"Well, I've been down so very damn long, that it looks like up to me" - Jim Morrison

The economy is already slowing and expected to slow some more. Will the ISM next week confirm the recession mindset that is creeping into the market?

As we end May and go into the Memorial Day weekend in the US, the unofficial start to summer, we seem to be at an inflection point. In this first half of the year, financial markets have been hit with a tremendous amount of negative news - war in Europe, zero Covid lockdowns in China, aggressive expectations of rate hikes in the US, persistently high food & energy prices that are hitting consumers. Stock prices have suffered tremendously, with the SPX down over 20% and the NDX down over 30%. We have seen companies missing on earnings and layoff announcements even at Amazon which heretofore seemed impenetrable.

If you have been reading my blogs since the start of the year, I hope you were rightly negative early and often and were able to sidestep some of the worst of this. That is my goal. If you were not, or are new, I encourage you to read some of the older posts, simply so you can understand more of my thought process, how I approach the markets. Either way, we sit here at the start of summer, when markets typically start to slow down and take a pause (though not always), and need to ask ourselves - where are we going from here?

In order to answer that question, we have to start with a forecast of the economy. Yes, I know forecasts are almost always incorrect. That’s fine as long as we know we aren’t going to be perfect. We can think of different scenarios that could play out if we are wrong. However, we have to think about the economy because it is the economy that drives profits, not just of publicly traded stocks, but all companies. I look at the ISM and not GDP because it is coicident with the SPX. You can see below that GDP is lagging and really not helpful at all when it comes to predicting the SPX. The ISM on the other hand, is quite useful.

If we can get a good gauge of the economy, we have a sense of profits. The chart below shows the ISM in the US in orange compared to NIPA all economy profits in white, and the quarterly SPX actual earnings in blue. We can see that the economy, as measured by ISM, leads the profits of companies and therefore it is useful to have an idea of where the economy is going.

If we couple that with interest rates, we can start to build a view of the markets. The 10 year Treasury can be decomposed in many ways, but one of these is the expected future Fed action for the next 10 years. So the 10 year Treasury is the summation of Fed moves. It is also the basis for the pricing of all asset in the economy - we build a mortgage rate from it which values houses, we add a spread to get to the cost of credit, and we begin with it to generate the weighted average cost of capital for our DCF. Thus, it is not surprising that the interest rates have an effect on the P/E for the market, the multiple that we will pay for earnings. As rates go higher, investors are less confident in the future, and pay a lower multiple. From this, we can see that we can have a view on the E (above) and now a view on the P/E (below) which together give us the view on P.

So, we have to have a view on the economy. Where do we start? Well, the Federal Reserve has hundreds of PhDs building hundreds of models of different aspects of the economy. Instead of reinventing the wheel, maybe we can look at some of the work it has done.

I start with the Nowcasts. Per Wikipedia “Nowcasting in economics is the prediction of the present, the very near future, and the very recent past state of an economic indicator. The term is a contraction of "now" and "forecasting" and originates in meteorology. It has recently become popular in economics as typical measures used to assess the state of an economy (e.g., GDP), are only determined after a long delay and are subject to revision. Nowcasting models have been applied most notably in central banks, who use the estimates to monitor the state of the economy in real-time as a proxy for official measures.”

Every regional Fed branch has their nowcasts and most of them publish. We can see in real-time what the Fed is seeing in real-time as the FOMC polls the different Fed regions to ascertain how the national economy is doing. I start with the St. Louis Fed nowcast since I am using the St. Louis Fed FRED database. From this we can see the expectation that real GDP (i.e. GDP with inflation subtracted) is thought to be a bit over 3% right now. Yes, it has come down markedly from the double digits last year, but this is still a healthy number relative to history, and it has recently picked back up after falling.

