Take a step back

With the market pullback leading many to question if it continues, it's worth looking at the forest and not the trees

At Satori, there were five partners. One of them used to like the phrase "let’s take a step back” during some of our more strategic discussions, when he felt we were getting into the weeds too much. In one heated discussion, he had said that so many times that I recall saying “if we take any more steps back, we might fall out of the window”.

However, he was right. Often, we get too caught up in the moment. We lose sight of the big picture thematics or secular drivers or cycles. We are focused on the trees and not the forest. When this happens, it is more likely that the behavioral biases that are often linked with short-term decision making can lead us to poor decisions. So, it is right to take a step back at times to make sure that the raison d’etre of the market is still intact.

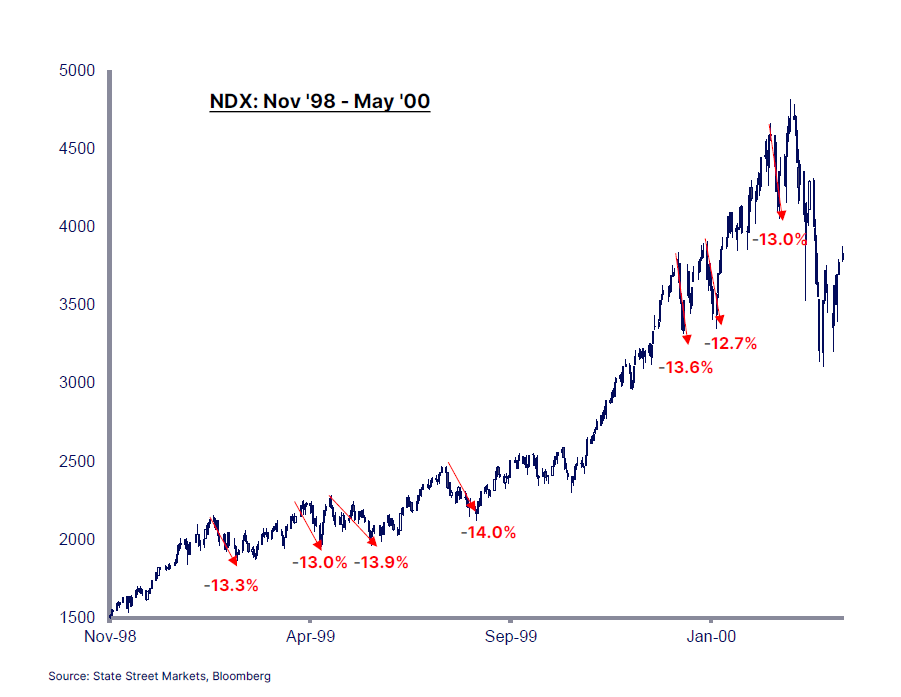

It is often the cases that markets take a step back too. One chart shared with me by Mr. Risk showed that in the Tech Bubble, there were 7 corrections of 12.7-14%. In each the market continued to new highs before, the final bust, where the first wave lower was more like 40%. Thus, neither bulls nor bears are wrong based on the price action just yet:

In fact, the current correction is less than the “steps back” that we have seen in 2023, 2024 and earlier in 2025, yet each of those saw new highs set:

So, taking a step back can be a useful respite in finding focus and re-energizing for a push forward on the strategic path. That is, if the path is the right one. In the work I do with start-up companies, I find that the most successful companies and entrepreneurs are those that are more adaptable than set in their ways. The founders that see the company as their child and they can’t envision a different path are the ones that often watch things go to zero.

Investment management is the same thing. It is a pendulum between dogmatism and pragmatism. The best investment managers are those who know when it is time to be dogmatic and dig in their heels and when it is time to be pragmatic and move to the sidelines.

With that in mind, I want to take a step back and work through my three-stage process to know whether now is the 9% move on the way to a 15% correction before a move higher, or it is the first 9% of a 40-50% move lower that pops a bubble.

