… I told you I know what is going to happen.

As I it to write this on Sunday, I am listening to recaps of what happened on TV, I am reading what happened and could happen going forward on Substack and X. There are a lot of opinions, some more informed than others.

None of them have many concrete answers of what will happen. Will Iran retaliate? It is difficult to see how they won’t in some way, lest the regime collapse. What will it look like? Ballistic missiles or sleeper cells in the US? The response from Iran likely dictates what happens next.

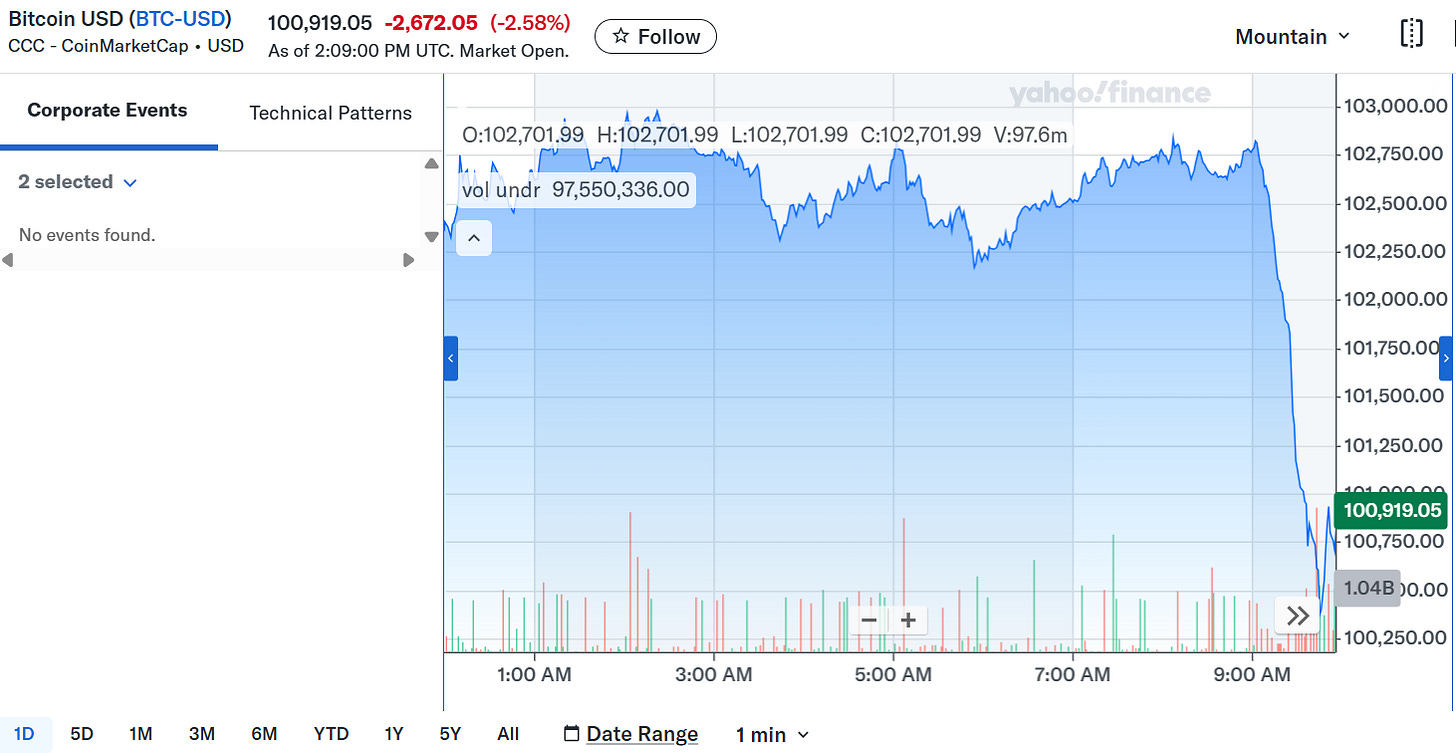

All of this means uncertainty. Sure, we are at peak uncertainty right now. This will diminish over time. However, right now, it is hard to say what one should with investments since we don’t know how much more involved in a Middle East war the US is about to get. The market is responding that this may not be good for risk assets. Just look at the reaction of Bitcoin, which trades 24-7 365:

We see that the Iran Parliament has agreed to close the Straits of Hormuz:

This should give a strong bid to oil. Does this make sense for Iran to do so? It may be their only response but the countries that are hurt the most are Qatar that uses it to export LNG and China, which gets its LNG and oil through this strait. These two countries have been the biggest allies for Iran, so closing the Strait hurts their biggest allies. Uncertainty.

Layer onto all of this the July 9 tariff deadline. More uncertainty. The market is still expecting TACO i.e. Trump Always Chickens Out. We discussed that before. I listened to a webinar with Andy Lapierre of Piper Sandler and team. Andy and team are far less enthusiastic that Trump will back down. In fact, they see very little case of this at all. Thus, we may be at a place where tariff uncertainty comes back to the forefront. Will this be as bad as Liberation Day? Unlikely, since that was such a surprise. However, suffice to say the market thinks that tariffs will still be de minimus and not even at the 10% across the board level they are now. This is what Polymarket thinks will be raised:

The annual run rate based on the May numbers is close to $300mm. Few think it stays at this level or goes higher, the majority think it goes lower. This is still a risk.

The attached podcast discusses the FOMC, the US fiscal situation and what this means for Treasury demand. What is the bond market telling us? What is the crypto market telling us? How is the credit market responding?

This podcast was done on Friday, before the bombing in Iran. In many ways, things have changed. What hasn’t changed is that markets are not priced for uncertainty, even though there is a considerable amount of it. This tells me to be very careful. This tells me to …

Stay Vigilant

Share this post