Terminate, with extreme prejudice

Channeling my favorite movie as I think about markets after this week

As I wrote to you last week, the first week of September this year was a very critical week. We entered the week, sitting at a very important level for risky assets. It was a week full of economic news that would set the tone on the soft vs. hard landing debate. Finally, September itself is the seasonally worst time of the year. What we heard this week, would set the tone, perhaps for the rest of the year.

I wrote a few threads this week as the week unfolded. Thus, many of you may have a sense for how I think things transpired. However, I thought it might be worth going through the week using my favorite Fundamental, Behavioral & Catalyst model.

FUNDAMENTAL

You really need no other chart than this one. The ISM & its components are the most important indicators to watch. We got this information on Tuesday, after which I wrote the thread that I called ‘Resolving Lower’. This news was quite downbeat. Not so much because the headline came in at a weaker-than-expected 47.2. After all, this was slightly higher than last month. The downbeat news came from the collapse in New Orders to Inventories, which you can see above tends to lead the headline index. It led on the upside all of last year, indicating that we wanted to be invested. The move lower was something we do not see quite often. In fact, from the report:

“The combination of falling orders and rising inventory sends the gloomiest forward-indication of production trends seen for one and a half years, and one of the most worrying signals witnessed since the global financial crisis.”

“Although falling demand for raw materials has taken pressure off supply chains, rising wages and high shipping rates continue to be widely reported as factors pushing up input costs, which are now rising at the fastest pace since April of last year.”

Ladies & gents, this is all you need to know about an economy that may be slowing much faster than the market expects while pricing pressure may not resolve lower as fast as the market thinks either. This starts to put the FOMC in a pickle. Should they cut 50 bps to stave off falling growth? For one, that invites the inevitable panic that the FOMC sees something in the economic data that is pointing to hard landing. That alone is bad. However, cutting 50 bps risks re-igniting inflation that almost all of the market (and the central bank) has written off as a problem. Not good.

Then we got jobs data. Of course, long-time readers of Stay Vigilant know two things about my relationship with labor data. 1. It is quite lagging. It is the “E” in the HOPE acronym. We know what will happen to it because we see housing, new orders and profits all moving first. 2. The non-farm payroll, which everyone focuses on the most, is the worst of all of the data and not even essential given all of the other data we get on jobs. I wrote about this in the thread “Does NFP even matter?” this week as well.

That said, let’s see what the labor market told us this week:

