I was happy to speak to Sagar Singh Setia who is a fellow Substack and LinkedIn conspirator. We have spent time engaging online but had not had the chance to sit down and talk markets.

Below I am going to put in some of the charts that have content that we referenced.

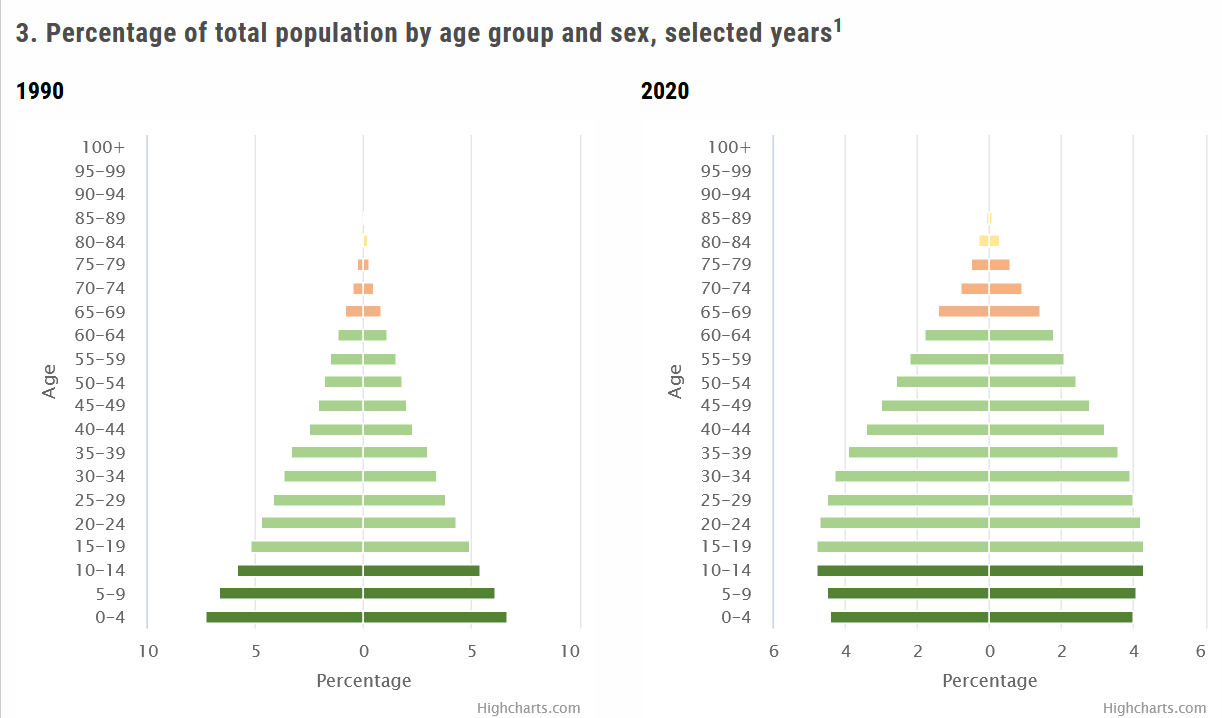

India’s population is the second largest in the world and expected to be the largest population in the world by 2050.

It is also going to be a very young population over the next 30 years. You can see the largest age cohorts in the Indian population are 30 years old and younger. This means the population will be in its prime earning and spending years for the foreseeable future. This chart comes from ESCAP 75

As Sagar mentioned, this is well-known to investors. We can see that in the discount rate being demand for India relative to All Regions in the world, all Developing countries and relative to China. For this I look to CS’ HOLT platform. The lower the discount rate, the move investor enthusiasm because investors are demanding a lower denominator to discount the future cash flows back. The line for India is in red. China, on the other hand, is double that of India and higher than all developing countries.

I also reference the corruption level in India. One can see the global ranks here: https://www.transparency.org/en/cpi/2021. India ranks 85 out of 180 countries which is an improvement of 95 where it was 10 years ago.

Then we pivoted to discuss Europe. We discussed how the LDI or liability-driven investing scare may be behind us. You can see the 30-year Gilt yield is back down to 3.77%, well below the 5% level that was hit and where the BOE had to intervene.