FUNDAMENTAL

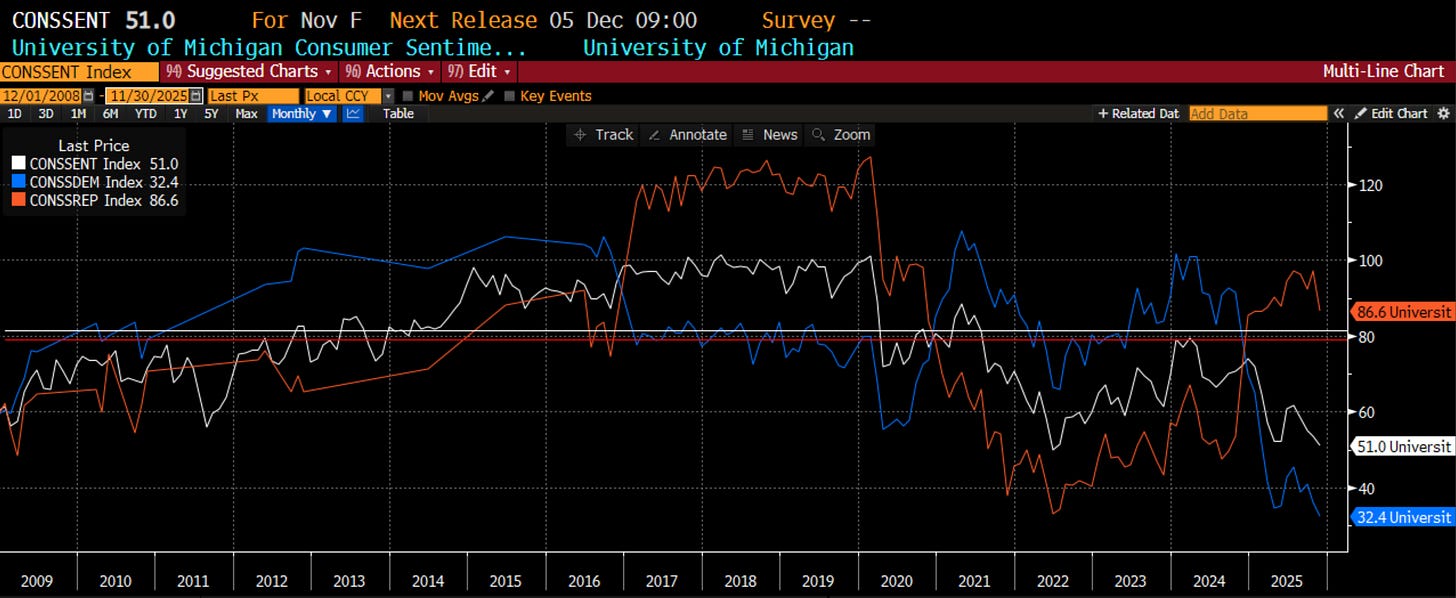

Perhaps the most widely-shared chart this week was of the University of Michigan Consumer Sentiment, which hit a 3.5 year low. This was cited as confirmation that both the weakening labor market and the K-shaped economy were about to spell doom for the market:

There are many flaws with this survey and others. One of the starkest is the political divide we see in the data. We see here that Democrats in blue have plummeted to the lowest ever. Republicans, on the other hand, are right about their 17-year average. Does that mean Republicans are just happier people? Well, kind of. The white horizontal line is the average of Republicans which is 82. The red horizontal line is the average of Democrats which is 79. So, on average, Republicans survey as more upbeat. The political divide has never been this wide. In the 1st Trump Administration, it was +40 for the Republicans and that is when the phrase “Trump Derangement Syndrome” was invented. During the Biden Administration, it swung to +37 for the Democrats. No time have we seen the +54 that we have now.

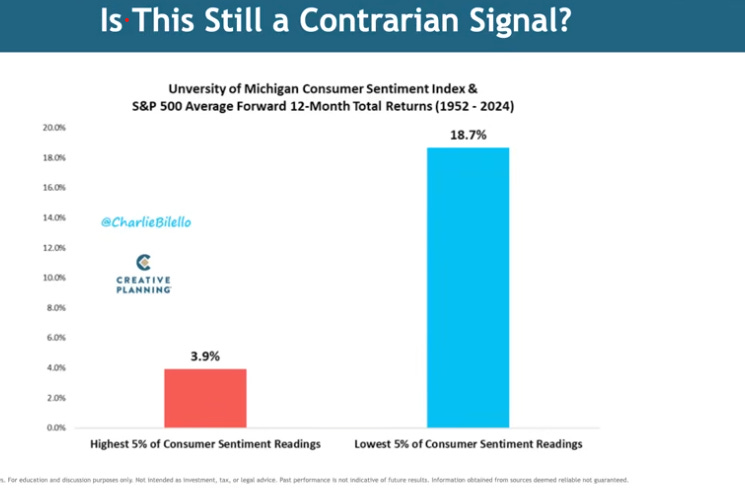

This leads me to be careful of the narrative that we see in the media or online. Your view of the economy, and therefore profits and stock prices, might have a lot to do with your party affiliation. Even if we take the average as being indicative, and realize we are at a 3.5 year low, could this be a good thing for the market? This chart comes from Charlie Bilello via Mr. Risk. It shows that forward stock returns are better when sentiment is low, not high. Maybe we should be happy that no one is happy?

