Something's gotta give

The next few weeks are full of economic data and earnings news that will set the stage for the rest of the summer

I spent the afternoon today celebrating the life of a friend’s father (hat tip KB). Given all of the negatives of the past couple years, it was a delightful day of reminiscing with friends, sharing stories, and just being … normal.

It took place in one of those old school Italian steakhouses. We have quite a few of them in Chicago. I know NYC has its share. Maybe other cities aren’t as lucky. If you are in Chicago, ask me for a few names if you want to try. Anyway, these are the types of places with waiters in the white waistcoats, lots of old wood, and of course, the requisite soundtrack of some member of the Rat Pack - Frank Sinatra, Dean Martin or Sammy Davis Jr.

One of the songs that played today was “Something’s Gotta Give” by Sammy Davis Jr.:

When an irresistible force

Such as you,

Meets an old immovable object like me.

You can bet as sure as you live.

Something's gotta give

Something's gotta give

Something's gotta give

How true is this when we think about what has been going on in the markets? We were worried about inflation and rate hikes, but now maybe we are worried about a recession. Then we got a jobs number that was really strong, so now we are worried about rate hikes again. With the economy slowing, earnings are going to fall. As earnings come out, they aren’t as bad as feared and stocks rise. What is happening? Something’s gotta give.

Before I continue, can I ask you a favor? If you find these blogs at all useful or interesting, maybe even valuable, could you please forward it on to a friend, or share the link on social media? I only do this to try and help people demystify the jargon and confusion of finance - demystifinance as I say. The more people I feel I can impact, the better. Thanks.

When I see so many conflicting stories, themes and narratives, I go back to first principles. At least my first principles. For those that have been reading all year, which started with the Three Body Problem:

they know that I look at the world through three parts - Fundamental, Behavioral (aka supply/demand) and Catalyst. Each week I try to focus on one part in the writings, though I am always thinking about all of them. This week I want to try and do a quick overview, because I feel in the next 2-3 weeks, we are going to get important news on all three parts of the three body problem. Here goes.

Fundamental

I spent some time last week speaking about the US economy. I have some more to say about that below, but first, I want to look at some of the global economies. About 40% of S&P 500 earnings come from overseas, and so we should not be so insular in looking only at the US economy. Given the interconnectedness of risky assets globally, news from abroad impacts your portfolio regardless of where you reside.

One of the big stories of 2022, and there have been quite a few, is the Covid lockdown in China, which has had a deleterious effect on the economy. Xi Jinping knows this. He is, after all, going for a third term as President some time this Fall which would put him in rare air among Chinese leaders. Lately, at the margin, the news has gotten somewhat better. There are still lockdowns, but not quite as bad it seems. People can go out for food etc. There has also been stimulus put into the system. We are starting to see this in the data. The China PMI which came out at the end of June showed a move back above 50, which is the expansion/contraction level. Some will certainly question the validity of the data, as Chinese government data is notoriously questionable (for that matter, all government data is questionable). We are not seeing the uptick yet in the Li Keqiang Index (recall that it is bank lending, rail freight and electricity consumption). We are seeing an uptick in total social financing and the stories are that provinces have been told next year’s infrastructure spending can be puled forward to this year. China is not afraid to build even useless buildings and roads to keep people employed and generate social stability. There is some logic to this relative to simply handing people checks as the US did during Covid lockdowns.

It is far too soon to signal an all clear and suggest this is a risk-on signal. Last week we looked at relative Chinese vs. US M2 growth. It was another sign suggestive of a potential period of out performance in China. Much like in the US, with a political event this Fall, the natural inclination of politicians is to spend. In China, the government has been able to. In the US, it doesn’t look as likely.

Another way of trying to corroborate what we are seeing globally is to look at the most economically sensitive economies. With its consumer electronics, white goods, cars, ships and steel, Korea has quite the economic sensitivity. This is why so many technical analysts will also watch the Kospi Index for clues to global risk. The PMI in Korea is still above 50 but still moving in the wrong direction.