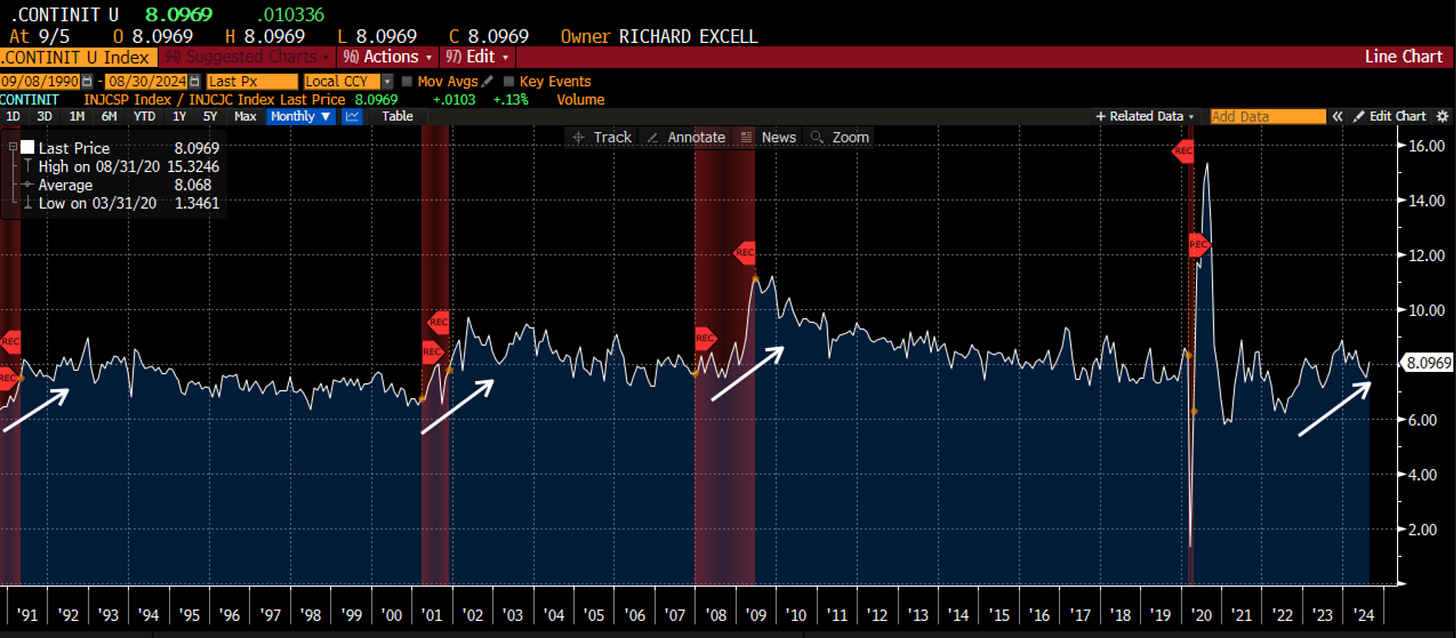

The ratio of continuing to initial claims. This tells us how many people not only file for unemployment insurance when they lose their jobs but are more persistently out of work. When this ratio rises, we are in a recession. This ratio has been rising and continues to.

Conference Board jobs plentiful vs. jobs hard to get. When this ratio falls, it means jobs are much harder to find. It signals we are in or are close to a recession. I can tell you anecdotally, in speaking to my students, the job market for financial services is not good right now. Then you look at the firing going on in Silicon Valley too. While jobs are added, they are added in healthcare & government. Not even in the high-paying healthcare jobs.

Then from the ISM data earlier in the week, we see the survey that asks the number of industries that are hiring. This fell to a number that is consistent with a recession.

Finally, within the BLS data itself, where we got the non-farm payroll number which was, wait for it, revised lower again, we also saw the ratio of part-time to full-time workers. In fact, in this report, there was actually job loss in the full-time jobs and job gains in part-time jobs. More importantly, this ratio is not trending well. When it trends (or moves sharply) higher, we get a recession.

In previous weeks we have shown the weakness in housing. Recall my preferred measure that looks at mortgage rates AND unemployment. Sure, mortgage rates are moving lower with the fall in 10-year US Treasuries. However, weakness in the job market, the high-end, full-time job market, may suggest further weakness in housing. This, of course, means more weakness in orders and eventually profits.

This section is clearly trending negative

BEHAVIORAL

There is a wide array of indicators I like to follow in this section. I also like to see market survey data. However, I am also finding a good list of Substack accounts that do a great job of helping me get a sense for the overall supply/demand situation in the market.

One of those good follows is

which follows a number of the same indicators and brings it forward in a clear and concise interpretation. I like the instant threads too in those times when I am following the market closely.One of those indicators that turned negative this week was the Put-Call ratio. Options on the long side are instant-gratification instruments. Because of the theta aka time decay, investors and traders do not seek out the insurance value of put options unless they are really nervous or over-extended. The theta can be too much of a drag on returns. Thus, when you see a spike in the volume of puts over calls, it should give an indication of near-term direction in the markets. The spike this week should give people pause.

In “Resolving Lower” I highlighted that Nasdaq futures were breaking down this week after the data. This continued and the MACD rolled over and headed lower. This indicates a change in trend. We are not at levels where the market is oversold yet either. This is a negative technical set-up and one that is easy for objective traders to short, with a tight stop back in the channel, and look for a move 10% lower.

The e-mini S&P does not look quite as vulnerable, bit you can see price starting to break below both the trend line and the ichimoku cloud. The lagging span is still holding on, so there is a bit more hope for the bulls here, but the crossover of the MACD paints an ominous picture too.

Another good follow on the trading signals is

. Not only on the commentary of the technical set-up, but also in trying to get inside the minds of traders. Marko writes about the DAX, but the lessons he discusses are universal. In addition, in downside moves, correlation across markets moves toward 1, so where the DAX is going is indicative of the US markets and vice versa.The Behavorial/technical/supply demand set up for stocks has been positive really for the past year or more. Even when we have seen negative fundamentals signals in 2023, it was the positive technical picture that kept me, and others, invested in the markets. However, that picture may be changing. Is this a long-term negative? Maybe not. The Fibonacci retracement points to a move lower to about 16,750 in the Nasdaq or about 10%. However, that may be enough to get to the sideline, or stay on the sideline if you are there, for the time being. It is enough for me to suggest this category is negative.

CATALYST

What will get people to change their minds? In the next week, maybe nothing. The following week we have not only an FOMC meeting, but also some housing data that will be impacted by the lower 10-year yields.

