The behavioral part of the market - supply & demand

As the fundamentals of the market deteriorate, the riskiest parts have presumably started to stabilize. Stocks are off their lows and crypto like Bitcoin is well off the lows. These are the types of moves that cause a lot of people some consternation. However, those who have actively participated in the markets know that it comes down to 'what is priced in?' The supply and demand balance in the financial markets are a function of many behavioral metrics, because in the end it is human beings making the decisions to buy or sell. I can hear your push back - but what about quantitative finance? what about systematic strategies and algorithmic trading? I would answer by saying that even behind the sophisticated code that drives all of those, are human beings. Humans constantly tinkering because the model is not working the same way it did in a back-test. A human deciding whether or not to allocate some (or more) money to these strategies. So biases can and will develop in all types of strategies. The trick is not to believe it does not exist but to look at where it might show up and try to interpret the different ebbs and flows of these views, and these flows.

Confidence

It all starts out with confidence. Decision-making with confidence is quite different than decision-making with no confidence. Even if the buy/sell decision does not change, confidence can affect the relative sizing of the position. So, are people feeling confident?

NFIB Small Business Optimism

The top hiring part of the economy is small business. It drives everything else. If people have jobs, they feel confident. If small business feels confident, it is more likely to offer those jobs. I have shown you a long-term view of small business confidence. You can see the exuberance before the GFC and the subsequent crash - well before the market did. You can see the exuberance during the Trump administration which led stocks while many couldn't believe stocks were going higher with such a divisive President. It all comes down, in my mind, to the economy and regulation (and the expected changes to it). In absolute terms, the level of confidence is still near 100. This is about the median of the last 20 years. However, the trend in this data is NOT good. Since 2017 we have had lower and lower highs. We have moved below the midpoint of the range. I wouldn't call this a red flag just yet, but it is a very yellow flag to be sure.

Conference Board Consumer Confidence

We see some, maybe even a lot, of the same reaction in the Conference Board number. Consumers are not that far away from small business. However, the biggest difference is in the post Covid world. While small companies were fading in their outlook, consumers were feeling better? Why? One can only guess as the labor force data said they were not at work. I would guess it is because the checks to people from the government were far bigger (relatively) than the checks to companies. Fiscal stimulus has served well to carry people through the crisis but companies can see the end, can feel the end, right now. We are still dangerously near the median, in an economy with the HIGHEST nominal growth this century. I might suggest this is a yellow flag because of that alone, however, objectively, it is all pretty neutral right now.

Case-Shiller Home Price Index

For just about everyone out there, the biggest asset on their personal balance sheet is their house. The wealth from housing can help potential retirees feel good about their future. The lack of equity in a house can get young couples a little nervous. We know that in the economy, housing leads overall activity. It is the first to move higher and the first to move lower. What stands out from this chart is twofold: 1. we have more than recovered from the housing crisis 15 years ago 2. Covid has really changed the dynamic for many. High prices would naturally be seen as a negative - an inhibitor to activity. However, as I wrote on Linked In this week, it isn't interest rates, or even prices here, that drives housing. It is actually jobs and how much people are getting paid. They do not make the decision to buy a house lightly. If there is still demand to keep prices high, this is good because buyers feel confident enough to purchase. This is good for the economy because of the multiplier effect. We will see as we evolve through the Spring season if prices hold up. For now, I would characterize this environment as healthy and positive for all involved.

American Association of Individual Investors

The last category of confidence I review is individual investor confidence. These are the people behind the flows into 401k, ETF, Bitcoin etc. This particular measure, at least the way I have constructed it, is typically a contrarian indicator. I look at the number of Bulls vs. the number of Bears. When the number falls too low (below -20) this means too many people have gotten bearish and risk assets can move higher. This is what we just saw. Conversely, when the number of bulls gets too high, above 20 on this, it is time for the market to move lower. Think late December. Individual investors are still feeling bearish, but we are off the extremes. As a result, I characterize this as more neutral right now but something one clearly wants to watch quite closely.

