The bullish argument

Building on a LinkedIn from this week, I explore the bullish argument. Do I have this right?

This week I want to build on a post I put out on LinkedIn on Thursday. In that post, I briefly went through the arguments I have heard various bulls make. I think these captures all of the views but if I have missed something, please let me know in comments.

On Substack here, I am going to add to some of the charts and dialogue to try and flesh it out a bit more. This is in the spirit of avoiding confirmation bias or the tendency to interpret new evidence as confirmation of one's existing beliefs or theories. As you know, I have thought that the risks were rising and that risky assets were not pricing in a margin of safety. However, risky assets have moved higher over the past week. Thus, I want to explore what I think is driving that as a way to force myself to think critically about my own views.

Chart of the Day – the bullish argument

At least I think this is the bullish argument. I was thinking more about it and reading several pieces from people I know are upbeat right now. I am trying to find what I think are the consistent themes I read across all of the pieces, and I think it goes something like this.

Rates

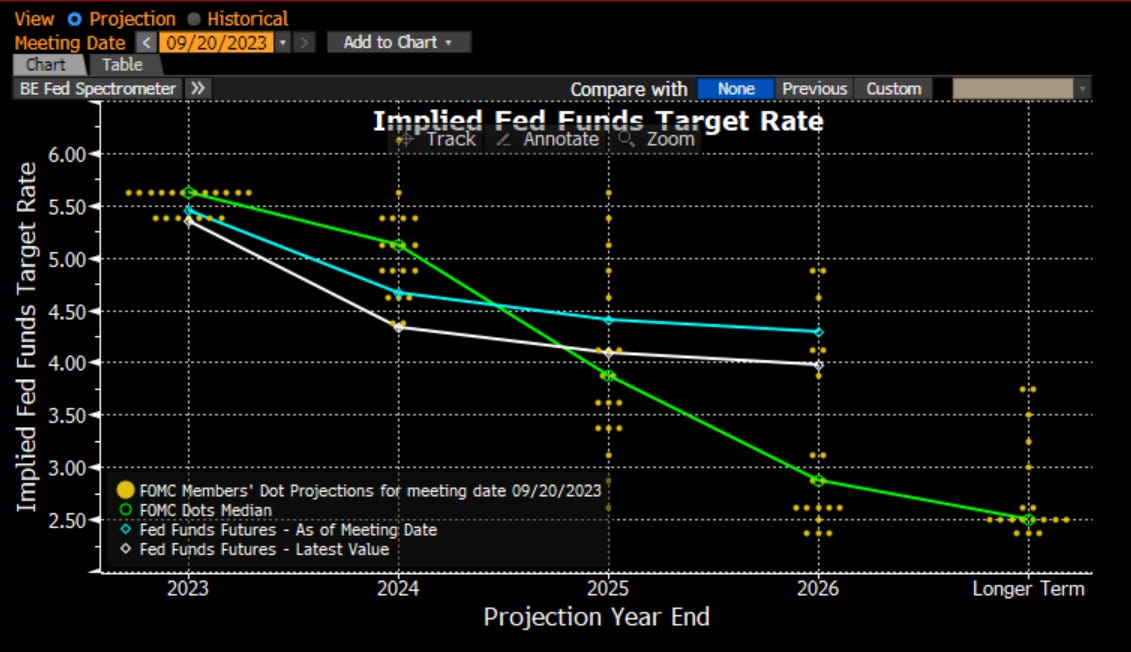

The FOMC is finished raising rates. Yes, Jay Powell and company go with the ‘hawkish pause’ but we all know that only means they are on a pause. In fact, if we look through history, the FOMC tends to cut rates within 6-9 months of the last hike. This means rates will be lower next year because the FOMC will cut with inflation under control. Just look at the FOMC dot plots which I show here. The FOMC itself says we will be exiting 2024 with lower rates than where we are now. We can see with the blue & white lines that the market itself is more dovish and anticipates more rate cuts than the majority of FOMC members, but the FOMC will figure out the market is correct.

If we look back over the past few years, we can get a sense for where the market has been in relation to the FOMC. It had been pretty in synch with the FOMC until late 2022, after which time the market has been consistently more dovish than the Fed. We can see that we are ending the year where the FOMC said we would be and not where the market has said we would be. Surprisingly, even though the rates market has had to get more hawkish, the equity market has rallied like it is Peak Fed all year long.

