The second of the three bodies - Behavioral

How do the supply & demand dynamics of risky assets look right now?

(I am reprising this blog from my www.demystifinance.blogspot.com I did earlier this year but updating the information. I wanted to introduce you to my thought process)

Since I took my first behavioral finance class at Booth GSB with Prof. Hsee (Thaler wasn't teaching that quarter), I have been capitvated by the idea. A lot of people who didn't go to U of C think that all we care about is the efficient markets hypothesis. This is just not the case. There is an entire group that focuses on behavioral finance. In fact, I would encourage you to listen to the discussions on YouTube between Eugene Fama of EMH fame and Richard Thaler of behavioral finance fame. They are enlightening. One thing you quickly realize is that in both cases, we are talking about models of the world. No model is perfect. In fact, Lars Peter Hansen (another U of C Nobel winner) in his laureate speech said that one should never trust a single model. My entire investment process revolves around not trusting a single model, a single approach, but instead exploring all angles and seeing where the preponderance of the evidence prevails.

In trying to eliminate behavioral biases from my approach, I have taken to looking at a large variety of indicators. This blog post will be longer than the others simply because of the number of things I look at. In fact, the ones I am posting here are fewer than what I look at. In each category I will try to tell you why I look at these and what the evidence suggests. Then I will try to bring it all together. So, please bear with me on this journey.

The first bias I try to avoid is anchoring bias. In order to do this I look at market valuation measures. Many think that this belongs in last week's post on fundamentals. I feel differently (though I did look at relative measures such as equities vs. fixed income or credit last week). For the market valuation, which frankly most seem to focus or anchor on to form their view, it is really a measure of sentiment. There is no statistical significance between the market or a stock valuation and it's performance over the next 12 months. If anything, of late, the higher the valuation, the better the performance. However, over a 10 year horizon, the ONLY significant variable is valuation. I am not trying to suggest that the level at which you buy something does not impact your future returns. What I AM trying to say is that much of the world will focus on valuation and say the 'market is too expensive'. Frankly, I want to avoid that. However, I do appreciate that when levels are extended, there is very little 'margin of safety' to use a Ben Graham term. In today's parlance, that just means that stocks can move a lot lower than you think on seemingly marginally negative news.

I really don't care for P/E. Few analysts use it in any given sector so why should it matter for the market. That said, if you do need to use it, please use the forward P/E. We invest on a forward-looking basis and not on the past. We also have the problem of index composition - the biggest names/sectors in the SPX in 2000 are very different than now. In spite of these shortcomings, let’s consider it. Looking at the SPX forward P/E, we do in fact see that it is quite elevated and at the highest levels this century. That said, after hitting a high of 22x forward in early 2021, it has fallen (because of prices lower and earnings higher) to a level just above 17x, not too far above the 30 year mean. Elevated yes, extreme no longer.

I prefer to use EV/EBITDA as it is a better measure across a variety of sectors and looks at what is available to all levels of the capital structure. Even here, we have very little margin of safety. It hs moved higher for 15 years. That said, this more conservative measure has also pulled back considerably and is near the long run mean.

The next bias I try to avoid is confirmation bias or the habit we all have of interpreting information in a way that confirms our own view. I look at various survey measures for this. Where am I in consensus? If I agree with the bulk of people, how can any of us make money? If I don't agree but there is a large consensus, what will change their mind because that is the only way for me to make money. Said another way, if everyone is on one side of the boat, it is probably a little safer on the other side.

A very short term indicator measures the flow of money into falling stocks vs. rising stocks. At it's extremes, it is a measure of when the market is overbought or oversold. I use a 10 day moving average to take out some really short term noise. You can see from this chart, the market here is looking pretty oversold, too many people are on one side of the boat. This recent bounce was the result of extreme oversold levels where marginally good news helps. One negative, if you can squint, is the trend of volume in falling stocks has increased in the past year:

The next measure is more of a medium term measure of sentiment called the Fundamental Stock Indicator (FSI). It measures jobless claims, commodity prices and consumer confidence. Are people looking for work, are companies paying more for goods and do consumers feel good. All are ways at suggesting what earnings could look like and it does a good job of being coincident with the market. It can help me stay focused and avoid the noise of the market. On this front, it still looks pretty healthy. Looking into the details, maybe not as much. Clearly the CRB Index is having a big impact. Normally it is positive, but at extremes we need to be carefuldd:

A really good contrarian indicator is Wall Street strategists' opinions. Not to pick on the 'sell-side' but it is their job to sell stocks to us. They are always bullish. However, if you read between the lines and get look at changes in their sentiment, it can be telling. I look at a number of things but one thing I like is the distance to the average strategist target price. If they are bullish, as we get close, they will move the target higher. If they are not, they will let the market get to that target and maybe even go above. You can see that the distance to the targets is about 14%. Yes, maybe some targets are starting to come lower with the weaker market. This is human nature. However, the negative revisions have not kept up with the action. Wall Street is a little more optimisitic than normal:

Do the companies themselves support this generally upbeat sentiment? After all, it is earnings that drives stocks and the market and not strategists target prices. One way to look is management sentiment on conference calls at earnings. However, large cap companies know how to play the game. Another way is to look at small business sentiment. These companies do the bulk of the hiring in the US so we should care how they feel. Perhaps because of Covid, perhaps because of high CPI and PPI, sentiment is not good here and hasn't been steadily trending lower for a couple years:

Do consumers agree? Earnings only come from selling product to consumers. If consumers are still happy, they will spend. So it should all come down to whether consumers feel good or not. Well, consumers are also pretty downbeat, again because there are just so many things to worry about in the world these days - inflation, jobs, Covid, environment, social issues, geopolitics. Things start to wear on people after a while and this is what we are seeing:

Does this negative sentiment carry over to house prices? House prices are important because they are a very good leading indicator of the economy and the market. They turn higher before other measures and turn lower early too. Home building has a very good multiplier effect so when this market is strong, other local markets tend to be as well. 2020 and into 2021 was a strong housing cycle. Is it continuing? So far, so good. We are going into the Spring season with high prices and low inventories. In spite of higher mortgage rates, building permits have held up. MBA purchase activity is a little weaker. However, overall, housing still looks okay:

The next bias I try to avoid is loss aversion. It is human nature to dislike losses. In fact, the research shows we get more pain from a loss than do we get joy from a similar size gain. Investors try to avoid losses at all costs, often times holding onto losing positions so we don't lock in the loss. Institutional investors also dislike losses but this is because if you lag your benchmark or lose money, you can have capital taken away from you and you could lose your job. So when the pros get nervous, they look to hedge. When they look to hedge, they go to the options market. Thus, in order to see where loss aversion is creeping in, I look at several options market signals.

One of the better indicators of the market medium term is the 1 month moving average of the Put-Call ratio. When there is nervousness, people start to hedge. they buy more puts. In normal times, investors will look to sell calls against their holdings. When euphoric, there is little options trading. If we look at this ratio, we can see where we are on the spectrum of panic to euphoria. I use the 1month (20 day) moving average to take out the daily noise. When this turns higher, it is bad news for the market, but when it moves lower (regardless of the level) it gives the all clear. It had moved higher late last year even ahead of this move we have seen. It is in the process of stabilizing now. Not yet an all clear but maybe past the worst. Hedges are being rolled out of not closed. This suggests we may be past the panic:

The press focuses on the VIX Index and rightly so. The VIX or Volatility Index is a measure of 1 month equity implied volatility. However, the market of this product is the most liquid options market in the world and it trades 24/7 thus all asset classes will use the VIX to hedge. In fact, equity volatility is highly correlated with credit spreads so credit investors may use the VIX more than equity investors. The curve here is almost always upward sloping as there is always some latent hedging demand. When there is concern, the curve start to flatten. When investors panic, it goes inverted (below 0 on this graph). So a flattening curve is a warning sign. A deeply inverted curve (well below 0) is more of a contrarian sign. The curve is inverted. This is a clear sign of fear. How long can it last? It can get more extreme but doesn’t usually last a long time. This could be a sign we are past the worst for now. Something to watch:

Along the same lines of hedging demand is the measure of skew. I look at two different measures but they usually give the same signal. The first is the Cboe Skew Index measuring the difference in implied volatility for out of the money puts and calls vs. at the money. The other is the CSFB (Credit Suisse Fear Barometer) Index that measures how far out of the money I would have to go to buy a put if I sell a 10% out of the money call. Investors don't like to pay money as it is a drag on returns. When the cost is high (distance otm is high), there is a lot of hedging. When it is low, there is less hedging more often than not because the market has already moved lower. This is coincident with the market and moved lower at the same time. We can see the hedging cost has fallen meaningfully from the highs but is about at the average of the last 5 years. Investors can hedge more freely now. Perhaps this is healthy for the market.

