This is gonna be a BIG week

Earnings, ISM, NFP, & FOMC - there are lots of catalysts for the market & our portfolios this week

Long time readers of Stay Vigilant know that my process focuses on three parts - Fundmentals, Technicals and Catalysts. So far this year, I have spoken about all three parts and those parts are as critical today as they were at the start of the year. Nothing has really changed on the first two parts of the problem.

Traders and investors alike are split between a Fundamental view of a recession vs. a soft landing. The data that has arrived this far this year has afforded both groups something to grasp. On a technical or supply/demand front, it has equally been the case. We have seen short covering all year long and are starting to see money flow into the equity market. We are all aware of the downtrend line and the 200-day moving average that many, including me, have referenced. We breached that this week but didn’t really get a strong follow through on good volume, so the technical picture is unclear though it looks positive.

It takes catalysts to changes people minds. It takes catalysts to motivate investors to move from current positioning. It takes catalysts to change the narrative. This week, we get more catalysts in one week than at any point this year.

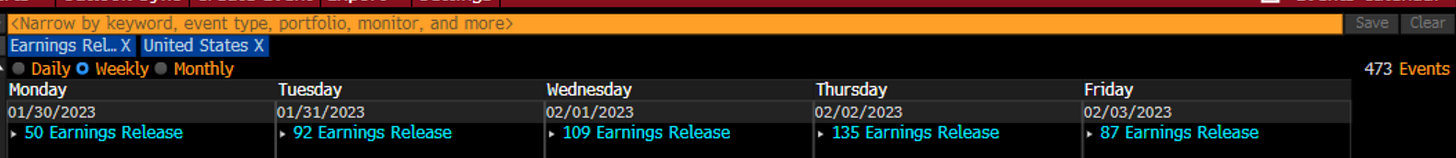

First, this will be the busiest week for earnings this season. As we can see, in the United States alone, we will get 473 separate earnings reports. Of these reports, 104 are int he S&P 500 which is 20.8%. On top of the 143 reports we have already seen, this means that after this week, half of the S&P 500 will have reported. If we look at the world in total, there are actually 4000 total companies reporting globally this week. All fundamental investors will have something to chew on as they drink through a fire hose of reports.

As for how things have gone so far, I wrote about this on Friday on LinkedIn:

Chart of the Day - earnings update. You can't read, watch or listen to any financial media without hearings stories about companies’ earnings right now.

We are now in the heat of the earnings season. We have seen almost 30% of the index report at this point. Next week will be even more & by then we will have a very clear picture of the earnings story.

There have been some positive stories (e.g. Tesla last night) and some brutal stories (e.g. Intel last night). In general, the trend is worse than previous quarters. Does the market care?

The top chart today shows the actual revenue and earnings growth this season. Revenues are growing about 6% while earnings are shrinking more than 1%. Inflation is still a problem as it drives nominal revenues higher, but margins are squeezed & it doesn't drop to the bottom line.

Some industries are struggling more than others -materials, staples, tech, financials & communications are struggling. The latter 3 as human capital is a big part of expenses. They have responded by increasing layoffs.

Some industries are thriving - industrials, energy, utilities & discretionary. The first two may make sense as they are high fixed costs biz less affected by rising variable. The latter makes less until you see it is Tesla & hotels carrying the day. Stores are struggling.

The lower left on top has an orange line where we are. This is the worst quarter on over a year. It is expected to get worse the next two before improving.

The bottom chart shows where earnings & revenues are coming in relative to expectation. Better than expected as always, however, the rate of beats is the slowest in 9 qtrs. Most sectors are beating except Industrials where even better numbers were expected by names like MMM & DOW have disappointed.

The lower right on each chart shows the stock reaction to the news. On the bottom we can see some pattern if we squint that better than expected news is rewarded. On the top, the moves seem more counterintuitive vis a vis the news.

The best sectors this year have been tech, communication & discretionary. It is not being driven by the news we are getting on earnings. It is driven by the technical and the short covering I showed the other day. I hear the angst on Twitter as shorts go against traders.

I point this out as earnings drive stocks longer term. Technicals & positioning are a bigger driver short term. You can choose what drives your process more.

For me, I choose to wait patiently and to ...

Stay Vigilant

#markets #investing #earnings #stocks

I felt two weeks ago that earnings would drive price. I still feel that way. The worst-case scenario on earnings has not played out even though the news is negative. Will that continue?

Another big piece of the puzzle is the economic picture. I mentioned earlier that traders and investors are split between whether we will see a soft landing or a recession. The soft-landing crowd has gotten bigger and is being led by stock and bond investors alike.