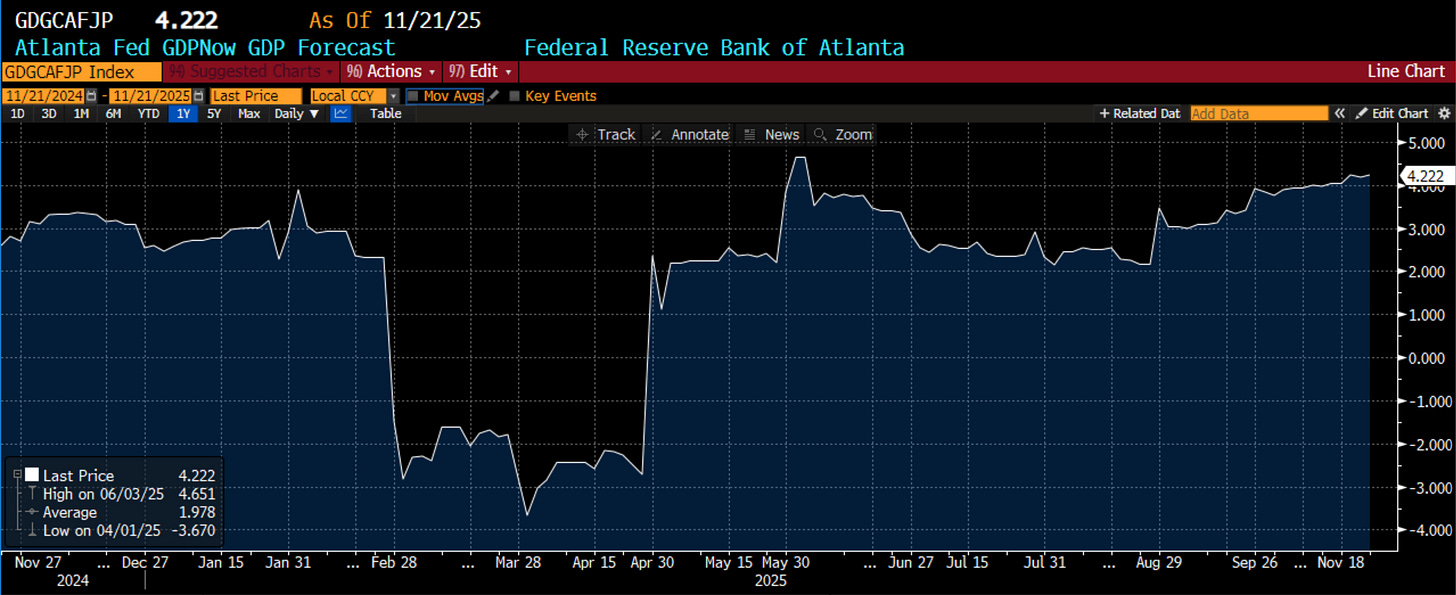

I try to be more objective. Take, for instance, the Atlanta Fed GDP Nowcast. Many were quick to point it out in Q1 when it was imploding. They wanted to highlight the poor policy decisions of the President. Fair enough. We should then point it out now as well. It is tracking at 4.2% suggesting that the economy is quite fine right now.

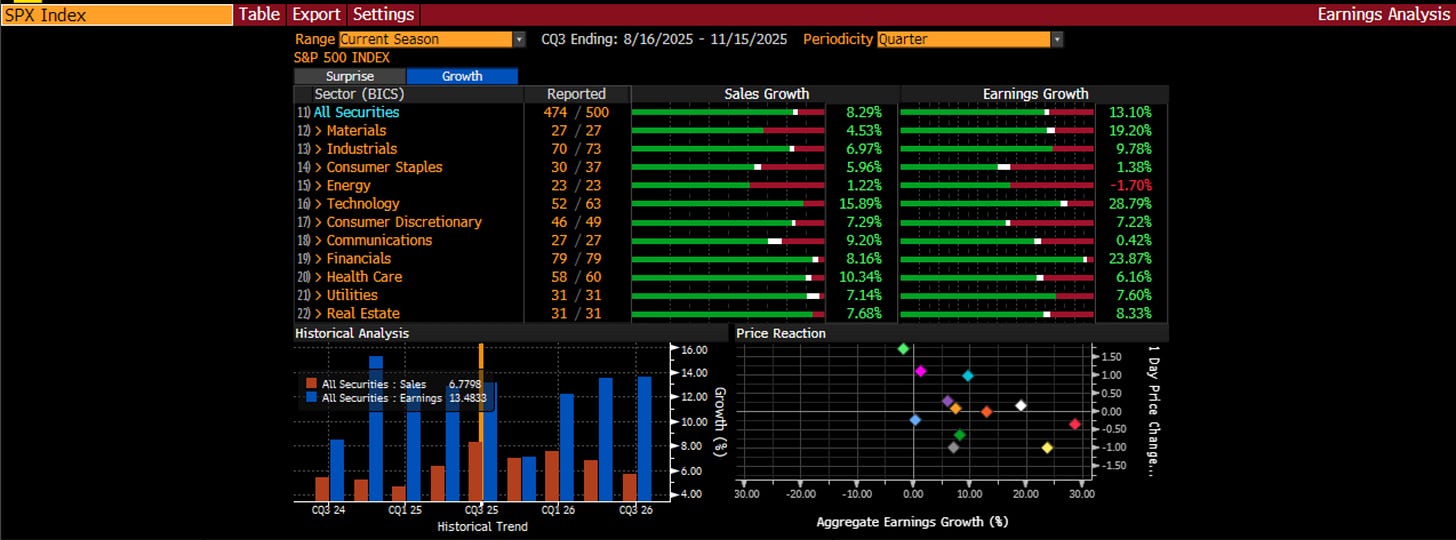

Also, let’s not forget that sales growth has not been better over the last several years and earnings growth is still quite good:

This was a point I tried to make to people on LinkedIn this week. Profitability matters for the market, and matters for the valuation investors will put on the market:

Chart of the Day - index valuation

You don’t have to linger long in finance social media to see the charts of the SPX valuation and people calling for a bubble. It is either the forward P/E or (gasp) the Shiller cyclically-adjusted P/E (always trotted out by fixed income and not equity people I notice)

As I have harped on before, it is dangerous to look a this time series and make conclusions. After all, the SPX Index in 2025 looks very different than the one in 2015, 2005, or 1995. The names and sectors that are more highly weighted are simply quite different

You wouldn’t pay the same P/E for a bank or energy company as you would for a tech stock, so why would you pay the same for an index full of tech vs. one full of the others?

That is not to say that the valuation of the index isn’t somewhat challenging. Those expecting further multiple expansion are likely to be disappointed

Earnings will have to drive the market from here. What will drive earnings?

Perhaps it is tax policy that is favorable to companies. Perhaps it is de-regulation. Perhaps it is the productivity gains from AI. After all, the flipside of the ‘AI companies have no revenues’ argument is likely that the customers of AI companies (the rest of the market) are getting a product at a subsidized cost

If these are the case, we should expect to see profit margins expand. If we see profit margins expand, earnings will grow and drive the market

In fact, if you look at the SPX profit margin vs. the SPX forward P/E for the last 25 years, you see a relationship not surprisingly. As companies are more profitable, investors are willing to pay more for that stream of earnings

This does NOT mean that it is great for every part of the economy. In fact, one way the larger companies hold on to margins is by letting people go. See the recent slate of layoff announcements

That does not spell doom & gloom for the market though. Yes, you need people to have jobs to ultimately pay for goods & services. I get that

For now, though, companies are making money at an increasing pace. Profit margins are rising to all-time highs at the market level. This actually justifies a higher multiple

Be careful thinking the market is ‘overvalued’ simply because a time series is at a level that has rarely been seen before. Would you ‘sell’ that profit margin line too?

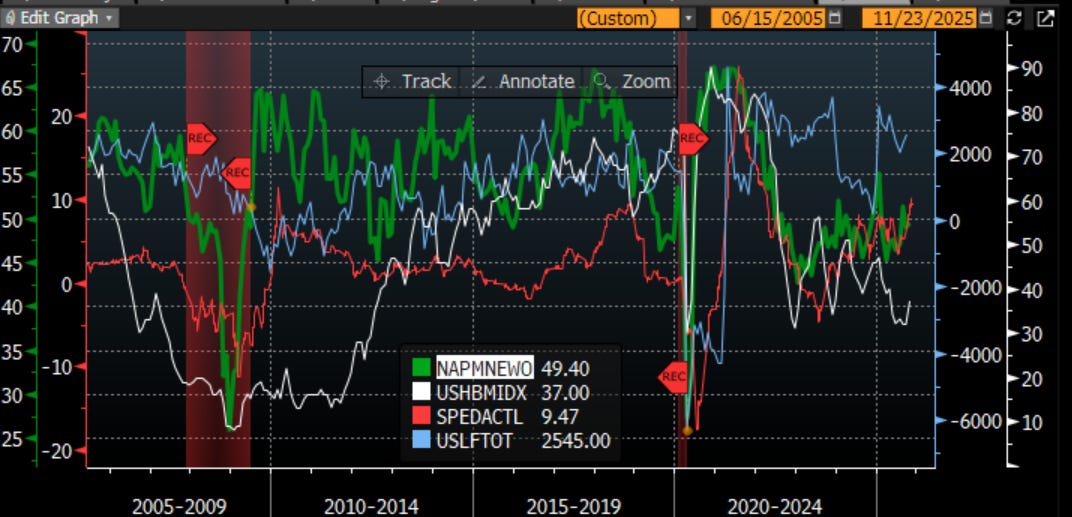

This is important to understand because employment follows profits and not the other way around. Yes, in the HOPE framework of housing → order →profits → employment, housing is still struggling. However, new orders have ticked up, and profits have held on. Employment is weak now and this is likely because companies were hesitant to fire even when profits collapsed in 2022 because of the problems of hiring post Covid. Thus, some of that ‘extra’ workforce is being rationalized. I see that as a lagging indicator, and not a leading indicator. Profits are good.

Finally, financial conditions continue to be easy which should be good for equity returns.

Pulling it together, the FUNDAMENTAL category still seems to be largely in check indicating an economy that is still supportive of stocks and risk-taking.

BEHAVIORAL

This is where there are clearly some problems in the market. This has been the focus of markets this week for sure. It has been my focus on LinkedIn as well.