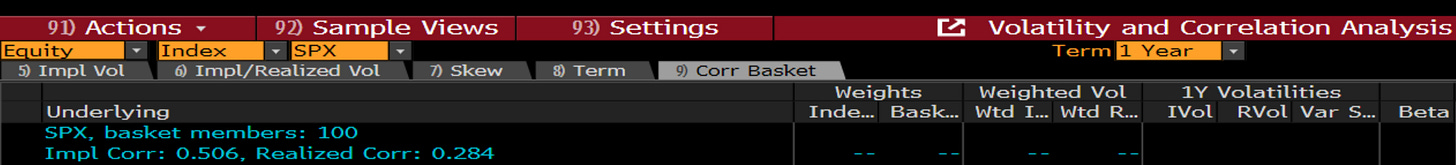

Another sign from the options market is the level if implied correlation. Sometimes we have a stock market where all stocks move together - this is a market with high implied correlation. This is typically when things are bad. Other times, when times are good, each stock marches to its own beat. This is when we have a market of stocks. In earnings season, correlation should fall. When the market is driven only by macro factors, it will rise. You can see on this calculation, that if we look over the last 1 year, the implied correlation of stocks to each other and the index is much higher than which it has actually moved. While the absolute level of correlation at 50% is not at an extreme (Covid, GFC it got closer to 80%) it is still quite elevated relative to what we are seeing in actual price moves:

What about other markets and not just stocks? Some say volatility is it's own asset class because the implied volatility of various markets moves together. This is true. Often you can see the nervousness in one market before it appears in others. None tends to lead the others but one of them always seems to give a guide, depending on what is causing the concern. I look at equity, Treasury, FX and swaps spreads. All have been rising throughout the past 6 months and stand at pre-Covid levels. All asset classes - equity, Treasury, credit, FX - are feeling nervous. In fact the measure of Treasury volatility in blue is getting close to Covid highs. There is a lot of uncertainty in the market and markets do not like uncertainty:

Finally, while we often want to focus on absolute levels, what really matters is the cost of this insurance. What is the true cost - the sticker price you pay? Is 20 VIX good or bad? The cost in my mind is the extra amount you have to pay for this insurance, above and beyond the realized volatility in the market. For a long discussion on implied vs. realized, please take my class, but suffice to say, the implied volatility is how much we expect the market to move and the realized volatility is how much is moving. Is there a premium? If so people are nervous regardless of the absolute level. Is there a discount? Perhaps the horse is already out of the barn. I look at the 1 month level and compare to movement. You can see, that in 2 years of history, we are pretty boringly in the middle of the range. So in spite of higher implied volatility, it is priced here not because of nervousness but because of the actual movement of the underlying stocks themselves. This doesn’t suggest fear, but more normal behavior:

We are almost there. Just two more categories. I warned you it was long. Thankfully this is the abbreviated version. Framing bias occurs when people make a decision based on the way the information is presented to us. This can easily happen on a daily basis when we are stuck in the moment. It can happen when we are thinking short-term and not longer term. It can happen when we myopically focus only on our asset class and not is what is happening elsewhere. So to avoid this, I use technical analysis, to look at trends, how strong they look, are there signs of weakness. I look on daily and weekly measures. I look across other assets. This total picture helps me avoid this framing bias. I will go thru this section more quickly.

SPX daily chart is gotten decidedly worse this year. We have broken support levels and are not oversold yet. This is the chart of a ‘sell-the-rallies’ asset class:

SPX weekly chart, giving us more perspective of the trend we are in. The first rule of trading, the trend is your friend. I will let you decide if you can see where the trend is. We have yet to break those key levels longer term but are starting to project into an uncertain area where the conviction of bulls will be called into question:

However, the US is not the entire world. For a good look at what is happening in other stock markets I look at the Korean Index called the Kospi. It has always been thought to be a key measure to watch because of Korea's importance to global trade, and the composition of the index with companies that matter to so many critical products (e.g. just think Samsung). On this front, this is a more worrying sign. This is the same weekly chart we just looked at for the SPX. That has not broken trend. Korea HAS broken trend. We are getting near some oversold levels which could be a near-term reprieve but some damage has been done. This is not healthy for global risk:

