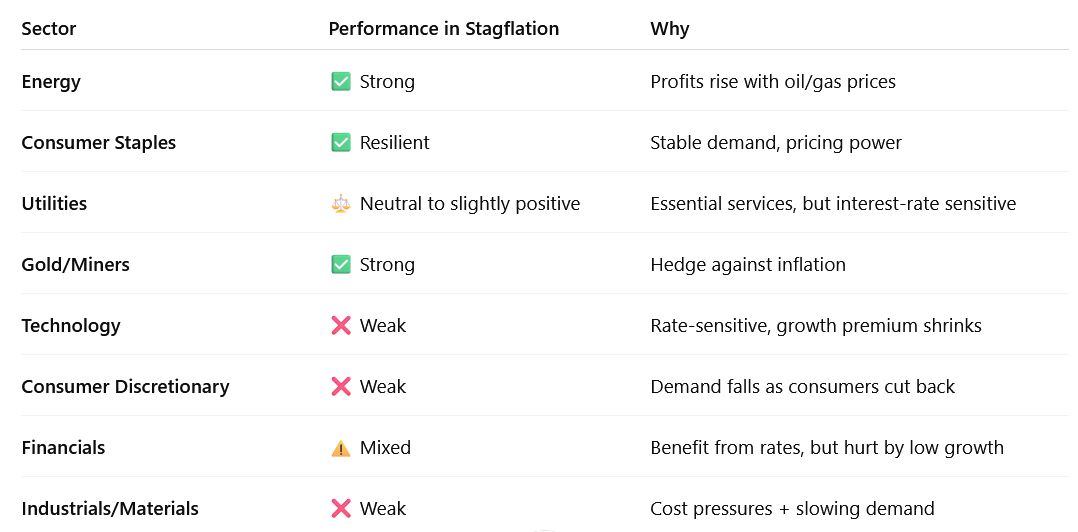

That leads to the second important question: what are we to do as investors? In stagflation, the stock and bond markets do not perform well overall. However, there are some sectors of the market that tend to do better. Thus, I feel it is best to position into these sectors and out of the ones that will struggle. Again, this is a summary from ChatGPT:

I would add Healthcare in here as a sector that does well in stagflation, provided you are in the boring cash-generating parts of healthcare and not in healthcare IT or biotech. As you look at this table, refer back to the top to see what sectors are working and not working. You see that Tech and Consumer Discretionary are doing the best and Industrials are right there too. These are three of the worst sectors in stagflation. On the bottom you see energy, healthcare, and staples. These are the sectors that should do the best. Thus, I think while there is risk to the overall market based on my assessment of the data, I also feel that there is an opportunity given the recent sector performance versus what should be working given this data.

The bond market is pricing in falling inflation and Fed rate cuts. I do not think you will see either of those, thus it is difficult for me to get interested in bonds until there is at least a 5% yield on them. The stock market is pricing in rising growth and falling prices. The reality is that we are seeing neither of these. Thus, I can’t get excited owning stocks, and if I do, they are going to be in the sectors that benefit in periods of stagnant growth and rising inflation.

There are technical reasons for the price action we are seeing in the market. The Treasury buying bonds is dampening volatility. Falling volatility brings people into risk assets because of VaR-based capital allocation and volatility targeting within risk parity. This creates opportunities in the market for those who are watching closely. This creates opportunities for those who … Stay Vigilant