Chart of the Day - Bitcoin and the box

I highlighted last week that Bitcoin had broken its 365 day moving average

Why this one and not the standard 200 day? Its because Bitcoin spot traders 24/7/365 so it is a better measure of traders there

Why does it matter?

Because every cyclical move the last 3 years never broke this secular trend. It was now about to break. When it had broken on the downside before, we went into ‘crypto winter’. We it broke above, things were good again

The catalyst is probably the crypto Treasury companies needing to sell because they did not actually invent some new alchemy where converting their company into a Bitcoin company made them a great company. I’m looking at you Strategy

Why does it matter? I think Bitcoin is a great measure of market risk appetite. This is particularly the case as institutional investors moved in. It is another asset with returns, risk and correlation. It will be added and risk managed as such. There is no emotional attachment to the idea

Thus, Bitcoin weakness matters for all of us

A friend texted and asked if he should buy. I said no. Or more accurately, not yet

The reality is, Bitcoin is heading into the box. I mean technically. it will trade down to the 50% retracement area, perhaps stopping initially at the 38% Fibonacci retracement. This defines the box on the chart. This means 70-80k.

It is probably heading into the penalty box too, so don’t expect a V-shaped recovery. Technical breaks like this do P&L damage but also emotional damage

The best thing that could happen to Bitcoin is that it goes sideways for a while and people stop to focus on it in my opinion

If it continues to fall, it will further suppress risk appetite in stocks and other risk assets

We all need to pay attention to the box

This is why I say we all need to pay attention. Bitcoin is the leading indicator of risk appetite in market. It suggests trouble ahead still for stocks.

With the higher volatility, vol control funds, who really led the selling in Q1/Q2 have been pretty stable in their allocations. Will this change if volatility goes higher still? Very likely.

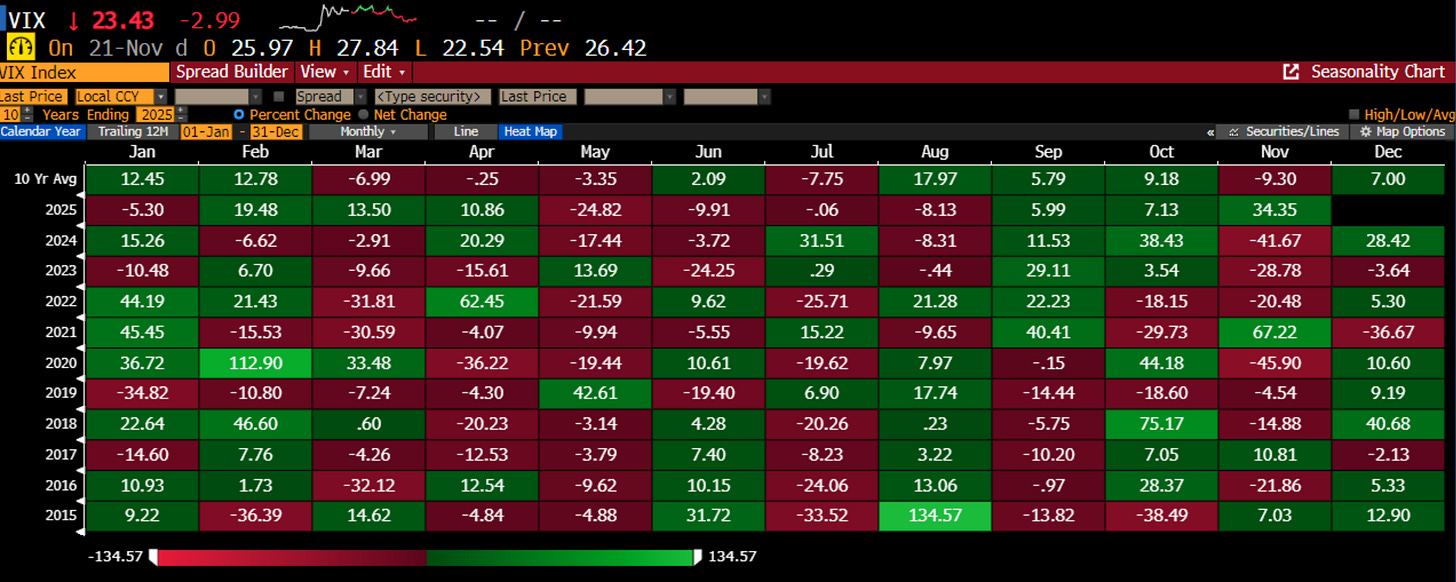

It is worth noting, though, that the VIX was lower on Friday and the hedges I heard were taken off all revolved around the VIX. With a holiday-shortened week ahead of Thanksgiving, and likely so reduced position-taking among traders and investors as we move into December, there may be less of a need for hedges, and so maybe the VIX will not move that much higher, so no need for vol control funds to sell stocks. Perhaps.

Chart of the Day - sentiment

People are still WAY too bullish

errr I mean

People are WAY too bearish

Wait, what?