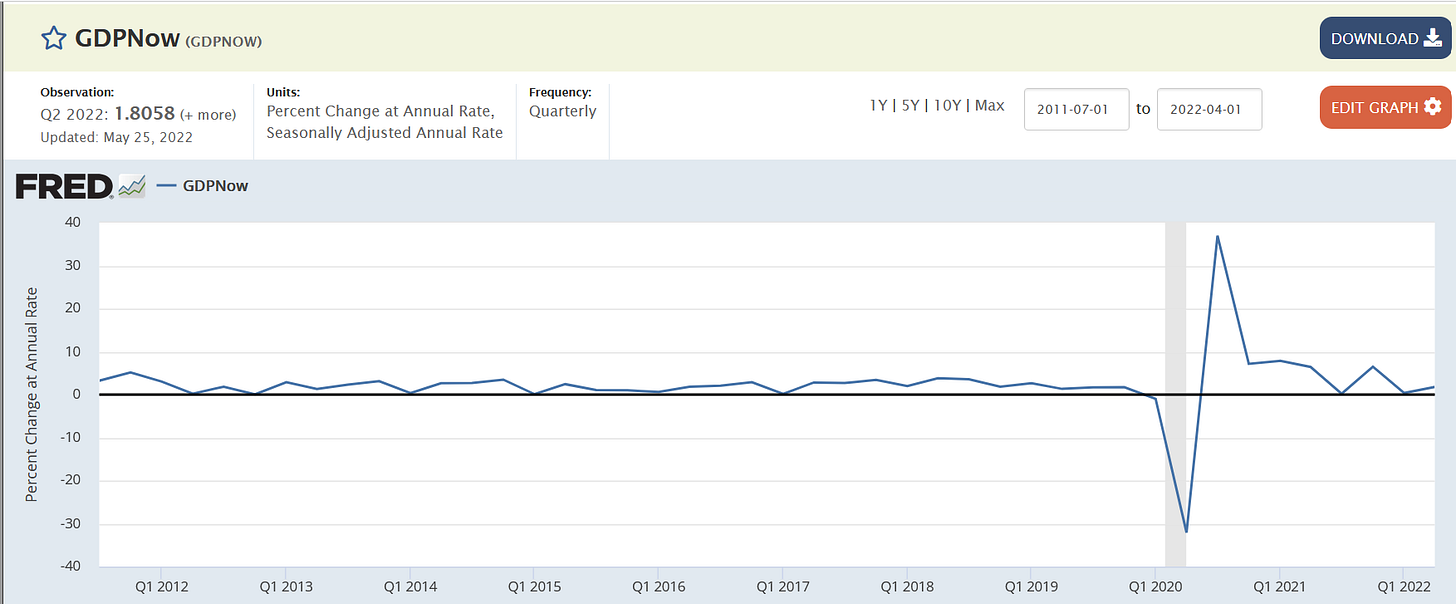

The one most market pundits follow is the Atlanta Fed nowcast called GDPNow. This isn’t because it is the most accurate. It is because it is the only one on Bloomberg. This shows you one of the many biases of investors - the availability bias. Anyway, the GDPNow shows a lower level of GDP forecast but it also shows a small uptick recently.

There aren’t just nowcasts for growth, but also for inflation. The Fed prefers the personal consumption expenditures (PCE) measure of inflation to CPI or PPI. The nowcast for this measure comes in at almost 4.8% and also moving higher. So, 2-3% growth with high 4’s in inflation gets us to 7-8% nominal growth. Unfortunately, a lot of these coming from inflation which doesn’t help consumers.

As I mentioned, the Fed has many models and not all are nowcasts. Each region puts out a measure of activity. The combination of these is a good coincident measure of the ISM for me. I also like the ratio of internal ISM measures of new orders and inventories. However, before I get to those, I want to tell you another reason I like the ISM.

From today’s Linked In: “The second of the two charts below, to me, is the most important chart. It comes courtesy of CS & it shows four clearly defined regimes: ISM below 50 & rising, ISM above 50 & rising, ISM above 50 & falling, ISM below 50 & falling. There are two takeaways from this. The first takeaway is that the best returns in the stock mkt happen when ISM is rising whether above or below 50. An improving economy is best for gains. The 2nd takeaway is that the ONLY negative returns in stocks come when the ISM is below 50 & falling.

The top chart shows the current ISM in orange. I have drawn the magic 50 line horizontally. You can see we have gone below there 3 times in the last 10 yrs. The question is, will it happen again? I have put on the chart 2 measures that can help anticipate the ISM itself. The 1st is the ratio of ISM new orders to inventories. The logic here is when times are good & improving one orders new goods. As things slow, inventories build up. As this ratio rises, we anticipate higher ISM & as it falls we anticipate lower ISM. You can see how well it has done the last 10 yrs. It has been pointing to a much lower ISM but notably still above 50.The last reading it actually picked up some.

2nd is a geometric index(white) of the regional Fed surveys - Philly Fed, Empire, Chicago Fed, Dallas Fed etc. It has shown to be coincident with ISM & gives us another confirming view. It had been falling with ISM but also notably ticked higher.”

Did I tell you the Fed has many models? Well here in Chicago, the Fed has a measure of national activity. You may ask why the Chicago Fed cares about national activity as much as its own regional activity, but given Chicago is a transportation and logistics hub for the rest of the country, the Chicago region cares very much about what is happening elsewhere in the country. Maybe California, Texas and Florida do not care about what is happening in Chicago, but we care about what is happening in those places and more than just because most people want to move there. This index is created such that the zero level is trend growth. So readings above zero mean above trend growth and reading below zero mean below trend growth. The latest reading of 0.47 shows growth is still expected to be above trend nationally.