Derivatives markets

I got my start in the business as an options market maker so I have always felt there is a great deal of information in this market. There are so many ways to make, and lose, money in the world of options. One not only needs a view on direction, but on the pace at which we will move there, the timing of the move, and the opinion of everyone else on those views. It is a very challenging world to navigate, but if you can do it well, there are fabulous outcomes. The world of derivatives dwarfs all other assets. By some counts, there is $1 Quadrillion of derivatives in the world. Think about that number. Yet, how many people do anything but give a casual glance as to what is happening there. Not me, I feel we can learn a lot about investor views in this market.

20 Day Put-Call Ratio

When investors are feeling nervous they buy insurance. The insurance they buy is in the form of put options. When investors are feeling more confident, they either look to generate income buy over-writing their stocks with calls, or if even more confident, they add long call options for leverage. Thus, looking at the ratio of the number of puts traded to the number of calls traded (for this I look at equities only) we can get a good gauge of not what people are saying, but what they are doing. When this ratio is moving higher, there are nervous investors. When it moves lower, people are feeling more confident. You can see how sharply lower it moved in the latter half of 2020. This suggested the sharp moves higher in equities that we saw. Surprisingly, it moved higher last year suggesting nervousness. You may say 'well that didn't work'. However, I would suggest it did in many ways. Investor sentiment is reflected through the multiple on earnings that investors pay. It is not reflected in the earnings themselves. All of 2021 was characterized by declining multiples even with higher earnings. The fundamentals drove stocks, not the sentiment. We seem to be in a very similar environment now. This measure continues to look to trend higher. Do not expect multiples to expand To the extent companies deliver on earnings, stocks will go higher. We saw these moves in the quarter (AMZN). To the extent earnings miss, stocks will get punished (see FB). Thus, this is actually a negative sign to see for overall risk sentiment.

VIX and CDX markets

Institutional investors also look to buy insurance when they are feeling uncomfortable. One form of this insurance is the VIX Index. While this index is constructed by using a strip of S&P 500 Index options, this index has a life of its own, with options and futures on it. It is extremely liquid and traded all night, thus investors of all asset classes use it. Even when there is a 'European VIX' or a 'Gold VIX', we see that most investors just choose the original. Back-tests show (go to Cboe.com) that it is highly negatively correlated not only to equity markets but credit markets too. Thus, it is the go to hedge. Readers of my Linked In will know I wrote about the equity vs. credit market this week. The credit market has been the preferred vehicle for risk in the post GFC world. This is where the potential troubles will arise imho, not in the equity market. In this chart I show you the VIX Index and another form of insurance, the CDX or credit default swap index market. You can see here, that while we are not at the high levels we saw when Covid hit in 2020, institutional investors in the credit (and equity) market are feeling more nervous and looking to hedge. It is always said that credit leads equity. Credit investors worry about return OF capital and not return ON capital. If they are nervous, we should all be nervous. Especially with $2 trillion of issuance each of the last 2 years.

CSFB Index

This is another hedging metric to watch. The CSFB (Credit Suisse Fear Barometer) Index looks at the relative cost of a put vs. a call, for a zero cost options collar. It actually ends up being a coincident measure with the SPX Index itself as you can see. Typically, this relative cost only falls when the market is itself falling and balancing the upside vs. downside risks. However, this time the overall index has not fallen apace with the CSFB. Perhaps it is a magnitude issue like September of last year. Perhaps there is something more afoot. I am not willing to suggest we should ignore this now and therefore look at this as a yellow flag.