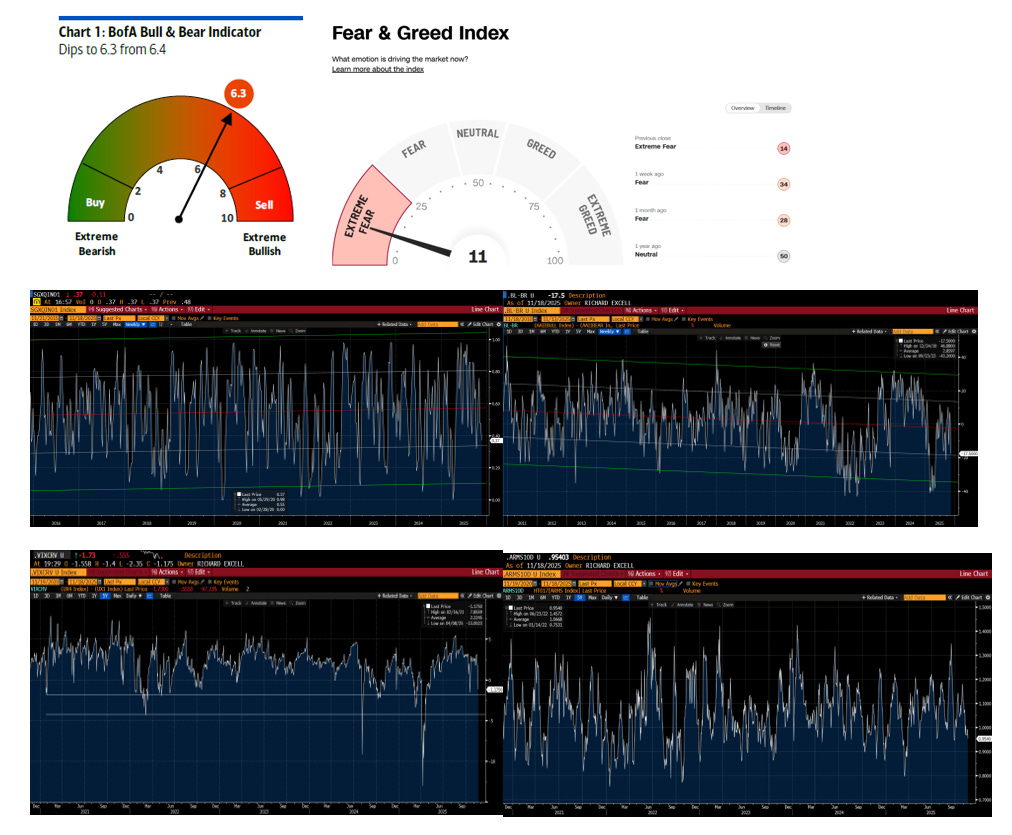

Bloomberg had the headlines and X.com is on fire because of the BAML Global Fund Manager survey report indicating that the sentiment in markets is still very bullish. I am not criticizing this report as it is the gold standard of surveys

However, one can also refer to the CNN Fear & Greed Index, used by many in their models, that is calculated based on many market metrics, that suggests the market is in extreme fear

How can this be?

No one really knows but one explanation is we have underinvested bulls. In the survey reports, one can indicate their positioning is bullish etc, when it reality their actions suggest they are getting pretty nervous. I don’t kow if this is full reality, but it could explain it

I say this because I looked at some other sentiment indicators I look at in the market, and while not at extremes, all of them seem to suggest the price action in markets is more negative than positive, that we are nearer panic than euphoria

Gather we are not at panic yet. Just that we are closer

Take for instance the AAII Bull less Bear index in the middle left. Readings of +/- 40 indicate extreme bullish or bearish sentiment among individual investors. We aren’t there yet but are at 1 s.d. nervous on a 10 year horizon

In the middle on the right is the SocGen risk-on/risk-off sentiment indicator for cross-asset risk allocation. It ranges from 0-100. The average the last 15 years is about 55. It is volatile. It is at 37 which is 1 s.d. on the nervous side over the past 5 and 10 years

The lower left is the VIX futures curve. It is usually in contango i.e. upward-sloping. When it goes into backwardation (front month above further out months) it is a sign of panic. Think of it as people buying hurricane insurance because they are watching the Weather Channel. When it backwardates by 2 vols or more, panic is in. We are right about there. It can get steeper as we saw in March/April, but for normal markets, we are close

Finally is the 10 day moving average of the ARMS Index. This measures the volume traded in declining stocks vs. advancing stocks. it is more sophisticated than a simply advance/decline line because it speaks to how much is trading in each. 1.3 is overbought and 0.8 is oversold. We are at 0.95 so closer to oversold

All in all, feels like a lot more things saying we are closer to a bottom than a top. I say this knowing full well that whatever NVDA says tomorrow, good or bad, trumps everything (no pun intended). However, I think before we get all beared up, particularly because we think that everyone else is bullish, it is worth looking at a few more indicators than then one that is convenient on X.com

In spite of all of the negativity and poor price action this week, and the dangers that Bitcoin points toward, the NDX Index has yet to break support. This keeps me from getting too bearish at the moment. While crypto has clearly broken and looks like the market is testing the crypto treasury stocks and people like Michael Saylor and Tom Lee, so far, the stock market has been somewhat resilient.

