With the school year now in the books, I am preparing to lead a student trip to Europe. This is the first time I have taken students abroad, so there is some nervousness and anticipation. I can only imagine there is similar nervousness and anticipation as investors may be preparing to send some assets abroad, perhaps even for the first time. Maybe there is even more apprehension for global investors who have been invested in the US thinking about bringing those assets back home. This is a possible new theme that I have highlighted before, so I want to stay on top of the action. Let’s take a look at the rotation of assets:

You can see above that China (FXI and KWEB) has fallen into the ‘Weakening’ quadrant where former leads go before beginning to lag. Investors that moved into the China/DeepSeek trade may want to be careful as faster money may see this and choose to leave. If you haven’t bought in yet, it may be time to be patient before you do. You can see Europe (FEZ) is on the cusp of doing the same. On the flip side, India (EPI, INDY) have clearly moved up the pecking order as it is now in the Improving if not Leading zone. Brazil is leading too. Looks like some rotation within the Emerging Markets landscape. A lot of US beta is in the Lagging quadrant, which may be difficult to believe given recent price action. I particularly note US small caps which continue to struggle and belie an economy and a set of policies that still may not be working for the masses. Gold has been about the only consistently strong asset class of late. Could that be changing?

One thing is for sure, retail investors were NOT spooked by the move lower in stocks. While institutions were forced out of stocks and may be forced back in (more below), this chart from JP Morgan that has been shared by quite a few people at this point shows how aggressively retail bought the dip. Maybe they are trained to do so. Maybe retail so the validity in the Trump Administration action. Either way, chalk one up for the little guy who clearly listened to Pres. Trump to buy the dip on April 9. When will institutions get back involved? Soon it not already, I think.

This chart, courtesy of Bespoke Investments and Mr. Risk, shows that the reversal in the VIX Index from above 40 to 20 or lower has been the fastest in history. That month of April trading is just a dream, or bad nightmare, depending on how you acted. However, for now, markets have normalized which seems somewhat incredible. This matters as well because I have discussed many times how volatility is in input to asset allocation. Hedge funds that were stopped out in April, got their books back in May and as volatility fell, were likely encouraged to take on even more risk. Thus is the nature of the markets that rely on systematic triggers (back-tested of course) to allocated. It isn’t just hedge funds either.

Asset owners, aka real money, also have taken to the systematic allocation game by using volatility targeting strategies within their risk parity framework. The allocation to stocks (inverted and in white above) is then a function of the volatility of the market. Whether the trigger is implied volatility (proxied by the VIX in blue) or realized volatility (in orange), we can see that lower volatility begets higher allocations to stocks. We are only starting to see these allocations pick up. Will retail sell it back to them now or are we set to be squeezed even higher? For me, the bigger question is: if I have to buy stocks now because my systematic trigger is forcing me into the market, do I buy the US market or take on risk elsewhere?

A good place for me to start to answer this question is looking at the global discount rates as measured by HOLT, now owned by UBS. I have put three measures up here: the US in red, Europe ex UK in blue and Emerging Markets in green. Lower discount rates mean higher valuations, mean that investors have a lower hurdle and may see lower risks. In the US, we can look and see that in spite of the uncertainty and change happening in the US, the discount rate is not only the lowest in the world, it is not too far away from the lows it hit in the 2021 bull market or the 2000 tech bubble. Not a lot of margin of safety as I showed last week. How about Europe or Emerging Markets? Both are pretty close to the global long-run norm around 6%, and near the midpoint for their own history as well. Both may look relatively appealing versus the US but are not screaming buys in absolute terms from a valuation perspective. So, then it becomes a question of what the investor may think about economic growth in those regions.

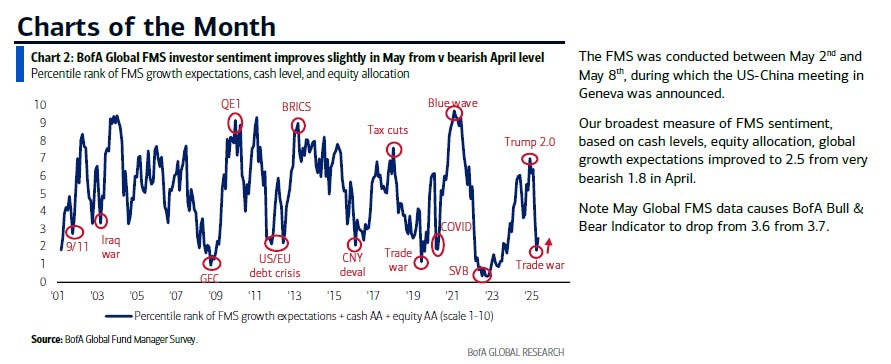

Investors are still not feeling terrific. They feel better than in April and may in fact feel better than even this latest BAML Global Fund Manager Survey would suggest since it was taken before the latest US/China detente. Sentiment is pretty bleak among the institutional crowd though.

