I am going to try and do a few more thematic posts this year, in addition to the typical three-part assessment of the risky asset landscape. One of the themes I have this year is cryptocurrency broadly speaking.

I know just by saying that, I have turned off 40% of readers, while another 40% are saying “it’s about time”. There are 20% that are still unsure or confused as to what to do with it.

I don’t say this because now that there is a Bitcoin ETF trillions are going to flow into the space and Bitcoin is going to $1 million. I say this because now we are getting regulation in the crypto space, something the insiders in the industry fought to their core because the raison d’etre was to not have centralization, regulation or trusted third parties. Now we have those. How can this still be good?

For me, the analogy is the internet. The early adopters and purists were accessing the internet in the 80s when I was in college. However, until browsers became wide spread that helped the masses access the internet, there was not explosive growth. I think this is the phase we are in now. Do I think it helps Bitcoin? Sure. However, I think it helps crypto broadly as the acceptance level will go higher. This means more mainstream and institutional money funding projects.

Early last year I said I preferred Ethereum to the Nasdaq. I thought the more interest disruptive technology bets were going on there. I was wrong in the sense that AI exploded more than I gave it credit for. However, there have been some very exiciting projects being built on the Ethereum network and others too.

My University of Illinois, Gies College of Business, and CFA Society of Chicago colleagues Monique Thanos and Tony Zhang join me on this Macro Matters podcast to speak about crypto as we enter 2024. I am sure the three of us will cover it a few more times this year too. Both University of Illinois and CFASC have fully embraced blockchain and cryptocurrency so this topic is top of mind for us.

Before I leave you to listen to the podcast, I wanted to add a couple charts.

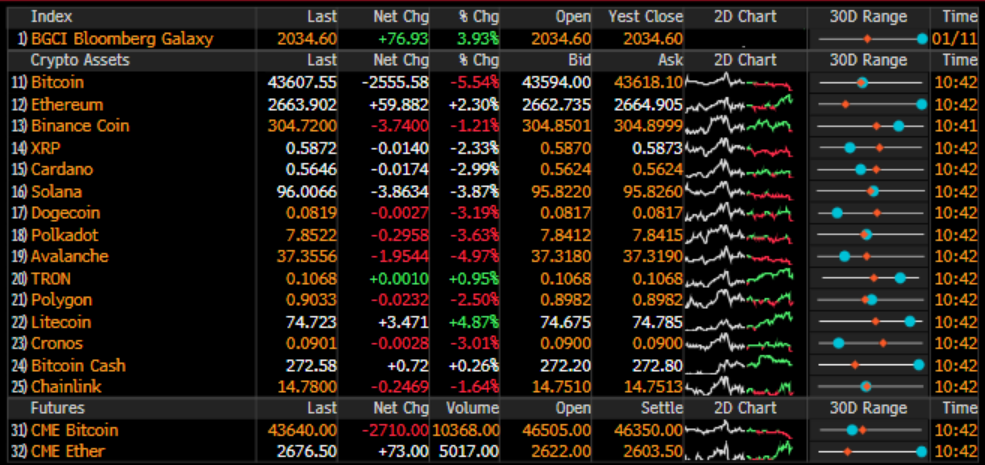

When we did this podcast on Monday, this chart looked different. Bitcoin was the only coin at the top of its 30-day range. Now it no longer is as traders are already planning for the next round of ETF approvals and those are in Ethereum. I think Solana is the next one after that so keep watching the momentum in those coins.

As for Bitcoin itself, this is the weekly chart. It has clearly broken out of its crypto winter. Sure, it is very overbought right now and I think there will be some ‘sell the news’ type of price action in the coin. However, I am looking to buy this on any dips. Will I use ETFs or execute in the spot market which I always have? I haven’t decided yet but I do think it is interesting to see the fees on the ETFs come crashing down. Fidelity’s ETF has no fees until July. I wonder if they extend that if they see success. It is a winner take all game in the ETFs now and Fidelity is not a new player in crypto, having been exposed as a firm since 2014.

It really has not been fully risk-on from a crypto standpoint this past year as Bitcoin as led the way. Historically, Bitcoin is the safe haven in crypto so it outperforms in down markets and lags in up markets. Last year it outperformed in a strong market. Is this the year Ethereum and other coins begin to outperform? That was the massive spike yesterday potentially anticipating this.

For now, I will leave you to the podcast. Please like, share and subscribe if you enjoy it. Regardless …

Stay Vigilant

The outlook for cryptocurrency in 2024