Term Premium

Term premium is the extra amount investors demand to lock up their money for a longer period of time. This is a core element of finance - the time value of money. This measure has been distorted, intentionally in my mind, by central banks and financial repression. The normally positive number went deeply negative in 2020, at the same time the amount of negative yielding bonds in the world hit its peak. Regulators forced pensions, insurance and banks into sovereign assets. Then central bank buying pushed this number deeply negative. All other investors had to respond by moving out on the risk curve - to corporate credit, public equity, private equity and digital assets. The extent to which central banks back off their demand for bonds, the term premium is allowed to rise. As it rises, sovereign yields rise. As we know, sovereign yields rise and riskier assets suffer, both because of the change in discount rates applied to those assets, but also because of the greater appeal of the risk-free asset. Thus a rising term premium, in the near term, is going to be a negative for risky assets. This measure is rising and based on all of the commentary from the Fed et al, will continue to rise.

Bitcoin price

Finally, I look to Bitcoin as a great measure of investor sentiment. I feel Bitcoin crosses over between Millennials who want to break from the traditional finance world and Boomers who are libertarian/anti-government. I feel Bitcoin is an asset for the entire world, with most of its drivers outside the US and not internal to the US. While maximalists will tell you it is uncorrelated with other markets like stocks, it is not. It is highly correlated and that correlation is moving higher, not lower, as institutions get involved. The chart of Bitcoin is fantastic. It is at a level of reward vs. risk. We could hold here and move back to the highs or support can fail and we move back to 2020 levels. I can potentially see reasons this plays out either way. I would say that the signal from here is neutral right now, though it was positive when it held and bounced as we saw for US equities. This is the place to keep your eyes focused, if you only look at one measure of sentiment.

Intermarket analysis

The last step I take is to look across a number of markets to gauge how each might be feeling. Money flows globally and if one area or more are feeling pain, it typically means others will. If one area or more are feeling great, that rising tide may lift all boats. I look through countless assets but I want to highlight 4 charts today: NDX Index, KOSPI Index, Copper and Oil. I think they tell us the story we need to know.

NDX Index

There has been a fair bit of pain felt in the Nasdaq this year, particularly in the highest flying technology and biotech stocks. However, if we step back and look at it on a weekly basis, the chart is still holding up pretty well. We have not gone below the average level where most long-term investors are long from. Yes, moving averages are flattening here, which is worrying, but the market is pulling back some form oversold levels. While the shorter-term chart is less positive, I would still suggest this chart is solidly neutral and might actually turn better in the near term.

Kospi Index

I do not get the same warm and fuzzies from the Kospi (Korean) Index. This is a very economically sensitive index. It will be impacted a good deal by growth in Asia and not just the US. Emerging market central banks have been tightening policy for a year. I know we are focused on the Fed, but global liquidity has been coming out for a longer time. This is bad for all risk assets and we see it the impact on the Kospi.

Copper

Speaking of global growth measures, I can think of none better than Copper. It is a key input to housing markets, but also to so many other industrial applications, nowadays being electric vehicles, smartphones and the like. Copper led us out of the Covid bottom in 2020. When it flat-lined in 2021, people started to feel nervous. However, it is holding the line and the MACD looks set to turn up. This is a good sign for global growth and may be suggesting that we are see a near term re-pricing of risk in equities, but not a fundamental flaw. This corroborates the decline in multiples even in the face of stronger earnings. Not the best of markets, but not one in which to panic.

