I started a bi-weekly, unedited podcast for the CFA Society Chicago called Macro Matters. We do this because even though CFA charter holders are well-trained in security analysis, you would be very surprised how little they think about the macro.

Empirical evidence suggests 70%+ of a stock’s movement is the result of macro. However, the CFA exam only spends about 10% of its time on the subject. Thus, I get together to speak with some of the CFA Charter holders I know that focus on macro, to discuss what we think will happen in markets as the result of news.

Do we always agree? Nope. Just listen to this week. Are we always correct? Nope, just listen several times last year. Do we at least get people thinking about topics and subjects they should care about? Yes, I think every time we do that.

Most of us are trained to not worry about the macro. All that matters is alpha. I used to have scores of hedge fund portfolio managers work for me. When they made money, they were geniuses. When they lost money, it was ‘too macro’. As I told them, the macro always matters, it’s just that sometimes you are aligned with it, and sometimes you are not. Whether you invest according to it or not, you need to be aware of what it is saying.

Phil Dauber, who was a guest on a Stay Vigilant and writes

Substack, had this to say about macro in the last week:“With a nod to Madonna and George Harrison, we are “Liiivvving in a Macro World, and I…”. Anecdotally attributed to Steve Cohen, the common wisdom is that trading/investing is 1/3 macro, 1/3 sectoral, and 1/3 single stock ( bond, whatever..). Whilst this is often true, there are definitely times during which this formula does not reflect reality. This is one of those times. Really, all that matters is macro. It’s the tectonic plates, it’s the paradigm shifts, it’s the “big levers”, which shift the calculus. It’s harder to ‘invest’ until these unknowns become more clarified-because they are so broad- but tempting to trade the short-term vacillations. Add to that the nascent but rapidly growing ‘casino’ mentality in society, and “voila”…”

The macro that matters and that came out after the podcast dropped was all about inflation. First, we had CPI:

Bulls will point to the lower than expected 0.1% month over month reading, driven actually by the pull forward in consumer spending pre-tariffs. New and used cars and furniture were big drivers. More importantly for me, the year over year was in line at 2.4% which is higher than last month. Still not to the Fed’s level.

Then we got PPI:

Once again, the month over month numbers came in slightly less than expected. In addition, numbers that feed directly into PCE such as portfolio management, airline services and healthcare, point to a PCE number that should also come in at 0.1%. Stepping back, though, we see that the year over year number was in line at 2.6%, and up from last month’s 2.4% which was actually revised higher to 2.5%. Economists like the micro trends as they try to discern where inflection points may be. Traders in correctly take monthly numbers and extrapolate to the yearly. Consumers look at their costs still being higher. I think this is important and feeds into the next stream.

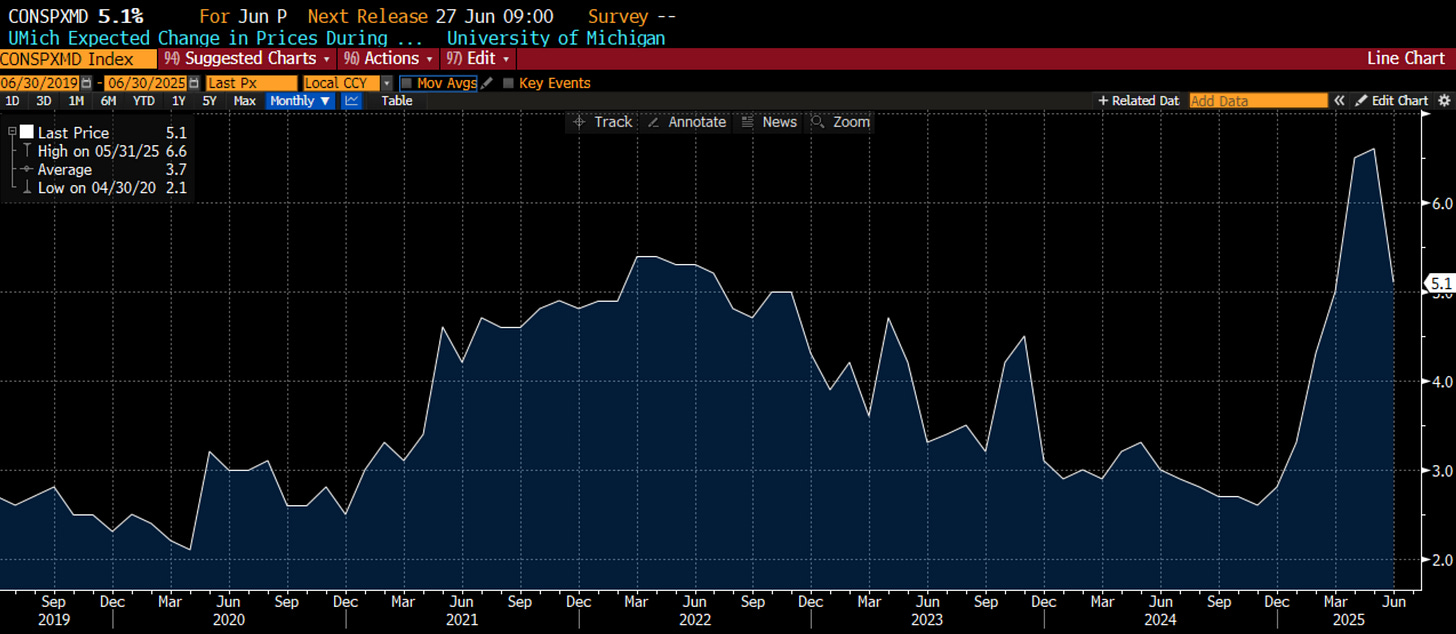

The inflation expectations number:

The data this week does not appear to support a stagflation view as it is all softer than expected. That is certainly something to note. That said, inflation expectations and year over year changes in CPI and PPI are still stubbornly sticky. I think it is equally important to look at what could be leading to some of this stickiness. For this, I look at wages and rents. On this front, we can see rents moving much higher on a year over year basis. For all of the buzz about the Zillow rent number, the Fannie Mae rental average is moving much higher. As a landlord myself, I can tell you that the Fannie Mae number is closer to my reality than what I see others put out from Zillow. Sure, I am not renting on the coasts or the hottest markets. However, rents have been heading higher. However, wages are not keeping up. I think wages are going to continue to march higher because people have to rent. There is not enough supply of housing. This will move PCE higher. All of that said, I recognize the benign (by market standards) inflation numbers. However, in the face of that, the market could not rally. Something to think about.

Now considering the Fed has a dual mandate, it is important to keep track of the labor market. Jobless claims came out this week worse than expected. It wasn’t horrible, but it points to an unemployment rate of 4.5% or so. I think maybe a better depiction of the labor market comes courtesy of Nancy Lazar at PiperSandler. She references the Employment Diffusion Index:

The trend here is clear. Post GFC there was a trend toward higher employment. Post 2022 there is a trend toward lower employment. On a 12-month basis, the market is about split between industries hiring vs. those laying off as there are clear winners and losers right now. This is down sharply from the post Covid labor market but also still much better than the GFC labor market. Bottom line, labor markets are worsening, and the trend is not positive, but we are still not at an absolute level that might spur the Fed to action.

I think the Fed still has its work cut out for it after this data. There are calls for Fed cuts with month over month inflation muted and jobs getting worse. However, year over year inflation is still not where the Fed needs it and frankly got worse. Labor markets are deteriorating but quite slowly and are still not at any alarm level. What is a Fed official to do? Probably nothing in my opinion.

In reality, we will find out more next week. For now …

Stay Vigilant

Share this post