There are other signs to be cautious too. The 20 day Put-Call has not turned back lower. We are moving into a thinner liquidity week where any story can press markets, maybe even getting stock indices to break their technical support. For all of these reasons, I am currently cautious on a BEHAVIORAL standpoint. I would use options to express my views right now. I would make sure you have good stop-loss orders for any positions you take. I would practice good risk management.

CATALYST

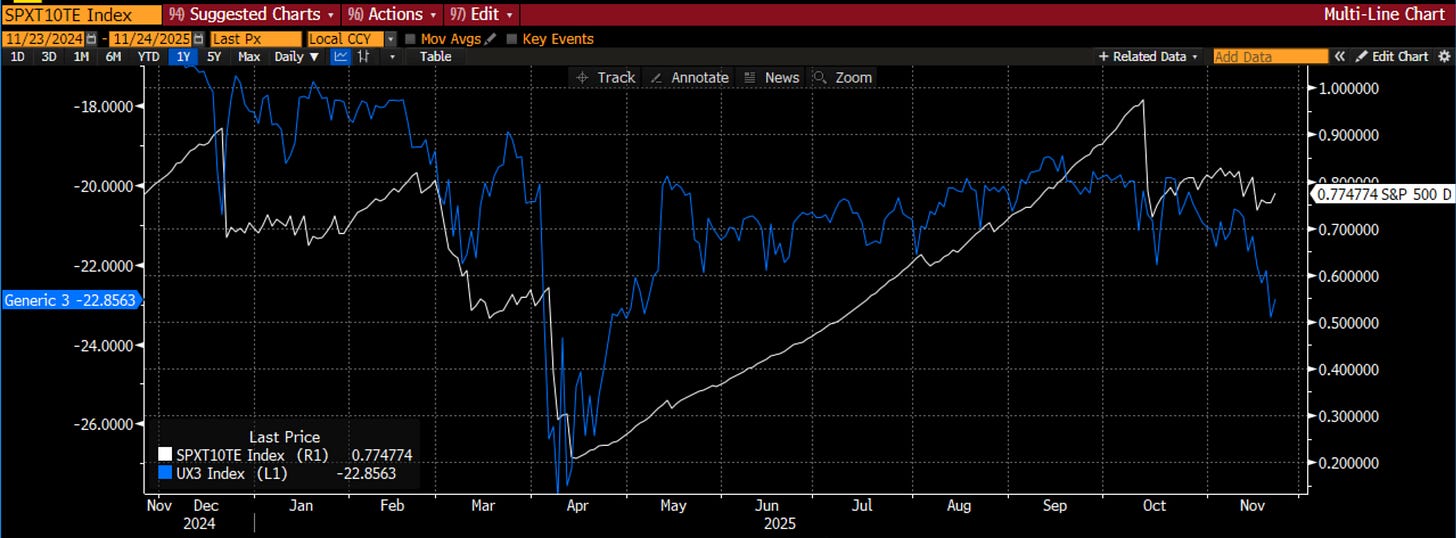

Maybe the biggest catalyst in the near-term is the FOMC. We have gotten many speakers giving us hawk and dove speeches. The rates market, which had a cut full priced after October got down to less than a 30% chance of a cut, before NY Fed’s Williams suggested on Friday we still need a cut. The odds moved up to 63% and this ‘saved’ the market.

You can see that the market found its footing and rallied on Friday right after Williams gave a more dovish speech. It is clear investors want to see the FOMC run to the rescue.