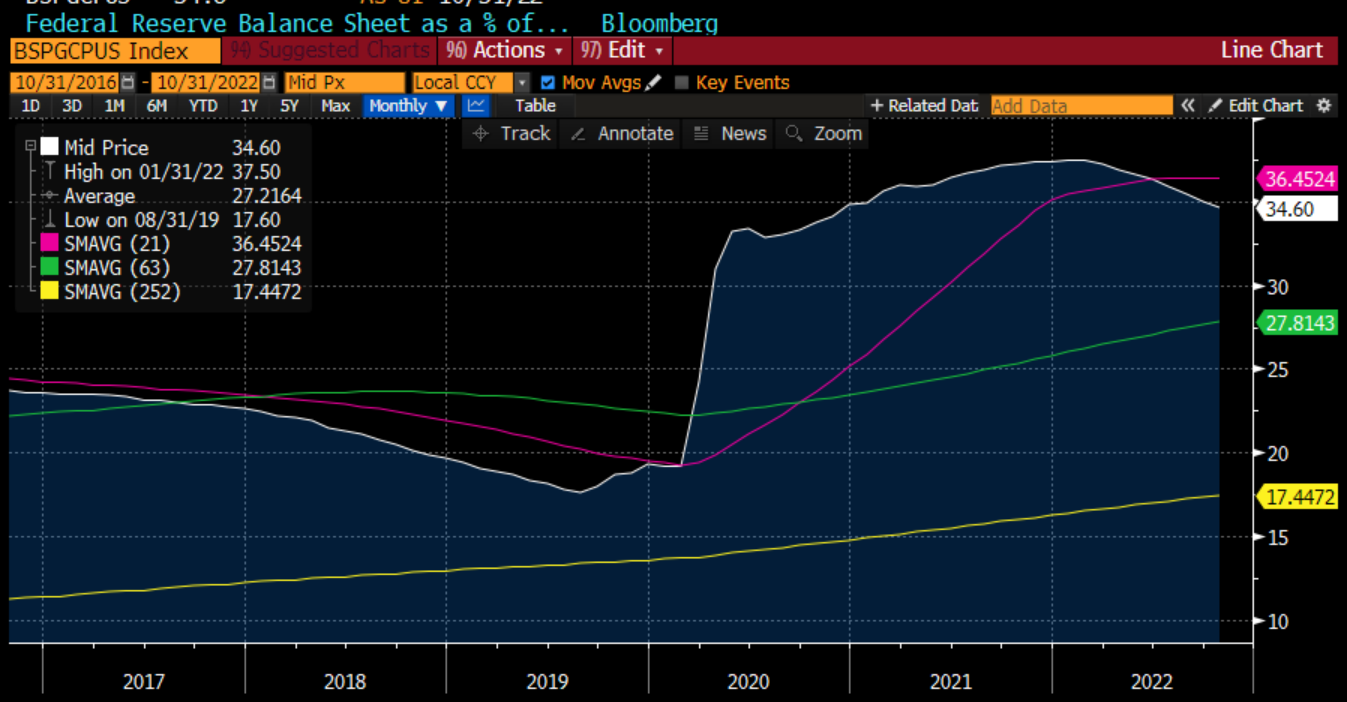

The balance sheet at the BOE had been coming lower via some semblance of QT. Sagar mentions he expects QE to begin again in the UK. The BOE balance sheet as a % of GDP will be the measure to watch:

You can see that this is higher than the Fed balance sheet as a percent of GDP. I mention that I had talked about - back in June - the possibility of the Fed pivot being it backing off of QT and not slowing the rate moves.

We can see this in the liquidity conditions in the various markets. I posted about this on LinkedIn this week. The chart comes courtesy of an IMF blog

This is one reason why risk parity portfolios, preferred by US pension funds, have had one of their worst years on record. Recall, these are meant to be ‘all-weather’ portfolios as pitched by Ray Dalio.

We spoke about adjustable-rate mortgages. In the UK this is about 20% of mortgages. Frankly, I am surprised by this. My sense was this was closer to 40-50% to be honest. My sense is with rates having been at the lower bound, consumers chose to lock rates.

https://www.axios.com/2022/09/28/uk-homeowners-mortgage-rate-shock

This is the data for the US.

https://www.financialsamurai.com/adjustable-rate-mortgages-as-a-percentage-of-total-loans/

Moving onto energy, I referenced how energy companies (at least in the US) are not investing as much in capex. In absolute dollars the number is going up, however, as a function of revenues, it is not.

We also spoke about crude oil demand. We can clearly see the Covid shock, but the trends in demand, in spite of the move to EV’s, have been positive outside of this trend.

Sagar also spoke about the demand for mining. He shared this image with me on this topic, where the demand for mining will come from:

We turned to Japan and spoke about the Yen. We can see the move in the Yen has now gotten to close to 35-year highs.

Japan has imported inflation, and this is showing up in property prices.

I referenced a story that Japanese salaries are less than burger flippers in California. This is the article: https://www.washingtonpost.com/business/japan-asks-if-its-better-to-flip-burgers-than-work-at-a-megabank/2022/10/30/052a2286-589f-11ed-bc40-b5a130f95ee7_story.html

Finally, we spoke about the revenge of old economy vs. new economy. We can see this in the last 12 weeks (and all year) as energy, financials, healthcare, industrials are doing well (in the Leading quadrant), while tech and communications are in the lagging quadrant.

Overall, it was a great discussion where we spoke about a range of ideas. I hope you enjoy the discussion as much as I did.

Share this post