Another Asian economy to focus on is Singapore. Having lived there for most of the 90s, a truly awesome time, I can personally attest to the breadth of the economy and the deepwater port, that brought in people in energy, tech, shipping, finance and offshore manufacturing. It may be made in China or Vietnam or Malaysia, but it gets shipped via Singapore. The PMI here is still flirting with recession territory.

So the global economy is clearly not out of the woods. In fact, it is only starting to get bad. A rule of thumb used by many is that the ISM (US PMI) does not bottom until 18 months after interest rates peak. I have drawn vertical lines below at the 18 month period after the 10 year US yield peaked and you can see it has been pretty good for 25 years. Arguably this was a disinflationary period which you can see from the trend lower in yields, and so maybe this time is different. Perhaps but if anything, that means this time is probably worse. Even the rule of thumb if you believe rates peaked in June, suggests the ISM will not bottom until sometime late in 2023. That is more than a year of continued struggles. Optimistically, even if you think the ISM cycle itself is in the 18 month range (over the last 50 years it has a range between 1-2 years from peak to trough though we do have one reading at 3 years), this would point to a bottoming sometime in the summer of 2023. Either way, we are in for a tough economy for a period of time still.

However, what type of recession might we have? I put out a post on Linked In this week that asks this question. We can look back at GDP data the last 50 years and see that sometimes we have both nominal and real recession, most times nominal is near zero when we have a real recession. However, back in 81-82 we had a real recession but not a nominal recession. The post got a lot more engagement than normal, and I even heard people discuss it on a conference call this week, as well as discuss the topic on other social media. It would seem that this might be a subject where there is some debate, but where we might want to focus. This is the post:

“This topic has come up more & more in the conversations I have had with friends lately. Is a recession a foregone conclusion? Certainly looking at the coincident & anticipatory economic data - the ISM, ISM internals, shape of the yield curve etc - suggest that a recession is fairly imminent. Recession risk indices at Wall St investment banks are rising into territory that says it will happen this year. Even Google Trends data sees searches for recession at double the rate as before the Great Fincl Crisis.

Anecdotally most people I speak to don't see it. I have traveled coast to coast in the US & from the top to the bottom of Europe in the last 6 wks speaking to many people. All have complained about inflation & said it will cause them at some point to consider not spending as much. However, in all of these places there is still a great deal of construction, hotels are full, restaurants are busy, airports are overcrowded. These signs may not be indicative that we won't have a recession in 2023, but that one in 2022 seems unlikely. How do we square the circle?

Yesterday I looked at the stark difference in nominal vs. real GDP. The negative GDP in 1Q (which may or may not be duplicated in 2Q) is in real terms i.e. after inflation. If we look at the growth in GDP in nominal terms i.e. in current prices, it was positive. In fact it was sharply positive. However, many seem to be extrapolating negative real GDP (even two quarters) into a nominal recession that would look like the GFC. However, in 2008 we had a recession in both real AND nominal GDP. That is a different animal. Often through time it is pretty close where we may have a real recession but nominal is pretty close to zero. It is rare to see a real recession with positive nominal growth. We have seen it before.

The chart today shows you nominal GDP growth in blue vs. real GDP growth in orange. I have highlighted on here when we have had recessions as deemed by the NBER. When both nominal and real GDP is negative, it is bad news. Look at Covid. Look at the GFC. Stock returns are worse than they have been this year. When we have had a negative real GDP but nominal has been close to zero, we have negative stock returns but they are not as bad as they have been this year. High single digit type of losses. However, when we have negative real GDP but positive nominal GDP, as we did in 1981-1983, SPX returns have been in the positive double digit area. After all, earnings drive stocks and earnings are nominal.

So what will we see? Will this recession which seems to be a foregone conclusion look like 2008? Like 1991? or like 1982? The type of recession we get will matter a good deal for equity returns. It matters as to whether the recession is priced in or not.”