The premise for this is that once the FOMC pauses, it is only 6 months on average until the FOMC cuts. This is true if you look back through time. What do you also see as you look back through time? The FOMC is cutting after the pause because a recession is about to begin. It had gone too far, and things were starting to break. The one exception to this was the mid 90s, when the FOMC cut once, raised again, cut again, then raised a few more times. This was unique. It was cutting in response to the Asian Financial Crisis and then the LTCM crisis. It hiked because stocks kept going higher. Then things broke. Perhaps that is the proper analog here with what we are seeing abroad vs. the AI boom here. It still ended badly, it just took some time, and carried out some shorts in the meantime.

I think the counter point to the FOMC on hold and will soon cut rally would be threefold. First, the market hasn’t been correct about rates for a year. The FOMC has been consistently more hawkish and continues to tell you that: 1. Inflation is still not to target 2. Yes, financial conditions have tightened and there are some global risks out there that lead them to believe there could be trouble ahead that suggests they could stop or ease 3. The base case is a soft landing in which case rates will be higher for longer. So, for me, this suggests that either rates stay at this level for all of 2024 or we get a recession and not a soft landing and that is what leads to lower rates. Don’t listen to me, I am nobody. Watch the Stan Druckenmiller You Tube from the Robin Hood Conference. He is levered long 2-year futures because he thinks the FOMC will have to cut rates. Not because inflation drifts gently back to 2%. He thinks this because he sees a deep recession. Absent a recession, it seems to me 2% real + 2% inflation expectations +1% term premium = 5% nominal rates

Economy

Thus, I think it is a little inconsistent and disingenuous to think that we get both a soft landing AND rate cuts. People will say ‘but look at all of the dry powder the FOMC has’ to which I would respond that the FOMC would not use this until it has to i.e. until its dual mandate suggests this. The FOMC has a mandate for price stability (not there yet) and full employment (we are there). Rate cuts happen because unemployment is up a LOT or we risk deflation not inflation around 2%. The view then hinges on the economy - soft landing vs. recession. Soft landing has clearly won in 2023 vs. those like me that called for a recession at the start of the year. Whatever the reason, and there may be many, the fact is the economy has been better than expected this year. Will it be next year? I look at the same anticipatory indicators I always like to use, which were frankly telling me there would not be a recession this year but I ignored – Housing, New Orders and PMI.

Housing leads us into and out of recessions. The strength in new home sales because of subsidized mortgages led to strength in the NAHB housing number from the get-go this year. We can see that in orange. This fed into new orders. I look at the ratio of new orders to inventories in blue. It starts rising almost right away as well. This ultimately brought the PMI in white up. Forget about GDP. Yes, it was high in Q3. However, it is horribly lagging and will be revised, most likely lower, two more times. Look at these numbers that are forward-looking. They told us there would be a soft landing this year. What about next year? Since the end of the summer, NAHB housing data has rolled over. New homes are still okay but existing home sales are the lowest this century. New orders are also rolling over and now PMI, which looked like it might pop above 50 again, just fell sharply more than expected. This suggests to me that it might be Druckenmiller and not the bulls that are correct.

Thinking of the employment report that came out on Friday, we saw a move higher in the unemployment rate to 3.9%. This is still remarkably low given the extent of hiking. However, it is also up 0.5% from the lows over the summer. You can see that unemployment tends to move higher roughly 24 months after the FOMC starts hiking. We are right in that sweet spot of when the jobs data is about to get a lot worse. The strong labor market has been underpinning the views of many on a soft landing. Will it persist?