This week, you can see the multitude of economic data that we will get:

My preferred measure for growth in the economy is the ISM. This will come out on February 1. Over the two weeks, we have gotten reports from many of the regional Fed branches. Combined, these reports in orange can give some indication of the direction of ISM. The two biggest of them - NY Fed’s Empire Manufacturing and the Philly Fed - have both fallen substantially. By adding others (Dallas, Chicago, Richmond) we get a bit better picture of the entire country. This has looked a little better as the Midwest is holding up better than the East Coast.

Another predictor of ISM is the ratio of new orders to inventories. It had given a negative signal (blue below) for the past 6 months but has been going more sideways of late.

Finally, the S&P PMI in purple hooked up from a very low level last week. It does not have nearly the history as ISM does, only going back to 2020, but it also correlates to the ISM pretty well.

Are these signals are telling us that the ISM, which was 48.4 last month (in white) will come in better than the 48 expected? If so, will the soft-landing crowd be even more emboldened?

Another component of this economic view will be the jobs picture. Employment is a lagging indicator, as orders and profits are affected well before employment. Companies won’t look to shed a lot of workers until profits are hit, particularly given how difficult it was to hire employees in 2021 and early 2022. Yes, we have seen big tech laying off thousands, but those employees have largely gotten work elsewhere (as we see in the better than expected jobless claims) and total employment at the platforms is still higher than pre-Covid. We have seen other industries - financials, industrials - start to join in the reduction of workforce and this is something that is a much more trend to watch.

For now, the JOLTS (job opening & labor turnover survey) data still suggests 10.5 million open jobs in the US. This is double the number of open jobs than we have seen at any point this century. We can see this in white below.

In addition, the unemployment rate (inverted in orange below) is at 3.6% which is very close to the best we have seen this century. There is no doubt that the labor market is very strong still. Does this add credence to the soft-landing view?

I have been mentioned on social media that I can anticipate a job-full recession, the exact opposite of the jobless recovery we had in the post Great Financial Crisis period. At that time, companies had gone to the brink of ruin and were very hesitant to hire people back until profits had been in place for many years. Employees were tasked with working harder which many did because consumers also went to the brink of ruin. Thus, we had a good economy but a poor job market.

Now, however, companies have gone to the brink on the inability to hire people post Covid. We know of the Great Resignation stories post Covid. Companies saw this. This was the shock they had to face. Thus, I believe companies will be very hesitant to let go of productive employees until and if they have several quarters of poor profits. Thus, we could have a macro recession, but jobs data hold up. Perhaps you may suggest this sounds like a soft-landing, but I am not so sure. I believe we could see negative growth and poor profits, but we may not see employees fired.

While the 1% did well in the post GFC period, this would mean the 99% would do better in this post Covid period. The pendulum swings back.

This matters a great deal for your Fed view. Remember, the Fed has a dual mandate - full employment and price stability. If employment stays as strong as it is, this give the FOMC carte blanche to single-mindedly focus on price stability.

There have been many stories leaked to the press about how Jay Powell very much cares about his place in history - he does not want to be known as another Arthur Burns who lost control of price stability. There are other doves on the committee that care about not hurting the economy. We have heard from Brainard etc. However, JayPo has a strong influence on the committee so we will see if he does care about a place in history.

Why do I say that? I say that because the market itself is far more dovish than the FOMC. We can see from the CME Fed Watch Tool that it is solidly consensus that we will only see 25 basis points in the meeting this week:

The same tool sees another 25 bps in the March meeting. The market is not pricing in any chance of 50 more than 50 bps in total over the next two meetings. The market has firmly priced in Peak Fed.

Not only does the market see Peak Fed by March, but by the end of the summer and through next year it is pricing in cuts, taking the Fed Funds rate from 4.75% in March to a low of 3%.

MacroAlf (a good follow on Twitter and Substack, albeit maybe a little pricey) calls this the “immaculate disinflation”. You see, while there are 175 bps of cuts priced in, the bond market stops at 3% which is above the perceived long-run neutral rate of 2.5-2.75%. This means that the bond market is pricing in rapidly falling inflation (cuts) but no recession (stopping above neutral). This is the soft-landing priced in. We know that this pricing is entirely inconsistent with the Dot Plots the FOMC puts out. Will that be a focus for the discussion post the meeting this week?

I think it will be. Why you say? I say this because of the financial conditions. JayPo and the FOMC have reverenced the focus on financial conditions at every FOMC in the past year. In September and December, there was particular focus on financial conditions and the need to continue to hike rates until financial conditions are sufficiently restrictive, paraphrasing JayP.