If you follow me on Linked In, you may recall the next chart from a week ago. If you don’t, you might enjoy it. I post daily. Either way, this is what I had to say a week ago:

“I am fortunate to work with a large number of very talented graduate & undergraduate students in my applied portfolio management class. Each semester they are charged with building a model of the economy. They find a terrific assortment of variables but there are some that are in every model. The chart today has these variables (not necessarily with the same lags but you can see the trend). The are: Building Permits (housing), Job Openings/Labor turnover (jobs), M2 growth (money), Yield Curve (money & credit), ISM New Orders and Consumer Sentiment. There is an intuition why each matters & there is empirical regression analysis why each matters.

You can see from the chart that right now, jobs & housing are holding up. Maybe starting to flatten a bit but still a tailwind. However, each of the other variables is in steep decline. This graph visually depicts, for me at least, the debate playing out in real time among mkt participants, asset class rotation, sector rotation, Fed officials & political pundits. Can the labor mkt & housing hold up well enough for us to have a soft landing even if the Fed is in play. Or, will the negative sentiment, slowing money & credit, and falling new orders bring us into a hard landing & recession. Ultimately, whether you want to buy the dip hinges on this question.

If the economy can slow down but still hold up and not go into recession, then earnings can hold up & you have the buying oppty of the year. If not, there is still some downside in risky assets as we are still 15% above the 2019-2020 level from which the Covid monetary & fiscal rally started.”

I said before that when we forecast, we have to assume we will be wrong. If we are wrong, how will we miss it? A view of ‘slowing growth, but not a recession just yet’ could be missed by growth either surprising to the upside or a recession happening sooner that expected. If a recession were to happen sooner that expected, it could well be because of the events around the world. The zero Covid lockdown in China has really devastated the economy there. You can see the PMI measure is already below 50 suggesting a recession. It has gotten so bad that the Washington Post led with this in a story yesterday: “China’s premier said in an emergency meeting Wednesday that the Chinese economy faces “grim challenges,” in an unusually stark warning that comes as coronavirus controls have paralyzed parts of the world’s second-largest economy.”

If we look at the US and China PMIs over the last 17 years, we can see that since 2016 or so, the two have become less tightly connected. I am not going to suggest the Trump administration has everything to do with this but the trade war didn’t help. Supply chains are rationalizing away from China but that takes some time. Bears will argue that the US disconnected for a few years but then came crashing down to converge in 2020. Perhaps the same will happen this time. Again, if we are wrong on the downside, this could be a big reason for it so we must be aware.

What could get us to be wrong on the upside? Why could growth be better than expected? I have mentioned in previous posts that I think the housing already in progress can help us stay strong through 2022. In addition, the pent up demand for travel, particularly international travel, is another possible driver of unexpected strength. If my anecdotal tally of friends and family is any indicator, there is a fair bit of demand.

Finally, another source of potential growth could come from the government. It is an election year after all. Yes, only mid-term elections, but the forecasts right now are for the incumbents to get slaughtered in the mid-terms, with the Democrats expected to lose both the House and the Senate. One can imagine this is not sitting well with the Administration. Thus, there is scope for some unforeseen spending from the government. Interestingly, if we look at the drivers of the economy (remember GDP = C + I + G + (X-M)), we can see that consumer (C) spending in orange has been slowing down. Corporate investment in white is actually still near the highs of last year. Combined, this would normally mean quite robust growth. However, the big drag, the only negative catagory, is government spending (G). Yes, this is because we are lapping some big numbers. However, if this number were not a negative, because of some pork politics in an election year, is there scope for stronger than expected growth? Not my base case, but something to consider.

I want to end by going back to where we started with the chart of ISM and SPX returns. Equity investors really only worry about a recession. When growth is rising, stocks do great whether coming from a low base or a high start. This is when it is good to be an investor. Even when the economy is slowing but still positive, returns are positive. More muted but positive. This is when it is good to be a stock picker because the rising tide isn’t lifting all boats. The astute investor is moving into the right sectors, the right factors, and the right stocks. The one time when there is no cover, is when there is a recession. This is when an investor gets into as much cash as it can and hides. The latest BAML Global Fund Manager survey showed over 6% cash on mutual fund balance sheets. This is very high and indicative of a fear of recession.