Speaking of time horizons, I wrote this post about the yield curve on Friday:

Chart of the Day - 16 months

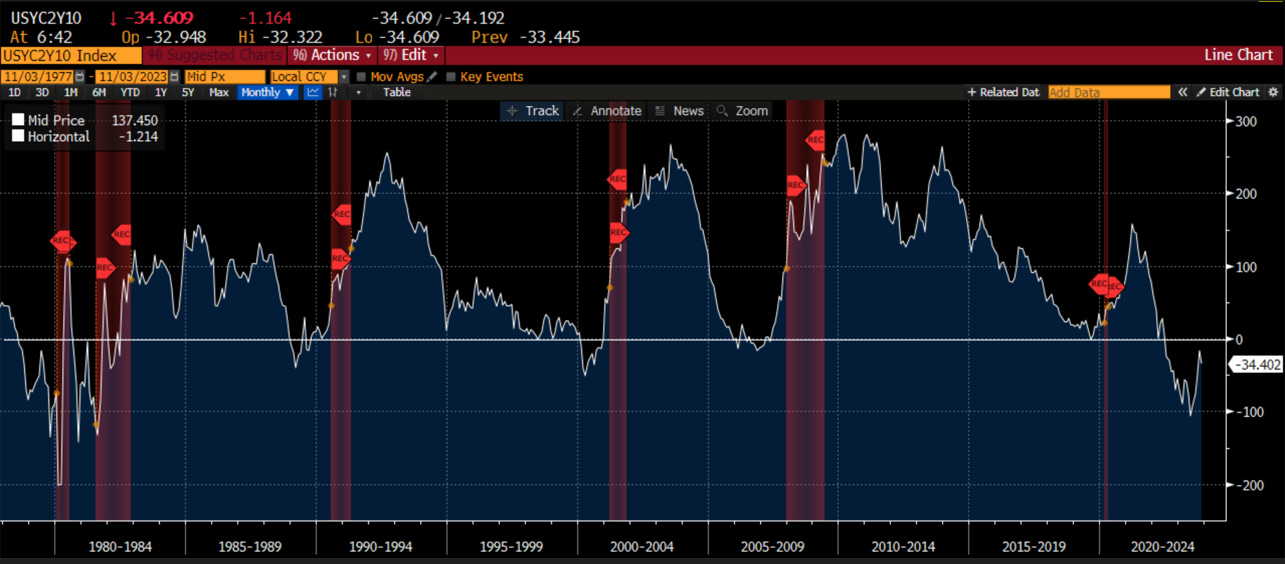

Yesterday was a bit long so today I will try to keep it short and sweet. I want to focus on 16 months. Why? Because over the last 45 years, that is the average time it has taken from the time the yield curve has inverted until we have a recession

The yield curve is a favorite indicator of mine and many other economic forecasters because it has a 100% hit rate. When it inverts, we have a recession. There is logic to it if you think of the yield curve as an approximation of bank margins, as they invert, less money flows to the economy etc

The problem with the yield curve is that there is a long lag (16 months on average) and it is variable. While the average is 16 months it has been as short as 7 months and as long as 24 months. So, it is tough to say 'we are going to have a recession but we don't know if it will start pretty soon or in a while'

That sound kind of sill when you phrase it that way so instead you switch to 'the yield curve is inverted which is giving a warning sign' as it sounds better. In the back of your mind, you are still counting to about 16 months though

However, you are always looking for a better catalyst than just sometime in the future. That catalyst is when the yield curve re-steepens past zero. That shortens the window to less than 5 months

Well friends, we are at 16 months from the time the yield curve first inverted at the end of June 2022. The curve has re-steepened from over 100 bps negative to 30 bps negative. It hasn't gone past zero but it is thinking about it. With 10yr nudging higher it is in range

Normally it re-steepens with short rates getting cut. This time, maybe it is long rates moving higher. Why? BOJ backing off YCC & the impact on global rates. Treasury issuance moving to coupons. Inflation staying sticky. Global bond investors backing off

For now, we can still rest easy & enjoy a Santa Claus rally. As you think about your portfolio for next year, keep the yield curve in mind. Especially if it moves above 0

Putting it together, for me, while the economy has surprised on the upside all year long, the underpinnings of the 2023 soft landing - new home sales, jobs market, government spending - do not look set for a repeat in 2024. As such, I think I find the Druckenmiller view more compelling, that if we are seeing rate cuts, it is because the economy is in a recession. These rates cuts will further steepen the yield curve which is another recession signal. Recessions are not good for stocks.

Technicals

What has been good for stocks this year? The technical picture.