That very well may be because the institutional crowd still see the global economy slowing. The top chart shows a net 50% of investors see global growth slowing, though the bottom chart shows the fears of a global recession have peaked and are coming lower. Again, was all of that tariff noise just that? Are we going back to where we were at the start of the year? There was a lot of ink spilled this weekend, discussing the latest positive news from the Trump trip to the Middle East. Trump himself posted quite a bit on X and Truth Social about the ‘magnificent deals’ that were signed, some of which may benefit the Magnificent 7, and some may not. There was a very good Substack on the subject by Mark Tinker who writes the Market Thinker blog. You can find it here: Market Thinker Substack

Mark discusses how Trump is seeking active and not passive global investments in his trade deals. This doesn’t mean he is urging people out of index funds and into mutual funds again. It means he is urging investors to not recycle their Dollars into the US stock market but instead into investments in the US. Mark references an FT article (italicized font) and then describes more. It sounds like maybe global investors invested in the US, particularly Sovereign Wealth Funds, could be rotating their investments. What does this mean for stocks? Well, Mr. Risk turned me onto an article in Barrons that asks much the same question. You can find it:

Barrons: Stocks are Up and Tariffs Haven't Inflicted Much Pain ... Yet

Mike Green was also talking trade, tariffs and Trump in his Substack this weekend. It is excellent and you can find it: YES I give a fig - Michael Green

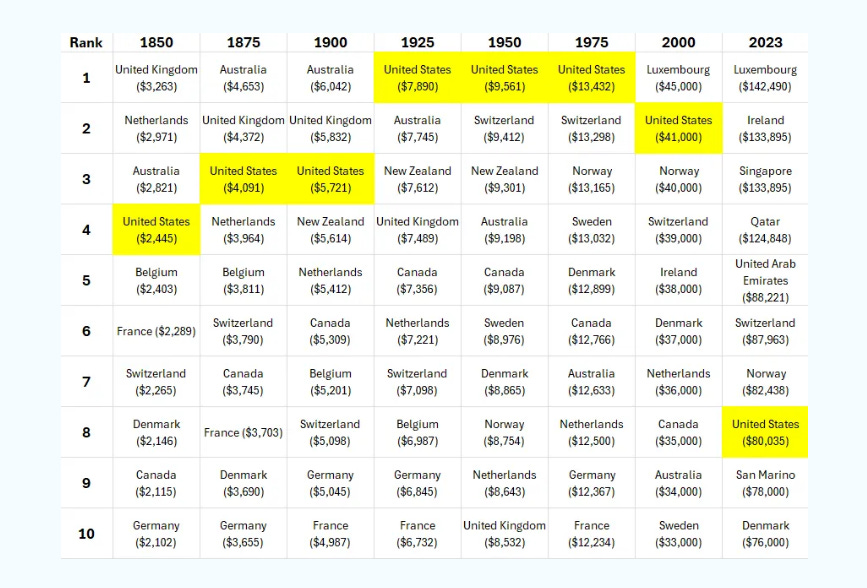

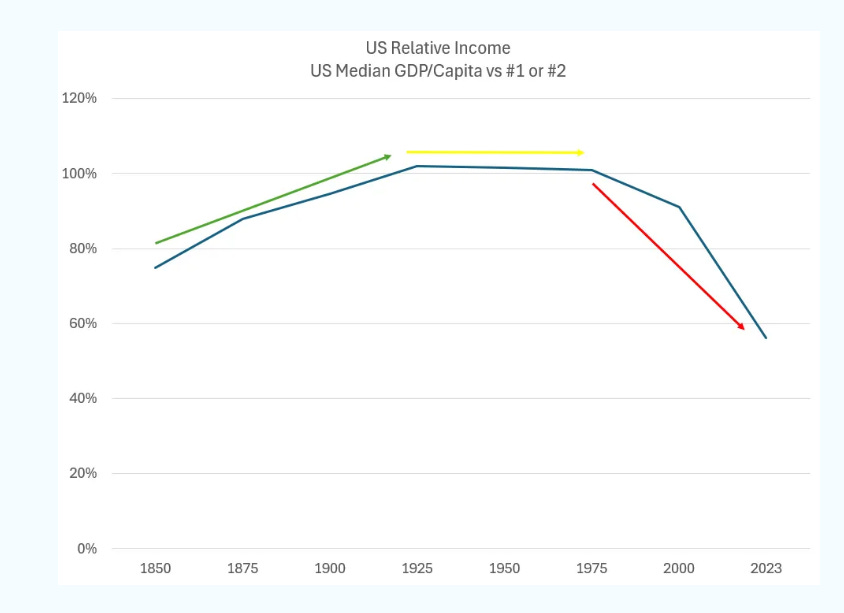

Mike discussed a lively debate that he had on X (you should follow Mike on X because he is not afraid to take on some pretty big names and always back up his views with good data). Mike’s point was that while many will point to the absolute wealth in the US, if we look on a per capita basis, the US has been falling for decades, or since the Globalization theme took over. This is something Trump and his followers may not know explicitly be certainly sense intuitively because they sense that while trade may make everyone better off in absolute terms, one’s view of their own fortunes is always relative. While US per capita GDP has doubled since 2000, the US has fallen quite sharply in relative terms. This matters.