There currently is a 71% probability of a 25-bps rate cut in September, with a 29% chance of 50-bps. This came down over the course of the week after Nick Timiraos from the WSJ had this to say post the NFP data:

@NickTimiraos

There was a chance the jobs report would provide an obvious signal on the size of the first cut, and futures-market pricing would move to 90% right away for either 25 or for 50.

Instead, this report doesn't neatly resolve the tactical question, and the pricing is at 50-50.

The headline figures weren't bad enough to make 50 the base case but, in light of the revisions, it wasn't good enough to convincingly and cleanly douse speculation on a larger cut.

I would expect more Fed speakers this week. We have already heard uber-dove Goolsbee out calling for 50-bps and Williams out saying we only need 25-bps to normalize. I personally think 50-bps is a signal the FOMC models are getting a lot more negative than they let on. Either way, I do not see how Fed cuts can be a catalyst. As you can see, there are 10 rate cuts priced in until December of 2025. The market is expecting quite a bit from the FOMC. So-what if some of it is brought forward a bit? There is a long lag before it impacts, and the 10-year has already moved quite a bit which is the market doing the FOMC’s work for it. I do not see the Fed as a catalyst. We are pricing in rate cuts for sure. The only question now is if rate cuts come in a soft landing which is good for stocks or in a hard landing which is bad for stocks. I think the soft landing vs. hard landing debate is all that matters.

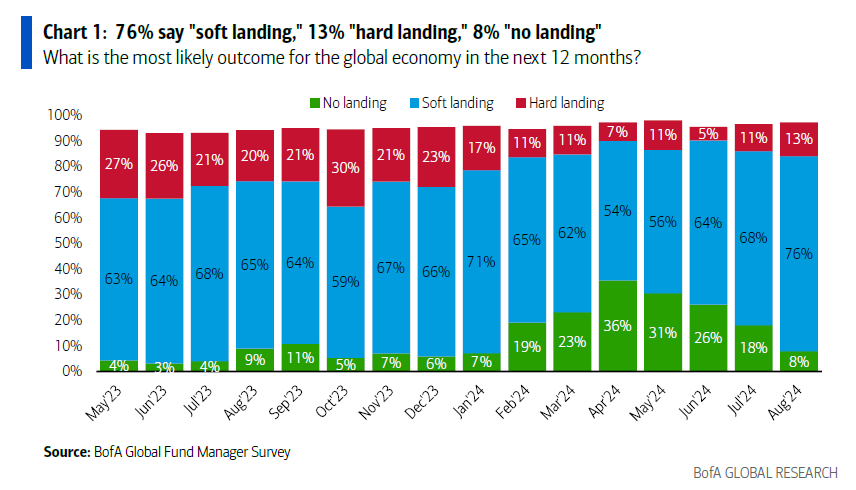

I have shown this before and I show it again. It is the BAML fund manager survey from 2 weeks ago. 84% of the market sees soft landing or no landing. Only 13% of the market thinks a recession is possible. If the data shows that a hard landing is becoming more likely, THIS is the catalyst that will get the most minds to change.

The most leading of economic indicators is housing. The FOMC week we get both building permits and housing starts, both forward-looking measures of housing. I overlay these with the MORT*JOB index that is both mortgage rates and unemployment rates. Yes, mortgage rates are lower. However, jobs are getting worse. What will matter more for consumers? We will see in the data.

There is a quote in “Apocalypse Now” where Capt. Benjamin Willard (Martin Sheen) is given his mission to kill Col. Walter Kurtz (Marlon Brando) because he has lost the plot. He is told to terminate the colonel’s command. The CIA re-iterates ‘terminate, with extreme prejudice’.

I always thought of this quote when I saw market set-ups that made me want to sell out of positions and get to the sideline. Perhaps much like in a battle, with all sorts of action and noise, it is difficult to lose our bearings. Thus, at times it is best to get out of risk so one can more objectively assess what will happen going forward. At those times, I would look at my positions and tell myself ‘Terminate, with extreme prejudice’. This week was one of those times when I muttered those words to myself and took action.

I am not here to get anyone to freak out. I am not here to give anyone trading or investing advice, only to tell you how I am thinking about the world. Most likely, we correct to some level and find a floor. Heck, there are some that say that if we are down on Monday, the Turnaround Tuesday will reset the move higher, much like it did in August. That is entirely possible.

Yet, with the fundamental backdrop deteriorating, maybe faster than we thought, giving us all sorts of negative recession vibes, with the technicals deteriorating, with Put-call ratios suggesting hedging is being put on aggressively, it is not time to be Col. Kurtz. It is time to be Capt. Willard. It is time to …

Stay Vigilant