Why does this matter? That is precisely what I will be speaking to my friends at Spiderrock Advisors this week. The topic is business cycle investing. This topic and approach might seem quite common to my friends in Europe and Asia, however, it is not an approach that is discussed much in the US. I teach a class on this at the University of Illinois, Urbana-Champaign, but you won’t find it in too many curricula. Perhaps the topic will become more popular now, because followers of this approach would have had the correct sector and style allocations for the past 2 years as we moved from reflation to inflation. We have been in stagflation but look to be moving to deflation. This has an impact on the assets you want to hold in your portfolio.

Within this framework, one topic we look at value vs. growth, but not as many do. Many will speak about the subject and look at an S&P Value vs S&P Growth Index. There is nothing wrong with these indices, however, they are not designed to be sector neutral. Therefore, using this data, you get quite a few sector effects too. The value vs. growth I use below is sector-neutral to isolate only value and growth factors. The key driver of the decision to move from growth into value is inflation. If you think it will be rising, value is the place to be. If you think it is falling, growth is the place to be. There are other styles as well, but we can see below, as inflation expectations rose for two years, value massively outperformed growth even on a sector neutral basis. These expectations have been falling. Coincidentally, we see growth stocks rising relative to value of late. This has looked largely like short-covering, but has been driven by this inflation dynamic.

Energy has been synonomous with value and tech with growth. If we look at the price action of energy lately, it has had a major sell-off, admittedly from a high place. The chart below is courtesy of my friends at Bespoke Investments (I recommend).

You have to take my class to learn more, but I will give you the punch line - in deflation, no stocks (nor any risky assets) are safe. Quality (balance sheet and earnings) works the best.

Inflation expectations have been falling, but what is driving that? Largely, it is the move in commodities, which might be showing signs of moving lower. This week we will get a reading on CPI, which will have quite an impact on the market’s expectations of Fed rate hikes. If the CPI cools off as the commodity index suggests it might, this could lead to a short-covering rally in stocks as Fed rate hike expectations lower. I am not betting on this, but it is an event that we have to watch. As we said, something’s gotta give.

Largely, the Fundamentals section globally still looks like a lot of wood to chop in the coming 12 months. This is not a positive time for risky assets. For equities, the economy drives earnings, and earnings drive stocks. For credit, recessions mean loan losses. For commodities, recessions mean falling demand.

However, there may be some reasons to be positive. I have said in the past few weeks, that something doesn’t add up. The places I go, I don’t see a recession. It does not feel like 2020, 2008 or even 2001. Yes, some of that is that the recession may not happen until later this year, so perhaps a timing issue. I don’t think that is the entire story. Back in early 2020, as part of the Investment Exchange Forum podcast I do for the CFA Society Chicago (open to all people, and available on any podcast app), I did a series on Peak Globalization. I did the series because the topic had come up at many of our events. It was still controverisal i.e. many thought that the idea was nonsense. You can access the podcast series here.

Subsequently, it is no longer controversial. Due to tariffs and trade wars, then Covid and finally environmental reasons, companies are clearly shifting production. Not ‘back home’ as they say, but near-shoring, make things nearer to where they are sold. I was golfing with a friend this week who is a middle market M&A banker. He works with several small Midwest manufacturing companies, whose business prospects are holding up quite well as business comes back from overseas. He tells me this is place that foreign companies are looking to invest. We know that European manufacturers, that can no longer source cheap Russian nat gas, are considering building plants in the US closer to cheap energy. It is a lot faster to do that than wait for an LNG exporting facility to be built. Looking at US data, the foreign direct investment in the US has continued to rise.