The other asset that is thought to have a PhD in Economics is copper. You have seen me post about the copper to gold ratio. Copper is used in so much of home building and electronics. It is a great gauge of economic activity. I plot it here vs. the US PMI. You can see how this relationship tracks economic activity and has been weakening. In absolute terms, copper has gone higher, being dragged up by passive flows into index products that are looking for exposure to commodities where supply has been disrupted - aluminum, nickel, corn wheat, oil and natureal gas. However, on its own, copper is also giving us a warning sign for the economy:

The last asset I will show is the one that has been in the news everyday this year. The 10 year US yield. You might ask why I look at the yield and not a tradable product like bills, notes or bonds. I do because I think everyone thinks in terms of yields. They then back into the price of those other products. So much talk of higher yields affecting everything from mortgages to equities. Another camp will talk about the long-term trend lower in yields. Stepping back, we are pretty much in the middle of a range we have been in for 10 years:

The last category, yes the last, is money flows. The final bias I want to speak about is overconfidence. We all tend to over estimate our abilities. This is no different for a corporate CEO or professional investor. Everyone has an element of overconfidence. for me to see where it might become a problem, I look at three measures - equity fund flows, mergers and acquisitions and IPOs. When all of these measures are too high, we are overconfident. One could else see the panic in the financial crisis from when money flows went deeply negative at the wrong time, and M&A and IPOs completely stopped. We are not at that extreme yet. Are we at the overconfidence yet?

Equity fund flows had been trending higher for a year but have gotten much more negative lately. ETF prices are driven exclusively by flows. Negative flows mean lower prices. Where does the feedback loop stop:

Mergers last year were at a 5 year high. The latest crisis and Fed uncertainty has slowed this a little bit. However, there were signs before the past month that some overconfidence was creeping into corporate boardrooms:

While IPOs really peaked in late 2020/early 2021. These backed off quite a bit last year but were still elevated relative to pre-Covid years. Higher volatility and lower prices have brought these too a halt. Another example of some exuberance that has come out of the market:

When I pull it all together, but more importantly document my views, I can avoid the very last and most important bias to avoid - hindsight bias. As they say, hindsight is 20/20. I have never seen so much blatant hindsight bias as I did in my 30 years on Wall Street. Everyone called the last crash. Everyone said to be long this or that. The only way for me to think of avoiding it is putting my views out there for all to see. Importantly, it allows me to go back and see what I was thinking and when. It is the only way to stay grounded and objective and I encourage you to do the same

The evidence:

Anchoring: this had been pretty negative but as we move back to median levels it is becoming more neutral. I would prefer more margin of safety but this is not a red flag anymore;

Confirmation: it is more mixed, small companies and consumers look pretty downbeat right not but that may be factored into the market already, this bears watching;

Loss aversion: the options market is also mixed to positive, there had been a lot of hedging before this move that pointed to it, vol curves have gone inverted and vols are moving higher, implied correlation is relatively high, the cost to hedge has come lower and in spite of high implied volatility, the realized volatility matches it. I will say it is a neutral picture overall but there are some positive contrarian signs;

Framing: the technical signals look weaker, trends are breaking, the Kospi was a negative but could be oversold, the SPX daily looks weak and the weekly is moving into a critical area, copper is suggesting some econmic weakness and the 10 year yield is well off the lows that supported us last time;

Overconfidence: fund flows, M&A and IPOs were all elevated, but have come lower, positive equity flows have started to reverse;

Combined, this is a mildly negative signal. There are actually some reasons to be positive for a short-term trade - VIX curve, Put-call flows, even the ARMS Index. We have lost a lot of the exuberane we had seen in valuations, M&A, IPO and flows. Some froth has come down. However, there are negatives too. Variables like the Kopi and Copper which are tied to economic activity are weakening. Short-term SPX charts have gotten negative and even the medium term chart is at an inflection point. Investors are voting with their feet and in a world dominated by passive flows, I worry about negative feedback loops and reflexivity. Some things to like, some to dislike. In all, there are still mild reasons to remain cautious and …

Stay Vigilant