This is the data above comparing the US vs. the global top dog. The point is while Globalists and economists see trade as inherently positive, there are many in the US that see that the US has lost relative ground and this can’t continue. This means that Administration wants to change the script. This means Trump will use tariffs as needed to do so. This means Trump wants investment in America and this doesn’t mean buying the SPX. It means real investments in factories, data centers and fabs.

“The Art of the Deal”? Is Trump really playing 4D chess? Maybe he is. If we look at the path of tariffs courtesy of Bloomberg, we can see that tariffs on China have gone up from 11% to 39% on average this year. However, stocks are not far from the highs. If I would have told you on January 20 that we would tripled the tariffs on China and US stocks would barely be down, would you have agreed? However, when we look at it vs. the 145%, markets are responding in relief, volatility is falling, and money is being put to work. Pretty amazing. Maybe Trump has outwitted the machines with his approach of ‘fear then deal’.

Trump is also very much in touch with a segment of the US population that very much feels left behind. My 29-year-old son asked me this morning two questions: “Why are prices still so high that it is hard to afford anything?” and “why does the job market suck so much that I can’t find a better job to afford things?” This is someone with a college degree and other certifications that has a white-collar job at a Fortune 100. I wrote about this on Thursday on LinkedIn in a post called commencement. I said that the students (and parents) I speak to tell me the jobs market just isn’t that great. Sure, many are getting A job, but few are getting their dream job. Just like my son, they have a job but don’t really feel better off. So, it isn’t bad enough that the Fed gets involved, but it may be bad enough that they want to vote for an Administration that wants to change the narrative, that wants to improve the US on a relative basis, that wants to see a changing nature of investment in the US/

The questions also inherently point to a ‘stagflation’ view which is ironically exactly the view of my portfolio management class from the economic models they built. This is the third straight semester the class has found this. Forget about what you read in the media (regardless of your source it is biased). Forget about judging the economy based on the SPX. Heck, look at small caps the last several years and tell me the economy is rocking. Look at a small cap portfolio and tell me soft data isn’t accurate. This week we got the NAHB Housing Market data. You know I favor this because of H.O.P.E. Housing leads the economy. The NAHB data points to a slowing economy. It is still quite mixed though. Anecdotally, neighborhoods around Chicago where the top 1-5% live, see bidding wars for houses. They are sold in days. Those that are middle class, it is a bit harder to sell a house. It takes months. I can speak from experience having sold houses in each type of neighborhood. We may not be talking about a recession just yet, but this still looks like slowing growth. This is the ‘stag’ part of the program.

I then wrote about the ‘flation’. Before the CPI, I took a chance and tried to forecast a higher print. I was wrong, which happens more than I am willing to admit. However, I did and do say that just because that print was lower (but still above the Fed target), the forecast index I built using the student model favorite variables is still pointing to higher prints. Even if we don’t get this, I would go back to my son’s question, something I have referenced before. Economists worry about the change in CPI and see a slowing rate of growth. Individuals see prices still going higher. This is the next phase of the Administration focus, with change in tax rates which puts more money in people’s pockets, making them feel wealthier, and relentless focus on bringing down costs for where they spend, for instance the new focus on drug costs, which likely is more negative for the Pharmacy Benefit Managers than anyone else.

However, those are posts for another weekend. Those are potential positive catalysts. For now, I look at US stocks and see a source of funds with limited upside. Not sure retail can buy even more than it did. I am sure some investors are brought in by lower volatility, but others may see this as a chance to sell to fund a data center, for example. I think the narrative is changing and the Mag 7 is no longer the only game in town. I think there are maybe better opportunities abroad. I will know more when I get back from the trip I am embarking on.

For now, I have to go pack. Then it is …

Wheels Up

Stay Vigilant

"Now this is the law of the jungle, as old and as true as the sky, and the wolf that shall keep it may prosper, but the wolf that shall break it must die. As the creeper that girdles the tree trunk, the law runneth forward and back; for the strength of the pack is the wolf, and the strength of the wolf is the pack." Rudyard Kipling.

Good reading. Thanks. Have a good trip