This chart shows the year over year changes in the ISM vs. the year over year changes in the Russell 2000. Some think that these small cap stocks are a better measure of the US domestic economy than the SPX which is 40% multinationals. I have drawn a horizontal line to indicate when we have had bad recessions in early 2000s, 2008 and 2020. You can see from this that the returns to stocks are suggesting we are going into a recession even though the ISM isn’t yet. This is another indicator to me that a recession is being priced into stocks. If we do not have a recession, what happens to stocks?

What are the odds of a recession? It appears the market is putting those at over 50%. What are other indicators telling us. Back to the Fed. I did say it has a lot of models right? This first measure, in the Fed’s own words “is obtained from a dynamic-factor markov-switching model applied to four monthly coincident variables: non-farm payroll employment, the index of industrial production, real personal income excluding transfer payments, and real manufacturing and trade sales.” You can see it rises rapidly just before the onset of a recession (grayed areas). At its current level, it is not suggesting a recession in the very near term.

There is another measure used as well. Per St. Louis Fed “The Sahm Rule identifies signals related to the start of a recession when the three-month moving average of the national unemployment rate (U3) rises by 0.50 percentage points or more relative to its low during the previous 12 months.” It is not quite as good as the model above, however, it also is suggesting very low probability of a recession in the near-term.

Finally, the Cleveland Fed uses the yield curve as its way to predict a recession. This measure is also on Bloomberg and so there is the availaibilty bias to it. However, in spite of the flattening of the 2y-10y portion of the curve, this measure puts the odds of recession at a shade over 2%. Perhaps it is looking at a differen area of the curve or a combination of many parts of the curve. This is surprisingly low to me, but noticably at odds with market participants. Even the bulge bracket Wall Street firms, which never forecast a recession it seems, put the odds at 30% (GS and MS in the news this week as such). So, we have a difference of opinions it seems.

This is also notable because the Fed has a dual mandate of growth and inflation. If the Fed is not worried about the economy going into a recession, then it will solely focus on inflation. This could be why there is aggressive pricing of hikes into the Fed funds rate. It could also be why previous doves sound quite hawkish. However, the market is starting to back off a bit, probably because it is worried about growth. We no longer have a full 50 bp hikes priced into each of the next two meetings:

The market also expects the Fed to have to reverse course near the end of 2023:

The first part of my investment process is to start with the trend of the economy. Where will I think we are going and why? Where can I be wrong? I have been negative all year long (really going back to September of last year). However, as I said at the start, we may be at an inflection point. Negativity is now consensus. Solidly consensus. Cash levels are high. Defensive positioning is en vogue. Retail investors are bearish. Macro funds and CTAs are short the market. HF leverage is low. What if things improve ever so slightly? What if the data points to a slowing but not a recession?

These are the questions we should ask right now. We get the next ISM report next week on June 1. What will it show? What will the internals (new orders, inventories) tell us about the ISM going forward? How will investors react? I think if this number is inline or better to the 54.8 (down slightly from 55.4) that is expected, there will be panic. This panic will be investors who do not own the market, do not own enough or are even short. If the number is lower than this, expectations will be confirmed and the expectation of earnings will come even lower. The summer market will hinge on this ISM next week imho.

As James Carville told Bill Clinton in 1992 “it’s the economy, stupid.”

Stay Vigilant

Ex---Market troughs tend to need one or both of the following things---a bottoming out of ISM or shift from the Fed/bond market. It is hard to imagine ISM not sliding further, but on the second point, the bond market and more importantly Fed expectations, as you point out, have peaked, at least for now. That is certainly good news and hard to ignore when equity sentiment readings were so off the chart negative. Going forward, regarding the recession call, there is one thing that markets are struggling with. Many, despite the surge of inflation, hold onto the secular stagnation thesis, and there is a flavour of that discounted in the inflation fowards. I have a problem with this view. In the post-GFC world there was household and financial sector deleveraging. That is why trend growth during the 2010s was in the 1.5% range, which being so low, supercharges the risk of recession. But that is not the case now. Just look at the financial obligations ratio---super low. Conclusion: it is harder to get the US in recession, barring some unforeseen shock, because trend growth is probably in the 2.5-3.0 range. Still, on the other side Summers makes a good point about how difficult the Fed's job is with unemployment under 4.0% and inflation over 4.0% and how that often leads to recession. Moreover, I do not find the Fed's forecasts credible--they see marked slowdown in growth but no rise in the unemployment rate. Historically, tightening in financial conditions, always leads to a higher unemployment rate, which would bring in the Sahm rule. What is the bottom line? Markets are deeply oversold on sentiment basis. A 10% rally off the low seems likely, but the question of recession, and a recession style decline aka 35% is not off the table, but possibly just ready to enjoy some nice holiday weather and a Cubs game or two over the summer.