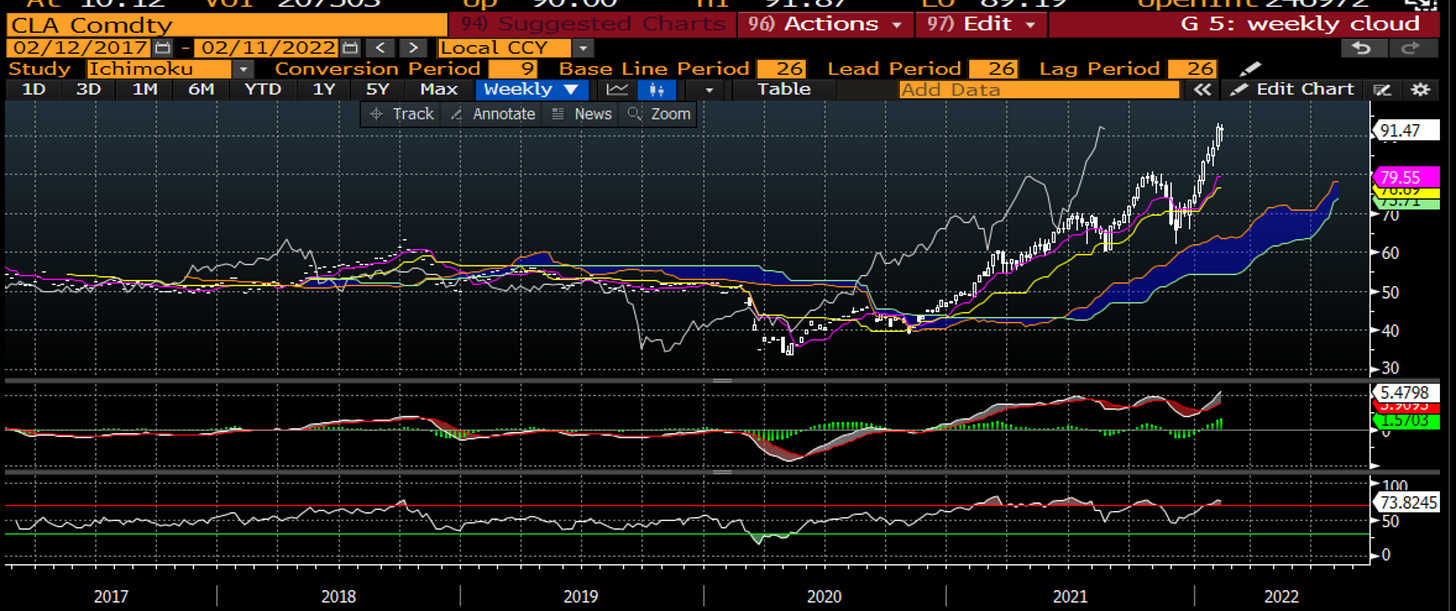

Oil

Those are both measures of global growth. Growth is hanging in there and not falling out of bed. That is not positive but not negative either. Oil on the other hand, is a measure of inflation, especially now. As people who follow me know, I believe we are in a period of structural short supply. OPEC has told us they do not feel they need to urgently help. Venezuela is really in no position to help. Russia is deciding geopolitically not to help. ESG Investors are telling those who can help that they should not. That doesn't sound to me like a recipe of a lot of supply dampening the 2019 levels of demand we are seeing. This means inflation, this means hakwish central banks, this means a re-pricing of risk.

Pulling it all together, you can see I am essentially using a qualitative diffusion index. I am assessing simply where the preponderance of the evidence is, and what the message from the markets it. How and why is the money flowing the way it does.

Sentiment is a mixed picture. Companies do not feel particularly good right now but housing holds the key. It is seasonal but right now, it could offset this company weakness. I will continue to watch, but I think this ends up being a bit neutral.

The derivatives market is more downbeat. Option hedgers are getting nervous. The most overweight part of the market is credit and those investors are particularly nervous in my mind. Institutional accounts see a lower market. The Fed is backing off its buying and the market will re-price as it is no longer forced into risk. The riskiest (and rewardiest) of all is Bitcoin, and it is at a critical inflexion point. Overall, this gives me a bad feeling here.

Finally, I try to be objective and look at price. It is the intersection of supply and demand after all. I look at the most important markets. We feel okay longer term in the US, but the EM markets are falling apart. Growth looks okay, but slowing in the commodities, but that same market tells us inflation is moving higher still. This is a mild form of stagflation and this is not a market to be long risk, unless that risk is in oil futures. Overall, I pull this together and feel the behavioral portion of the market is giving me a major Yellow Flag. It is a market where one should still be looking to reduce their risk exposure.

Stay Vigilant.