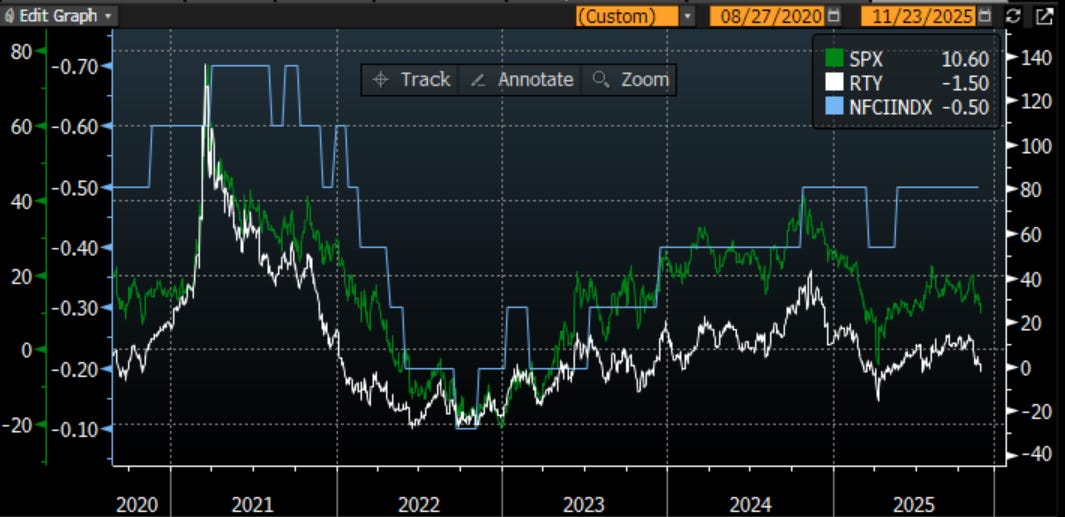

It isn’t just tech stocks either. This is a chart of the December 2025 rate cut odds compared to the small cap vs. large cap relative performance. It is painfully obvious that small caps need a rate cut if they hope to outperform.

It may be less obvious that even Bitcoin needs a rate cut. This is the chart of Bitcoin and rate cuts. Is it the debasement trade? Is it the need for liquidity? Either way, for something created in defiance of central authorities, it is interesting to see Bitcoin traders begging for a rate cut to bail them out. Crypto expert Mike Creadon discussed this on LinkedIn:

“I remember meeting Rahm once when he was Mayor at Raj’s house in Bucktown. It was right after the MF Global debacle - which was a scandalous black eye for the futures industry because a former US Senator and ex-Goldman guy did the unthinkable: he traded and lost heavily the sacred tabernacle of “seg funds”.

Rahm was and still is a very high energy guy. Former ballet phenomenon, in fact. He wanted answers. We - some of the leaders of the prop firm industry back then (and donors that night to his re-election campaign) - had to act fast and get the message out that all was fine and dandy at the Chicago exchanges.

A couple of my (far more wealthy) colleagues offered some half-baked, defensive postures. “It’s an isolated incident! We lost a boatload ourselves!! It’s not our fault!!!!”

Rahm was steaming. “All of that may be true. But you’re not going to win any points in Washington or on Main Street with those self-serving responses. You don’t want them to kill the golden goose!!”

Silence.

Unsure if it should leave the room or speak up, I chose the latter.

“There won’t be a federal bailout for the losses incurred..”

Rahm ran at me and almost tackled me, right then and there, some of his fingers waving more than the other. “Brilliant - yes. All of you get on TV and radio and print tomorrow and say what he said: “No federal bailout for MF Global.” Meeting adjourned.

Everyone was ecstatic. We had a plan. I think Don even gave me a high five.

Fast forward to today. You go online and see BTC bulls - who; don’t get me wrong, I love with all my might - screaming, begging, pandering for a 50 basis-point rate cut in December.

I must be dreaming. Or hallucinating. I can see the T-Shirts now: “I came for the Decentralization - And Stayed for TARP Meets ZIRP”.

Friends - am I becoming a curmodgeon in my 5th decade? A wanna be University of Chicago economist with a “Free Markets or Die” approach. Is it wrong of me to think risk takers - God bless every single one of them - should lie in their beds and piles of losses they made all on their own. ‘Cause we all - righteously - know how they feel about who keeps the upside.

I hope bitcoin goes back up and frankly, I have no doubt it will eventually or someday. When? I can’t tell you. Why? Not because I’m withholding a secret or have some inside scoop. Lord, knows I don’t. Because I can’t see the future.

I can offer a thought though - that a legislative booster or central banking intervention to salvage digital gold is unwise, foolhardy, thriftless and chicanery.

Still, I can’t sit here and tell you in this upside world we live - (did you see the Trump - Mamdani Love Fest yesterday, for example) - definitively that it will not happen.

Oh Rahm. Where art thou.”

All of that said, I do think the FOMC will be responsive to markets. if they stay weak, they can use the SF Fed report that suggests tariffs weaken the economy. If they strengthen, perhaps there is less of a need but one imagines the communication would suggest that January is on the table.

One more potential positive catalyst would be the end of the war in Ukraine which was rumored over the weekend. While this still may be a bit away, the move lower in oil on Friday with these rumors could be another support for consumers in both US and Europe.

Finally, one other catalyst is the Supreme Court and tariffs. My gut suggests that stocks rally if the tariffs are found illegal. While it creates a mess for the Administration, companies will appreciate the clarity and finally start to invest. When I speak to people on that, I get a more mixed result. What do you think?

After taking a step back, it would appear to me that the FUNDAMENTALS are still strong, the BEHAVIORALS are weak and should give us pause, but that the potential catalysts coming up are net positives for risk and not negatives.

This could in turn provide some support for the weakest markets (crypto) and even give reason for stocks to rally if they continue to hold support. Thus, I am not giving up on the Santa Rally myself, though I do recognize that there is a higher risk that this is closer to “The Year Without a Santa Claus” (one of my favorite movies this time of year when I was young).

When we look at the forest and not the trees, we can often gain an important perspective that is important when going through the volatility of the markets.

Stay Vigilant