Another bullish argument is the technical picture. Don’t forget positive seasonality. Look at the typical strength in Q4 if we look back the last 20 years. To which I would say ‘you are exactly right.’ There are other technical data points I can show that suggests the weekly or monthly trends are weakening. However, the recent strength the last few days has seen the SPX recover the 1 year moving average and recover from some oversold levels. Now the Santa rally and greedy PM bonus hunting is largely in place. This behavioral impulse to get longer and ride beta into year end, or if you are a long/short manager, to reduce shorts and lean as net long as you can is a very real phenomenon. Having been in that seat, you can’t ignore it. It can run pretty hard into December expiration at which time people will reduce positions, close books and build up hedges for next year before liquidity dries up too much. This is 5 weeks of run way.

If I look at the market leader this year, the Nasdaq 100, it held at the support level from whence it broke out in the early summer. I thought it would get down to the 1 year moving average but it held above there and has bounced led by the Williams %R getting oversold and recovering and now the Stochastics are turning higher. It is running into some trendline (and Ichimoku cloud not shown here) resistance. A break of that level and we will be off to the races into year end.

The big qualifier for that is geopolitical risk. More geopolitical risk could catch everyone leaning long completely off guard and cause a panic. Right now, it seems consensus that the Israel/Gaza conflict is contained, Ukraine/Russia is winding down toward an armistice over the winter and China will not blockade Taiwan. It doesn’t even consider something else happening. Admittedly geopolitics are always negative for risk and unpredictable. However, it does feel like they are trending in the wrong direction and not the right direction so caveat emptor. This chart from MacroMicro.me does a great job of quantifying how much risk has risen. I encourage you to explore the site as you can see where this stands versus history that goes back to 1900. You can see that we may not be at the hot war stage we were in early 2022, but we are at the highest levels of the last decade. I think this is a risk worth considering.

As an aside, if you haven’t seen it yet, I thought this video from Vice Chancellor Habeck of Germany was very powerful and very on point:

Earnings

Earnings are the last piece. These continue to be better than expected. Sure, earnings for the Magnificent 7 were more of a mixed bag than clearly good. Sure, earnings for the Russell 2000 small caps have been nothing short of abysmal. Just look at the earnings beats the companies put up for this quarter, across the board in the SPX.

The counter would be to look at the lower right panel. This is the stock reaction based on earnings news. Yes, companies beat earnings. However, stocks went lower on that day. Why? They went lower because the vast majority of CEOs lowered guidance for next year. The commentary was about slowing growth, still high inflation, inability to pass on price, labor costs going higher, theft, etc. It was not an unabashedly bullish story. Sure, the quarter was fine but the outlook was not.

I also want to build on an idea I have shown many times of the linkage between rates and earnings multiples. MAN Group had a piece out this week that look at real yields and P/Es (hat tip JH for the share). I have tried to re-create the chart here. The FOMC is acting through the real yield channel and wants the market to follow suit. This has happened before if we look back to 2010-2014. At that time, the FOMC was actively easing real yields and trying to get market players to take more risk to pull us out of a recession that was taking longer than expected. The market took a long time to embrace, but when it did, it went all in and the earnings yield fell sharply (P/Es rose sharply saying it another way). Now the FOMC is actively trying to slow the economy by raising real yields. It has raised them to the highest levels since pre Great Financial Crisis. The market has not fully embraced this, and earnings yields stay historically low (P/Es high that is). How do you think these lines recouple? By the FOMC easing real yields or by the market raising the earnings yield (lowering P/Es)?

I think I understand the bullish argument. Frankly, the most compelling argument of all of them is the 5-week seasonal rally. The others I think are internally inconsistent. I don’t see lower rates UNLESS we have a recession; thus, I do not see lower rates as a reason to buy stocks. If the economy recovers, in spite of forward-looking indicators showing softness, I think the FOMC will have to stay in play. The economy leads earnings. If the economy is fine, and so the negative guidance we hear is simply CEOs positioning for next year, it means the economy is strong, the FOMC is still hiking and multiples contract. Marginally bullish maybe? Not wildly bullish. This all assumes no more geopolitical risk at a time when the world sees the US as incredibly weak because we lack leadership across at least 2 of the 3 branches of government (which 2 depending on who you ask I imagine).

All in all, there is a bullish case to be made. I guess I just don’t see it that compelling.

Stay Vigilant