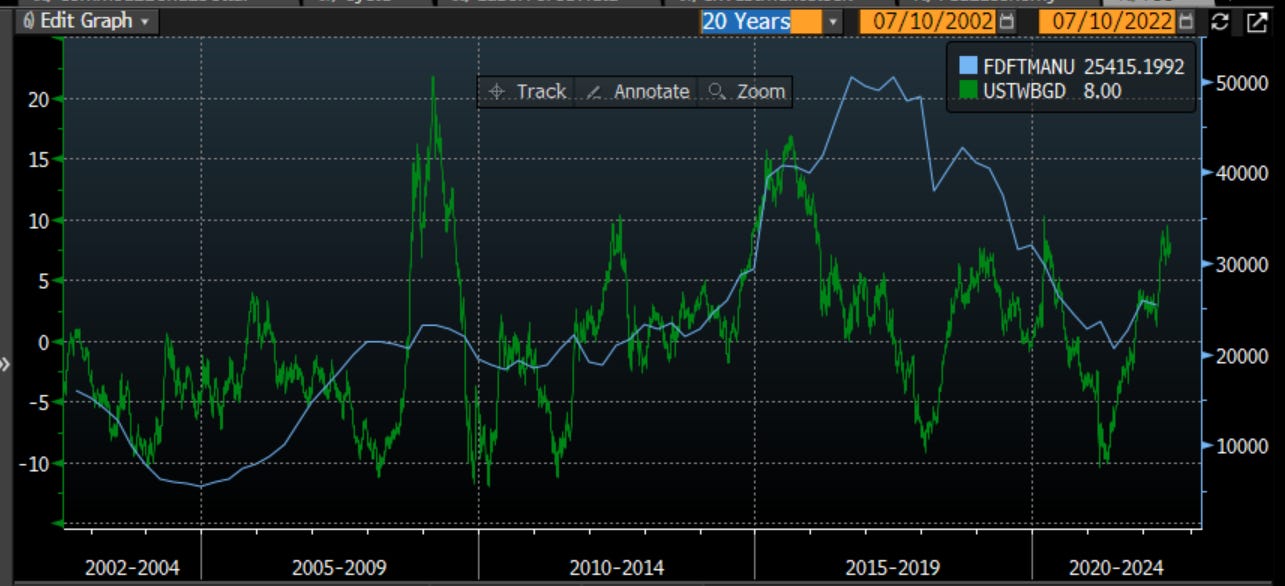

If I look at a longer term chart of the moving average of this data (in blue) and plot it versus the dollar, we can see that US FDI is correlated to moves in the dollar, as the dollar gets stronger, there is more US FDI and vice versa. Perhaps some good news in the midst of a lot of negativity.

Behavioral

The next category I consider is what I refer to as Behavioral. This looks at supply and demand in the market. Supply and demand are driven by investor sentiment largely. As I like to frame it, if a potential investment has good fundamentals, but everyone is selling because they are negative, you will want to know this so you are patient. Conversely, if the fundamentals are negative, but investor sentiment is shifting, you might want to be careful on your negativity.

In fact, when fundamentals are negative, and investors are there too, all asset classes start to suffer. I write a blog for the CME Group called “Excell with Options” which you can find here. This week I am adding to the repetoire with “Excell with Ag Options” and for this piece, I looked at the broader moves of the grains and livestock space. What we are seeing is that a lot of investors moved into this space with the rise in inflation the last 12 months, knowing that this was an area that could provide portfolio protection in an inflationary period. With a number of pensions having divested from energy, it was a commodity area that could be investable. However, as commodities roll over, and the market lowers its expectations of rate hikes, this is even hurting the agriculture space, which frankly received some bullish news from the USDA acreage report at the end of June. This is a great example of how positive fundamentals can be overwhelmed by negative supply and demand.

These futures are much more sensitive to CPI than to GDP as you can see below. Again, there are positive fundamentals in these products based on the acreage report, however, the herd is moving out of them. What happens if the CPI news this week does not come lower as the commodity index suggests it should? Will these ag tourists look to pile back in?

Commodities are not the only space with some institutional tourists involved. Digital assets have also seen many institutional investors moving in. After all, as institutions were exploring, they saw a negative correlation to the S&P 500 with positive returns. From a portfolio optimization standpoint, this is great. Of course, as the herd moves in, the correlation goes up.

I wrote a blog for Paradigm, a CeFi trading platform for institutional traders, in which I speak about how capital is allocated at various institutions, and why the money flowing into crypto (or any asset for that matter), from these allocations, can be both a blessing and a curse. Another example of the supply and demand impacting markets. You can find that here

Looking at DeFi, another set of risky assets in my book, it is following the classic bubble pattern. For this, I look at some of the bubbles in recent memory, that all more or less look the same. Below in white is the Nikkei bubble from 1989 and the Nasdaq bubble from 2000 in blue. I have also overlaid the oil bubble from 2008 and finally DeFi of the last couple years. The faster the bubble bursts, the sooner it can recover. Where it takes time, it is more prolonged.