Are conditions tight? I put two measures on here - the Chicago Fed financial conditions which use over 100 different indicators, and the GS financial conditions which were created by Bill Dudley and brought to the FOMC. The Chicago Fed measure is in white. I have drawn a white horizontal line and a red vertical line to help me highlight that the level of the financial conditions per the Chicago Fed are at the same level they were when the Fed started hiking rates last year. Does that seem sufficiently restrictive? Does it seem restrictive at all? If the FOMC instead refers to the GS data in blue, even this measure (more simplified) is as easy as it was in September and December when JayPo drew the market’s attention to it.

I feel that financial conditions are giving the market a very strong message that it is ignoring as it is so focused on the soft-landing. The market always feels it is ahead of the Fed. I am not so sure on this front given that the Fed does not have to balance a growth/full employment mandate, and instead can focus on prices. The Fed knows the impact of commodities on prices last year. The Fed knows China is opening back up which could give pressure to commodities. As I wrote on LinkedIn this week, I think financial conditions and the FOMC ar ethe big surprise this week:

Chart of the Day - financial conditions. I have been harping on fincl conditions for some time now. I care about them because Jay Powell has told us the FOMC cares about them.

In the statement after the FOMC meetings in 2022, financial conditions were mentioned several times. However, it was the Jackson Hole/September FOMC that had the impact on the markets.

Since that time? Financial conditions have eased and not tightened. Do you think the FOMC thinks their job is over if fincl conditions are easing back to levels where they started?

I am using the Chicago Fed National Fincl Conditions Index. It is the most broad of the various indices looking at over a hundred separate variables organized by Risk, Credit and Leverage.

It is designed to have a mean of 0 and a standard deviation of 1. Negative numbers mean easier conditions, positive means tighter. The level now is -0.33. It was -0.37 when the FOMC began hiking.

Two of the components of the index are stock prices and credit spreads. I have overlaid those here. These are the most observable of the measures for investors like us.

We can see the negative correlation of stock prices and fincl conditions. Tighter conditions = lower prices. Right now, conditions are easing and prices are moving higher. Conditions are not easing simply because stock prices move higher but it is 1 of 100 variables.

Similarly credit spreads as measured by Moody's Corp Baa vs Treasuries are tightening. At less than 200 bps, these spreads are not at all-time tights but are not too far away either.

This all means easier access to capital for companies either via the stock or corp bond mkt. How will easier access to capital impact inflation?

Personally, I feel it could bring on more supply that will dampen inflation; however, I don't think that is how the FOMC thinks about it. I believe they will see this keeping labor tight & risking higher inflation.

We have heard from many on FOMC, especially the doves. They have added to the soft-landing narrative. When will the hawks speak up? When will JayPo himself speak up? Will it not be until Feb 2?

This is a risk that is staring us right in the face. I believe people like JayPo see the levels of inflation not as a cyclical risk but as a secular risk. He does not want to be the Chair that lost control of prices.

It may not be something investors and traders care about this week. Earnings will drive fundamental investors. The move above the trend line will drive technical traders.

However, this is something the FOMC and the mkt will need to come to terms with within 2 weeks.

Stay Vigilant

#markets #investing #economy #financialconditions

Earnings have been poor but maybe not as bad as feared.

The economy has been bad but maybe not as bad as feared.

Fed hawkishness has been bad but the market sees us at Peak Fed, so we are past the worst.

Which of these, if any, will change this week? Which of these catalysts will get investors to change their minds? Which investors (recession or soft-landing) will be forced to? There is still a struggle between the fundamentals and technicals, between the investors and the traders.

I still see this as a time to Stay Vigilant

Latest Chartist: "According to LPL Research, a gain of 5% or more in January coming on the heels of a negative year represents a very strong plank in the bullish case. This has occurred five previous times since 1954. On each and every occasion, the S&P posted impressive gains ranging from 20% to 45% over the following year. The last time the S&P gained more than 5% in January after a negative year was in 2019. The S&P finished the year with a 29% gain. Whether history repeats remains to be seen.".....We'll see....keeping an open mind....

Financial conditions need to get tighter.

All I've heard in investment banking world to start the year is that "credit spreads have peaked", Powell is doing "25-25 and stopping" and CNBC hype beast Brian Belski thinks 4,000 on the SPX is the low for '23. Everyone is calling off the dogs and saying its time to hit the market running. Optimism abounds and the start to the year shows capital hasn't been destroyed (maybe short capital has for the time being?)

You mentioned last year that it'll take time for PE capital to hurt and when that happens we know we're near the bottom. Interesting thing I've heard is that PE bros who don't understand marking to market expect to get full price for their horses during 2H of '23 *when* credit markets reopen and are preparing to come to market accordingly. Let's see if that need for liquidity forces sales to continue even at lower prices if Powell lays the hammer.