If you are interested in learning more about DeFi, I also did an Investment Exchange Forum podcast series on this topic. Again, you can find it on any podcast app, or you can get it on the CFA website here

Suffice to say, right now we are seeing a purging of assets across the spectrum - stocks and bonds with their worst start in 30 years or more, ag products and other commodities being sold as inflation expectations come lower, crypto assets being sold as the era of free money ends and there are blow-ups galore. Investor sentiment across all asset classes is sufficiently low right now.

Catalyst

The fundamentals are weak and investors are negative. What will get people to change their minds? It is in this marginal shift that the bigger moves occur in the market.

Staying on the DeFi theme, there is a positive potential catalyst. Sometime in August, the Ethereum network will be switching from Proof of Work to Proof of Stake. The network has been running parallel chains and now that the bugs have been worked out, these chains will merge and the shift will happen. This is according to the Ethereum website:

The Merge

Soon, the current Ethereum Mainnet will merge with the Beacon Chain proof-of-stake system.

This will mark the end of proof-of-work for Ethereum, and the full transition to proof-of-stake.

This sets the stage for future scaling upgrades including sharding.

The Merge will reduce Ethereum's energy consumption by ~99.95%.

This is a potentially positive catalyst that could pull in more investors. Yes, we can argue that everyone sees it coming, however, it is one of those that investors won’t want to put money to work until it is official. This is something I am watching closely as I feel the sentiment and price action in crypto has been coincident if not leading the Nasdaq:

This is a topic I will be able to discuss more next week, as I am on one of four panels at a DeFi summit this week in Chicago that is being hosted by IDX Digital Assets. You can see more at their website: https://defisummit.idxdigitalassets.com/

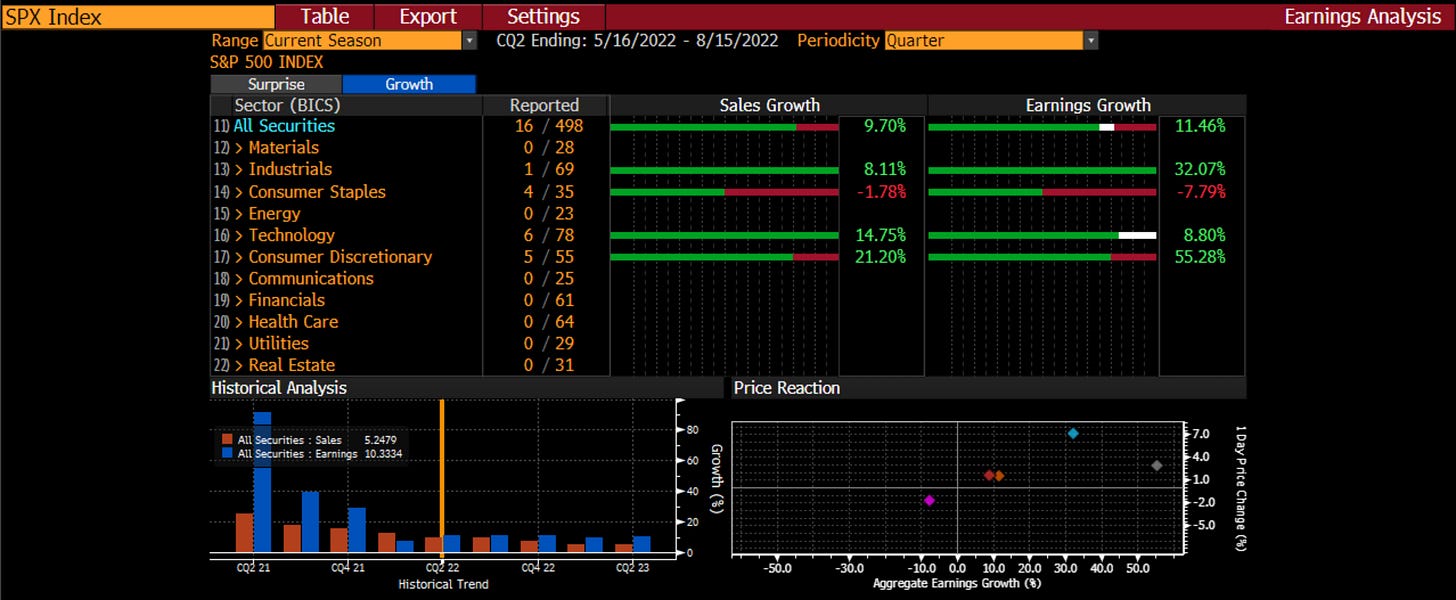

Another catalyst that will really kick-off in earnest in the next two weeks is earnings. The big bear story on stocks now is earnings, with multiples having fallen back to normal. The expectation is these will fall, but how much?

In the way-too-early look, we can see that 16 of the 500 companies in the S&P have reported. The surprises were positive but the sample set is small. However, when I was running a long/short HF portfolio, I would always watch the price action of other sectors that reported before mine would, not because the news was impactful on my stocks, but because the investor reaction to the news could help me understand how people are thinking and what issues they care about. In the lower right, you can see positive earnings surprises are met with positive price action.

We should also look at the growth numbers or the absolute sales and earnings and not just that relative to expectations. Again, way-too-early, but the data have been positive and the reaction to good news has been as well. Good news is good news, bad news is bad news.

As I said, the big bear story on stocks is a fall in earnings. So far, we aren’t seeing it but the next 2-3 weeks are when the bulk of the data comes out. Something’s gotta give.

The last potential catalyst will be economic data. The CPI comes out this week in the US but it is not the only data point. Economic data has been universally poor for the last two months. This is why recession fears are creeping in. However, if we look at the Citi economic surprise indices, we know that they are mean-reverting. What does that mean? It means as the data disappoint, economists lower their numbers. They continue to do so as long as the data disappoint. However, at some point, the numbers are lowered enough that the data start to come in better than expected. We can see in orange this has happened in China for a month. It has been happening in the US starting this month. Europe is still falling. How do investors react if the economic data start to come in stronger than expected?

The next few weeks we are going to get a lot of information. The fundamentals for risk are quite negative however, investor sentiment and actions are also negative of late. What changes those views, if anything? Events like the Ethereum Merge? Earnings? Economic data? Central bank expectations? Some might say that the last 6% of short-covering in the stock market means that people are not as negative as I think. The worst start to the year in 100 years, in spite of this move, might suggest otherwise. There seems to me to be the potential, particularly in illiquid summer markets, for a bigger than expected move. With the VIX falling, led by lower realized volatility, adding convexity ahead of the catalysts could be an interesting way to protect your portfolio.

Maybe investors have these feelings, as Camila Cabello sings in her version of “Something’s Gotta Give”:

I should know by now

You should know by now

We should know by now

Something's gotta give

Something's gotta break

But all I do is give

And all you do is take

Something's gotta change

Stay Vigilant

Golf is so frustrating. Only sadomasachists should play that sport. Hat tip, try running Sine Wave vs CESIUSD---its pure sex and is in line with bounce in data---generally SPX outperforms Treasuries when its going up....Here is another potential thought. Could the July hike, now 100bps on the cards be the last one of the cycle? Finally, ever check out the 1940s? Equities bottomed, then ranged traded, on the month that CPI peaked at 19.8%, which could be a nice analogue for scenario where there is no or mild downturn and would agree that nominal recession is harder to come by which means any earnings decline is also likely to be modest. Of course this comes with the usual caveat that whilst its hard to identify where the pockets of leverage and financial stress are this time, maybe some dead bodies, outside of crypto (which is sideshow) will cause a deeper downturn, Right now I don't see it, and am not at all convinced that ISM is going to 40. I am probably wrong, and may change my mind over the next 6-months, but that is where I am now...